How to stake on the EigenLayer mainnet

Staking on EigenLayer MainnetAuthor: William M. Peaster, Bankless author; Translator: Blocking0xxz

EigenLayer has made a splash in the DeFi space with its unique “re-staking” approach.

The protocol went live in June and is now ready to expand its re-staking opportunities by increasing the deposit cap for its supported ETH liquidity staked derivatives (LSD) assets from 3,200 tokens to 15,000 tokens. This means that more of us can now participate in EigenLayer’s mainnet re-staking.

1 Introduction to EigenLayer

- Aptos proposal “Gradual Upgrade of Mainnet Framework to v1.5.0” has opened for voting, which will introduce a new standard for creating replaceable assets.

- Regulatory Pressure Slows Down Capital Inflow, Ethereum’s Collateralization Rate Approaching a Key Milestone

- AlloyX: A liquidity collateral protocol based on RWA assets

EigenLayer is a unique Ethereum-based protocol that enhances the ability of ETH stakers.

By opting into EigenLayer, stakers can validate a wide range of software modules, from consensus protocols to oracle networks and everything in between, to extend Ethereum’s security in these systems.

This “re-staking” approach not only enhances the security of applications that rely on these modules, but also opens up new sources of income for ETH holders through additional validation fees. In this way, the protocol allows developers to leverage the security and decentralization features of ETH re-stakers through EigenLayer without having to create their own trust networks. Pretty cool, right?

2 EigenLayer Update

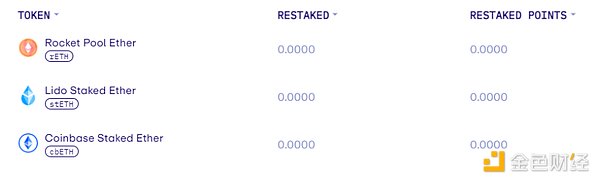

After a successful testnet phase, the protocol went live on the mainnet in June 2023, initially supporting stETH, rETH, and cbETH. The release was cautious, with a deposit cap of 3,200 tokens per asset to ensure protocol security.

In July of this year, EigenLayer is ready to implement the next phase of its plan. The protocol will increase the deposit cap for each asset to 15,000 tokens, and this update is expected to take effect at some point during the week of July 10, after the project’s limited-time update process is complete.

Once the deposit cap is removed, re-staking will continue until the total deposit amount of supported LSD reaches 30,000 tokens – at which point deposits will be suspended again. This phased approach ensures that more users can join the re-staking while still maintaining the security and decentralization features of the early network.

3. How to re-stake on EigenLayer

Now that we have learned about the latest updates, let’s take a step-by-step look at how to re-stake on the EigenLayer mainnet.

If you have read our “How to Try EigenLayer Early” article in May 2023, please note that the process is almost the same, with one difference: we are now re-staking on Ethereum instead of on the Goerli testnet as before. You can follow these specific steps:

(1) Prepare LSD — Remember, EigenLayer currently supports Lido Staked ETH (stETH), Rocket Pool ETH (rETH), and Coinbase Wrapped Staked ETH (cbETH).

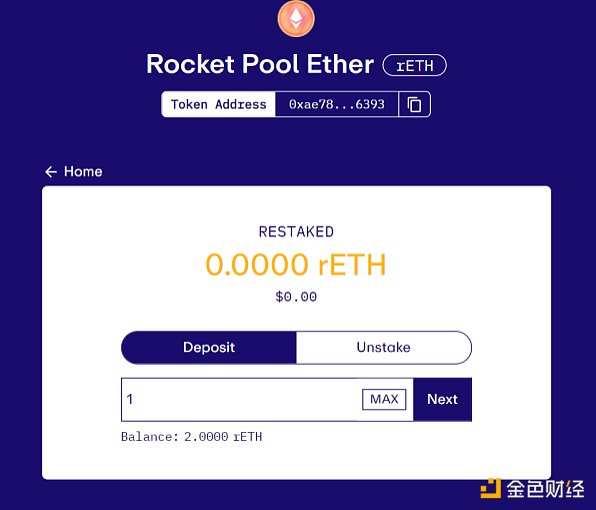

(2) Access the EigenLayer application — Visit app.eigenlayer.xyz and connect your wallet, then click on the asset you want to re-stake to continue.

(3) Complete the deposit operation — Enter the amount you want to deposit into EigenLayer on the current interface provided to you, and then complete the approval transaction and final authorization transaction to officially start re-staking!

Next, you can track all your deposits and re-staking on the main page of the EigenLayer application. You can also withdraw using the “Unstake” button on the deposit interface, but remember that EigenLayer has a 7-day withdrawal delay, so your funds will take a week to reach your wallet.

4. Summary

With the increase in deposit limits, EigenLayer is opening up new opportunities for users to participate in re-staking. As the protocol continues to evolve and grow, we can expect to see more exciting developments and even possible airdrops in the near future. So stay tuned to EigenLayer and happy re-staking!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- NFT lending protocol Gondi, developed by Florida Street, has completed a $5.3 million seed round of financing, led by Hack.vc and Foundation Capital.

- Injective, the pioneer of native chain order book.

- Bored Ape suffers from losses and is forced to sell, aristocratic holders become big losers

- Cross-chain vs Multi-chain

- Arkham Product Performance, Financing Status, and Investor Expectations

- Will NOVA be the next Pepe? Analysis from the perspective of trading techniques.

- Analyzing the new token governance system: Utilizing Balancer weighted pools to achieve deep liquidity and reduce impermanent loss.