After Friend.tech, how will Base ecology continue?

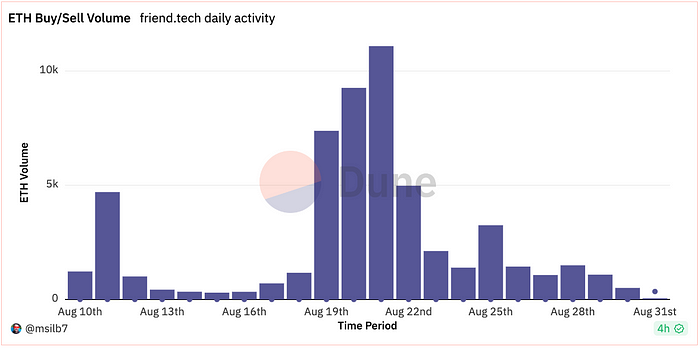

After Friend.tech, what is the future of the Base ecosystem?Two weeks after the launch of Friend.tech on the Base Chain, user activity gradually decreased, and there was even a net outflow of ETH from the contract on August 22nd. Currently, the total amount of ETH retained in the contract is around 3,500, worth about $5.8 million. Apart from Friend.tech, how is the development of the Base Chain ecosystem?

1. On-chain data

1. TVL

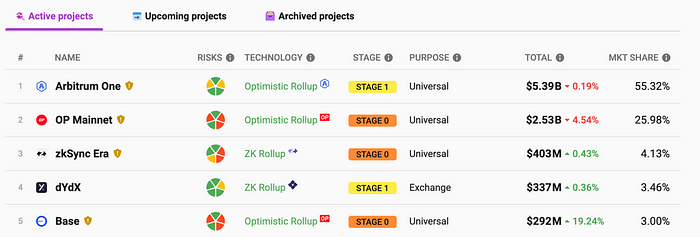

As of August 27th, TVL on the Base Chain reached 292 million, ranking 5th in the Layer 2 network and accounting for 3% of the Layer 2 market share. Both Base and zkSync have seen slow growth and relative stagnation in TVL.

- What does the US court’s friendly judgment on Uniswap mean for DeFi regulation?

- Can PEPE make a comeback? What do traders and analysts say?

- Digital Asset Lawyer Cryptocurrency Industry in the United States May Be on the Verge of Recovery

2. Trading volume and active addresses

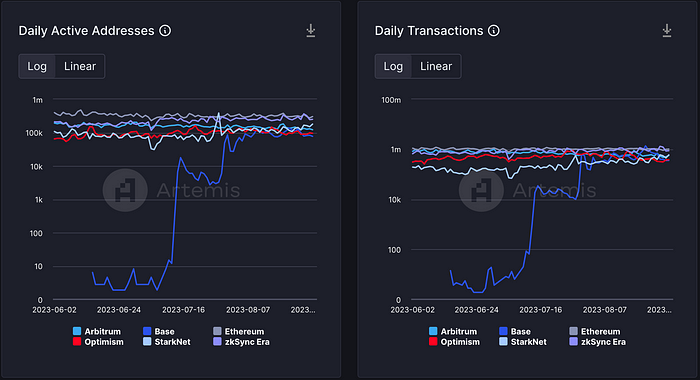

There have been two periods of rapid growth in daily active addresses and daily trading volume, corresponding to the mainnet launch of the Base Chain and the launch of Friend.tech. As of August 31st, the daily active trading addresses are 77,000, and the daily trading volume is 356,000 transactions, both lower than Layer 2 networks such as Arbitrum, Optimism, and zkSync.

The trading volume on the Base DEX reached its lowest point on August 3rd after the meme coin market ended. Subsequently, there was a rebound in trading volume with a series of new project transactions on the chain, but the volume started to shrink again after a market decline on August 16th.

2. Ecosystem projects

As of August 27th, the Base official website has included a total of 143 projects/partners. Defillama has recorded a total of 69 projects, with only 23 projects having a TVL exceeding 1 million, including 12 DEX.

DEX

The initially high-volume DEX on the Base Chain were Leetswap and Rocketswap, but both have experienced security incidents.

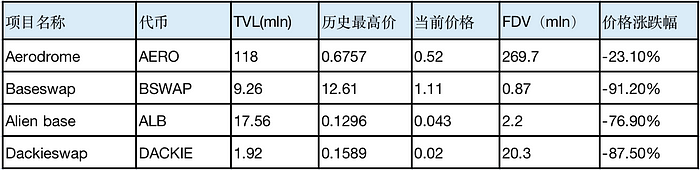

Currently, the leading native DEX is Aerodrome, with a fragmented first-place TVL status. This DEX has just launched liquidity mining and provides a high APY. Aerodrome is a Base liquidity layer developed jointly by the Velodrome and Base teams and partners. The initial supply is 500M AERO, of which 450M (90%) will be locked as veAERO. The initial circulating supply of AREO is 10M, with a weekly release increase of 3% from the previous week during the 1st to 14th cycles. From the 14th to approximately the 67th week, the weekly release decreases by 1%. Overall, AERO is a mining coin and has a high-speed growth in circulating supply in a short period of time. After the launch of Baseswap and Alien base on Aerodrome, both TVL and prices have declined.

Lending

The largest lending protocol on the Base Chain is currently Compound, with a TVL of 23.35 million. The second is the native lending protocol Moonwell on Moonbeam, with a TVL of 19.42. Aave voted and went live on the Base Chain on the evening of August 20th, with a current TVL of 1.68 million.

There is a connection between the deployer of the largest native lending protocol Magnate Finance on the Base chain and the solfire scam. The Twitter account of the project has been deactivated. The Total Value Locked (TVL) of other lending protocols, Grannay Finance and UncleSam Protocol, is less than $1 million. Compared to the well-established lending protocols like Compound and Aave, they have no competitive advantage in terms of brand, security, and liquidity.

Derivatives

EDEBASE has implemented a hybrid liquidity mechanism that allows ELP holders to provide liquidity through a smart router. 45% of the protocol’s revenue is distributed to ELP token holders and stakeholders, similar to the mechanism of GMX. The current TVL is 0.19 million.

Meridian Trade offers interest-free stablecoin lending, leverage trading, and zero slippage trading. Users can trade whitelist encrypted assets with leverage of up to 50x and obtain interest-free overcollateralized loans in ETH. The current TVL is $50,000.

Social Platform

Friend.tech gained popularity and attracted a large amount of funds in mid-August. However, from August 22nd, there has been a phenomenon of fund outflows and a noticeable decrease in trading activity within Friend.tech.

Games

LianGuairallel is a collectible card game that raised $50 million in financing in 2021, with a valuation reaching $500 million at one point. At the end of July, the game’s beta test was launched, and the game forged its NFT cards on the Base chain.

III. Conclusion

There have been multiple rug incidents with native projects on the Base chain. From a price performance perspective, there is higher risk for secondary participation. In terms of ecosystem development, projects with high popularity like Unibot are actively joining the Base ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Uniswap wins collective investor lawsuit, becoming a precedent sample in the DeFi regulatory challenge

- What does the US court’s ‘friendly judgment’ on Uniswap mean for DeFi regulation?

- Why choose Manta LianGuaicific to deploy applications?

- Grayscale’s victory over the SEC is not surprising at all. These analysts had already anticipated the outcome.

- Coinbase CEO If I start a business in 2023, I have ten cryptocurrency ideas.

- LianGuai Morning News | Coinbase to List PYUSD’

- Puzzle Ventures Why is ZKization of Consensus Layer Needed?