Two pictures will help you understand why Filecoin has strong resilience and how to easily resolve the scenario of significant QAP loss.

Two pictures explain Filecoin's resilience and how to resolve significant QAP loss easily.Abstract

-

Filecoin’s protocol design incorporates anti-fragility mechanisms, making it resilient to significant QAP drops.

-

These mechanisms provide strong economic incentives for new Storage Providers (SPs) to join the network and encourage existing SPs to stay in the network even after QAP drops.

-

In summary, after a significant QAP drop, the joining QAP will receive excess returns due to the sharp increase in reward concentration, which helps restore QAP and demonstrates Filecoin’s strong resilience.

As a decentralized data storage network, Filecoin requires SPs to determine QAP and, consequently, sector pledging and block rewards based on the stored data (whether it is real data).

Due to this unique structure, we can use the following model to verify and observe how Filecoin recovers with its strong resilience under different QAP losses (a large number of SPs exiting).

We can imagine two forms of QAP loss:

-

SPs gradually leave when their sectors expire;

-

SPs suddenly shut down, causing a sudden QAP drop;

Before interpreting the two model result diagrams mentioned above, we need to understand the assumptions made by this model.

This model is called the Agent-Based Model (ABM) by Kiran. The model implements Filecoin’s cryptographic economic mechanisms (such as locking, attribution, minting, and the interaction of token supply) and satisfies the settings of all possible scenarios as much as possible, including:

3 types of SPs:

-

SPs that only provide committed capacity (CC) sectors

-

SPs that only provide transaction sectors (Fil+)

-

SPs that provide both CC and Fil+ sectors

Two types of behavior logic for SPs:

-

Based on average cost – In this mode, SPs will join the network with a fixed number of sectors pre-configured and continuously update them until the termination date, after which SPs will leave the network (through QAP expiration or termination).

-

Based on return on investment – In this mode, SPs will use the predicted FIL-on-FIL return on investment rate (FoFR) to determine how much storage to join. If the predicted FoFR is higher than the pre-configured threshold, they will start investing.

-

Uniform distribution of CC, Fil+, and mixed SPs

-

Uniform distribution of only CC and Fil+ SPs

-

Fil+ skew: 70/30 distribution of FIL+ and CC

-

CC skew: 70/30 distribution of CC and FIL+

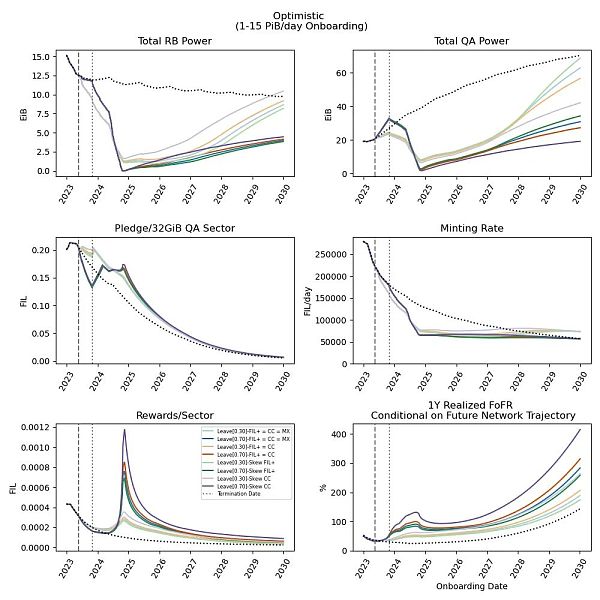

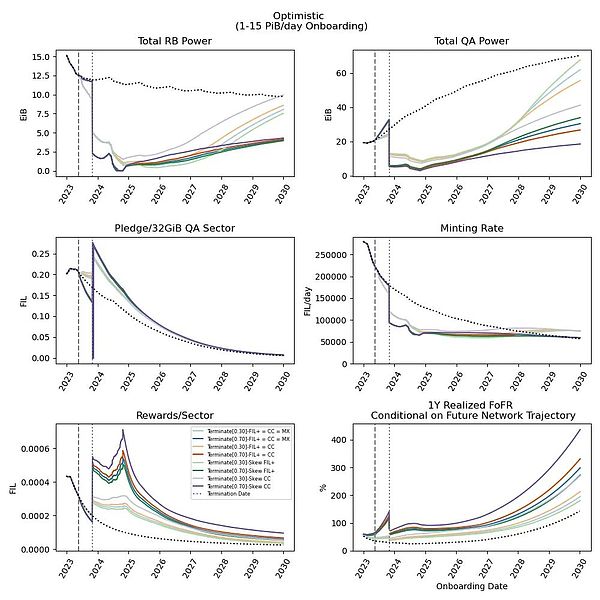

Under the assumptions that cover most cases mentioned above, we have obtained the following simulation results through the model calculation and analysis: (This is only a partial summary of the entire viewpoint, please refer to the original article for the complete model report)

The above figures test the key performance indicators (KPI) of the Filecoin network under different SP leaving network scenarios. The dotted vertical lines represent the start of the simulation, and the dotted points represent the dates when sectors start to leave the network. The simulation also includes a baseline case where constant joining is simulated using DCA agents, to provide a comparison baseline (black dotted line).

From the above figures, we can observe that when SP suddenly terminates storage deals, the network experiences a sharp decline in QAP. However, we also observe that the network QAP starts to recover after the termination event. This is because the increase in reward concentration leads to an increase in FIL-on-FIL return rate.

In this scenario, we recall the behavior logic of SPs based on return on investment. In the current network conditions, we can observe that participants who stay in the network will receive high FIL-on-FIL returns. Our simulation reflects this phenomenon, where SPs take advantage of the high FIL-on-FIL returns and increase storage. As a result, the Filecoin network’s QAP naturally recovers based on its characteristics, confirming its strong resilience.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion The potential of liquidity staking on Solana is gradually emerging.

- Injective Research Report L1 Built Specifically for Financial Applications

- Delay and Profit Analyzing MEV on Solana

- Loot 2nd Anniversary Review The Huge Potential of Lootverse and Dojo

- Opinion LybraFinance V2 will drive the growth of peUSD.

- A Brief Explanation of L1 Injective Built Specifically for Financial Applications

- Exploring the Potential Business Transformation of Intent-centric Narrative