LianGuai Observation | Chain gaming track has won large-scale financing, has GameFi passed the ice age?

LianGuai Observation | Chain gaming track secures large-scale financing, signaling the end of the ice age for GameFi?Author: Climber, LianGuai

Recently, there have been many positive developments in the blockchain gaming sector, with several related projects receiving large-scale financing. In addition, the world’s largest browser, Google, announced that it will allow NFT game advertisements to be placed starting from September 15th, which means that there will be more exposure to Web3 games for Web2 network users.

Furthermore, a report released by DappRadar and the Blockchain Game Alliance last month showed that the financing amount for Web3 games in July this year reached $297 million, a year-on-year increase of 336.76%, with 63% of the funds flowing into infrastructure.

Since reaching its peak in November 2021, the blockchain gaming sector has remained quiet, but it is still favored by industry insiders. One of the ten crypto sectors that Coinbase co-founder and CEO Brian Armstrong is most interested in is blockchain gaming.

- How can we prevent the Twitter attacks that even Vitalik Buterin fell for?

- LianGuai Daily | Binance.US lays off one-third of its employees; Hong Kong Securities and Futures Commission warns that JPEX is an unregulated virtual trading platform.

- Full Name Exploring the Path of Future On-chain Identity Layer Construction

So, do these signs mean that the GameFi sector is gradually emerging from the ice age and thawing? What exactly are the several blockchain gaming projects that have recently been favored by capital? Is now the best time for ordinary investors to position themselves?

Unexpected data performance

Although the blockchain gaming sector in the entire cryptocurrency market has been relatively quiet in 2022, there are still related projects that have achieved remarkable performance against the trend.

Take the Web3 gaming platform Iskra as an example. First, it received $34 million in financing in April last year, and then received an additional $40 million in funding in September of the same year. Iskra’s performance is also impressive. According to VentureCap Insights data, Iskra’s revenue in 2022 reached $8 million, with a profit of approximately $900,000.

Therefore, it can be seen that there are still resilient players in the blockchain gaming sector. The increase in the total amount of financing in this sector since the beginning of this year further confirms the market’s optimism about the prospects of Web3 games. So, with liquidity injection, how has the overall performance of the GameFi sector been recently?

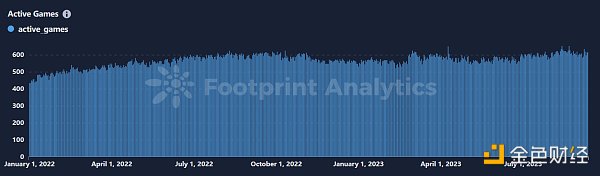

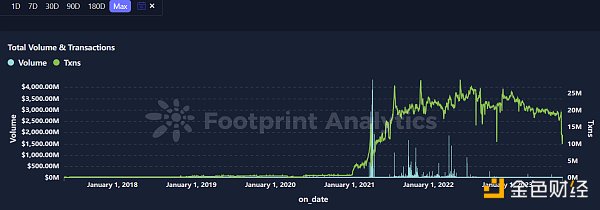

First, looking at the overall number of blockchain games, according to Footprint Analytics data, it has shown a steady growth trend in the past three years. The growth rate from 2021 to now is about 300%. As of now, there are approximately 2,558 blockchain games. On the distribution of public chains, they are mostly concentrated on networks such as Ethereum, BNB Chain, Polygon, and Wax.

However, the increase in the number of games has not correspondingly brought about a significant increase in the number of users and transaction volume. One of the reasons is that the number of active blockchain games has remained stable at around 500-600 in the past three years. This means that the blockchain gaming sector lacks innovation, and the level of game production has not been universally improved, resulting in insufficient attraction for games.

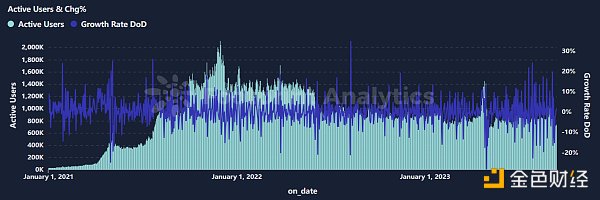

As a result, although the number of blockchain games continues to grow, the number of active users has not significantly increased, especially since the market crash in June last year, the number of users has remained stable. The multiple positive news in the market recently has not brought about an increase in the number of users, but instead has caused a decrease.

And in terms of trading volume and number of transaction addresses, the overall trend of the gaming chain is also similar to the above-mentioned data levels, all showing a downward trend. And after September this year, it became even more evident, indicating that the current situation in the GameFi field has not stabilized, but instead shows signs of decline.

Looking at the performance of the gaming section on exchanges, except for YGG, which rose sharply due to DWF Labs hype in early August, other related concept currencies such as AXS, MBOX, ILV, ALICE, etc., did not show a significant increase, but instead gradually trended towards historical lows.

New Forces in Game Chain

From the financing trend of the game chain track, industry giants’ views, and Iskra’s revenue performance, although GameFi is still in a severe winter, it is still a blue ocean worth investors’ attention and layout. In particular, the emergence of a new narrative for full-chain games has given Web3 game developers and enthusiasts direction and confidence.

Recently, the performance of the game chain track data has been particularly bleak, and at this time, projects that can receive a large amount of funding are undoubtedly worth looking forward to. Below, LianGuai will take stock of the recent chain game-related projects that have received large-scale financing.

BulletChain

On September 7th, Web3 battle-oriented game BulletChain announced the completion of a $2 million private placement round of financing, and the specific investors were not disclosed. The new funds will be used to expand operations. Currently, the game has launched beta testing from September 11th to 18th, and players can apply for internal testing through an application form.

The game is a free-play, game, and money-making mobile third-person shooter game, where players can participate in large-scale team battles of 50V50 and 25V25 on a large map, and can drive various vehicles on land, sea, or air.

GamePhilos

GamePhilos is a Web3 game studio. Media reports on September 3rd stated that it has raised $8 million in seed funding, which will be used for a free mobile/PC strategic game called “Age of Dino”.

In terms of funding background, Xterio Ltd, Animoca Ventures, SevenX Ventures, and Chain Hill Capital led the investment, while Hashkey Capital, Sanctor Capital, Game7, Bas1s, GSR, and GSG Ventures followed. In addition, the founders of the studio include former members of NetEase, Zynga, FunPlus, and ByteDance.

Galactic War

On September 3rd, P2E game Galactic War announced a $6 million funding from KaJ Labs. In June this year, KaJ Labs Foundation launched a $1 billion Web3 and AI funding program to support blockchain developers.

Galactic War is an AAA-level game with outstanding graphics design and multiple gameplay options. The game can be operated through virtual reality simulation activities, and players can experience the fun of making money in the game.

Mahjong Meta

On August 3rd, according to official news, Web3 mahjong game Mahjong Meta announced the completion of a $12 million financing round. This round of financing was led by Dragonfly Capital and Folius Ventures, with participation from Meteorite Labs, Find Satoshi Labs, LianGuairallel Ventures, and Emoote.

Mahjong Meta is a Web3 game platform dedicated to mahjong esports, and its core team consists of personnel from game companies such as Tencent, NetEase, and Lilith. Mahjong Meta launched its beta test in early May this year and the official version was released in August.

Conclusion

Although the performance of blockchain games in terms of on-chain data may not be satisfactory, they still have more advantages compared to DeFi, NFT, and other tracks. Recently, institutions such as a16z and Animoca Brand have also been betting on blockchain games, and there are also many blockchain game projects at the Korean/Singapore Blockchain Week.

Especially under the trend of AI explosion, games have been enriched with more content. Even though GameFi is still in a cold winter period, at least in terms of expectations, investors are more willing to believe that the spring of blockchain games will come.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service; MakerDAO Protocol RWA Total Assets Reach $2.613 Billion

- Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines

- In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

- Why should MakerDAO choose Cosmos instead of Solana?

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.