Again on Hayek: Digital Currency Abyss

Staring at the abyss for a long time, the abyss will return to gaze.

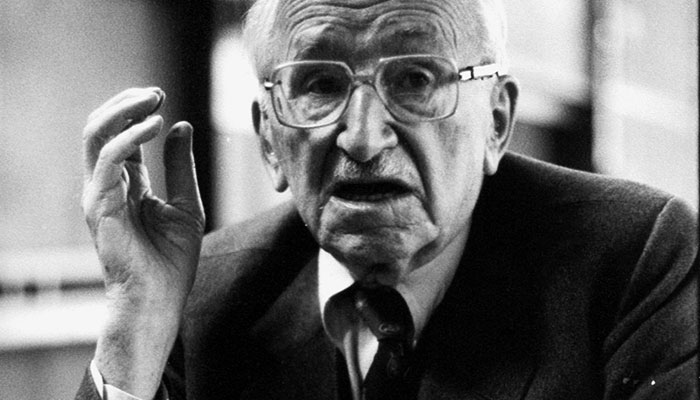

Forty-three years ago, "the non-state of money" subverted the orthodox monetary system concept: since free competition is most efficient in the general commodity and service markets, why can't we introduce free competition in the currency field? The author Hayek (Note 1) is a neo-liberal thinker with far-reaching international influence. His theory is ambitious and complicated, but his subject of thought is very concentrated on "reconstructing various spontaneous orders that exist in the social world." Emphasizing "freedom" based on "spontaneous order", his last economic monograph "Non-State of Money" put forward a revolutionary suggestion: abolish the central bank system, allow private money to be issued, and compete freely. This competitive process will find the best currency. The European Central Bank has stated that "the theoretical roots of Bitcoin can be found in the Austrian School of Economics", and the emergence of a bitcoin-like super-sovereign digital currency system has also been inspired by Hayek's monetary thinking.

Hayek believes that money and other commodities are the same from a competitive perspective. It is much better to be in a free and open market than to be monopolized by a few classes. Because from a government perspective, economic power will inevitably lead to concentration of rights, rather than letting the government judge something. The direction is not as good as the spontaneous order of market mediation. However, the non-stateization of this currency has not been realized for a long time because the cost of casting money is different, and there is a large loss in the circulation process. Therefore, there is a large-scale private coin circulation in history. But was eventually replaced by the national credit currency.

- Gongxinbao is about to issue a heavyweight agreement, and the sword refers to the trillion-dollar data economy market.

- Andreas Antonopoulos explains the principles in depth: What are mining awards, candidate blocks and coinbase transactions?

- Market Analysis | Huge amount of shock, do not change the upward trend, but be careful of the siphon effect

Digital currency is based on the encrypted transmission and circulation of computer equipment and the Internet. Compared with the traditional currency, its theoretical casting and circulation costs are zero, which clears the obstacles of non-state currency, but like all illegal currency, it faces a long time. A period of credibility and social recognition issues. What we need to think about is not an independent central bank, a self-regulating central bank or an ethical central bank, but a central bank of competition. The marketization of deposit reserve ratios, interest rates and exchange rates, as well as private financing in the face of monopoly money supply is purely thirsty. Hayek and other economists are similar to "accurately grasping the problem, but the proposed solution has loopholes." As long as the theory is based on assumptions, there is nothing wrong with finding the problem, but what is the variable that determines the variable, Who is it, the economic person, the social person or the natural person? We must keep thinking: what else is monopolized by the state with various excuses, but it should be an individual's freedom; or is the government and freedom truly opposed, and whether the government's existence is also free competition? What is the result?

Keynes (Note 2) is macroeconomics, a psychological understanding of the impact of reality, Hayek is more psychological expectations of the future, the current society is intensive development, Hayek's highly individualized thinking After being gradually eliminated, Keynesian theory is the first time that human society has entered a highly intensive development and derived from the economic thinking experience. Hayek neoliberal economics is the first economics brought about by the bottleneck of highly intensive social development. Thinking, it is more complementary to Keynesian theory, but society will not reverse development. Keynes and Hayek are both explorations and reflections on the development of closed society towards open society. Economic globalization impacts Keynesian theory, and neoliberal economy has multiple Closed economies are integrated to provide adhesives. Economically developed countries mostly encourage Keynesian economic practices, focus on macroeconomics, expand government spending, implement fiscal deficits, expand economic policies, stimulate consumption, and maintain prosperity. Foreign countries are required to adopt Hayek’s neoliberal economics. Double label is very good.

Keynes believes that human irrationality stems from its own flaws; Hayek believes that people sometimes appear irrational because they are deceived by decision makers. The Cairns money supply must be controlled by the central bank's exogenous variables. The price changes caused by interest rate changes. Hayek believes that the state monopoly is more harmful than the profit, because the monopolist has no positive incentives, but has the incentive to seek rent (Note 3). The most important thing in monetary theory is that the money behind it actually represents a certain "item". Marx elaborates on the benefits of gold and silver as general equivalents (Note 4), such as shells, gold and silver, in the gold and silver standard period, the so-called inflation is very Difficult to appear, there have been several major discoveries of gold and silver mines, which led to the depreciation of gold and silver, but with the growth of population, the looting between countries, the expansion of trade and the expansion of commodity production, for gold and silver The demand has expanded, and there has not been a huge change in the proportion of certain gold and silver corresponding to certain commodities. Such a currency is like an anchored ship, and it will not drift too far. This is the so-called "anchor theory." (Note 5)

Hayek’s "Non-Nationalization of Money" was published in 1976. Nowadays, the monetary policy of various countries has not realized the liberalization of his ideas, and the unified currency (the euro) that he has opposed for life has been established. As he predicted, the unified currency operates. It is not so perfect, and the situation in which the countries around the world are printing foreign currency has become increasingly fierce. Modern society has constantly proved that the market of free competition brings great prosperity, but stubbornly believes that the price scale that measures free competition – currency, must naturally be under the power of monopoly. In 1776, Adam Smith wrote in the "The Wealth of Nations" that "only when we expect the good money…from the note-issuing bank's concern for its own interests, we can enter a happy time." Not escaping the rules of human survival: self-promotion is more likely to produce good results.

Bitcoin has always been seen as an enhanced version of the gold currency, as its quantity is not manipulated at will, and it is easier to circulate than gold. In terms of individual liberalism, we do need one or more stable digital currencies to replace global production technology resources. Especially in the global interconnection of transactions, PayPal can indeed exchange more than 100 legal currencies worldwide, but PayPal actively freezes any The user account associated with the encrypted digital currency is moving farther and farther away from the original goal of “will allow global citizens to control their currency more directly than ever before”. The mission of Bitcoin is to open up a new era of doubts. Its mission has been completed, and there is no need to entangle things like faith and eternity. As long as human productivity is insufficient, there will be inequality. Inequality has always existed in the evolution of intelligent life. Human beings are also eager to create inequality. Contemporary people cannot solve it or even see the final solution.

Note 1: Hayek, full name Friedrich August von Hayek, CH (German: Friedrich August von Hayek, May 8, 1899 – March 23, 1992), Austria Born in the UK [well-known economist and political philosopher. It is known for its insistence on free market capitalism, against socialism, Keynesianism and collectivism.

Note 2: John Maynard Keynes, the first Baron Keynes (English: John Maynard Keynes, 1st Baron Keynes, June 5, 1883 – April 21, 1946), British economist. Keynes argued that the government should actively play the role of economic helmsman, through fiscal and monetary policies to combat economic recession and even economic depression. Keynes's thoughts were effective countermeasures during the global economic recession of the 1920s and 1930s, and the policy thinking that built up the prosperity of many capitalist societies from the 1950s to the 1960s, and thus was praised as "the savior of capitalism". The father of post-prosperity." Keynesian thought, which once dominated capitalism, has also become one of the schools of economics, called the Keynesian school, and has derived several branches, whose influence has continued to this day.

Note 3: Rent-seeking, the main way to obtain wealth is not through the creation of wealth, but the possession of wealth created by others, or the culture of profit-seeking, rent-seeking in many forms, in poor countries, political and commercial life. The focus is often not on creating wealth, but on rent-seeking. Rent-seeking can be cashed out through government contract rebates or by transferring state-owned assets to the chaebol and relatives of politicians.

Note 4: Marx said in the “Value Scale” section of Chapter 3 of “Capital Theory”, “Currency and Commodity Circulation”: “Gold performs the functions of the general value scale, and first of all only because of this function, gold, etc. The price of goods becomes the currency. Commodities are not allowed to pass the contract because of the currency." "Currency as a measure of value is the intrinsic value of the commodity, that is, the inevitable expression of labor time." Unfortunately Marx's intrinsic value scale from labor time The translation dream of the formal value scale of gold has not been realized in life, and no one of Marx's successors can achieve it.

Note 5: The international reserve currency actually has an “anchor”, which is a basis. This is the currency anchor, which is a very graphic concept. For example, the "anchor" of the US dollar was gold, but if there is no single sovereign state to determine the international reserve currency, it is equal to the "anchor". For example, a basket of currencies is equivalent to a package of "anchors". This is very difficult.

This article was originally created by Youyou Finance author, please indicate the source.

(Source: Youyou Finance)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why is the industry most concerned about these five things? The next bull market in the blockchain relies on them.

- EU: Established the International Trusted Blockchain Application Association to promote the adoption of blockchain technology

- Research Report | Blockchain Empowerment Reinsurance Research Report

- After April Fool's Day, Bitcoin is back with confidence rather than price.

- National Information Center Zhu Youping: The Office of the Internet Information Office is a measure to encourage the innovation chain of the blockchain to expel the bad chain.

- Number reading | The paradox behind the 109 reports The truth is that IEO is an antidote or a poison?

- Tesla may be best for a coin