Is the crypto market already on the eve of a bull market? Insights from data on the multi-dimensional BNB Chain.

Is the crypto market about to enter a bull market? Insights from BNB Chain data.After the tightening of macro policies and the successive collapses of crypto institutions such as FTX, the cryptocurrency market has been in a slump for too long.

Although no one can accurately predict the market’s direction, recent global policies, industry hotspots, and ecological activity indicators suggest that the market is recovering, and sentiment is gradually returning. We may be in the transitional phase from bear market to bull market.

Admittedly, “following historical experience” may not be entirely accurate, but there are always many first-hand and real insights in on-chain data that can help us judge opportunities and make investment decisions: which projects are eliminated after the reshuffle of survival of the fittest, and which projects have withstood the test and renewed vitality.

BNB Chain DEX trading volume is recovering and coming out of the bear market doldrums

Take various public chains as examples. All L1s that flourished during the bull market are gradually becoming silent in the deep bear market, and even some have approached death with no real on-chain activity. However, data shows that BNB Chain’s data has not only begun to recover recently, but has also become more prosperous.

- Decrypting the Unique Chinese Cryptocurrency Market: Real User Research and a Comprehensive Review of Chinese VC

- Lookonchain: Will the unlocking of 1INCH cause a large-scale market sell-off?

- Bitcoin New Protocol: BRC-721E

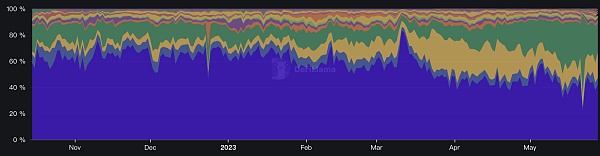

With the development of the overall market trend, many on-chain activities have also begun to recover from the low. When we compare multiple public chains, what is their status? Perhaps we can glimpse some directions of the future from the current trend. From the market share of DEX trading volume, DeFiLlama data shows that BNB Chain’s market share has rapidly increased in the past two months. Currently, it accounts for 22.3% of the entire DEX market, making it the second largest public chain in terms of trading volume, second only to Ethereum.

The green part is BNB Chain’s share, source: DeFiLlama

As of the time of writing, BNB Chain’s 7-day trading volume for DEX (May 23 to May 30) is about 5 billion U.S. dollars, while Ethereum’s mainnet DEX trading volume is only 5.6 billion U.S. dollars.

This can be said to be a monopoly. Currently, the total 7-day trading volume of all public chain DEXs recorded by DeFiLlama is about 14.7 billion U.S. dollars, and the top two public chains, whether Ethereum or BNB Chain, have trading volume data alone that is enough to exceed the sum of all remaining public chains.

User Growth and Frequent Interactions, On-Chain Activity is Returning

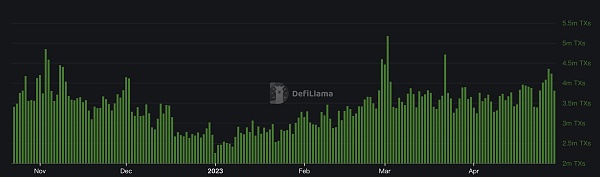

In addition to DEX transactions, various interactions have become a “required course” for on-chain players during the bear market due to the low gas costs. What conclusion can be drawn if we examine the number of on-chain transactions?

(Image source: DeFiLlama)

As can be seen from the above figure, along with the bear market, the number of transactions on the BNB Chain has declined. It reached a low point at the beginning of this year, but has gradually recovered since then. Recently, the number of Tx has returned to the level of the end of last year, and on-chain activity is still not low, and it is now showing a clear upward trend.

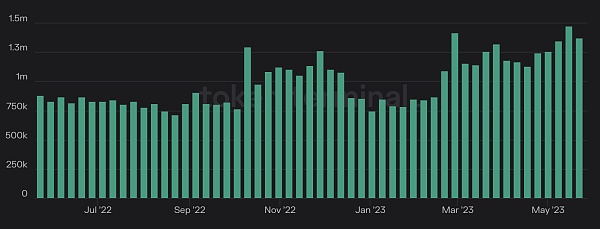

The recovery of its on-chain activity is due to various reasons. If we observe it from the perspective of user numbers, the results seem to be even more obvious.

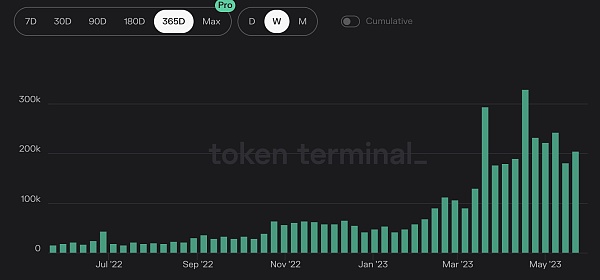

According to data from tokenterminal, the number of daily active users on the BNB Chain has been constantly increasing recently, and is currently about 1.4 million. In the second half of last year, this number was still hovering around less than 1 million.

(Image source: tokenterminal)

The current data has increased by nearly half compared to several months ago, and the on-chain activity of the BNB Chain is constantly recovering.

If we refer to the “big picture” of the Ethereum mainnet on-chain, the data is more referential. For example, as an “indicator” of on-chain activity, the activity level of the mainnet has always been an important indicator of whether the cryptocurrency market is prosperous or not. As for the number of daily active users on the mainnet, we can see from the trend in the figure that the number of mainnet users has been relatively stable in the past year, and there has been no upward trend recently.

(Image source: tokenterminal)

Of course, as an “indicator” of the entire cryptocurrency market, although the mainnet to some extent reflects the overall temperature of the market, its competitive relationship with other public chains is not obvious.

As the market generally warms up, all chains are seeing a recovery. We can use data from other chains for comparison.

Will Layer 2 Take Over BNB Chain’s Market Share?

As the hype of “new public chains” in the bull market comes to an end, this year’s market sentiment and on-chain activity have gradually shifted to Layer 2. Although from a technical point of view, security is guaranteed by the Ethereum mainnet, Layer 2 is more technically “orthodox”, but from the perspective of user experience and user perception, there is not much difference between Layer 2 and EVM public chains on the user side, and there is direct competition between the two.

Using Arbitrum as an example, after the mainnet went live, its data performance has been lukewarm. In March of this year, after a large-scale ARB token airdrop, on-chain activity quickly became active.

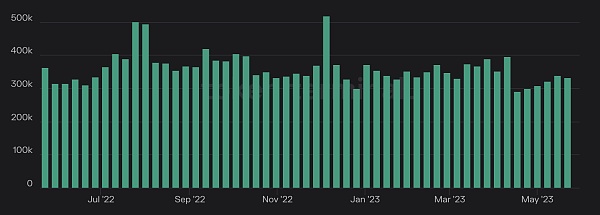

In mid-April, the number of daily active users on Arbitrum exceeded 320,000, reaching a peak in nearly a year. Except for a few peaks, the number of on-chain addresses for airdrops has recently stabilized at around 200,000. Although it has grown significantly since the airdrop, it still lags behind BNB Chain, which often has millions of daily active addresses.

(Image source: tokenterminal)

Optimism, which had an earlier airdrop, has performed slightly differently. In the past year, the number of daily active addresses on Optimism has steadily increased. Despite being more active than last year, the peak number of daily active addresses is still less than 100,000, which is a magnitude lower than the million-level data of BNB Chain.

(Image source: tokenterminal)

Although Layer 2 may dominate in DeFi-dominated applications, it is not widely adopted by other parts of the market at this stage. From a data perspective, Layer 2 is still difficult to directly confront BNB Chain in the EVM field.

Stablecoin use case is active, is it a sign of market recovery?

Regardless of whether it is a bull or bear market, there is always a demand for stablecoin trading. This is also an important trading indicator that reflects whether on-chain transactions are active. Stablecoins can to some extent reflect the adoption rate of the network. As the chain accelerates adoption and becomes more popular, the number and trading volume of stablecoins on the chain will inevitably increase.

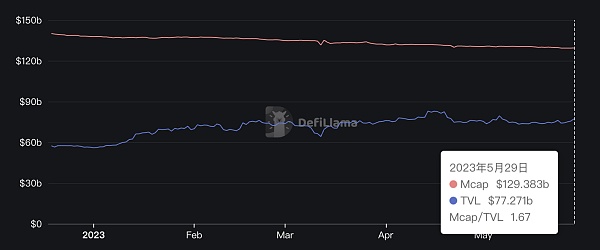

Looking back at the market over the past year, as the market has been down, the circulation market value of stablecoins has declined. DeFiLlama data shows that the circulation market value of stablecoins has decreased slightly, but the total TVL of stablecoins is still growing.

(Image source: DeFiLlama)

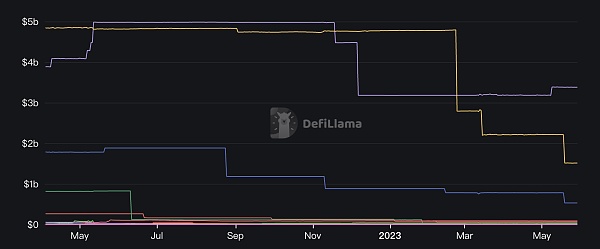

Previously, BUSD had experienced regulatory turmoil. As a chain with certain correlation with BUSD, the number of stablecoins on BNB Chain has also been affected, but it has not caused significant changes. The data shows that the circulation of stablecoins on BNB Chain has declined to some extent, but the TVL quantity still remains relatively stable, at around $6 billion.

Regarding the distribution of currencies, the current circulation of stablecoins on the BNB Chain ranges from most to least in USDT, BUSD, USDC, USDD, and DAI. Although the amount has decreased significantly, BUSD is still the second largest stablecoin in circulation on the chain with a circulation market value of approximately $1.5 billion. The largest stablecoin in circulation is USDT with a market value of approximately $3.3 billion.

(Image source: DeFiLlama)

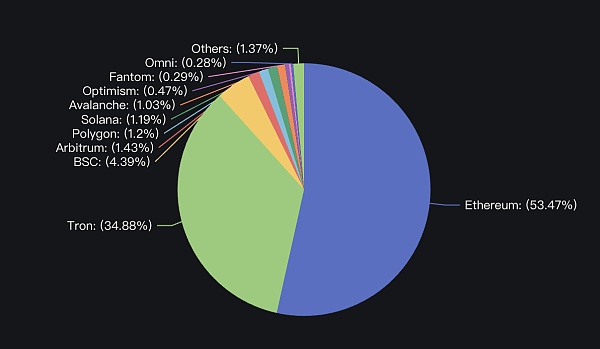

From the perspective of market share, stablecoins on the Ethereum mainnet and Tron mainnet have the majority of the share combined. For various historical reasons, the vast majority of the market share of stablecoins has always been held by these two.

However, the multi-chain nature of the stablecoin market is not set in stone. In the previous bull market, there was an unprecedented melee among “new public chains”. Currently, the bull and bear markets have already alternated, and the market is about to enter the next cycle. When the tide recedes and the bear market arrives, the market share of the stablecoin use case may be more representative.

(Image source: DeFiLlama)

Currently, DeFiLlama data shows that the stablecoin market value of BNB Chain is approximately $5.7 billion, accounting for 4.39% of the total stablecoin market value. Although Ethereum and Tron firmly occupy the top two positions in the stablecoin market value, the stablecoin market value of BNB Chain is still equivalent to the sum of the next three stablecoins, which is comparable to the stablecoin total value of Arbitrum, Polygon, and Solana.

Hard fork, store new chains, build “Another Binance” outside of CEX?

Currently, the BNB Chain TVL is as high as $4.5 billion. It ranks third in the entire DeFi market, second only to the Ethereum mainnet and Tron. As an old-fashioned “new public chain”, although this project is no longer “novel”, its ecology and projects are still thriving.

On May 22nd, The Block data showed that the ratio of DEX to CEX spot trading volume reached a historical high, with DEX accounting for more than 20% for the first time. At the same time, the cryptocurrency trading volume of CEX is at its lowest level this year.

A prosperous Layer 1 network can build a more decentralized crypto ecosystem than CEX.

In February of this year, after the restructuring of the BNB Chain, its structure can be compared to Ethereum. The BNB Beacon chain (formerly Binance Chain) provides secure technical support, and the BNB Smart Chain (Binance Smart Chain) has actually become the execution layer. And in its ecosystem, Dapps cover all tracks, including DeFi, SocialFi, NFT, GameFi, Metaverse, cross-chain, derivatives, infrastructure, etc., covering almost all areas of the on-chain world.

In February, the BNB Chain released the BNB Greenfield white paper and launched the test network “Congo” in early April. According to the latest news, the main network of BNB Greenfield will be launched in the third quarter of this year. Although it has not been launched yet, the birth of this new chain also shows us the further prosperity of the BNB chain ecosystem.

Although BNB Greenfield is still a new chain, its native storage function can provide strong infrastructure support for BNB Chain, and this innovation may bring a large number of imaginative new use cases.

On June 12th, BNB Chain will also undergo a “Luban” hard fork upgrade. This upgrade includes three proposals: BEP-126, BEP-174, and BEP-221, aimed at creating a faster and more secure network for users.

BEP-126 introduces the “Fast Finality” mechanism, which makes it impossible to reverse a block once it has been finally determined on the network, reducing the possibility of bad actors performing chain reorganization.

BEP-174 proposes “cross-chain relay management” to alleviate any potential security issues in the BBSC Bridge. BEP-221 proposes “CometBFT light block validation”, which helps to verify specific blocks from other CometBFT-compatible blockchains and enables data transmission between these blockchains.

Although the market is still relatively sluggish, due to its lower gas fees and always active ecosystem, BNB Chain is still the underlying preference for daily transactions of users.

In the world of encryption, projects in the bull market are certainly highly regarded, but whether a project can survive the bull and bear cycles ultimately requires time to test. With the cycle alternation of this round of the market, how will the future market pattern change?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Latest Interview with Zhao Changpeng: Being “Under the Microscope” of Regulation, Market is Recovering in Bearish Period

- Understanding the Ordinals family on Bitcoin in one article

- CoinGecko: How to discover “smart money” and track them?

- Bitcoin supply trend is changing, with a shift towards the East already taking shape.

- Current Status of Data Analysis in NFT Lending: Blend Takes 80% Market Share in First Month, Three Major NFT Loans Exceed Half the Total Amount

- Opportunity and risk, BRC-20 brings Bitcoin into the “smart era”

- Reflections on the .sats domain: Current development status and value analysis