Grayscale’s victory over the SEC is not surprising at all. These analysts had already anticipated the outcome.

Grayscale's win against the SEC was expected by analysts.Compilation: Blockchain Knight

On Tuesday, the United States Court of Appeals for the District of Columbia Circuit ordered the SEC to accept Grayscale’s application to convert GBTC into a spot BTC ETF for review, marking a significant victory for Grayscale.

However, for some crypto asset stakeholders, the outcome of this lawsuit is not surprising, as they foresaw Grayscale’s victory over the SEC earlier than anyone else.

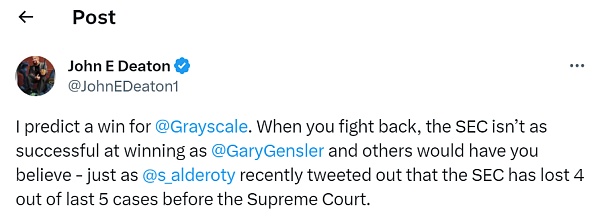

After Grayscale filed the lawsuit against the SEC, attorney John Deaton in the crypto field was one of the earliest experts to predict the company’s victory.

- Coinbase CEO If I start a business in 2023, I have ten cryptocurrency ideas.

- LianGuai Morning News | Coinbase to List PYUSD’

- Puzzle Ventures Why is ZKization of Consensus Layer Needed?

Deaton posted a prediction on X (formerly known as Twitter) on February 28, 2023.

He stated, “Many smart lawyers believe that because Grayscale is trying to meet a very high and difficult standard to prove the SEC’s arbitrariness and capriciousness, this regulatory agency will win the lawsuit.”

Now, after Grayscale’s victory in the lawsuit, Deaton also emphasized why he was confident in his prediction of this case. He explained, “Because the SEC cannot reasonably explain why it approved futures ETFs but not spot ETFs.”

Another person who predicted the outcome was Elliot Z. Stein, a senior legal analyst at Bloomberg Intelligence, who made the prediction during Grayscale’s oral argument in March.

In this debate, Grayscale referred to the SEC’s decision not to approve its ETF application as arbitrary. The judge in charge of the case seems to agree with Grayscale’s statement, believing that the SEC did not provide a decent explanation for why it did not approve Grayscale’s application.

This prompted Elliot to change his previous view on the case and increase the possibility of the company winning the lawsuit from 40% to 70%.

In a research report in June, Elliot mentioned, “The SEC and its chairman, Gary Gensler, may have prepared to lose the lawsuit and hope to approve the spot BTC ETF application before or just after the court’s ruling, thereby taking preemptive measures to ease the lawsuit or render it meaningless.”

Elliot is not the only analyst at Bloomberg who is confident in Grayscale’s victory over the SEC. James Seyffart and Eric Balcunas are two other crypto analysts who also predicted Grayscale’s win in this case.

This victory by Grayscale has had a significant impact on the crypto market.

According to Coinglass data, this victory triggered over $95 million in market liquidation in the first few hours, with short sellers being hit the hardest, as 88% of the $97 million liquidation came from short sellers.

In the 24 hours after the victory, the volume of liquidation increased to over $120 million.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Chainlink releases v0.2 Staking platform and specific details

- Two pictures will help you understand why Filecoin has strong resilience and how to easily resolve the scenario of significant QAP loss.

- Evening Must-read | Security Issues that Airdrop Hunters Need to Be Alert About

- Building the Future of Finance Prospects and Opportunities of NoFi

- Hong Kong anti-money laundering operation arrests more than 400 people, lawyer warns encrypted users to be careful of being implicated.

- Opinion The potential of liquidity staking on Solana is gradually emerging.

- Injective Research Report L1 Built Specifically for Financial Applications