19 Responses from He Yi: Regarding Listing on Binance, IEO Rumors, and Market Share

He Yi on Listing, IEO Rumors, and Market Share: 19 ResponsesAfter 9 months since the peak of Binance IEO’s masterpiece Stepn, Binance finally restarted IEO at the end of last year. However, due to the bear market, the performance of several IEO markets this year was not as good as expected, which caused some dissatisfaction in the community. The rumors of “girlfriend coins” are getting worse. In addition, as Binance is the platform with the second largest volume in the industry, new coins launched in the past six months often face greater selling pressure, resulting in the situation of peaking as soon as they are launched…

Over the weekend, in response to these questions and dissatisfaction from the community users, Binance co-founder and CEO He Yi answered and replied one by one on Twitter. BlockBeats has organized them as follows:

On June 4, He Yi responded to recent market rumors and questions in the community.

1. Binance still cares about the wealth effect. Everyone can count all the projects listed on all platforms today, and see the percentage of each platform that fell below the listing price after being listed. We should still perform the best;

- What is the value of the Unisat domain name, given that the total transaction volume since its launch is only $40,000?

- Bitcoin developers are debating whether to adjust the code to curb Ordinals and BRC-20 token activity.

- What impact will the upcoming legalization of stablecoins in Japan have on the market?

2. Regarding LaunchBlockingd’s project, we give users the lowest price we can negotiate, so users who grab the IEO can basically make a profit. However, the price in the secondary market is beyond our control. As for who bought the cheap chips and who sold them early, Binance does not control it, but the project party must unlock according to the public announcement, and Binance will supervise it;

3. Binance does not have any rat warehouses, no relative coins, and no girlfriend coins. Who do I need to take care of face to face? I am already busy taking care of Binance. I couldn’t get their projects listed on Binance before, so I made up some girlfriends and relatives jokes, right?

There are not many popular projects in the market. It’s not surprising to guess which hotspots are high. The project party now plays with one-digit unlocking, which is also beyond our control. If there is heat, everyone blames Binance for not going up. If there is no wool preheating project, everyone will still blame it when they go up. It’s better to use data honestly and count them one by one, which is not difficult.

4. Binance has a small layoff every three months and a large layoff every six months. The number of people increased twice from last year to this year during the bear market, and some people were eliminated. The business is not affected, only the efficiency is higher. Thank you for your concern.

It has been a long time since I communicated in Chinese. Recently, there have been a lot of Chinese-language opinion water army posts. It is a familiar scene in 2021, but everyone in the group is old friends, so please DYOR. Do some research before drawing conclusions. Thank you, everyone.

Compilation of responses to user questions and doubts within the community

What are the listing standards for Binance?

@web3xiaoba: Let me summarize Sister One’s listing standards: don’t focus on technology and innovation, just focus on the wealth effect. To be honest, the issuance price of LaunchBlockingd can only be bought by immortals (and robots). We common people can only buy in at the secondary level, and most of the time we are harvested by institutions and project parties.

He Yi: Is this quote out of context? I was responding to everyone’s wealth effect before, so I specifically emphasized the return on investment, and I suggest comparing all platforms. Technology and innovation are part of the evaluation system, not all of it, and even the sharpest knife is just used to rob in the hands of thieves.

@YourAirdropETH: Let’s not talk about education coins for now. Sei, a project that has only been established for a year and whose testnet is still unusable, can get so-called 80 million financing. Can you explain the relationship between Sei and Binance? What is the relationship between Multicoin, Jump and Binance?

He Yi: You see, there are many people who curse when a project is not listed on pepe, and when it is listed, even more people curse; many people think that Binance is stupid for not listing a certain project, but when these coins are listed, people with a discerning eye can see that they will fall sharply, and there will inevitably be another group of people cursing Binance. Therefore, Binance’s listing needs to find a balance point. Everyone still needs to DYOR when buying coins for investment, using mathematics to calculate, rather than following the shouting and cursing of others, and being led astray by others.

@YourAirdropETH: The secondary market has its own rules, but if a project itself is subject to so much criticism, don’t you think Binance’s project selection strategy has gone wrong recently?

He Yi: In 2017, when Binance started doing spot trading and issuing platform coins, there was also a lot of criticism. Sometimes it’s just a matter of seeing the direction a little earlier than the market. Binance’s listing is not just one person’s decision. We try to take into account the needs of most users in the listing logic. However, rumors and slander are more widely spread. I welcome all big v’s to analyze and compare all the projects listed this year one by one.

Don’t say the blame for Sei not yet launching their coin should be thrown to Binance. Even if they do launch their coin, the listing team will still look at Sei’s community, data performance, and user feedback. Each community has its own “value coin” standards, even BTC is criticized by many people. The low sentiment of the bear market reminds me of the time when the market was booming in 2019 and 2020, when patterns were rampant and exchanges were tearing each other apart.

@Kareninyu: This logic is incorrect because you earn money from these users. Either have a vision and follow a regulatory correct path similar to Coinbase’s listing standards, but this may not be realistic at this stage; or cater to the preferences of retail investors and list coins based on community popularity. Indeed, many of these coins are also air coins favored by retail investors, but even so, these coins are selected by users themselves, and coins should not be selected based on your power range or preferences.

何一:

1) Who said that Coinbase’s listing is “legitimate”? It is also welcome to compare Coinbase’s listing standards. According to US regulatory logic, except for BTC and BTC’s fork coins, none are “legitimate”.

2) Binance earns money from users, so the underlying logic of Binance’s listing is to list projects that can survive for a relatively long time and can bring returns to users. Here, the difference is in the investment and research capabilities and aesthetic differences. Which platform can identify suitable listing projects and the timing in the long run, and which platform’s users can survive longer, this is the core competitiveness of the platform.

@Kareninyu: According to your logic, it is just that my investment research preferences are close to Coinbase, and your investment research preferences are close to the projects you list. I really can’t argue with this logic in the current currency circle. Binance itself is already a signboard, and the presence of market makers means that the candlestick chart doesn’t look too bad. But in the end, what is the profit and loss of all retail investors combined, and how much positive significance do these projects have on crypto, there will eventually be a definite fact.

何一: You don’t have to look at the current currency circle. You can start counting from the time when Coinbase began to list a large number of copycat coins. Which trading platform doesn’t have market makers? The fact is who stands on the side of users, who will achieve long-term success.

@RyanYeSan: If it’s popular, Binance will also list it. I haven’t seen any clear standards or procedures for Binance to list coins. Shi’s technology is just as rough as a dog bite. Not all CEXs, including Binance, listed it at first.

何一: So, it’s a balance between quantity and quality. The platform has hundreds of coins, so you still need to do your own research on what coins to buy, instead of blindly following the trend.

@BTCdayu: I have to emphasize again that both CZ and One are already financially free. They don’t care about making money through any project, so no reader should be petty in judging – this is just because Binance is still thinking about how users can make money in 2019. Can IEO users make money by listing these projects? Of course. But why is the market reputation of Binance declining? It’s better to compare it with OKX. I can predict almost 100% of the coins to be listed on OKX, such as which coins will be listed and which ones cannot – because I know that OKX’s standards are absolutely neutral, and they care about the project and whether it is worth listing. For example: Can popular coins like pepe be listed on OKX? 100% yes. At that time, I didn’t think it could be listed on Binance, because in Binance’s logic, this kind of pump and dump would hurt users – and it did fall 70% after the peak.

何一: It’s a pity that there is no 100% match for your expected listing. Ironically, many people complain that these single-digit unlock tokens will smash the market when they go online. Why list coins to cut users? Binance can only check the token model, it has nothing to do with controllable or uncontrollable, it is related to the token model and value model.

@who46504471: What you are saying is that Binance’s listing is, to put it bluntly, helping the project party to cut retail investors (you can say it is not intentional), but you earn the listing fee, and the project party earns it back from cutting retail investors. How is the project valuation determined? How many are truly valued, and how many billions or tens of billions of market values are listed for retail investors to pick up? You know better than anyone else what’s going on, but you’re still awesome and you’re not changing. When everyone figures it out, your good days will be over.

何一: Some small trading platforms do rely on listing fees to survive, but Binance’s listing fees, are you talking about 2017? For individual projects, more people will still criticize Binance for not listing some coins than for listing them. Many people think that Binance is stupid for not listing certain projects, but for those coins that are listed, smart people can tell that they will drop significantly, and there will inevitably be another group of people who criticize Binance for being stupid. Therefore, Binance needs to find a balance in listing coins, and it is indeed impossible to be responsible for every project. Everyone still needs to DYOR when buying and investing in coins.

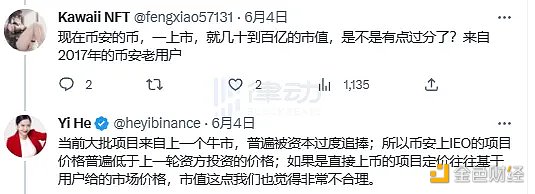

@fengxiao57131: Now, when Binance’s coins go public, they have a market value of tens to hundreds of billions. Isn’t that a bit excessive? From a Binance user from 2017,

何一: Currently, a large number of projects come from the previous bull market, and are generally overly pursued by capital. Therefore, the price of projects on Binance’s IEO is generally lower than the price invested by the previous round of capital; if it is a project that is directly listed, the pricing is often based on the market price given by users, and we also feel that the market value is very unreasonable.

https://twitter.com/heyibinance/status/1665283110479486976https://twitter.com/heyibinance/status/1665331086342094850

Bestie section & doubts about market share

@7thAnthony: Is it not good to have a regular and orderly coin listing process for trading platforms; a transparent and standardized coin listing requirement? For projects in the same track, which one is better for users, a project with high popularity that is not related and compromised by the exchange’s coin listing, or a project with no popularity that is only listed because of relationships? I am not fudding Binance, but all trading platforms have problems in this regard.

Hook, no reason. A Gamefi platform with almost zero community activity. At the time of the launch of LaunchBlockingd on Binance, DC had a few dozen daily active users, and the Twitter account was newly registered, with almost no followers. How was this project noticed by Binance? There is no innovation, no popularity, and the current data is all brought to it by Binance. What is the insider of this Hook project? According to my understanding, Hook is indeed a bestie/relative project. Sorry, I cannot tell the source of the information.

何一: When any project is listed, there will be other people pushing projects that are rejected. Projects with high stock market attention are criticized: the project is either technically stupid, overly defensive against witches, not giving airdrops, unlocking single digits, or it is a ghost town, so Binance is silly; the project in the incremental market is a “relationship household”, never heard of it, so Binance is silly. The so-called source of information is just where your butt is, whether you are a vested interest.

@7thAnthony: My source of information is “Little Beauty” who has a close relationship with you. I will not publicly disclose any situation similar to “I heard that…”. If you do not respond positively to your relationship with the Hook project, I will reveal more inside information.

何一: Welcome to expose, I don’t have a girlfriend, but there are many who claim to be my girlfriend, my relative, CZ’s friend and so on, who are extremely active in the market, taking investment quotas or pledging to go to Binance as “capital” or “girlfriend”; as for why some people believe it, of course, it is inseparable from everyone’s efforts? Please scold her directly next time.

@RobertWeb3Miner: Binance’s market share has been declining since you took over.

何一: I entered Binance in 2017, and the market share hasn’t fallen since. I’ve had more tricks than you in FUD, so keep your head down and do your job.

@RobertWeb3Miner: Deliver the trading platform system we bought from you in 17, take the money, and don’t deliver the system. Don’t do business if you cheat for money. Otherwise, your former colleague Justin Sun’s fire will be the fate of your Binance.

何一: Who did you contact to buy the trading system? Please provide payment records; I don’t know which firm you are with, but I haven’t taken your money. Whether Binance has taken mine can be checked. There’s a head for every wrong and a debtor for every debt; you can PM me. You look like an old coin circle person, and you’re full of resentment when you speak. It seems that your luck is not good. I suggest you curse others less, because it will backfire on you; and Justin Sun is not my former colleague, thank you!

About IEO and User Benefits

@qkldaliang: Binance has formed the habit of bullying customers by being a dominant player. Binance IEO should have a dedicated Binance project development team for assembly-line production, which is developing a bit like Tencent games. In the early days, it was mainly through acquisitions, and after the monopoly, it was mainly through self-development. In addition, I would like to emphasize that IEO protects the interests of long-term BNB holders, and there is little profit for those who did not hold BNB at that time or bought BNB to participate in IDO.

何一: IEO and Pool are benefits for Binance users, who can get first-issue/early-stage tokens at a cost lower than the market or for free. Whether BNB holders have benefited from them may be clearer, and there is a lot of online data to support this. Because these projects are based on Binance’s first issuance, the team’s token unlocking will be more closely watched after listing on Binance. These projects are not under Binance’s control and are not operated by Binance, so there is no need to imagine a commercial war. Binance has the best project resources in the coin circle, and once it can’t be ignored, it will be the leader if it mimics itself, so what everyone feels is the uncontrollable Binance not going up.

@btcpiggy: Recently, the small coin issue on Binance has been quite serious. Look at the IDs on your exchange, the big Vs are collectively calling out, and the retail investors are being cut. The ARBlocking has plummeted. The EDU AMA caused a short-term drop. I can understand Lina, and the adjustments you made later were quite good. But for the first three coins, can you explain? Can you remove projects that engage in malicious trading or cutting of leeks?

何一: The LPD project’s wallet and market maker accounts are monitored, and the LPD project token currently requires the project party to hold multiple tokens as part of mutual supervision.

@btcholdermnx: I trusted you and bought BNX and EDU, but lost it all.

何一:

1) I have been buying BNB since 2017 and have repeatedly stated that Binance only recognizes BNB;

2) The comment on BNX is that in 2021, BNX acquired JEX, and I advised those who held JEX in early 2017 to switch to BNX. From DeFi Summer BNX3, 4 dollars rose to a maximum of 200 dollars, then split and fell;

3) Binance IEO projects generally have prices lower than the financing prices of capital parties, which is a benefit to Binance users; I reiterate that I do not support any projects besides BNB, please do your own research.

Product & Others

@Bono47280966: Can you improve the web3 wallet and Binance’s interoperability channel, add multiple chains, and make it easier for exchanges to transfer money to the blockchain?

何一: Okay, very good suggestion. Currently, the Binance web3 wallet is in the testing phase, and multiple chains are being continuously added. Thank you for your support.

@ccksbhaha: Sister, GMX, the head of the Arb ecosystem, was added before. Can you add the head of the ZKS ecology earlier? I don’t want to be a bagholder again.

何一: So, does anyone still remember that ARB was brought to Binance this year?

@TooLooGAS: After experiencing some things, I feel that I can’t point fingers at some people or companies anymore. I just objectively ask whether the future value of EDU and HOOK will be positively reflected? How can ordinary people learn useful things from them, or what is their future significance for us? (I am not asking about coin price)

何一: Pay attention to the regular updates and business reports of the projects. The essence of Hook is an advertising platform. In terms of EDU, we need to see if Tinytap’s revenue and user data are healthy. Finally, we need to see if these two projects can attract non-crypto users and revenue. The crypto market is currently in a bearish state. If the project team scams its users and the users are completely insular, then the industry will only shrink more.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin domain name BNS speculation frenzy: opportunity or risk?

- The next trillion-dollar market? Global financial giants are rushing to embrace RWA tokenization

- Pre-Musk’s call Milady: A “cyber psychopath” pushed to the extreme

- What impact will the upcoming legalization of stablecoins have on the market in Japan?

- Is the US regulatory agency the reason behind the decline in cryptocurrency trading volume?

- U.S. Digital Chamber of Commerce Blocks Texas’ Anti-Bitcoin Energy Bill

- How LSTFi is Leveraging the $100 Billion Liquidity Collateral Market