Chainlink releases v0.2 Staking platform and specific details

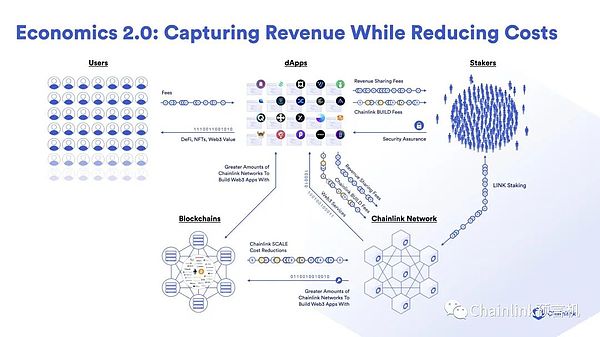

Chainlink releases v0.2 Staking platformStaking is a core element of the Chainlink 2.0 economics and aims to build a new layer of cryptographic economic security for the Chainlink network. Participants in the ecosystem, including node operators and community members, can secure the oracle service level and receive corresponding rewards through staking.

In December last year, Chainlink released the first version of the Staking plan (v0.1) and launched a staking pool with a limit of 25 million LINK tokens to secure the cryptographic economic security of the ETH/USD Data Feed on Ethereum. In version v0.1, both community stakers and node operator stakers can participate in the decentralized alarm system to monitor the service level of the oracle nodes and receive staking rewards.

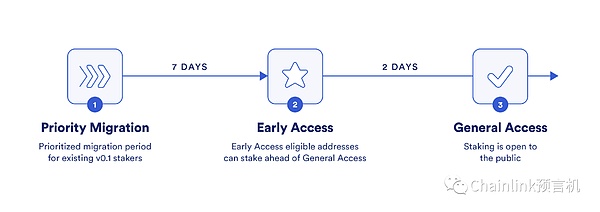

The next version of Chainlink Staking (v0.2) plan will be released in the fourth quarter of this year, and the staking pool will initially be expanded to 45 million LINK tokens. The v0.2 beta upgrade will be phased to expand the scope of participation. The first phase is the “Priority Migration” phase for existing v0.1 stakers; followed by the “Early Access” phase and the “General Access” phase.

v0.1 is the first version of the staking plan, while v0.2 has been refactored and upgraded into a fully modular, scalable, and upgradable staking platform. v0.2 focuses on the following goals based on v0.1:

- Two pictures will help you understand why Filecoin has strong resilience and how to easily resolve the scenario of significant QAP loss.

- Evening Must-read | Security Issues that Airdrop Hunters Need to Be Alert About

- Building the Future of Finance Prospects and Opportunities of NoFi

-

Greater flexibility: Community stakers and node operator stakers can have greater flexibility, and the staked LINK tokens are still held in the same secure non-custodial mode.

-

Greater security: Chainlink Staking provides greater security for oracle services.

-

Modular architecture: Compatible with future upgrades and changes, such as expanding staking to more oracle services.

-

Dynamic reward mechanism: Perfectly supports future new sources of rewards, such as user fees.

Security is a top priority for the Chainlink ecosystem, so the code repository for Chainlink Staking v0.2 officially launched a public code audit competition on the Code4Rena platform today. The competition will last for 18 days and has a prize pool of $250,000. The code repositories for Staking v0.1 and CCIP have also been audited on the Code4Rena platform. In addition, many top projects such as ENS, OpenSea, The Graph, and Aave use Code4Rena to audit their code.

This article will provide an overview of the release process of Staking v0.2 and its new upgrades and features. More detailed parameters about v0.2 will be announced on the eve of the mainnet release.

Staking is a core element of the Chainlink 2.0 economics.

v0.1 staker migration and phased rollout

Chainlink Staking v0.2 will be rolled out in multiple phases to allow more members of the Chainlink community to participate and contribute to the cryptographic economic security of the Chainlink network. The coverage of the v0.2 staking pool will be more extensive and will involve more small-scale community participants, thereby enhancing the security of Chainlink Staking.

Phase 1: Priority Migration

Stakers of v0.1 can prioritize migrating the LINK tokens and accumulated LINK rewards from v0.1 to v0.2, or withdraw them. The priority migration phase will last for 7 days. During this period, v0.1 stakers can migrate all or part of their v0.1 LINK staked tokens and accumulated LINK rewards. If a staker chooses to migrate only a portion of their LINK, all remaining staked tokens and rewards in v0.1 will be withdrawn. If v0.1 stakers do not take any action, their LINK staked tokens and rewards will remain in v0.1 and the accumulation of rewards will stop.

Since the size of the v0.2 staking pool is larger than v0.1 and it also includes the accumulated LINK rewards, v0.1 stakers will definitely be able to participate in the priority migration phase of v0.2. After the priority migration phase ends, v0.1 stakers can still migrate and withdraw in the subsequent early access and general access phases, but participation in these two phases is not guaranteed as the staking pool has a limit.

It is worth noting that during the priority migration phase, v0.1 stakers cannot migrate more LINK than the total amount of their staked tokens and rewards. If v0.1 stakers want to stake more LINK within the limit of each address, they can try in the later two phases.

Phase 2: Early Access

After the priority migration phase ends, LINK token holders who meet at least one of the early access qualifications will have the opportunity to stake LINK tokens in v0.2 until reaching the limit of each wallet address. Similar to the early access phase of v0.1, meeting the qualifications only means having the opportunity to stake in the v0.2 staking pool, but it does not guarantee participation as the staking pool has a limit. The early access phase will last for two days. The qualifications for early access will be based on version v0.1. Similar to v0.1, we will also release an “Early Access Eligibility App” before the launch, where you can check if you meet the qualifications.

Phase 3: General Access

After the early access phase ends, the v0.2 staking pool will be open to the public. At that time, if the v0.2 staking pool has not reached its limit, anyone will have the opportunity to participate in staking until reaching the limit of each wallet address.

Chainlink Staking v0.2 will be rolled out in phases

Iterative upgrade using a modular framework

The Chainlink Staking v0.2 codebase has been refactored and upgraded to a modular set of smart contracts. With modularity, we can perform a series of upgrades, such as adding new features or changing configurations. Stakers do not need to migrate all their funds to the new smart contracts to achieve the upgrade.

For example, v0.2 will support the ETH/USD price feed on Ethereum, and the alert conditions will be similar to v0.1. Future iterations of Chainlink Staking can add other new alert condition modules to expand to other oracle services (such as CCIP). As Chainlink Staking provides security for more oracle services in the future, the modular design and reward mechanism upgrade of v0.2 will make it easier for us to introduce new sources of rewards (such as user fees).

The upcoming upgrades for Chainlink Staking also include providing new tools for the BUILD project to distribute Chainlink BUILD rewards to stakers. We look forward to more excellent projects joining the BUILD program in the coming months. The staking platform will introduce user fee rewards and BUILD reward distribution plans, which will be based on user fees and participation in the BUILD program, continuously driving ecosystem members to provide higher security for the Chainlink network. Specific information about Chainlink BUILD rewards, v0.2 staker qualifications, and v0.1 stakers will be released in the future.

In addition, in the future, Chainlink Staking will expand the reputation system for node operators, comprehensively incorporate the staking mechanism, and build a more comprehensive penalty and alert mechanism to establish a more robust security guarantee.

Expanding the staking pool size and accessibility

The maximum limit of the staking pool for Staking v0.2 will be increased to 45 million LINK tokens, covering more types of LINK token holders. The maximum limit of the staking pool has increased by 80% compared to v0.1 and accounts for 8% of the current LINK circulation.

The expansion of the v0.2 staking pool is aimed at enhancing the security guarantee of oracle services and increasing user confidence. In addition, we always pay attention to security while expanding the staking pool size. Increasing the maximum limit of the staking pool can also provide support for the sustainable development of the Chainlink network before new staking reward sources (such as user fees) are implemented. The staking pool size is expected to continue to expand over time, especially as Chainlink Staking will cover more and more Chainlink services in the future.

Unbonding Mechanism

(解除质押机制)

A key design principle of Chainlink Staking v0.2 is to provide greater flexibility and predictability for LINK stakers in managing their LINK tokens. Therefore, v0.2 introduces an unbonding mechanism.

The unbonding mechanism plays a key role in the security guarantee of Chainlink Staking. This mechanism can maintain the stability of the staking pool for a long time. When a valid alert is issued, it ensures that there are enough LINK tokens in the system to be deducted (i.e., to prevent the staked LINK tokens from being withdrawn before being punished).

Stakers can withdraw their staked LINK tokens from v0.2 at any time and then enter a “cooldown period” lasting several weeks. Once the cooldown period ends, a “window period” lasting several days will begin. During this period, stakers can withdraw their staked LINK tokens. If the LINK tokens are not withdrawn during this window period, they will automatically re-enter v0.2. Therefore, if a staker changes their mind after initiating the withdrawal process, they can simply not take any further action.

The staked LINK tokens will continue to accumulate rewards during the cooldown period and subsequent window period until they are finally withdrawn. It is worth noting that extracting LINK tokens through the unstaking mechanism may result in the deduction of accumulated rewards, depending on the duration of the staker’s participation in v0.2 (details will be explained below).

Claimable Rewards and Ramp-up Phase

In v0.2, a new LINK reward mechanism will be introduced to further enhance the stability of the v0.2 staking pool, improve the security of staking, and increase the flexibility of staking rewards.

Stakers will receive attributed rewards, which include “claimable rewards” and “locked rewards” during the staking process. Claimable rewards can be withdrawn at any time without penalty. Locked rewards will gradually become claimable rewards during the ramp-up phase. The ramp-up phase lasts for several weeks and is tracked individually for each staker. At the beginning of the staking, the percentage of claimable rewards is 0% and gradually increases linearly to 100% over time. The percentage of claimable rewards is proportional to the progress of the ramp-up phase.

For example, if a staker’s ramp-up phase is 50%, then 50% of the attributed rewards will be converted into claimable rewards. When a staker’s ramp-up phase reaches 100%, all attributed rewards will be converted into claimable rewards. Furthermore, all newly accrued attributed rewards will automatically become claimable rewards.

If a staker successfully withdraws any amount of staked LINK tokens, their ramp-up progress will be reset to 0%. All locked rewards they have obtained will be automatically invalidated and flow into the public bonus pool, distributed among all stakers of the same type. For example, the invalidated rewards of a community staker can be distributed among all community stakers. The ramp-up phase will be reset when a staker withdraws the staked LINK tokens, and the attributed rewards can only be fully converted into claimable rewards after the ramp-up phase ends.

It is important to note that stakers can withdraw claimable rewards at any time without resetting the ramp-up phase. For node operators who stake, the ramp-up phase only applies to the base rewards generated by the staked LINK tokens and does not apply to the automatic delegation rewards from community stakers.

The table below shows the different types of rewards in Chainlink Staking v0.2.

Similar to Staking v0.1, a portion of the attributed rewards of community stakers will be distributed to node operators as delegation rewards. In return, node operators will provide services on behalf of community stakers (i.e., performing oracle computations). This mechanism is similar to the current delegation mechanism, where the staking rewards generated by community staking are used to further enhance the network’s security.

In v0.1, the tokens staked by community stakers will be automatically delegated to node operators, who will not have control over the staked tokens. In v0.2, the delegated staking rewards received by node operators will be proportional to the amount of LINK they have staked.

Dynamic Reward Rate

We have adjusted the calculation method for the reward rate in v0.2 to incentivize staking behavior and better support future sources of staking rewards (such as user fees). In v0.1, the reward rate is fixed, meaning that the reward rate for all community stakers remains unchanged regardless of the staking ratio in the staking pool. However, v0.2 will introduce a dynamic reward rate.

The dynamic reward rate is based on the premise that the total rewards given to all stakers are fixed, and the rewards are distributed proportionally to all stakers within a unit of time, regardless of the total amount of LINK in the staking pool. Therefore, the reward rate for stakers is not a fixed value but dynamically changes based on the staking ratio in the pool and the amount of rewards generated within a unit of time. When the staking pool reaches a certain level of maximum size and fixed total rewards, an effective minimum reward rate can be established. If the staking pool is not fully filled, the same amount of rewards will be distributed proportionally to the fewer number of stakers, resulting in a naturally higher reward rate, and vice versa.

Since future sources of Chainlink Staking rewards will gradually shift towards user fees, which are dynamic, the calculation method for the reward rate needs to be changed.

Deducting LINK Tokens Staked by Node Operators

Chainlink Staking v0.2 allows for the deduction of a portion of the LINK tokens staked by node operators as a penalty. These node operators stake LINK tokens to ensure the quality of oracle services. Deducting LINK tokens further enhances the cryptographic economic security of the Chainlink network. When a valid alarm is triggered and the penalty conditions are met, a portion of the LINK tokens staked by node operators will be deducted as a penalty for their substandard services.

In the future, as Chainlink Staking expands to more oracle services, the conditions for alarms and penalties will continue to evolve. In v0.2, the LINK tokens staked by community stakers will not be deducted. However, these stakers will need to upgrade to the new Staking version. Additionally, if the node operator staker provides oracle services outside the Staking scope, they will not face the risk of having their LINK tokens deducted.

Upgrading with Time-Locked Smart Contracts

If any iterative upgrade of the modular Chainlink Staking v0.2 codebase has a significant impact on the stakers, such as modifying the slashing mechanism, these upgrades will be announced in advance to allow stakers to choose whether to withdraw their staked LINK tokens on-chain before the upgrade is completed.

Another security measure is that all critical on-chain configuration changes and upgrades must be made using a time-lock smart contract. The contract will set a time delay of up to several weeks, with the most critical configuration changes requiring the longest delay (longer than the time required to unlock staked tokens). This time-lock mechanism allows the community to fully evaluate the updates and decide whether to opt-out before they are implemented on-chain. Only urgent functionalities for the protection of stakers or certain advanced features (such as adding rewards) do not require a delay. However, all configuration changes and upgrades must go through the time-lock before deployment.

It is worth noting that the Chainlink Staking v0.2 smart contract will still operate in an non-custodial manner. This means that stakers will always have full control over their staked LINK tokens, and no third party can withdraw them. When upgrading to the new version of Staking in the future, stakers will still need to manually migrate their stakes.

The Evolution of Chainlink Staking

The development of the V0.2 beta Staking platform was built upon V0.1. Additionally, we have taken feedback from the community, node operators, and other service providers into account. We would like to express our gratitude to all stakers who participated in Staking v0.1. The community is crucial to the success of the Chainlink network, and we support the most active members in the ecosystem through mechanisms such as early participation.

The long-term goal of the Chainlink ecosystem is to establish Chainlink as a global standard, providing users with the most robust and secure oracle services that cover various areas such as external data, off-chain computation, and cross-chain interoperability. Chainlink’s oracle services accelerate the adoption of the Web3 ecosystem and gradually establish a sustainable economic model, rewarding service providers based on their contributions to the oracle economy. Ultimately, Chainlink Staking will continue to evolve along with the development of the Web3 ecosystem and contribute to the creation of a robust smart contract internet.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Hong Kong anti-money laundering operation arrests more than 400 people, lawyer warns encrypted users to be careful of being implicated.

- Opinion The potential of liquidity staking on Solana is gradually emerging.

- Injective Research Report L1 Built Specifically for Financial Applications

- Delay and Profit Analyzing MEV on Solana

- Loot 2nd Anniversary Review The Huge Potential of Lootverse and Dojo

- Opinion LybraFinance V2 will drive the growth of peUSD.

- A Brief Explanation of L1 Injective Built Specifically for Financial Applications