Aura Finance: Why choose to drive LST liquidity growth on Optimism?

Aura Finance: Driving LST liquidity growth on Optimism.Author: Beethoven X; Compiled by: Deep Tide TechFlow

What is Aura?

Aura Finance is a liquidity layer built on top of the Balancer protocol. Just as Convex does for Curve, Aura Finance obtains the native governance token of Balancer, veBAL, and plays a critical role in building liquidity and incentivizing liquidity provision for network participants by providing an additional layer.

Liquidity providers can stake Balancer pool tokens (BPT) to receive incentives in AURA and BAL; AURA holders can stake and participate in the veBAL voting market, and the protocol can provide voting incentives to effectively incentivize pools with BAL (and AURA) issuance. To date, Aura hosts over 30% of veBAL governance power, allowing it to maximize LP rewards and guide most of the BAL issuance. Undoubtedly, Aura is a key player in the Balancer ecosystem.

Aura Finance hosts nearly $500 million in total locked value (TVL) on the mainnet and has built and nurtured a series of interoperability partnerships between protocols. From the powerful force of liquidity provision token staking and cross-chain infrastructure providers to the lending market and enhanced integrations, Aura has played an indispensable role in driving growth in the Balancer ecosystem on Ethereum, and now Aura is preparing to drive growth on Optimism.

- What is Web4 of the European Union? Which industries will benefit from it?

- Multi-dimensional analysis of NFT in the second quarter: Multi-chain competition intensifies outside of Ethereum, and Blur’s growth rate far outstrips its competitors.

- False exit, true entry: SEGA is raising the banner in the Web3 blockchain gaming arena

Why choose Optimism?

Optimism is currently the second-largest scaling solution for Ethereum, with a total locked value of over $835 million. With the recent Bedrock upgrade, Superchain has become a reality. Coupled with the ongoing development of Base, opBNB chains, and the OP Stack, Optimism looks poised to attract more attention and liquidity. With the launch of Aura, these developments provide an opportunity to lay the foundation for deploying Balancer and Beethoven X as core technologies and liquidity custodians on the network.

Especially over the past year, liquidity provision token markets have grown rapidly, becoming the largest DeFi liquidity category, with a total locked value of $20.754 billion. Moving liquidity provision tokens to layer two networks can provide higher speed and lowest cost. This is a capital efficiency exemplar, and we believe it has the potential for sustained growth. By providing the most efficient liquidity provision technology on DeFi with simplified liquidity and incentive mechanisms, Aura is now ready to accelerate LST growth on Optimism.

In 2022, the Optimism DEX, a unique DeFi partnership deployed jointly by Balancer and Beethoven X, will launch. Beethoven X is responsible for the front-end, while the underlying “native” incentive contract is governed by veBAL and controlled by BAL. Beethoven X’s DAO governance subsequently adopted an additional incentive proposal, committing to allocate 50% of its protocol fees to OP and matching Beethoven X’s OP grants, to be distributed to the pools as liquidity mining or measurement incentives.

Since its launch in July 2022, the Balancer and Beethoven X Optimism joint deployment has demonstrated its innovation capabilities, becoming a major provider of LST liquidity, accumulating $60 million in TVL by April 2023, and generating about $370,000 in protocol revenue. While these metrics are indeed commendable, there is still room for improvement. With the recent emergence of L2 veBAL Boost, there is an opportunity to leverage the upcoming Aura and significantly increase the network’s market share.

As a central hub, Beethoven X, Balancer, and Aura hope to play a key role in promoting Optimism liquidity growth. Users will soon realize the benefits of this collaborative effort by using a new liquidity layer to help ignite growth and implement efficient flywheel incentive programs.

Incentive Structure and Funding

This unique project, which is jointly developed by Beethoven X, Balancer, and Aura, ensures that Optimism liquidity pools are incentivized in the most efficient and sustainable way possible. Currently, Beethoven X uses a protocol fee pairing structure to incentivize liquidity pools. Beethoven X converts 50% of its protocol fees into OP, matches it with OP grant funds on a 1:1 basis, and returns it to the liquidity pool in the form of liquidity mining incentives. This approach aims to significantly increase the rewards distributed while maintaining a certain level of sustainability.

With the expected launch of Aura and cross-chain veBAL enhancements, Beethoven X will provide an additional liquidity layer for the Balancer ecosystem, enabling efficient voting markets. Therefore, Beethoven X’s current OP grant pairing plan can be transformed into a voting incentive using BAL and AURA issuance to increase protocol TVL. If voting market efficiency decreases, the incentive program can continue to directly distribute liquidity mining incentives to the liquidity pool.

Aura has also proposed an OP grant program that will distribute additional LP incentives or match rewards on the Aura voting market. The protocol aims to use their grant in one of two ways. The first method is to match OP tokens with voting incentives provided by the protocol to vlAURA holders, increasing the optimistic voting market of Aura and directing a greater proportion of BAL tokens to the optimistic pool. The second method is to distribute OP grants directly to LPs, matching BAL and AURA incentives on a 1:1 basis. The specific method will be determined based on efficiency at the time. If the grant program is successfully passed, the incentive structure mentioned has the potential to reward users with 100% of protocol fees returned.

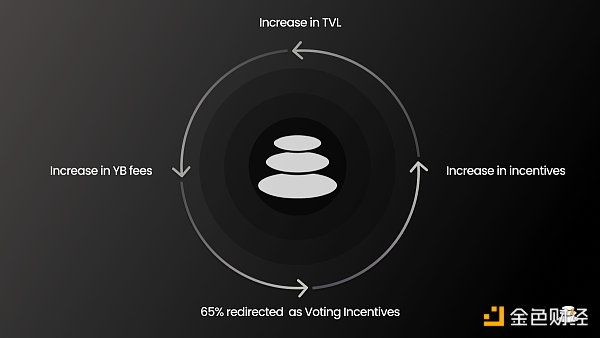

The Balancer pool also implements an effective liquidity flywheel designed to promote growth in its pools. Pools that generate more than 50% of revenue or 8020 pools have the ability to obtain core pool status. From these pools, 65% of Balancer protocol fees will automatically be provided as voting incentives to their respective pools. More incentives, of course, mean more TVL, and with Balancer’s innovative technology that allows fees to be taken directly from assets generated by revenue, more TVL is now directly related to more fees. This closes the loop and ignites a perpetual growth flywheel in the Balancer ecosystem.

Currently, only 25% of protocol fees are reclaimed on the Optimism DEX, but a restructure of the Balancer incentive program is currently under discussion. If Aura’s OP grant is approved, the proposal would generate an astounding 260% of protocol fees as liquidity mining incentives (130% without Aura’s grant) from protocol fee reclamation, OP grant matching, and an efficient voting market strategy.

Future Potential

The potential of high-performance, superchains on the second layer, efficient liquidity flywheels, rich incentive structures, and thriving communities, Aura has undoubtedly prepared itself for development on Optimism. All starting pools are either LST dominated or enhanced pools, and this effort will combine some of the most effective features in the Balancer ecosystem with Aura’s enhanced liquidity layer, creating core infrastructure that can drive Optimism liquidity growth.

The selected text is an empty paragraph element in HTML.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to stake on the EigenLayer mainnet

- Aptos proposal “Gradual Upgrade of Mainnet Framework to v1.5.0” has opened for voting, which will introduce a new standard for creating replaceable assets.

- Regulatory Pressure Slows Down Capital Inflow, Ethereum’s Collateralization Rate Approaching a Key Milestone

- AlloyX: A liquidity collateral protocol based on RWA assets

- NFT lending protocol Gondi, developed by Florida Street, has completed a $5.3 million seed round of financing, led by Hack.vc and Foundation Capital.

- Injective, the pioneer of native chain order book.

- Bored Ape suffers from losses and is forced to sell, aristocratic holders become big losers