Building the Future of Finance Prospects and Opportunities of NoFi

NoFi Future of Finance Prospects and Opportunities

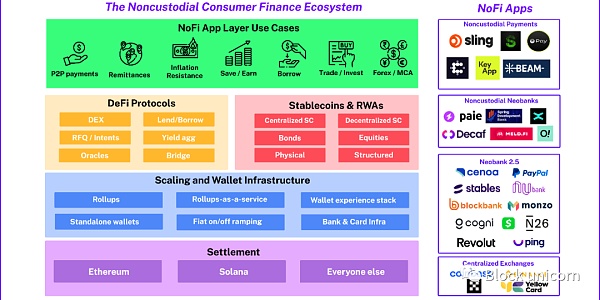

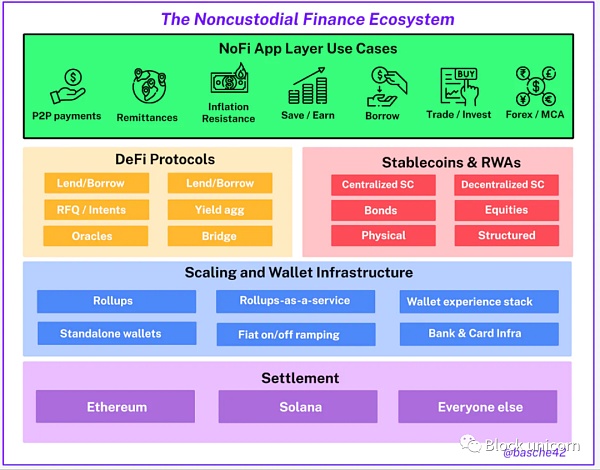

Although decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse form the foundation of an exciting new encrypted native internet, crypto/Web3 as a concept (let alone a new technological paradigm) will not continue unless it meets the needs of ordinary people and breaks free from its own closed niche. Fortunately, for those who showcased the crypto financial utopia to people on Thanksgiving, after being referred to as “the future of finance” for many years, it seems that crypto is finally seeing a boom in consumer-oriented, everyday financial applications built on blockchain technology. This emerging wave of non-custodial finance (NoFi) applications is guiding crypto toward an obvious opportunity for large-scale adoption in the mainstream market. Without the innovations of settlement, scalability, smart contracts, wallet infrastructure, and DeFi protocols, NoFi applications cannot be built on the basis of the previous waves of speculative crypto adoption. Although there are currently 5 to 10 million people trading on the blockchain every month, the service market for general finance consists of billions of people, which means there is still a huge potential market waiting to be developed by non-custodial finance (NoFi).

Synchronous Development

In the early adoption of new technological paradigms, we often see synchronous development in similar areas of ideas and problems, sometimes with slightly different solutions and assumptions. I have previously emphasized this point in a blog post on the wallet experience stack, where the wallet experience stack represents the convergence of identities enabled by wallets in Web3 and the middleware ecosystem for B2B businesses, and various players handle this issue in diverse ways. In the consumer finance field of Web3, we also see a similar situation, where wallets, payment applications, emerging banks, and centralized exchanges are developing in a convergent manner around some common and obvious use cases enabled by blockchain tracks with practical functionality. Let’s take a look at some examples.

- Hong Kong anti-money laundering operation arrests more than 400 people, lawyer warns encrypted users to be careful of being implicated.

- Opinion The potential of liquidity staking on Solana is gradually emerging.

- Injective Research Report L1 Built Specifically for Financial Applications

Non-Custodial Payment Applications

One irony of cryptocurrencies is that payments, perhaps the most obvious and typical use case since the birth of cryptocurrencies, has been the last use case to truly develop and gain momentum. Paying with volatile assets like Bitcoin and Ethereum is clearly a niche activity and has supported DeFi and NFTs, but blockchain payments only truly began to flourish with the emergence of stablecoins and cheap block space.

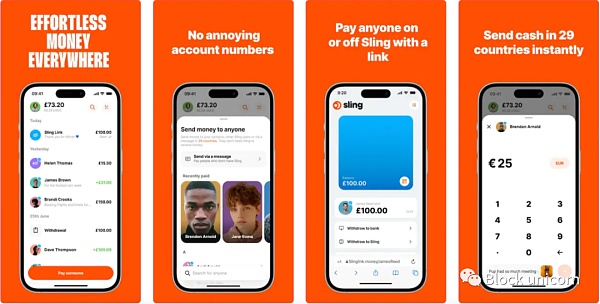

The most basic function of a crypto wallet, sending tokens, has finally become user-friendly enough to provide a Web2-level experience. We now see many applications and infrastructures focused on achieving this goal, including trendy consumer “crypto Venmo” and global payment applications such as Eco’s Sling and Beam. There is even a community that is crowdfunding for the meme token $SEND and building a peer-to-peer payment application supported by an AA (account abstraction).

Unlike cryptocurrency wallets, these applications resemble simplified versions of early Cash applications in appearance and functionality, typically focusing on providing peer-to-peer payments for students and young people, or specifically remittance services for foreigners and remitters.

Non-custodial/Semi-custodial Neo-Banks

While some emerging non-custodial fintech companies are targeting narrow payment use cases (which is already a huge use case in itself), others are taking a more comprehensive approach to their products, combining payments with additional stablecoin yields, multi-cryptocurrency accounts, investment features, and encrypted fiat-crypto hybrid accounts that integrate with traditional banking and card systems. Projects like Decaf and LianGuaiie (both Solana applications) and the upcoming IBAN smart contract wallet from Obvious come to mind. Even the exiled government of Malaysia is creating a non-custodial neo-bank called Spring Development Bank for its citizens on Polygon. It should be noted that these are centralized entities, although they represent users interacting with traditional KYC financial systems in their centralized capabilities, their core functionality and value proposition lies in users interacting with their non-custodial wallets (or semi-custodial/MPC) on-chain. Many functionalities that used to require banks (or challenger banks) are beginning to move onto the chain, and these non-custodial neo-banks provide users with a simplified interface to leverage all the functionalities of on-chain lending, borrowing, yield, and trading protocols in an exceptional user experience. In some cases, non-custodial neo-bank functionalities are paired with traditional banking functionalities, but as users’ financial “tasks” increasingly move onto the chain, the traditional financial system (just as centralized exchanges are now starting to affect crypto users) becomes more and more like a dumb switch.

Neo-Banks 2.5

While most non-custodial payment apps and neo-banks to date have been emerging crypto-native startups, we are also seeing significant activity in the existing neo-banking/challenger banking space, including existing neo-banks setting up non-custodial/semi-custodial wallets for their users and offering crypto services, as well as custodial crypto-focused neo-banks and investment models offering similar services in custodial form. While not fully Web3 non-custodial neo-banks, they directly or indirectly leverage blockchain technology to provide their services, and we can call this category “Neo-Banks 2.5”. Cenoa, based in Turkey, focuses on regions like Turkey and Argentina, providing custodial solutions for users to access USD stablecoins and on-chain yield protocols as an inflation hedge in countries where local currency fluctuations are most severe. The most recent (and perhaps most important) example is LianGuaiyLianGuail, which has expanded its crypto efforts from custodial crypto buying and selling to EVM-based stablecoins and embedded wallets, much like Yellow Card in Africa. In addition to typical fintech itself becoming crypto neo-banks, traditional consumer banks like Brazil’s NuBank, Germany’s N26, the UK’s Monzo and Revolut, and the US’s Cogni are also following a similar path. Operating in a competitive environment, neo-banks are considered challengers to traditional consumer banks, but in the crypto space, they find themselves transitioning from challengers to the challenged. They are becoming hybrid traditional financial and crypto neo-banks by increasing their investments in crypto services. It’s not surprising to see even these larger-scale traditional consumer banks starting to think in similar ways.

Centralized Exchanges

Centralized exchanges are one of the oldest “applications” in the crypto space. Although they represent “centralization” in the crypto environment, they are doubling down on developing their non-custodial wallets and quasi-superapps, and providing services to an increasing number of these “fintech” crypto use cases through their centralized infrastructure. Binance Pay (typically priced in USDT or TRC20 USDT) has significant influence and daily usage in cross-border remittance channels and emerging markets, especially in Latin America. Coinbase’s USDC yield offered in its main app, as well as the equity aggregation in its Coinbase Wallet app, along with the semi-payment functionality launched in its Base (e.g., Beam Eco), provide financial services to their existing user base. Centralized exchanges are well positioned to provide financial services to their existing user base and have invested in growth areas, such as independent wallets, to capture more emerging use cases.

While the exact scope and approach may vary, what are all of the above participants converging around? What is it? Is it practical consumer fintech use cases, early product-market fit?

Users and Use Cases

There have been many articles about early adopters of local economies in crypto, but for cryptocurrencies, the most important user group is clearly the “early majority” (in the words of Geoffrey Moore), a group that can meaningfully solve everyday financial product problems. To move from early adopters to the early majority, a technological paradigm needs to “cross the chasm” from early adopters trying to see the value in new things to the early majority who are just trying to get something done in their lives.

Moore also describes the typical process where a set of vertical use cases emerge, like a set of “bowling pins,” which get knocked down one by one as adjacent use cases provide ample opportunities for horizontal and generalization. All of this culminates in a “tornado” where early use cases converge under the massive adoption push of the early majority, creating a massive integrated winning platform and a suite of applications that find product-market fit. In our non-custodial financial world, we are seeing the emergence of the following “bowling pins,” which paint a picture of what the tornado may look like.

Payments

As mentioned earlier, although the value transfer from A to B is quite obvious in crypto’s design, the significance of crypto payments has been nothing more than an implementation detail for a novelty or some very localized crypto application (or criminal activity) over the years. The classical reference use cases within crypto have even become an inside joke in the crypto circles. But this is changing rapidly, and what is intriguing is that TRON and Binance have gained real traction in the daily payments space in emerging markets, and now more and more crypto application layers are attempting to reposition around consumer payments using blockchain infrastructure with the mantra of “it just works.” Of course, a key catalyst here is the emergence of stablecoins like USDT, BUSD, and USDC, which have a significant role in other parts of the non-custodial fintech space. Broadly, we can divide the payment traction seen in crypto into two near-term areas and one mid-term area – peer-to-peer Venmo-like payments, remittance payments, and B2C payments. Creating a Web3 version of Venmo might be the most obvious decentralized crypto application, but in reality, the full functionality and benefits of crypto can only be consumable with the arrival of stablecoins, cheap networks and layer 2 networks, seedless custody, and account abstraction. These same benefits also apply to international remittance payments, as a significant amount of crypto remittance flow begins to emerge between Latin America the United States and Africa Europe.

Inflation Resilience

Especially in emerging markets, inflation resilience is closely related to payments and remittances. The main factor here once again is stablecoins – especially USD stablecoins – as people in countries with weak or volatile currencies are seeking ways to protect their wealth. Latin America is once again at the forefront of this trend, which is expected given its unstable currency background, but we can see this trend in people’s desire to maintain the value of the gold standard – the US dollar (no offense to financial enthusiasts). Non-custodial financial applications can provide basic access to USD for anyone in the world (often easier/cheaper than traditional forex channels) as long as they can convert from fiat currency in some way. These USD can be held, put into interest-bearing accounts, and sent to anyone with a compatible wallet anywhere in the world at increasingly lower costs.

Savings/Returns

Everyone with excess cash needs somewhere to store and preserve that value, and we see non-custodial financial applications leveraging on-chain infrastructure to provide users with easy-to-use, consumer-friendly interfaces for earning returns and interest. Despite initially lower on-chain rates, more active interest policies from centralized stablecoin issuers to match the off-chain fixed income environment have brought on-chain rates closer to rates in the off-chain money markets. Various non-custodial yield products, albeit without the huge fundamental rate advantage that DeFi had during its boom phase, still enable people to effectively increase their savings. DEX LP positions for stable or blue-chip currency pairs, conservative money market positions, risk-free rates on stablecoins, conservative yield aggregation strategies, all provide potential on-chain sources of income for non-custodial financial applications, representing their users, whether it is for their stable assets (thus expanding the use case of hedging against inflation in these scenarios) or for any volatile/investment assets. We see the outlines of this experience in user-centric Web3 native applications like Instadapp and Zerion, which make it just a couple of clicks to deposit funds into yield positions, and consumer applications like Cenoa mentioned earlier that simplify it to just “savings” functionality.

Borrowing

On-chain borrowing is harder to bring to consumers compared to lending, as most credit in the world is low-collateral/uncollateralized, but we still see interesting progress and innovation. Non-custodial financial applications haven’t gone all-in on this (except for Binance truly offering crypto loans to users), but we can expect this to change soon as progress is made on the underlying protocols and can be delivered to the interfaces. MakerDAO’s SLianGuairk protocol allows you to borrow DAI at a fixed interest rate of 3.19% (and spend it with an optional linked debit card), which is very attractive in today’s environment as long as you are willing to provide double the loan collateral. It will be interesting to see if it attracts any retail borrowers who are priced out of personal loans under current interest rates and credit scoring systems and want to lock in low-interest loans for purchases without actually spending the funds. Alchemix offers “self-repaying loans” – which could be used for buying a car or making a down payment on a house. DeFi protocols like Goldfinch are delving into uncollateralized loans, serving the off-chain business, a concept that could be extended to millions of small businesses, and the experience gained from it will definitely provide insights for the next round of attempts to build more accessible credit applications, whether it’s based on oracle-based uncollateralized models, post-Sybil credit models, or innovative new collateralized loan protocols with more attractive features. The final boss is the opaque, centralized, Orwellian credit institutions and traditional banking credit ecosystem, which non-custodial finance will be able to present to consumers once DeFi offers better solutions.

Foreign Exchange/Multi-currency Accounts

For certain user groups, such as international students, foreigners, freelancers, and digital nomads, dealing with multiple currencies is a part of life. While receiving payment in one currency but needing to remit the home currency back to their country, using a SaaS application that requires payment in another currency, having multiple clients or part-time jobs that pay in different currencies – these are all situations that require quick exchange of funds between different currencies. Conducting such exchanges through traditional banking systems can be cumbersome, slow, and expensive, and for some people, the administrative overhead may actually be unaffordable. With stablecoins and decentralized exchanges (DEX) provided by non-custodial financial applications, people can have a “cryptocurrency multi-currency account” that includes multiple stablecoins, which they can send, exchange, or save according to their needs. Among these same user groups, multi-currency accounts have become a popular feature of non-cryptocurrency financial technology/emerging banking applications, as more and more emerging banks focused on these use cases and existing fintech companies began exploring blockchain as an alternative solution, these two use cases are expected to merge over time.

Trading/Investment

Trading is the first core use case of cryptocurrencies, so we won’t spend too much time discussing it here, but it is worth noting that the opportunity to invest or even trade risky assets has been something that the traditional fintech industry has been pushing for a while in the stock market (consider Robinhood), and it is a reasonable user demand that non-custodial financial technology applications can obviously provide to their users. Decentralized exchanges (DEX), bridges, and aggregators enable consumer applications to relatively easily provide non-custodial cryptocurrency trading to their users, allowing them to take on a certain level of risk exposure. With more real-world assets tokenized on-chain, the prospect of offering everything from cryptocurrencies, stocks, foreign exchange, real estate, to fixed income and other transactions from a single application becomes apparent for non-custodial financial technology applications. If a DeFi yield protocol for digital dollars can hedge against current inflation and achieve monthly savings goals, why not use the same application to simply invest the remaining funds into the latest hot cryptocurrencies or stocks?

Implementation Models

Of course, as synchronous evolution occurs around the problem space, there is synchronous evolution occurring around the solution space. As we finally start to see NoFi applications that can reasonably compete in large-scale markets, we can see some common threads supporting different approaches. Let’s start from the high-level settlement layer, go down to the application layer, and then delve into some key technical topics.

Multi-party Computation (MPC), Account Abstraction, and the Elimination of Other Seed Phrases

It is obvious that the next billion users will not securely store a 24-word phrase, and in the past 12 months, the encryption industry has taken this meme seriously and launched many different implementations, standards, and software development tools to help dApp developers provide web2-style login experiences with encrypted wallets. I detailed this area in the article “Wallet-Centric Experience Stack”, but it is worth reiterating that secure self-hosted solutions are crucial for the development of NoFi application layers, as they can provide web2-style login and recovery capabilities. Whether the specific implementation is based on MPC, smart accounts, or a hybrid of the two, NoFi applications are leveraging the latest and best wallet experience stack middleware innovations and bringing them to the public. Eco from Beam uses ERC-4337 compatible smart accounts and account abstraction infrastructure on Optimism (and later Base) to provide an entry process without seed phrases and a payment experience below 5 cents, even if the user has never set up a wallet before, it can be accessed through a link.

Solana

As a well-known Ethereum enthusiast, I have to admit that I must give Solana due praise. Sling, Decaf, and Key.app all run on Solana, and they may be the three smoothest NoFi applications currently in existence. Although Solana has always performed well in terms of cost (despite the decentralized tradeoff), its notable presence in the NoFi field lies in the quality of application builders and the positioning of everyday user value. Therefore, although Ethereum’s sidechain ecosystem is rapidly catching up with Solana in terms of cost and speed, from the perspective of innovating NoFi user experience, Solana’s application ecosystem may be ahead in some ways.

Zaps, Meta-Transactions, Intent

Without going into a lot of details about blockchain intent and the future of MEV, I just want to mention that bundling multiple on-chain operations together to facilitate easy trading for users is not just about allowing speculators to get the best limit order prices. Whether it’s on-chain “zaps” or “schemes” of multiple transactions to be executed together, or off-chain signature messages representing user intent, NoFi applications can leverage the combination of various types of transactions and transaction-like instructions to simply provide users with the content they are looking for. In NoFi applications, these small frictions will soon be eliminated, such as buttons like “Exchange to USDC and Save” or “Exchange to ETH and Stake”.

Block unicorn note: Zaps refer to the aggregation of a series of interactive processes into one-step/one-click execution operations, abbreviated as Zaps.

Integration of Cryptocurrencies with Traditional Financial Banking and Payment Systems

In this NoFi (Non-Custodial Finance) wave, another implementation theme we see is the integration of cryptocurrencies and traditional finance in meaningful ways. One of them is that the entities operating these applications are often able to add value to users by establishing relationships with banks or collaborating with some banking infrastructure providers. Non-custodial neo-banks, essentially 95% non-custodial wallets, can add services that convert fiat to cryptocurrencies and bank accounts to deepen the value provided by these applications. Being able to automatically deposit part of the salary into a non-custodial wallet makes other services in the wallet more valuable and necessary, and being able to use cryptocurrencies to swipe or tap payments at grocery stores further extends the value. Users need to undergo real-name verification when using these services, which means they give up some anonymity, but for most users, real life is already “real-name verified”, and this is just a way to better integrate cryptocurrencies into their lives. With Visa and Mastercard already experimenting with payments on EVM-based smart accounts and account abstraction, and the mixed world of linking on-chain and off-chain becoming increasingly common in user interfaces.

Tokenization of Real-World Assets

As mentioned earlier, an increasing number of high-quality real-world assets are being tokenized, enabling new types of consumer financial products that were otherwise impossible. The most obvious and direct way is through stablecoins themselves. Issuers like Circle and Tether are issuing tokens backed by billions of dollars worth of short-term notes and increasingly passing on the yields from government bonds and other short-term off-chain securities to stablecoin holders. Another example is the recent wave of on-chain US government bonds that crypto investors can access through platforms like Ondo Finance. While you need to go through KYC (and there are geographic restrictions depending on the product you want to use), once you complete the KYC process, you can earn attractive yields in a user-friendly on-chain wallet without having to click through confusing broker applications. As more valuable real-world assets are tokenized and introduced on-chain, they create more potential financial products for regular users.

Why now?

To understand why we are now seeing explosive growth in these use cases (whether you like it or not, TRX chain has 2 million DAUs) and why even serious players like LianGuaiyLianGuail are joining in, we need to look at some factors that are collectively driving progress.

Stablecoins

The first and most obvious reason for the rapid rise of NoFi is the maturity of the stablecoin ecosystem. Digital dollars (and an increasing number of other fiat currencies) can be considered the killer app of blockchain so far. As we’ve discussed in most examples, stablecoins are the lifeline of actual day-to-day commerce that volatile cryptocurrencies cannot achieve. Digitized frictionless fiat is permeating various applications, regions, and sectors. This momentum is accelerating, not slowing down, with Circle alone generating over $700 million in revenue in the first half of 2023 based on its $26 billion USDC issuance, surpassing their total revenue for 2022.

Tether is earning massive profits and if this continues, they could become significant holders of US government bonds. However, more important than the massive issuance volume or revenue statistics is the adoption by regular users and businesses to do the mundane and necessary things mentioned above, especially those who previously had little to no access to banking services in developing countries. In developed markets, we have yet to see their explosive use in the mainstream, but there is reason to believe that this may change (more on that later).

Maturity of Scaling Solutions

In the blockchain scaling wars, I don’t want to prematurely declare the victory of the trilemma problem in practical applications, although a significant amount of architecture, engineering, and decentralization still needs to be built in the blockchain scaling ecosystem, we are getting closer to the point where decentralized blockchains become too expensive and cumbersome to achieve everyday use. The cost of transactions on Solana has already dropped to the point of being almost negligible, and Ethereum’s “Manhattan Project”-like focus on Rollup-centric roadmap is finally showing real results. We will not only see a significant reduction in the cost of Rollup from EIP 4844, but also see all the scaling advantages that the zk space has yet to tap into. In addition, we are seeing the creation of a thriving L2 infrastructure ecosystem to the extent that applications will be able to easily launch dedicated “Rollapps” for their applications to achieve maximum control, performance, and profitability. Cryptocurrencies as a whole, especially Ethereum, have gone through a “difficult period” in terms of scaling, and these efforts are producing excellent “good enough” L2 solutions that are almost applicable to any use case with just a hard fork. Therefore, NoFi applications are entering the most lenient block space environment in the history of cryptocurrencies, with multiple good and constantly improving network options to choose from.

Innovation in Wallet Technology

As mentioned above, innovations like MPC, account abstraction, gasless transactions, and products like Privy and Web3Auth are tightly integrated into the entire “wallet stack”, providing developers who want to build applications on top of cryptography with deep native wallet functionality a more convenient way. The next wave of encrypted neobanks and non-custodial fintech applications will no longer have to worry about user seed phrases or the need for an installed wallet. Not only have these blockchains finally become cheap enough, but they can also add frictionless interaction between applications and state-of-the-art smart accounts with just a few lines of JavaScript code.

Macro Tailwinds

Taking a step back from cryptocurrencies themselves and looking at the backdrop in which they operate, we can see that the world surrounding cryptocurrencies is moving towards making this NoFi innovation more attractive and necessary. Inflation volatility has made a strong comeback, especially in developing countries with weak currencies, and the desire to avoid exposure to international and local inflation volatility is growing. E-commerce is attempting to penetrate every corner of the earth, but in areas where local banking and payment infrastructure is weak or where there is a lack of internet access, the enthusiasm for traditional fintech innovation has been suppressed. The long and boring path of market efficiency development is being driven by the reduction of centralized (i.e. expensive) intermediaries.

Blockchain as a Vehicle for Competition

All of the above factors, and more, converge to give blockchain multiple “vehicles” to compete in fintech applications. Rather than relying on speculative future value or ideology, cryptocurrencies are beginning to incorporate cool and tangible realities into their value proposition in this emerging NoFi field.

Transaction Costs

Centralized intermediaries have a certain profit requirement, and the more centralized intermediaries are stacked together to move value from one place to another, the more profit they will extract from consumers and businesses. Blockchain can consolidate intermediaries into smart contracts, fundamentally doing more with fewer resources. Where cryptocurrency’s victory becomes clear is in the reduction of transaction costs for international payments. The cost of sending a payment between two countries using the international wire transfer system is nearly $100, while sending it via USDC costs less than $1. As gas fees and scalability become less of a concern in the future, the clear advantage of cryptocurrency payment systems in terms of transaction costs will penetrate every possible consumer and business-facing service, and every profit that can be recovered through this method will be reclaimed by using blockchain. Autonomous DeFi protocols may design more “profit space” out of finance, and NoFi applications can feed these profits back to consumers through better financial products.

Composability

Composability is greater than simple interoperability and refers to how different parts of an ecosystem connect with each other to create higher-order and more complex value. From a basic perspective, NoFi products based on EVM wallets immediately gain the ability to pay with any other on-chain EVM wallet, interact with DeFi protocols, read identity NFTs from other applications, and create EVM application logic that utilizes wallets. Although this is a somewhat abstract property, it is closely related to general interoperability and network effects. However, the unique composability of cryptocurrencies allows for the combination of various services to achieve greater end customer value. When combined with the next property – permissionlessness, NoFi builders immediately gain a huge sandbox when enabling their users to connect to the blockchain, enabling easy facilitation of transactions, lending, borrowing, payments, or anything built on or combined with them.

Permissionlessness

When building fintech applications, integrating with other complementary providers or value-added services can be a cumbersome, expensive, and time-consuming process. Integration with cryptographic protocols is completely different because while there may still be some user experience issues when using some of these protocols, the fact remains that anyone in the world can add a basic “savings” functionality to their application when it is a wallet and they plug into Compound or Aave. This permissionless integration leads to faster innovation cycles and a wider range of potential building blocks for creating compelling financial products and experiences.

Reduced Business Footprint and Liability

One of the more interesting aspects of non-custodial finance that makes it an attractive approach for fintech players is the different division of responsibilities created by its non-custodial nature, involving users, developers, and other services. Together with the aforementioned permissionlessness, non-custodiality not only reduces the initial friction of integrating content like DEX trades into your application but also (in many jurisdictions) gives you the ability to do so from a legal and regulatory perspective compared to integrating traditional stock trading. The same applies to activities like lending, which are typically reserved for traditional banks but are accessible to anyone with a wallet (including your customers) through DeFi protocols. NoFi applications can offer a suite of financial services, BD licenses, MTL licenses, and even banking licenses if you can consider what can be moved onto the chain (and your exact jurisdiction) as well as regulated third-party providers such as regulated switches. There are even experiments with more decentralized wealth management in an on-chain advisory capacity (although again, this is not legal advice). This completely disrupts the way fintech applications are developed because it means that the financial services field can have a wider range of potential participants. By minimizing the off-chain footprint of business and earning money through transaction interface fees, NoFi applications can actually enter markets that they couldn’t access in a non-cryptographic manner.

User Experience (UX)

Is user experience (UX) a potential selling point for crypto financial services? I thought it was precisely because of user experience that we couldn’t achieve mass adoption. While we still have work to do to improve the user experience of crypto, over time, we can actually expect significant benefits in terms of user experience compared to non-crypto technologies. Take logging in and making payments, for example. To fully realize this, we need a certain number of applications that support crypto technology and users who already have wallets. But people will be able to simply connect to their wallets and make payments without entering any additional information because they control their own private keys. This will bring a better experience than web2 over time. Instant crypto payments, in essence, may require fewer clicks than the fastest web2 equivalent when sending international payments through a bank’s annoying wire transfer screens. Currently, user support for crypto technology is as much as opposition, but this will change soon (for some of the above reasons), providing an opportunity for a fundamentally different sovereign user experience, which is an embodiment of the simplicity of user experience implied by wallets, and will attract users in terms of pure usability.

What’s next?

Non-custodial finance (NoFi) is now entering the prime environment, and I believe the number of participants competing for this opportunity will grow by an order of magnitude in the next few years. This field will not only become highly competitive but will also merge with the competitive dynamics of financial technology and the existing new banking industry, forming a dynamic whole. It is difficult to accurately predict who will become the winner, but there are some future directions worth paying attention to.

Social and Social Finance

Almost parallel to all this non-custodial finance (NoFi) content is a thriving decentralized social network ecosystem, a large part of which revolves around cryptocurrencies. Protocols like Lens, Farcaster, and BlueSky will open up new design spaces for social applications, and with the explosive growth of this social network design, business model innovations for creators and others are likely to merge with the emerging NoFi meta-field. In the past week, we saw a very interesting experiment with social tokens on Friend.tech deep in the crypto Twitter, although it is still in its very early and niche stage, as more and more innovation happens in the area of decentralized social (De-So), both sides will influence each other. Perhaps the most influential example is what would happen if Twitter/X enters the world of crypto payments. In addition, there are currently ongoing experiments on on-chain community finance, microloans, social insurance, basic income plans, etc., which have finally become relatively simple technically, and we should expect the development of the multi-person financial field oriented towards solving people’s actual real-world problems.

B2C Messaging and Conversational Blockchain Commerce

Message protocols like XMTP are finally starting to be adopted in consumer wallets, not only in consumer wallets like Coinbase Wallet, but also in experience stack providers like Dynamic.xyz, which is targeted towards B2B. This begins to imply a set of very powerful business use cases that may involve conversations between consumers and dapps or even merchants. Conversational support, sales, and marketing will enter wallet-based commerce and add an additional layer of consideration for NoFi applications. Will they become B2C platforms themselves (like what Decaf is doing with its consumer wallet and merchant encrypted PoS solution), or attempt to be a universal client for blockchain commerce, representing users to allow application support for transactional messaging? This will open up a whole new trusted business communication space as artificial intelligence clogs all of our digital communication channels and spammers become more effective and scarier.

Experience stack providers will focus more on NoFi as an application scenario

I expect that wallet experience stack providers mentioned in this article and my other articles will increasingly focus on NoFi as a vertical. In addition to games, NFTs, and traditional DeFi, these consumer-facing financial applications are the perfect embodiment of middleware product value propositions, providing web2-like experiences on the web3 track. There are over 40 well-funded companies and projects in this field, and their attention will bring better NoFi development solutions and the emergence of more killer applications.

Momentum finally appearing in developed markets

Early NoFi progress has mostly been concentrated in emerging markets or involved people related to those emerging markets. Intuitively, this makes sense as markets in these regions are typically underserved, while affluent countries often over-serve consumers. However, with the various forces mentioned above at play, we will see more and more innovation happening in markets where consumers are over-served in certain obvious dimensions but underserved in certain less obvious dimensions. This is likely to manifest as innovation gradually flowing back from developing countries to more developed ones.

Unhosted Super Apps

Lastly, although this article assumes many different approaches to NoFi applications, it is entirely possible that a few dominant players will aggregate these “imperfect financial functions” into a “unhosted super app” similar to WeChat or GoTo. These apps would not only be able to perform all the tasks mentioned above, but also connect the entire decentralized internet through some dApp browser (or more likely, a “mini-program” style lightweight app framework). Some general web3 wallets certainly hope for this scenario to emerge and many are fundraising with that as an investment theme. While I think there could be one or two web3-integrated wallets in the current batch that achieve super app scale and scope, I think it is more likely that existing tech giants and smartphone manufacturers, or NoFi apps starting from a more focused mass market and more limited initial scope, will achieve this.

Conclusion

Although I am excited about use cases that come directly from on-chain culture and are completely avant-garde, a fully decentralized internet and metaverse will take time. In the meantime, NoFi already exists and serves as a bridge for the crypto space to reach the early majority of users.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Delay and Profit Analyzing MEV on Solana

- Loot 2nd Anniversary Review The Huge Potential of Lootverse and Dojo

- Opinion LybraFinance V2 will drive the growth of peUSD.

- A Brief Explanation of L1 Injective Built Specifically for Financial Applications

- Exploring the Potential Business Transformation of Intent-centric Narrative

- Exploring MEV Solutions in the BSC Ecosystem BloxRoute and Sentry Node

- TG bot Maestro protocol with the highest number of users