Is the US regulatory agency the reason behind the decline in cryptocurrency trading volume?

Did the US regulatory agency cause the decline in cryptocurrency trading?Author: Josh Adams, BeInCrypto journalist Source: BeInCrypto Translation: Blocking

Summary

-

Cryptocurrency exchange trading volume hits lowest levels since October 2020

-

Some attribute this to US regulatory actions and this year’s banking crisis

-

Main participants are moving overseas to cryptocurrency hubs like the UAE and Hong Kong

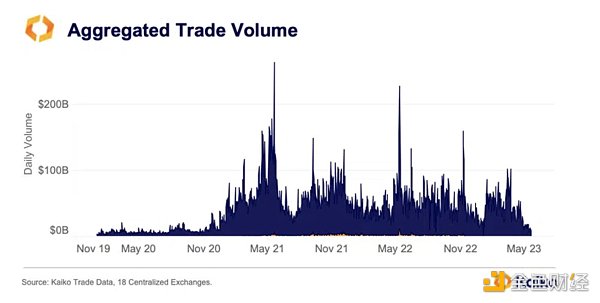

According to data from Kaiko, cryptocurrency exchange trading volumes have hit their lowest levels since October 2020. Experts point to the banking crisis and an unfriendly regulatory environment in the US as key factors.

Data from 18 centralized cryptocurrency exchanges tracked by Kaiko shows a daily cryptocurrency trading volume of $5 billion, hitting its lowest point since 2020. Many believe the US Securities and Exchange Commission (SEC)’s recent crackdowns and regulatory uncertainty are driving the decline in trading volume.

Cryptocurrency trading volume significantly declines

Cryptocurrency exchange trading volume refers to the total number of buy and sell orders of digital assets. It is the most commonly used indicator for evaluating exchange size and popularity.

In both cases, the overall trend this year has been downward. Experts widely believe that US regulatory actions are one of the key reasons. However, there is currently no clear consensus.

Total trading volume. Source: Kaiko

Danny Oyekan, founder and CEO of digital asset exchange Blockfinex, told BeInCrypto that this year’s banking crisis may have played a role.

He said: “Trading volumes actually performed well in the Middle East and Asia, but relatively poorly in the US and Canada. It appears that US exchanges are struggling to get the necessary banking services after strengthening regulatory reviews and there has been little progress in clear regulation.”

Should US regulators be blamed?

Oyekan believes that the fundamental reason for the low interest in cryptocurrency trading is the uncertainty in the US, which is driving interest to other markets globally.

“The uncertainty of regulation, economics, and accessing funds through banks has led to many key players turning to overseas, especially to international cryptocurrency centers like the UAE and Hong Kong, which may explain why the trading volume in Asia has been so strong,”

Similarly, Ryan Li, co-founder of CyberConnect, believes that the unfriendly regulatory environment in the United States is part of the problem.

He told BeInCrypto: “Several factors are at play this year, including low liquidity and market panic caused by regulatory action (especially in the US). Trading volumes often reflect the current macroeconomic environment, and May is always an interesting time for cryptocurrency.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin Virtual Machine BVM is released, ushering in the era of smart contracts?

- Bitcoin Virtual Machine (BVM) is released, ushering in the era of smart contracts?

- 【Exclusive from ChainDD】Russia abandons the plan to build a national cryptocurrency exchange in order to respond to financial sanctions as soon as possible.

- Is the crypto market already on the eve of a bull market? Insights from data on the multi-dimensional BNB Chain.

- Decrypting the Unique Chinese Cryptocurrency Market: Real User Research and a Comprehensive Review of Chinese VC

- Lookonchain: Will the unlocking of 1INCH cause a large-scale market sell-off?

- Bitcoin New Protocol: BRC-721E