Viewing the activity curve of new concepts in the current market through the on-chain data of FERC-20.

Analyze market trends for new concepts using FERC-20 on-chain data.Author: @DodoResearch, Translation: Odaily Planet Daily Xiaofei

Last week, @jackygu 2020 launched FERC 20 with the concept of fairness on Ethereum, attempting to bring back the Fair Launch of BRC-20 to Ethereum, which has attracted attention and discussion in the community.

FERC 20 can be seamlessly integrated into DeFi, with functions such as lock-up period and crowdfunding to prevent pre-trade and robots. This article will evaluate the performance data of FERC 20 since its launch. It can be seen that in the current sluggish market situation, after the appearance of a new hot spot, the activity will be greatly reduced after the speculative funds are briefly heated up, the profitable addresses exit, and long-term development requires more actual application construction.

- Binance’s response in full: All user assets are safe and protected; SEC’s allegations are aimed at unilaterally seizing control of the definition of the cryptocurrency market.

- 19 Responses from He Yi: Regarding Listing on Binance, IEO Rumors, and Market Share

- What is the value of the Unisat domain name, given that the total transaction volume since its launch is only $40,000?

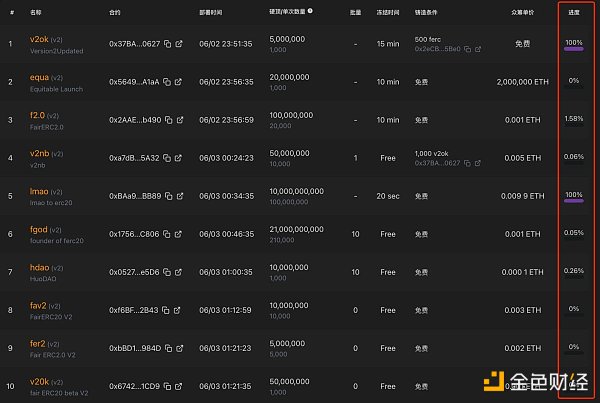

Overview of FERC 20:

FERC 20 allows any address to deploy tokens using a four-letter identifier. Any address can mint FERC 20 tokens. Since May 31, 14,939 addresses have participated in minting, with 139,551 transactions (an average of 9.3 times per address).

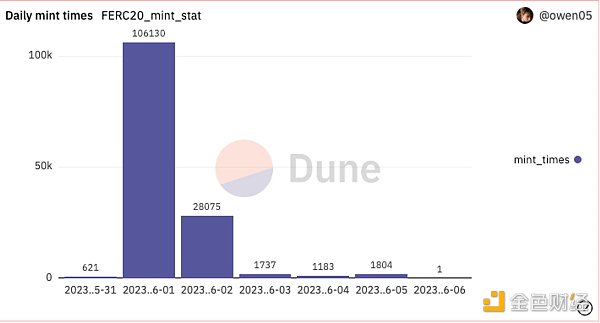

Daily volatility data of FERC 20:

On June 1, the peak was observed. A total of 13,519 addresses participated, initiating 106,310 minting transactions, and minting 116 FERC 20 tokens. However, the activity showed a clear downward trend.

About FERC:

The first token deployed based on Fair ERC 20, $FERC, has risen from $0.1 to $1.15 since June 1, an increase of 10 times.

Liquidity on Uni is close to $900,000, and trading is relatively active, exceeding $10 million on June 1 and June 5.

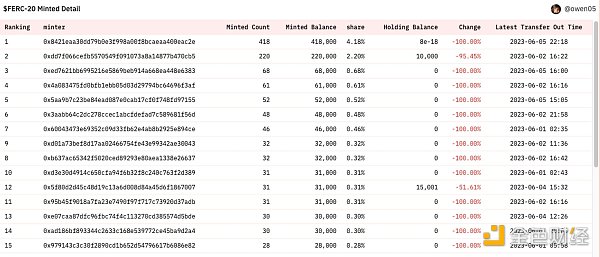

About FERC minting:

Of the top 15 addresses holding the most minted tokens, 13 addresses have already sold all of their tokens, while the remaining two addresses have sold 95% and 50% of their tokens, respectively.

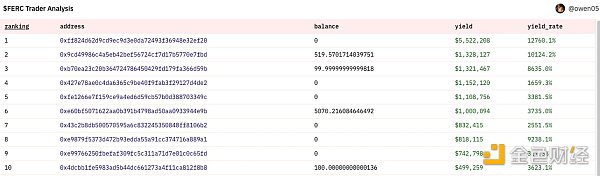

Profitable Addresses:

The top 10 profitable addresses each earned over $500,000, with the highest address making a profit of $5.52 million.

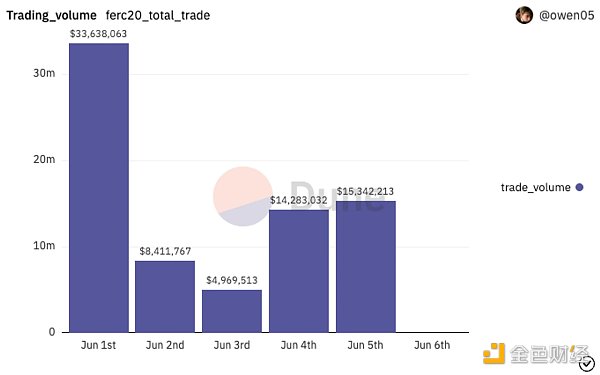

FERC-20 Trading Statistics:

On June 1st, the total trading volume of FERC-20 reached $33.64 million, with $FERC contributing nearly half. However, from June 2nd to 5th, $FERC dominated, accounting for nearly 80% of the volume, while other tokens were relatively weak.

FERC trading addresses accounted for about 70% of all FERC-20 addresses, dropping to about 50% on June 4th.

FERC trading accounted for about 60% of all FERC-20 trading, dropping below 40% on June 4th.

Limited Overall Activity:

Limited Overall Activity:

The trading activity of FERC-20 tokens peaked on the second day after its launch, and then declined significantly. The number of participating addresses and deployed FERC-20 tokens is limited, and speculative trading of FERC accounts for most of the funds.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin developers are debating whether to adjust the code to curb Ordinals and BRC-20 token activity.

- What impact will the upcoming legalization of stablecoins in Japan have on the market?

- Bitcoin domain name BNS speculation frenzy: opportunity or risk?

- The next trillion-dollar market? Global financial giants are rushing to embrace RWA tokenization

- Pre-Musk’s call Milady: A “cyber psychopath” pushed to the extreme

- What impact will the upcoming legalization of stablecoins have on the market in Japan?

- Is the US regulatory agency the reason behind the decline in cryptocurrency trading volume?