What impact will the upcoming legalization of stablecoins in Japan have on the market?

What will the legalization of stablecoins in Japan mean for the market?Not only Hong Kong but also Japan is supporting the development of crypto from a policy perspective. Just yesterday, Japan implemented the revised “Fund Settlement Law” and defined stablecoins as a new “electronic payment method,” further clarifying the status of stablecoins in Japan’s legal framework and establishing detailed rules to regulate the issuance and use of stablecoins in Japan. What changes and opportunities will this policy bring to the market? Odaily Planet Daily will provide the following interpretation based on the financial department’s documents and relevant laws.

Details of the bill

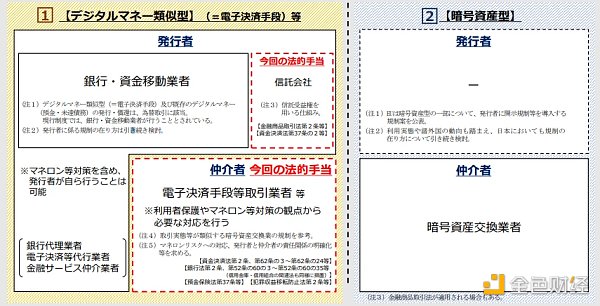

Simply put, the revised “Fund Settlement Law” divides digital currencies into “type digital currencies” and “cryptographic assets.” The focus of this revision is to separate the former and include stablecoins such as USDT that are pegged to fiat currencies in the “type digital currency” category and classify them as foreign exchange transactions. Therefore, the issuers of these stablecoins will be limited to domestic banks, transfer service providers, and trust companies, and the new regulations have more specific provisions for issuers and agents. Only agents who have obtained an electronic payment license can participate in the issuance of these stablecoins.

For stablecoins issued overseas, their supervision is mainly completed through agents in Japan. During this period, agents have an obligation to protect customers’ assets. At the same time, from the perspective of anti-money laundering, the financial department can require them to provide transfer records for inquiries.

Algorithmic stablecoins are classified as “cryptographic assets,” and their management methods are the same as other digital currencies. For detailed content of the “Fund Settlement Law,” please refer to the official website link.

- Bitcoin domain name BNS speculation frenzy: opportunity or risk?

- The next trillion-dollar market? Global financial giants are rushing to embrace RWA tokenization

- Pre-Musk’s call Milady: A “cyber psychopath” pushed to the extreme

Industry attitude

In fact, several Japanese banks had already participated in stablecoin-related businesses a few months ago. On March 2, G.U.Technologies announced its cooperation with Shikoku Bank, Tokyo Kiraboshi Financial Group, and Minna no Bank to conduct stablecoin experiments and issue stablecoins on the JaBlockingn Open Chain through its developed management and issuance system.

Mitsubishi UFJ Trust announced on the 28th of that month that it had formed a technical alliance with Datachain and conducted a “PVP payment” experiment to achieve mutual transfer and exchange of various stablecoins issued domestically in the future.

It is not difficult to see that the traditional financial sector overall still maintains an open and positive attitude towards new stablecoin regulations, and actively collaborates with companies in the Web3 field to explore future business in this area. Their participation also provides reliable support and endorsement for the promotion and use of stablecoins in Japan.

Latest Attitudes Towards Stablecoins in Other Regions

The US House of Representatives held a stablecoin hearing on May 18, where both Republican and Democratic parties engaged in heated debates over stablecoin bill drafts, with the main point of contention being the regulatory power of states versus the federal government. The Republican-sponsored bill advocates that stablecoin operators be allowed to register in any state of their choice without going through the Federal Reserve, and that each state can set its own standards; while the Democrats argue that the Federal Reserve System should play a leading role in decision-making, and require issuers to comply with more terms to regulate the industry. At present, the two sides have not yet reached a final consensus.

Meanwhile, the EU will develop detailed rules for implementing MiCA (EU market regulations for encryption assets) in the coming months, which also propose a series of conditions for stablecoin issuers, including obtaining official licenses and having certain reserves. In addition, the Chairman of the European Banking Authority stated last month that “central banks should have the right to veto the wide introduction of so-called stablecoins”, and that “all issuers will be subject to a strong authorization and regulatory framework”.

Conclusion

The lifting of the stablecoin ban will bring new opportunities to Japan’s crypto market, and stablecoin businesses led by traditional finance will undoubtedly be easier and more convenient in terms of regulation and promotion, which also brings new challenges to these institutions. How much impact the amended regulations will have on the market remains to be seen. Odaily Planet Daily will continue to pay attention to this issue.

Reference Links

Domestic stablecoin issuance possible with the revised Fund Settlement Act to be enforced on June 1, there are also benefits for multinational companies

Explanatory materials for the bill to partially revise the law related to fund settlements for the construction of stable and efficient fund settlement systems

《Fund Settlement Law》Full Text

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What impact will the upcoming legalization of stablecoins have on the market in Japan?

- Is the US regulatory agency the reason behind the decline in cryptocurrency trading volume?

- U.S. Digital Chamber of Commerce Blocks Texas’ Anti-Bitcoin Energy Bill

- How LSTFi is Leveraging the $100 Billion Liquidity Collateral Market

- Bankless: What has the market learned one year after the UST crash?

- Bitcoin Virtual Machine BVM is released, ushering in the era of smart contracts?

- Bitcoin Virtual Machine (BVM) is released, ushering in the era of smart contracts?