Uniswap wins collective investor lawsuit, becoming a precedent sample in the DeFi regulatory challenge

Uniswap sets a precedent in the DeFi regulatory challenge by winning a collective investor lawsuit.Author: Joy, LianGuaiNews

Encryption institutions have won consecutive victories in court. After Grayscale won its lawsuit against the SEC, Uniswap also won a collective lawsuit from investors.

The judge believed that the current cryptocurrency regulations did not provide a basis for the plaintiffs’ claims. According to current US securities laws, Uniswap is not responsible for any damages caused by the misuse of the protocol by third parties, and their claim requests have been dismissed.

Investors sue Uniswap due to losses in transactions

Previously, a group of investors from North Carolina, Idaho, New York, and Australia filed a collective lawsuit against Uniswap Labs, its founder Hayden Adams, its venture capital firm LianGuairadigm, Andreessen Horowitz, and USV in accordance with federal securities laws.

- What does the US court’s ‘friendly judgment’ on Uniswap mean for DeFi regulation?

- Why choose Manta LianGuaicific to deploy applications?

- Grayscale’s victory over the SEC is not surprising at all. These analysts had already anticipated the outcome.

The investors claimed that the tokens they purchased through the protocol from December 2020 to March 2022 were proven to be fraudulent, resulting in economic losses. Investor Nessa Risley claimed to have lost approximately $10,000 after purchasing fraudulent tokens such as BoomBaby, Rocket Bunny, and Matrix Samurai.

The investors also believed that the decentralized exchange was selling unregistered securities and that Uniswap was an exchange or broker-dealer that had not been registered with regulatory agencies. However, Uniswap disagreed with being labeled as an “exchange” or “broker-dealer”.

In the lawsuit, presiding Judge Katherine Polk Failla acknowledged that the tokens in question in this case were “genuine” securities. However, this recognition did not help them win the lawsuit. The judge also stated that Uniswap’s ability to charge transaction fees and other aspects such as governance tokens were not sufficient to convincingly establish the liability of the platform’s development company.

The court document stated: “The court dismisses the appeal in its entirety.” It further explained that simply because investors purchased fraudulent tokens on Uniswap did not mean that the decentralized protocol itself should bear responsibility, stating, “Given the decentralized nature of the protocol, the identity of the issuer of the fraudulent tokens is essentially unknown and unknowable, causing identifiable harm to the plaintiffs, but without an identifiable defendant.”

Judge states current policies are insufficient, lacks precedent

As a judge with extensive experience in handling cryptocurrency cases, Judge Failla previously presided over the SEC’s lawsuit against Coinbase. She also has experience overseeing other cryptocurrency cases, including those involving Tether and Bitfinex. Her ruling highlights her in-depth understanding of cryptocurrency projects.

She believes that the decentralized nature of Uniswap means that the protocol cannot control which tokens are listed on the platform or who can interact with it. She also stated, “These underlying smart contracts differ from the overall code provided by the defendants, but rather are token pair or token exchange contracts created by the issuers themselves.”

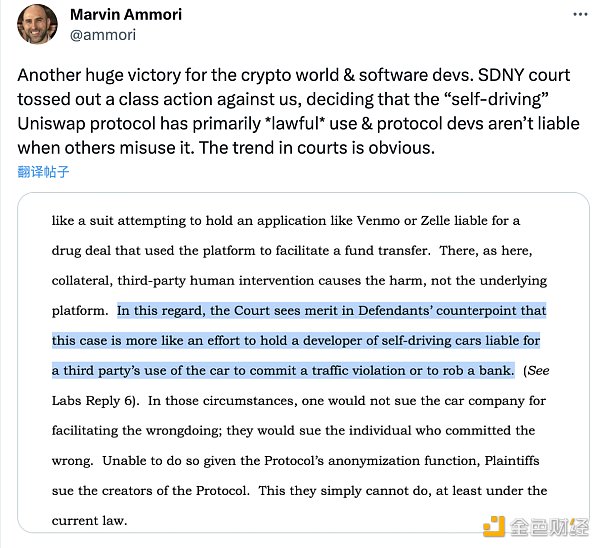

In order to provide a better explanation, Judge Failla also made several analogies, such as using payment applications Venmo and Zelle as examples. The plaintiff’s lawsuit is equivalent to trying to hold the companies that facilitate drug transactions on their platforms responsible, rather than the drug dealers. She also compared the case to holding the developers of autonomous vehicles responsible for the actions of third parties using the vehicles, such as traffic violations or bank robberies.

At the same time, Failla acknowledged the current lack of legal precedents surrounding DeFi protocols, stating that “no court has yet ruled on this issue in the context of decentralized protocol smart contracts.”

The lack of clarity on how securities laws apply to DeFi was also addressed. The court did not find a legal avenue to hold Uniswap Labs or venture capital firms liable under federal securities laws, stating that “laws are currently being developed around these exchanges, and regulatory agencies may one day address this gray area.” Furthermore, regarding the plaintiff’s concerns about federal securities laws, she suggested that it would be best to present them to Congress rather than to the court.

In the ruling, the judge also cited SEC Chairman Gary Gensler’s statement in September 2021, in which he hinted at stricter scrutiny of DeFi projects. The SEC had initiated an investigation into Uniswap Labs at that time, but apparently did not take further action.

However, she went on to state that the core smart contracts of Uniswap are essentially not illegal and can perform legitimate transactions, just like trading cryptocurrencies ETH and Bitcoin as commodities. In this statement, the judge specifically mentioned the commodity attributes of ETH.

Although Judge Failla’s comments do not constitute a definitive ruling on the legal classification of Ethereum in the United States, they do indicate a certain stance and serve as a rebuttal to Gensler. Gensler had previously only recognized the commodity attributes of Bitcoin and considered all other cryptocurrencies as securities, therefore falling under the jurisdiction of the SEC.

DeFi Applications Face Regulatory Challenges, Uniswap Provides Regulatory Sample

Marvin Ammori, Chief Legal Officer (CLO) of Uniswap Labs, expressed his approval of this legal victory. He believes it is another huge victory for the crypto world and software developers. The SDNY court dismissed the collective lawsuit against us and ruled that the “autonomous” Uniswap protocol is primarily “lawful” to use, and the protocol developers are not responsible when others misuse the protocol. The trend in the courtroom is evident.

In fact, Uniswap’s “victory” comes after the Tornado Cash incident, where the US Department of Justice accused Tornado Cash founders Roman Storm and Roman Semenov of conspiring to launder money, violating sanction regulations, and operating an unlicensed money transfer business. Roman Storm has been arrested and released on bail. However, despite being a DeFi application that provides mixing services, Tornado Cash’s situation seems less than ideal.

The Anti-Money Laundering Certification Expert Association (ACAMS) Senior Manager Craig Timm said that the Department of Justice seems to specifically point out in the Tornado Cash case that the problem lies in its user interface, not the smart contract itself. It seems unlikely that charges would be brought without a user interface.

Tornado Cash’s native token TORN is another worse factor. Former financial crime prosecutor Anand Sithian said. According to the indictment, the defendants profited from the operation of the Tornado Cash service using the token. The document references messages they allegedly sent to each other discussing the necessity of raising the price of TORN.

So although the US government only considers 7% of all activities conducted through the service as illegal, the profits brought by the Tornado Cash token TORN may add an extra layer of liability to the founders. Perhaps the illegal activities occurring on the Tornado Cash platform are not as extensive as imagined, and the court will now start paying attention to the profits because the Tornado Cash founders have a clear profit motive.

Currently, Uniswap seems to be in a “favorable” position in US regulation. It has previously cooperated with regulatory agencies to block the user front-end interface of certain privacy tokens and the token has always had only governance functions. This may provide a sample for other DeFi projects to cope with regulation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Coinbase CEO If I start a business in 2023, I have ten cryptocurrency ideas.

- LianGuai Morning News | Coinbase to List PYUSD’

- Puzzle Ventures Why is ZKization of Consensus Layer Needed?

- Chainlink releases v0.2 Staking platform and specific details

- Two pictures will help you understand why Filecoin has strong resilience and how to easily resolve the scenario of significant QAP loss.

- Evening Must-read | Security Issues that Airdrop Hunters Need to Be Alert About

- Building the Future of Finance Prospects and Opportunities of NoFi