How LSTFi is Leveraging the $100 Billion Liquidity Collateral Market

LSTFi's Use of the $100B Liquidity Collateral MarketCompiled by: BlockingBitpushNews Mary Liu

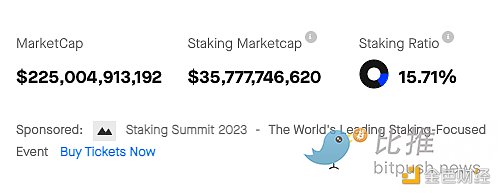

Liquid staking tokens (LST) are rapidly gaining popularity in DeFi. The value of the liquid staking industry has skyrocketed in recent months, with market leader Lido having a total locked value (TVL) of $13 billion – twice that of the second-largest DeFi protocol, MakerDAO. According to Staking Rewards data, more than 19 million ETH are currently staked, which is equivalent to 15.7% of the supply, with LSTFi accounting for 47% of the staked ETH, or $17 billion at current prices.

While LSTFi brings high liquidity to Ethereum, they also present new challenges for the network.

- Bankless: What has the market learned one year after the UST crash?

- Bitcoin Virtual Machine BVM is released, ushering in the era of smart contracts?

- Bitcoin Virtual Machine (BVM) is released, ushering in the era of smart contracts?

Liquid staking

LSTs are representative of staked Ethereum on the Beacon chain and are income-generating tokens that allow users to earn staking rewards without running their own nodes, as well as to enter and exit staking positions by simply buying and selling LST tokens.

Since the introduction of staking ETH withdrawals in April, many innovative protocols have been looking to further integrate LST tokens into DeFi and offer new strategies to earn additional returns on top of staking rewards.

Basic LST strategies

Many leading DeFi protocols already support LST, with Lido’s stETH having the broadest support while Rocket Pool’s rETH is also rapidly gaining market share.

LST holders can deposit their tokens into currency market protocols such as the third-largest DeFi protocol Aave to earn interest and staking rewards. They can also borrow other assets using LST as collateral, with their overall returns and profits exceeding accrued interest – unlocking recursive lending strategies.

Aave Founder and CEO Stani Kulechov said, “There is a strong interest in using stETH to earn additional returns without taking on excessive risk.”

MakerDAO users can mint their DAI stablecoin against stETH or rETH collateral, providing a simple way to obtain stablecoins to counteract LST liquidity.

Curve recently launched crvUSD, a stablecoin that users can mint using Frax’s frxETH token, with Curve indicating that it will soon expand support to other LSTs.

Users can also provide LST liquidity paired with ETH on decentralized exchanges such as Uniswap to earn trading fees, with impermanent loss being negligible.

The LST gold rush

New protocols are also profiting from the LST craze, with many protocols offering inflationary tokens as rewards.

Five weeks after launching its collateralized debt protocol, Lybra Finance’s total value locked (TVL) skyrocketed to $183 million, allowing users to mint its eUSD stablecoin using stETH. Lybra pays rewards to eUSD holders using ETH staked as collateral.

Origin OETH is a yield-aggregating LST that has also accumulated $15 million in TVL within two weeks of launching.

However, while new protocols may sometimes offer higher APYs, untested protocols may be more vulnerable to attacks than more established ones. Earlier this week, emerging LST liquidity market UnshETH, with $32 million TVL, froze withdrawals after being hacked.

Leverage strategies

Some protocols combine multiple DeFi plays to create complex LST strategies.

MakerDAO frontend Oasis.app launched a service in October that allows users to leverage their exposure to stETH. The product allows Aave users to borrow ETH against stETH collateral, then use the borrowed funds to purchase additional stETH in a single transaction.

Gearbox Protocol offers up to 10x leverage on stETH.

Pendle allows users to deposit LST assets and then mint new tokens representing accrued earnings (YT tokens) and underlying principal collateral positions (PT tokens). This means users can choose to hold onto their earnings tokens and sell the underlying collateral. Additionally, traders buying PT tokens can purchase ETH at a discounted price below market rates, but cannot use the ETH until a predetermined time period has passed.

EigenLayer

Many users in the Ethereum community are also awaiting the launch of EigenLayer, an innovative “re-staking” protocol that will debut on the mainnet in Q3.

In addition to verifying the Ethereum blockchain, EigenLayer will also allow Ethereum stakeholders to protect other services, giving them additional rewards. It is also working on support for stETH and rETH, enabling LST holders to participate in re-staking.

Centralization concerns

However, some industry insiders warn against over-financializing Ethereum’s underlying security mechanisms.

Superphiz, co-founder of the EthStaker community, said: “The purpose of staking is not to promote DeFi, but to promote the security and health of the Ethereum network. You have to separate these two goals.”

Some researchers worry that the financialization of LST will make Lido Finance’s dominant position a monopoly. Lido Finance currently controls 36% of all Ethereum staked and attracts 32% of validators. Ethereum co-founder Vitalik Buterin recently stipulated that no staking pool should control more than 15% of Ethereum staked.

Although many in the community are working to raise awareness of the issue, others believe more action is needed. Anthony Sassano, host of The Daily Gwei podcast and member of the Rocket Pool oDAO, urged the LST platform to use economic incentives to divert users from Lido.

Sassano said: “We all know that the most powerful force in crypto is economic incentives, but too many people are still thinking wishfully that they can trigger change on this issue in some simple way… Now is the time to go full speed ahead and make this market more decentralized.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 【Exclusive from ChainDD】Russia abandons the plan to build a national cryptocurrency exchange in order to respond to financial sanctions as soon as possible.

- Is the crypto market already on the eve of a bull market? Insights from data on the multi-dimensional BNB Chain.

- Decrypting the Unique Chinese Cryptocurrency Market: Real User Research and a Comprehensive Review of Chinese VC

- Lookonchain: Will the unlocking of 1INCH cause a large-scale market sell-off?

- Bitcoin New Protocol: BRC-721E

- Latest Interview with Zhao Changpeng: Being “Under the Microscope” of Regulation, Market is Recovering in Bearish Period

- Understanding the Ordinals family on Bitcoin in one article