Although Bitcoin has broken through, most people are still just onlookers.

If you are concerned about politics, then you must know that at the G20 summit in Osaka, Japan at the end of this month (June 28, 29), the Minister of Finance of Japan will share the Japanese cryptocurrency with the G20 financial leaders. Positive experience; if you are concerned about finance, then the message "Bitcoin breaks through 10,000" must have already smashed your Weibo, circle of friends and the various information channels you are using; if you just fall in love with the Internet, then there is The news of Facebook's virtual currency project Libra is bound to hit you overwhelmingly.

Although the cryptocurrency has come a long way since its birth, it is still quite rare for a scene like this to be like a spring breeze. Many consumer groups have begun to resonate with decentralized finance. Many well-known companies have begun to get involved and research blockchain and encryption technology. Governments have changed their attitudes before and gradually recognized and valued cryptocurrencies.

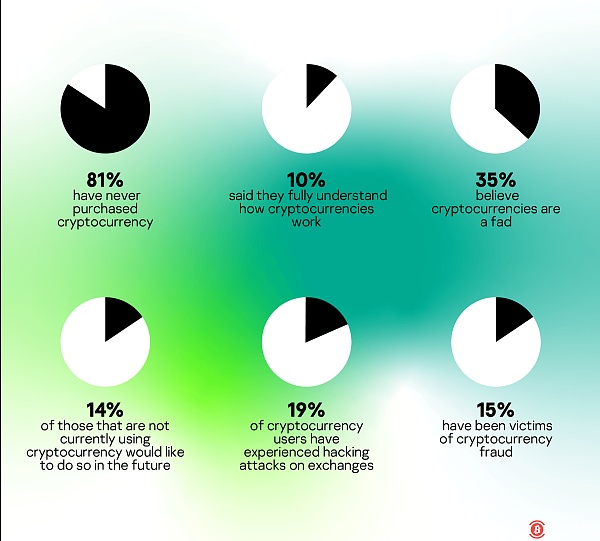

Encrypted currency, this still young thing, has become an important part of modern social civilization – contrary to this trend, most consumers are still very cautious about cryptocurrency. According to a global survey by Kaspersky, a well-known Russian cybersecurity agency, 81% have never purchased cryptocurrencies or related products.

- 48 cryptocurrency exchanges approved by the Philippines

- Analysis of the madman market on June 26: Crazy, what should we do?

- Bitcoin, which is also step by step: an alternative feast brought by the skyrocketing gold

Kaspersky’s findings

Kaspersky’s survey of consumer attitudes toward cryptocurrencies involved 22 countries around the world. Based on feedback from respondents, we obtained the following results:

(1) 81% of people have never purchased cryptocurrency and related products

(2) Only about 10% of people understand how cryptocurrencies work

(3) Up to 35% of people think that cryptocurrency is a fashion

(4) 14% of people are reluctant to use or purchase cryptocurrency

(5) 19% of the people involved in cryptocurrencies have been hacked and 15% have been scammed

From the conclusions of this sample survey, we can see that only a small number of people (considering that the sample of respondents are mostly young and middle-aged people with certain spending power and education level, the actual proportion should be smaller) Being involved in cryptocurrency transactions, and the real understanding of cryptocurrencies is even rarer.

The scary thing is that the ratio of the two is even lower than the proportion of hackers and scams among the attendees, and some people say they strongly refuse to contact and use cryptocurrency. Therefore, it is not difficult to conclude that the public's trust and recognition of cryptocurrency is still at a relatively low level.

Tu Kaspersky's findings on consumer attitudes toward cryptocurrencies (image from Kaspersky Lab)

One of the reasons for lack of trust: unable to build product dependencies

Any commercial product is eager to build consumer trust, but this trust is often not so easy to build. Building trust usually takes a lot of time, that is, for a long enough time, for a market with enough potential users, according to the funnel model, it will eventually be able to screen out a large number of stable user groups.

If a product can give its users a high degree of product reliance on it, then it will break the rules of time to find a shortcut to build trust. Alipay is a classic example of this: an app that can help people with convenient payment and property management on a daily basis. It will make the vast majority of people quickly dependent, even at all.

For young cryptocurrencies, it lacks the qualifications of many years in the financial market, and it does not achieve a high degree of reliance on its products at the technical level, at least for now.

The second reason for lack of trust: huge financial risks

The financial risks associated with cryptocurrencies come mainly from two sources: price volatility and cybersecurity.

I don't think I need to repeat too much on the first point. The "ups and downs" of Bitcoin in recent years are enough for everyone to talk about for a while. So here I mainly talk about the second point.

Cybersecurity risks also include two aspects: one is the cybercriminals (hackers) stealing and attacking private key addresses or nodes, and the other is that exchange users lack protection from insurance and claims, once the exchange is For a reason, the digital assets it occupies are lost, users can't recover their original assets, and they can't claim from the exchange. (The second point is mainly for decentralized exchanges)

As I have investigated in the survey data above, many holders of cryptocurrencies do not know much about the cryptocurrency itself. They may only know a little about how to safely and effectively keep them. This is exactly what hackers bring. The opportunity is unfortunate, based on the anonymity of the blockchain and the fact that most countries do not actively control the cryptocurrency, the stolen usually can only eat this dumb loss.

As for the lack of insurance, the main reason lies in the imperfection of the regulatory system and the industry structure. The imperfection of the former causes the relevant property issues and disputes to be unable to obtain effective legal intervention or protection. The imperfection of the latter leads to the user agreement. The two-way benefits cannot be guaranteed. (哔哔News)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC, ETH continues to rise, how to look at the market outlook and profit grasp

- The bull market has a top! The indicator tells us where the top of the BTC is.

- BTC broke through 11700 and hit a new high, and the trend achieved a strong rise

- Amaranths are tied! After the big rise, the price of bitcoin fell below 10,000 dollars.

- Deloitte Report: 73% of Chinese companies regard blockchain as a strategic priority

- Reaffirming that it does not threaten global financial stability, what promises G20 has made to the encryption industry

- Market analysis: BTC double bottom formation, rebound immediately