Bankless: What has the market learned one year after the UST crash?

Bankless: Lessons learned from UST crash, one year laterAuthor: 563, comp.: Kate, Marsbit

It’s hard to believe that it’s been a year since the death spiral of Terra. The impact of the loss of billions of dollars in wealth is still being felt in UST.

Today, let’s take a look at the state of stablecoins one year after the UST crash.

——Bankless team

- Bitcoin Virtual Machine BVM is released, ushering in the era of smart contracts?

- Bitcoin Virtual Machine (BVM) is released, ushering in the era of smart contracts?

- 【Exclusive from ChainDD】Russia abandons the plan to build a national cryptocurrency exchange in order to respond to financial sanctions as soon as possible.

What did the market learn after the UST crash a year ago?

The death spiral of Terra USD (UST) and the corresponding collapse of LUNA shattered the hope of the cryptocurrency market to set a new all-time high in 2022, and toppled the first (many) leverage dominoes, which were supported by cheap funds, speculation, and outright fraud. Users who had pinned their hopes on UST’s idealistic algorithm design saw billions of dollars and countless fortunes disappear in a matter of days.

Many early supporters of the Terra ecosystem were fascinated by the concept of a fully decentralized stablecoin. Although the architecture of UST was ultimately proven to be unsustainable, some would argue that the idea of DeFi users completely isolating themselves from traditional systems is a very valuable goal.

A year later, as we reflect, we ask ourselves: “what have we learned?” and “where are we now?”

Although algorithm (“algo”) stablecoins have fallen out of favor (although the market cap of USTC is only 1.5 cents, the market cap is still $150 million), the broader stablecoin industry has continued to consolidate its product-market fit. Whether as a means of exchange or a store of value during bear markets, today’s DeFi market is awash in stable assets.

The only question is, what did we get wrong?

Despite many people boasting about their USDC and mocking those holding Terra, all DeFi USDCs fell below 90 cents in March of this year when it was discovered that Circle’s funds were tied to now-defunct Silicon Valley Bank, putting DeFi to the test. Users flocked to the relatively “safe” USDT (which just doesn’t feel right).

In contrast, in April 2022, the market value of stablecoins was about 82% centralized stablecoins (mainly USDT, USDC, BUSD, and TUSD). Today, our centralization level is 95%. After USDC decoupled, only Tether (USDT) surged from 44% of the total stablecoin count to over 63% today. Not very good.

Therefore, on the one hand, we have algorithmic stablecoins, which, although decentralized, are easily susceptible to death spirals. On the other hand, we have centralized fiat-backed stablecoins, which are open to bank failures and scrutiny. How do we reconcile this?

Fortunately for us, the bear market has always been an ideal environment for practitioners to stop and do what they do best – innovate.

In today’s article, we will introduce some exciting new decentralized stablecoin projects. These new projects not only improve the anti-fragility of token design – new mechanisms and truly innovative use cases for stablecoins are also coming, they may weaken Tether’s dominant position and provide the market with some much-needed decentralization.

1. Curve’s crvUSD

Curve Finance is the preferred stablecoin trading platform for DeFi.

Since entering the field, Curve has had a very big impact on the market. The entire ecosystem is built on this pillar, whether it is innovating stable fund pools in the AMM model, or reinventing token design with their voting custody architecture and subsequent measurement mechanism.

Source: Twitter

Just as users can use Maker to cast DAI with their ETH, Curve users will soon be able to cast crvUSD with assets on Curve (such as ETH and its derivatives). Using their new loan clearing AMM algorithm (LLAMMA), Curve plans to improve the stablecoin design of DAI’s proven debt collateral position (CDP).

Here’s the ELI 5 version of why crvUSD clearing can be greatly improved over traditional design:

-

The collateral is gradually liquidated within a certain price range, rather than immediately liquidated when the liquidation price is reached. This reduces the likelihood of large-scale liquidation causing market fluctuations.

-

The design of crvUSD is designed to provide lower prices to Curve’s AMM, thereby incentivizing liquidators to arbitrage on external DEXs. In addition, the gradual liquidation strategy reduces the demand for external DEX liquidity, thereby reducing the risk of bad debts.

-

If the price rebounds above the liquidation price, the forced liquidation can be canceled. This means that “scams” will not be the borrower’s main concern.

2. TapiocaDAO’s USDO

Liquidity is the lifeblood of financial markets — without it, incentive mechanisms dry up and economic activity withers.

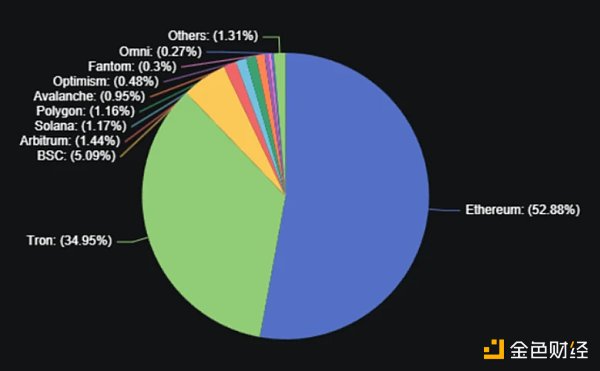

Today, the liquidity of stablecoins exists in a small bubble around decentralized DeFi. While we can say there is $130 billion in value locked in stablecoins, not all ecosystems are created equal. If your protocol exists in a low-capital allocation market, you are fighting gravity.

Source: DeFi Llama

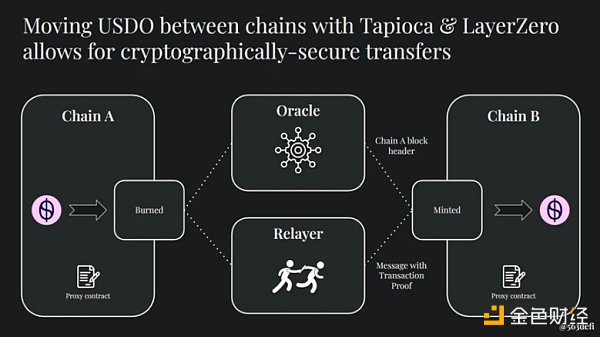

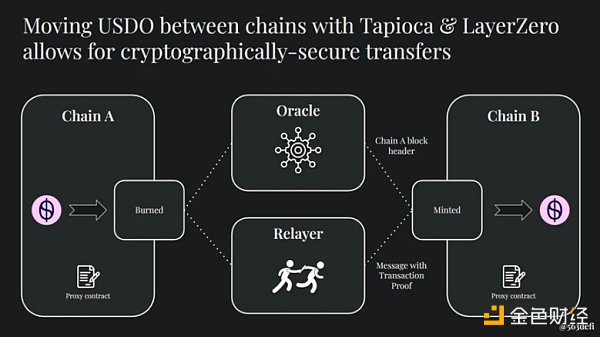

TapiocaDAO is building a fully on-chain decentralized bank — where users can seamlessly borrow, lend, and mint their stablecoin (USDO) across roughly 17 EVM and non-EVM chains (and counting) — all without bridging. Tapioca achieves this by leveraging LayerZero’s universal messaging network as its on-chain infrastructure, with the goal of setting a strong foundation for our multi-chain future stablecoin.

USDO is another CDP design, using network gas tokens (like ETH, MATIC, etc.) and their LSD as collateral. Full-chain borrowing and leverage are also possible in addition to simple fund transfers. For example, you can:

-

Open a collateralized debt position (CDP = “loan”) for your stMATIC on Polygon, mint USDO on Berachain, and use up to 5x leverage with just a click

-

Use your yield-generating jGLP on Arbitrum as collateral, borrow USDO on Starknet, and your yield helps repay your loan

-

Lend your USDO to users on any of the roughly 17 chains supported by LayerZero — with huge capital efficiency improvements over traditional lending platforms

The fragmentation of DeFi liquidity has been a problem for existing and emerging protocols. With Tapioca using LayerZero, we may soon see the day when new projects are no longer forced to default to liquidity market leaders.

3. Redacted Cartel’s DINERO

Redacted Cartel, known for its establishment of meta-governance and unparalleled bribery market “Invisible Hand,” has announced the highly anticipated Dinero project, entering the world of stablecoins and LSD.

Source: Twitter

The initial paper released in April revealed the basic design and motivation behind Dinero. Essentially, Dinero aims to provide users with high-quality Ethereum block space, called the Redacted Relayer, through private RPCs (remote procedure calls). The RPC sends transaction data from dApps/wallets to the blockchain.

Using the Redacted Relayer provides several advantages over transacting with the default RPC:

-

Prevents malicious actors from exploiting MEV opportunities (hi, Jared!)

-

Meta-transactions – the ability to pay gas fees using DINERO stablecoin instead of ETH

-

Enables additional use cases such as privacy-preserving transactions and order flow payments once a certain scale is reached

The DINERO stablecoin itself is a CDP, overcollateralized with a combination of USDC and Redacted’s own LSD pxETH, where the ETH used to mint pxETH runs Redacted’s validators. This closed-loop system allows Redacted to create a comfortable block space ecosystem. By marketing DINERO as a transaction medium and gas token on their block space island, Redacted is turning the tables – offering a unique stablecoin use case.

The Future is On-Chain and Overcollateralized

For us decentralization maximalists (including myself), 2023 is shaping up to be an exciting year for stablecoin innovation.

With most projects eschewing algorithmic designs in favor of overcollateralization, the likelihood of UST-style death spirals decreases with each subsequent code commit.

Even Frax – whose very name denotes its decentralized architecture – has decided to go fully collateralized – which suggests the market appetite for “unstable stables” is at an all-time low. We’ve also observed experiments with non-pegged Defi-native assets, such as Reflexer’s RAI, pushing the boundaries of the centralized/decentralized dichotomy.

Overall, we see DeFi users getting excited about having fully on-chain asset-backed decentralized stablecoins. Whether the future is dominated by crvUSD, USDO, DINERO, FRAX, RAI, or something new altogether, at least we can all agree it’s better than Tether domination.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is the crypto market already on the eve of a bull market? Insights from data on the multi-dimensional BNB Chain.

- Decrypting the Unique Chinese Cryptocurrency Market: Real User Research and a Comprehensive Review of Chinese VC

- Lookonchain: Will the unlocking of 1INCH cause a large-scale market sell-off?

- Bitcoin New Protocol: BRC-721E

- Latest Interview with Zhao Changpeng: Being “Under the Microscope” of Regulation, Market is Recovering in Bearish Period

- Understanding the Ordinals family on Bitcoin in one article

- CoinGecko: How to discover “smart money” and track them?