The next trillion-dollar market? Global financial giants are rushing to embrace RWA tokenization

Global financial firms are quickly adopting RWA tokenization, which could become a trillion-dollar market.Original Author: Karen, Foresight News

The tokenization of Real World Assets (RWAs) is not only key to the mainstream adoption of DeFi and Web3, but also has the potential to disrupt certain financial sectors.

“Anything can be tokenized” is not an empty phrase. On the blockchain, any tangible or intangible value can be represented on the chain, including gold, real estate, debt, bonds, artwork, carbon credits, ownership, and content licenses. Due to the enormous advantages of low cost, high efficiency, broad accessibility due to the division of ownership, high liquidity, and adoption by DeFi, more and more financial giants are beginning to explore and lay out in this field.

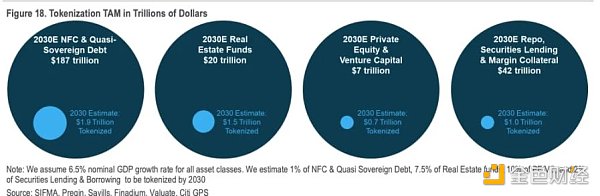

A recent report released by Citigroup predicts that by 2030, there will be 4 to 5 trillion dollars in tokenized digital securities, and trade finance transactions based on distributed ledger technology will also reach 1 trillion dollars. This aggressive prediction is based on the following assumptions:

- Pre-Musk’s call Milady: A “cyber psychopath” pushed to the extreme

- What impact will the upcoming legalization of stablecoins have on the market in Japan?

- Is the US regulatory agency the reason behind the decline in cryptocurrency trading volume?

1. It is expected that there will be a tokenized market of $1.9 trillion in the $187 trillion non-financial corporate and quasi-sovereign bond markets (1%);

2. It is expected that there will be a tokenized market of $1.5 trillion in the $20 trillion real estate fund market (7.5%);

3. It is expected that there will be a tokenized market of $0.7 trillion in the $7 trillion private equity and venture capital fund market (10%);

4. It is expected that there will be a tokenized market of $1 trillion in the $42 trillion securities financing and mortgage activity market (2%);

5. It is expected that there will be a tokenized market of $1 trillion in the $12 trillion trade finance market.

In the Digital Hong Kong Dollar Pilot Plan announced by the Hong Kong Monetary Authority earlier this month, 16 selected companies from the financial, payment and technology sectors will conduct the first round of trials this year to explore in-depth the potential use cases of the digital Hong Kong dollar in six areas, including comprehensive payment, programmable payment, offline payment, tokenized deposits, third-generation Internet (Web3) transaction settlement, and tokenized asset settlement. In fact, in February of this year, the Hong Kong SAR government successfully issued HKD 800 million in tokenized green bonds. This is the world’s first tokenized green bond issued by a government.

In this article, the author summarizes and organizes the exploration and layout of financial giants in the tokenization of RWAs. Among them, financial institutions such as JPMorgan Chase, Goldman Sachs, DBS Bank, UBS, Santander Bank, Industrial Bank of France, Hamilton Lane, etc. have stepped from the research and exploration stage into the actual test/application stage, while institutions such as Temasek, HSBC, and BlackRock are still in the exploration and preparation stage.

In recent years, major Chinese banks have also adopted blockchain technology in fields such as supply chain finance, trade finance, and payments, and have released relevant platforms such as blockchain trade finance platforms, asset securitization platforms, and Internet e-commerce financing systems. More are used to digitize transformation and improve financial service efficiency.

Overall, although the tokenization of assets is far from reaching large-scale adoption, with some giants that dominate the financial market gradually shifting from the research, exploration, and trial stages to the promotion stage, the momentum of RWA tokenization adoption has changed significantly.

JPMorgan Chase: Tokenization is the killer application of traditional finance

As a multinational investment bank and financial services company headquartered in New York, JPMorgan Chase has also been actively testing and laying out in the RWA field.

“Tokenization is the killer application of traditional finance,” said Tyrone Lobban, head of JPMorgan’s digital asset platform Onyx Digital Assets, showing the bank’s firm vision and emphasis on RWA tokenization.

In April of this year, Tyrone Lobban stated in an interview with CoinDesk that the company is still firmly implementing the plan to tokenize traditional financial assets, and is basically not affected by the crypto bear market and regulatory uncertainty. The bank has processed nearly $700 billion in short-term loan transactions using its Onyx Digital Assets platform. Clients using Onyx-based repo services include Goldman Sachs, BNP Paribas, and DBS Bank, and fifteen other banks and broker-dealers are currently seeking registration. As the platform develops, Onyx will focus on traditionally difficult-to-finance assets such as money market funds and use them as collateral. It is expected to issue a wider range of blockchain-based assets, including private equity funds.

Onyx Digital Assets was launched by JPMorgan Chase in November 2020 as a blockchain-based enterprise platform aimed at tokenizing traditional assets and unlocking liquidity. Onyx Digital Assets’ Tokenized Collateral Network (TCN) uses blockchain to transfer ownership of money market fund (MMF) shares as tokenized equity, allowing asset management companies and institutional investors to pledge or transfer MMF stocks as collateral.

JPMorgan Chase’s exploration of RWA goes beyond Onyx, including:

-

In May 2022, JPMorgan Chase was reportedly exploring the use of blockchain for collateral settlement, with the first such transaction occurring on May 20, when two JPMorgan Chase subsidiaries transferred tokenized BlackRock money market fund shares as collateral on their private chain. JPMorgan Chase plans to expand tokenized collateral to include stocks, fixed income, and other asset types in the coming months.

-

In October 2022, JPMorgan Chase tokenized US dollar deposits through JPM Coin and plans to soon enable euro deposits on its blockchain-based platform. JPM Coin is a stablecoin pegged to the US dollar that runs on the Quorum blockchain, allowing JPMorgan Chase customers to transfer US dollars held in deposits at the bank.

-

In November 2022, the Monetary Authority of Singapore (MAS) launched a digital assets pilot and decentralized finance (DeFi) services, with the first industry pilot under its Project Guardian exploring potential DeFi applications in the wholesale funding market having completed its first live transaction and testing the use of asset tokenization and DeFi in broader financial use cases. In the first industry pilot, DBS Bank, JPMorgan Chase, and SBI Digital Asset Holdings conducted foreign exchange and government bond trades on a liquidity pool that included tokenized assets.

Goldman Sachs: Entering the RWA Market via the Tokenization Platform GS DAP

Goldman Sachs, another top investment bank, is also exploring the RWA space.

-

In April 2022, Mathew McDermott, Global Head of Digital Assets at Goldman Sachs, said at a cryptocurrency and digital asset summit that as investment banks delve deeper into the cryptocurrency space, Goldman Sachs is exploring NFTs, particularly “the tokenization of physical assets.”

-

A report from June 2022 shows that the GS Digital Assets department is using blockchain technology and smart contracts as foundational technologies to provide clients with digital issuances of debt, stocks, funds, and derivatives, and to subsequently digitize their end-to-end lifecycle, including transactions, settlements, custody, and asset services on distributed ledgers on both public and private blockchains, including the establishment of strategic GS DAP digital tokenization and lifecycle platforms.

-

In November 2022, the European Investment Bank (EIB) announced the launch of Project Venus, a digital native bond denominated in euros, in partnership with Goldman Sachs Bank Europe, Santander, and Société Générale. The two-year, €100 million bond uses private blockchain technology for issuance, recording, and settlement, representing the first issuance of the Goldman Sachs tokenization platform, GS DAP.

-

In January of this year, Goldman Sachs’ digital asset platform, GS DAP, was officially launched. The platform, developed using Digital Asset’s Daml smart contract language and the privacy blockchain Canton, ensures that data is shared only with eligible stakeholders through its privacy protocol while supporting the scalability required to connect assets globally.

-

In February of this year, the Hong Kong government announced the successful issuance of an HKD 800 million government green bond program (GGBP) using the Goldman Sachs tokenization platform, GS DAP.

Citigroup: Asset Tokenization Approaching a Tipping Point

Citigroup’s “Money, Tokens, and Games” report, released in March of this year, states that although the potential for asset tokenization via blockchain is transformative, it has not yet reached the point of widespread adoption and is approaching a tipping point with the potential to be measured in billions of users and trillions of dollars in value.

-

Citigroup believes that if tokenization theory proves true, the 21st century could see the creation of regulated, global, token-based multi-asset networks. As early as 2020, Citigroup analysts stated that banks could explore opportunities such as loans collateralized by tokenized real estate assets as new liquidity secondary markets are created.

-

In June 2022, Citigroup announced it had chosen Swiss crypto custody company Metaco to develop and pilot digital asset custody functions, with a focus on tokenized securities.

-

In April 2023, Citi India completed its first blockchain letter of credit (LC) transaction for its client Cummins India Limited. Contour is a global digital trade finance network powered by blockchain technology that enables multiple parties (banks, corporates and logistics partners) to collaborate in real-time, securely and seamlessly on a single platform. Citigroup is a founding member bank of Contour.

DBS Bank: Participating in the Monetary Authority of Singapore’s digital asset pilot and DeFi services

DBS Bank in Singapore is one of the earliest financial companies to enter the digital asset field, mainly involving digital asset trading, securities token offering (STO) and custody services in the early stages. Although STO is also a form of asset tokenization, its purpose is to raise funds and is subject to more restrictions, such as being issued only on private chains and strict regulatory constraints.

-

In August 2020, DBS Group announced the launch of the digital exchange DDEx (DBS Digital Exchange), providing tokenization, trading, and custody services to institutions and qualified investors.

-

In June 2021, DBS Bank launched its first securities token offering (STO) by issuing digital bonds, raising $11.35 million.

-

In November 2022, DBS Bank announced it had completed a fixed-income product transaction through JPMorgan’s Onyx, becoming the first Asian bank to use the network.

-

In November 2022, the Monetary Authority of Singapore (MAS) launched its digital asset pilot and DeFi services, and as part of the first industry pilot under Project Guardian, DBS Bank, JPMorgan and SBI Digital Asset Holdings conducted forex and government bond transactions for a liquidity pool including tokenized assets.

Temasek: Preparing for tokenized assets

Temasek has been exploring the application of blockchain technology and asset tokenization for several years, but has not yet launched formal services. It is worth mentioning that Temasek suffered heavy losses in the FTX crash last year, having invested about $275 million in FTX and FTX US from October 2021 to January 2022, and decided to write off all of it last year.

-

In January 2021, the Singapore Exchange (SGX) and Temasek announced the formation of a joint venture (JV) that focuses on capital markets workflows through smart contracts, distributed ledgers, and tokenization technologies.

-

In May 2022, Pradyumna Agrawal, Managing Director and Head of Blockchain Investments at Temasek, stated that he does not hold Bitcoin but is preparing for tokenized assets.

HSBC: Exploring Asset Tokenization Use Cases

HSBC’s exploration of asset tokenization is relatively cautious, and the scope of its involvement in asset tokenization is currently limited.

-

In November 2022, HSBC announced plans to launch HSBC Orion, a DLT-based bond tokenization platform that enables the tokenization of digital bonds and currencies used for settlement, enabling atomic settlement or delivery versus payment (DvP). However, the digital bond program does not involve cryptocurrencies but uses permissioned blockchain infrastructure.

-

In the first quarter of 2023, the European Investment Bank (EIB) teamed up with BNP Paribas, HSBC, and Royal Bank of Canada Capital Markets to issue a sterling-denominated digital bond represented on a private blockchain, with the £50 million ($61.6 million) floating-rate bond registered on a private blockchain.

-

In 2023, HSBC posted a job listing for a Product Director for its global private banking and wealth business who will focus on asset tokenization use cases.

-

HSBC was among the 16 selected companies, including those from the financial, payment, and technology industries, to participate in the first round of trials in the Digital Currency Pilot Program launched by the Hong Kong Monetary Authority in May of this year.

Fidelity: Aggressively Investing in Crypto, Cautious about Real Asset Tokenization

As one of the world’s leading asset management companies, Fidelity began researching and exploring the cryptocurrency field in 2014, and its layout is relatively aggressive. In 2018, its subsidiary Fidelity Digital Assets helped institutions adopt digital assets, providing digital asset custody, trading, and asset management services. In 2022, it launched a cryptocurrency investment product, Fidelity Crypto, for retail customers. It is worth mentioning that Fidelity planned to allow investors to set up Bitcoin accounts in their 401(k)s last year, but they were blocked due to regulatory issues.

However, Fidelity’s layout and progress in the tokenization of real assets is not clear and seems to be in a wait-and-see phase. However, with the development of the tokenization of real assets, Fidelity may further expand this field in the future.

Singapore Exchange: Exploring tokenized asset settlement with the Monetary Authority of Singapore

-

In November 2018, the Monetary Authority of Singapore (MAS) and the Singapore Exchange (SGX) developed a delivery and payment (DvP) function for settling tokenized assets across different blockchain platforms.

-

In 2020, when DBS Bank launched its digital asset exchange, the Singapore Exchange held 10% of DBS Digital Exchange shares.

-

In January 2021, the Singapore Exchange and Temasek announced the establishment of a joint venture (JV) called Marketnode, which focuses on capital market workflows through smart contracts, ledgers, and tokenization technology.

BlackRock: Exploring Tokenization of Stocks and Bonds

Asset management industry leader BlackRock is relatively active in the Crypto field, such as entering the Crypto market through blockchain ETFs, spot Bitcoin private trusts, providing Core Scientific, a Bitcoin mining company, with a $17 million loan, and providing crypto trading and custody services to institutional clients through Coinbase Prime.

Although BlackRock has publicly announced that it is exploring this field, there is currently no significant substantive progress in tokenizing real assets.

-

In March 2023, BlackRock CEO Larry Fink stated in his annual letter to BlackRock shareholders, “BlackRock will continue to explore the digital asset ecosystem, especially in areas that are most relevant to our clients, such as permissioned blockchains and tokenization of stocks and bonds.”

BNY Mellon: Tokenization has the ability to completely change the financial landscape

BNY Mellon has also been actively exploring and practicing in the Crypto and tokenization of real assets fields and is open to the application prospects of the tokenization of real assets. The bank is not only a major custodian of USDC reserves, but also approved by New York regulators to provide cryptocurrency custody services.

-

In September 2022, Mellon Bank of New York released a report titled “The Rise of Tokenization,” which stated that tokenization has the ability to completely change the financial landscape and fundamentally alter investment management, use, and monetization.

-

In May of this year, Mellon Bank of New York said that it is currently advancing initiatives involving distributed ledger technology, tokenization, and digital cash, including providing custody and clearing services for digital assets, as well as achieving new use cases such as security tokenization.

UBS Group: Substantial progress has been made in tokenized assets

UBS Group, a multinational investment bank and wealth management company headquartered in Zurich, Switzerland, has made substantial progress in tokenized assets.

-

In October 2019, according to finews.com, UBS Group was seeking to tokenize assets in its securities division, including debt, structured products, and physical gold.

-

In May 2021, UBS Group offered a pilot program to more than 100 institutional clients to tokenize physical assets. The project runs on the Ethereum platform.

-

In November 2022, UBS Group announced the listing of the first blockchain-based digital bond, a three-year bond worth about $370 million with a coupon rate of 2.33%. The bond will be issued on the SIX Digital Exchange blockchain-based platform and traded on SDX and SIX Swiss Exchange.

-

In December 2022, UBS’s London branch issued $50 million in tokenized debt securities on Ethereum to high-net-worth individuals and family offices in Hong Kong and Singapore.

Santander Bank: Testing tokenization of bonds, agricultural products, used cars, and real estate

-

In September 2019, Santander Bank announced the issuance of the first end-to-end blockchain bond on Ethereum (worth $20 million).

-

In March 2022, Santander Bank, a Spanish multinational bank, partnered with Argentine agricultural tokenization platform Agrotokeon to provide loans collateralized by tokenized agricultural commodities to Argentine farmers. The credit collateral is based on Agrotoken’s soybean (SOYA), corn (CORA), and wheat (WHEA) tokens.

-

In October 2022, Santander Brazil began testing a tokenization system for the transfer of used cars and real estate.

-

In January 2023, the European Commission and the Association of German Banks jointly launched an initiative on the importance of tokenization, with over 20 well-known partners from the private, industrial, financial, and digital sectors participating, including Santander Bank.

Deutsche Bank: Tokenized Fund on Memento Blockchain

-

In May 2021, Deutsche Bank Singapore Securities Services and Hashstacs (STACS) announced the completion of a proof of concept (POC) called “Project Benja,” which was a “bond in a box” concept verification that used DLT for digital assets and sustainable development-linked bonds. Deutsche Bank said the POC allowed it to evaluate the actual handling of tokenized assets and the opportunities and challenges they might offer commercially in Singapore and other markets.

-

In February 2023, Deutsche Bank launched a tokenized fund on the Memento blockchain.

Societe Generale: Participating in RWA Tokenization DeFi

Societe Generale has also been actively positioning itself in the field of digital assets and is one of the few financial companies participating in DeFi.

-

In April 2019, Societe Generale subsidiary Societe Generale SFH issued €100 million in collateralized bonds on Ethereum.

-

In May 2020, Societe Generale SFH issued €40 million in collateralized bonds as securities tokens registered directly on a public blockchain.

-

In April 2021, Société Générale issued a structured product on the Tezos public blockchain.

-

In August 2022, MakerDAO agreed to provide up to $30 million in loans to SG Forge, a digital asset subsidiary of Société Générale. In January of this year, SG Forge drew down the first tranche of $7 million in DAI stablecoins as part of the loan.

-

In April 2023, Société Générale subsidiary SG-Forge launched the EUR CoinVertible stablecoin pegged to the euro for institutional clients. The EURCV stablecoin is only available to institutional investors who have joined Société Générale through its KYC and AML procedures.

Hamilton Lane: Offering tokenized access through tokenized funds and partnerships

Hamilton Lane is a US-based private markets investment management firm that partners with blockchain-based financial services companies to lower investment barriers and offer tokenized access to clients.

-

In March 2022, Hamilton Lane partnered with digital securities exchange ADDX to offer tokenized access to the Hamilton Lane Global Private Assets Fund.

-

In October 2022, Hamilton Lane established a partnership with digital asset securities firm Securitize to expand investor access to Hamilton Lane funds through tokenization.

-

In October 2022, Hamilton Lane and blockchain financial services company Figure plan to collaborate on a blockchain-native registered investment fund focused on the private markets. The fund will use Figure’s Digital Fund Services (DFS) platform to digitize ownership of fund shares on the Provenance Blockchain.

-

In January 2023, Hamilton Lane launched a tokenized fund with a minimum investment amount of $20,000, down from $5 million, and deployed on Polygon.

State Street: Creating a range of tokenization solutions

State Street is a leading provider of financial services to institutional investors, with $37.6 trillion in assets under custody and $3.6 trillion in assets under management as of March 31, 2023.

-

State Street Digital, a digital asset service platform launched by State Street, provides a range of custody, fund management, collateral management, tokenization, and payment tools.

-

In August 2022, State Street announced that it sees “significant opportunity” in tokenization and is committed to tokenizing funds and private assets by 2023 to improve client efficiency and accessibility.

-

State Street has also invested in blockchain-based financial and regulatory technology company Securrency and created a range of tokenization solutions, including:

1. Proof of concept for tokenizing fund shares with asset management companies;

2. Automated FX non-deliverable forward over-the-counter trade lifecycle;

3. Digitized transaction processing on State Street Alpha, providing aggregated data, analysis, and real-time insights.

China’s Domestic Banking Layout

In recent years, China’s major banks have also adopted blockchain technology in the fields of supply chain finance, trade financing, and payment. They have released related platforms such as blockchain trade finance platforms, asset securitization platforms, and Internet e-commerce financing systems, which are mostly used for digital transformation and improving financial service efficiency.

In August 2017, Agricultural Bank of China launched a blockchain-based e-commerce financing system for agriculture.

In 2018, China Construction Bank tested “Blockchain + Finance” and completed the construction of the BCTrade blockchain trade finance platform. It then released the BCTrade 2.0 blockchain trade finance platform in 2019. This platform uses blockchain technology applications to achieve the full electronic process of trade finance business transactions such as domestic letters of credit, forfeiting, and international factoring, including the transmission of transaction information, debt confirmation, and bill transfer, making up for the lack of related system platforms, avoiding the risks that may be caused by non-encrypted transmission, and improving business processing efficiency.

In June 2018, Bank of Communications officially launched the full-process blockchain asset securitization platform “Jucai Chain” for investment banking, which deployed blockchain nodes for internal institutions such as Bank of Communications, CICC, and PwC, as well as intermediary institutions such as Zhonglun, CCXI, and CCX. It realized the double-chain onboarding of asset securitization project information and asset information, and synchronized the process of cross-institutional due diligence based on smart contracts, comprehensively reshaping the operation process of investment bank asset securitization business.

In December 2019, Bank of China completed the pricing of the first phase of the 20 billion yuan special financial bonds for small and micro-enterprise loans in 2019 within China, with the funds raised specifically for the issuance of small and micro enterprise loans. In this issuance, Bank of China simultaneously used its self-developed blockchain bond issuance system. The system uses blockchain networks as the underlying platform, supporting the on-chain interaction and certification of key information and documents during the bond issuance process.

In August 2020, the China Banking Association organized the construction of the China Trade Finance Cross-Bank Trading Blockchain Platform (CTFU Platform) jointly with the five major banks.

In January 2021, the “Gongyin Seal Chain” blockchain platform independently developed by Industrial and Commercial Bank of China passed the five credible blockchain technology evaluations conducted by the Ministry of Industry and Information Technology.

In March 2021, as a joint lead underwriter, Shanghai Pudong Development Bank, together with Central Securities Depository Co., Ltd., used blockchain technology for the first time to support the issuance of 2 billion yuan Tier 2 capital bonds by Standard Chartered Bank (China) Co., Ltd.

In June 2021, China Merchants Bank launched the blockchain portal website “Yilian Tong”. The blockchain application scenarios explored by China Merchants Bank include supply chain, electronic bills, fund settlement, cross-border finance, multi-party cooperation, and contract certification, among others.

Summary

Although the current DeFi and Web3 markets still have a significant gap compared to the traditional financial market in terms of volume, RWA tokenization has the potential to introduce the next trillion-dollar market for Web3.

However, the current asset tokenization market involving collateralized borrowing and lending, credit, composability, and other attributes in DeFi is relatively small and faces challenges such as poor liquidity, liquidity fragmentation, and incomplete infrastructure. In addition, more clarity from regulatory agencies and relatively consistent relevant standards are also crucial for stimulating the growth of RWA tokenization.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- U.S. Digital Chamber of Commerce Blocks Texas’ Anti-Bitcoin Energy Bill

- How LSTFi is Leveraging the $100 Billion Liquidity Collateral Market

- Bankless: What has the market learned one year after the UST crash?

- Bitcoin Virtual Machine BVM is released, ushering in the era of smart contracts?

- Bitcoin Virtual Machine (BVM) is released, ushering in the era of smart contracts?

- 【Exclusive from ChainDD】Russia abandons the plan to build a national cryptocurrency exchange in order to respond to financial sanctions as soon as possible.

- Is the crypto market already on the eve of a bull market? Insights from data on the multi-dimensional BNB Chain.