A brief history of the pass: a journey from the past to the future

Pass, the beginning is a decentralized virtual concept pursued by computer geeks, and now it has developed to shape the billion-dollar industry, covering the world's top companies, such as BMW, Rakuten, including India. Governments. Recently, it has undergone a series of developments involving assets ranging from stocks to art. Many companies use the pass as a reward or credit score, or pass the stock into a certificate, and some pass certificates have been put on the exchange. Is this a development trend? If so, how does it evolve and what will happen next?

The role of the card

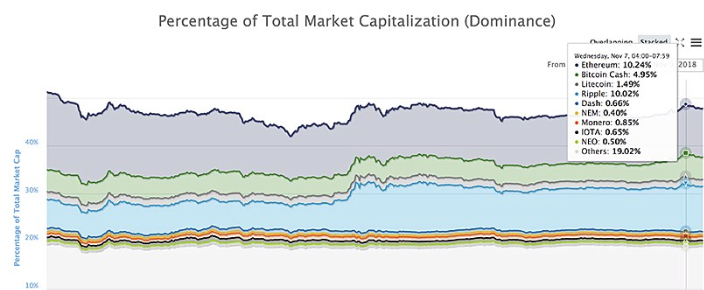

Regardless of the platform, the concept of the certificate is basically the same: the certificate is the representative of its ecosystem. What is the role of the certificate? It can be used to vote, pass value or provide access. Many projects have developed and implemented various types of certificates, and now there are more than 2,000 types.

- Hugo and IPFS: How does this blog work (and can immediately scale to a peak of 5000%!)

- Bitcoin has bottomed out, but it takes 22 years to reach new heights, and bank giant UBS analysts come to a conclusion after comparing multiple bubbles.

- Ma Zhitao, deputy governor of Weizhong Bank: For the development of blockchain, compliance is the bottom line, and innovation is the way out.

Application classification of the certificate

Value exchange – this is the most widely used application. As a valuable tool, CV motivates users to use its systems and gradually evolve into a complex CIS economy.

Voting rights – Passes can be used to vote, giving their owners the right to participate in decisions within the system (eg setting up transaction fees, electing the primary node, upgrading the entire network). In various blockchains such as Ethereum or EOS, although the voting mechanisms are different, the pass is the most important manifestation of the decentralization of the holders.

Charges – Passports can be used to access a variety of functions in a variety of decentralized applications. For example, REQ burns a pass in every transaction.

Representatives of assets – dollars, real estate, precious metals, and even bitcoin – can be certified and used for trading. In this case, the certificate representative has such assets.

Therefore, the certificate is also diverse, right? Currently, all passes are present in the blockchain network. But the original certificate is not the case. The original certificate is that there is no infrastructure.

The earliest pass, ERC20

Initially, there was no uniform standard for Ethereum. In the Ethereum ecosystem, the threshold for issuing certificates is very high. Interoperability and exchange need to be unified, and in the early stages of Ethereum, each publisher must develop its own version to implement its functionality, including sending a pass. Therefore, each type of pass has its own unique way of operation, and instant exchange requires complex code to implement. Moreover, any minor code error can cause a loophole in the contract, causing evil, such as cracking or freezing someone's assets.

On November 19, 2015, Fabian Vogelsteller proposed a specification (20th edition) in which the functions covered were widely accepted in the Ethereum community. Since then, distribution and transaction passes have become relatively easy, as developers can create the right infrastructure. Any exchange can support the ERC20 Pass or a new pass from the shelves. This has given the green light to countless ICOs and the industry has begun to flourish.

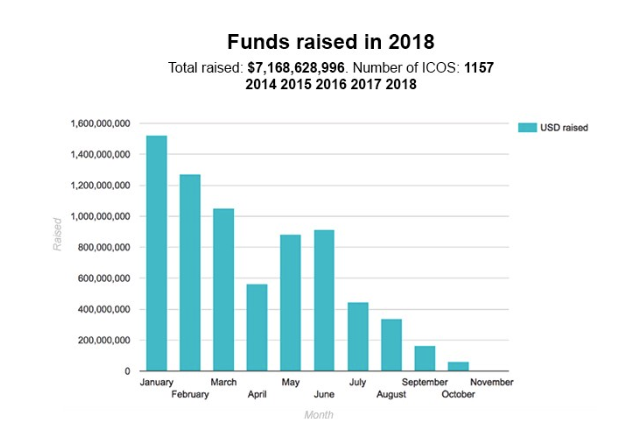

In 2016, ICO raised $90 million.

In 2017, ICO raised $6.2 billion.

In 2018, ICO raised $7.2 billion.

As can be seen from the figure, from 2016 to 2017, the growth rate is 68 times. Numerous startups use it as their preferred method of raising funds. ICO has become a hot topic, making the blockchain a concern and demonstrating its unlimited potential.

Stabilizing currency admission

With the development of the market, the exchange between the certificate and the legal currency is very necessary. The reasons are as follows:

Initially, the pass (or token) can only be traded with bitcoin. But today, Bitcoin is also very unstable, and there are often two prices to consider when trading. This is unrealistic for many traders.

Finally, Bitcoin should be exchanged for fiat money so that the trader or investor can increase his dollar or euro portfolio.

In the case of extreme market volatility, holding tokens and BTCs is very risky and is likely to cause significant losses. It is also difficult to convert bitcoins into French currency. Only after the market stabilizes, re-enter the transaction.

Therefore, the stable currency, as another cryptocurrency, solves these problems at once. Tether (USDT) is the first stable currency to be offered on mainstream exchanges such as Bitrex and Bitfinex. A year later, new stable currencies (TUSD, GUSD and USDC) were launched as substitutes for the US dollar, each supported by the true full audit funding of the company that issued the coins.

There are still plenty of room for many other assets – the current market value of all stable currencies is only $2.6 billion, and at the time of this writing, the market value of the entire market is $222 billion, so if you need to close your position, there will be no Enough stable currency.

Stable currency supported by gold and silver

After the stable currency was supported by the legal currency, the certificate representing the stable assets began to appear. What do you think of when talking about stable assets in the market? Gold and silver.

Precious metals are an excellent choice as a pass, hold and trade because they have a thousand years of history and have long been known for their resistance to currency.

Both gold and silver can be represented by Kinesis. Both the KAU coin and the KAG coin are inlaid with gold and silver in a ratio of 1:1. If their prices fall, they can be sold at the price of gold or silver for profit. Or you can pay by using a Kinesis debit card anywhere you accept Visa. The project is supported by the Allocated Bullion Exchange, the leading exchange of precious metals in the industry for more than 10 years.

Passed stock

Current stock issuance and trading involve multiple parties, including banks that organize IPOs, stock exchanges, client brokers, stock management departments, and of course, institutions that allow IPOs to occur. Issuing stocks through the blockchain is similar to the above, but smart contracts can be used to limit the initial buyer’s early sale of stocks. It does not rely on exchanges or stock management offices in their respective jurisdictions. It is possible to make stocks trade globally through blockchain-based solutions.

It does not require an owner registration form because the pass is itself a kind of ownership and cannot be forged. Anyone can see the list of company shareholders, because the identity of the shareholder will be announced when the stock is traded.

The Malta Stock Exchange and Neufund signed a cooperation agreement to pass on their stocks. More exchanges will gradually understand the benefits of the pass, and sooner or later join the ranks. Although this does not mean the death of the exchange, for most users, the convenience of operation is the most important.

What is the future?

The pass can be used to access the decentralized application. They can be used for media, trading fiat currency, gold, silver, equity holdings, property rights, voting rights or other values. They can also be used as bonus points. Why are companies keen to use passes, not paper money? Because the issuance of the pass is relatively easy, the transaction speed is very fast, and the blockchain address is difficult to be cracked. All information on the blockchain cannot be overwritten, deleted or forged. In this case, all of the certified stocks can be safely stored in their owner's account and do not require special management.

With the development of the pass, the future may purchase properties, cars, art or gold directly through the Kinesis currency system. The Kinesis currency will not only circulate in the current established market, but also be similar to the New York Stock Exchange, but it may also flow to the free market.

Today, if you want to sell an apartment to buy stocks, you can't do it in one step. You first sell it in the currency, deposit it in the exchange, and then buy the stock. In the future, you will be able to trade the certificates that represent the ownership of your apartment and purchase the shares you want to buy. Will this bring benefits to the public? of course! Instant payments without any restrictions create new business models that save time and money. And these transactions are open and transparent. Isn't that the future you want? We look forward to the arrival of that day.

This article is a translation, the original link: https://hackernoon.com/a-brief-history-of-tokens-a-journey-from-the-past-to-the-distant-future-95f33d3534c9

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction to cryptography and practice – Part2

- Blockchain Foundation: Misunderstanding of Decryption Mining and Consensus

- Market Analysis: BTC trend is entangled, it is difficult to drive emotions

- During the wet season, the miners’ spring is back?

- Will BSV reproduce the BCC zero-zero operation?

- Replace the SWIFT system? I understand the blockchain cross-border settlement system

- The game of the exchange after the BCHSV "belowed"