Rapid rebound = giving money to traders? An analysis of 4 tokens with the best performance in volatility.

Analyzing 4 high-performing tokens with rapid rebounds and potential trader incentives.Author: Cryptocurrency researcher Ann; Translation: Baize Research Institute

By observing the market trends in the first half of 2023, I have compiled a list of volatile tokens that have performed well.

The key criterion for inclusion on this list is naturally volatility. Like other parts of the market, if the market crashes, these tokens will also decline, just not as much as other tokens. However, what sets them apart is their strong rebound, which often allows traders to earn daily profits of 10%+, providing excellent opportunities for traders.

In addition, the price volatility of these tokens is also beneficial for traders using the DCA (Dollar Cost Averaging) strategy as it provides immediate gratification. Don’t you like assets that rise after being bought at the bottom (support line)? Don’t you prefer assets with a clear bottom rather than those that may not have one?

- Coinbase Unlocking the Future of NFTs – Exploring ERC-6551 Token-Bound Accounts

- Without looking at the process but focusing on the result, what problems can the most dominant architecture of Web3, Intent-Centric, solve?

- AMA with Alex, co-founder of Matter Labs The Final Battle of zkSync

Arbitrum (ARB)

ARB, the native token of Ethereum’s leading L2 solution Arbitrum, is a relatively young token that was launched less than a year ago (March 2023). As ARB was introduced during the bear market, it has not yet experienced a true “boom moment”.

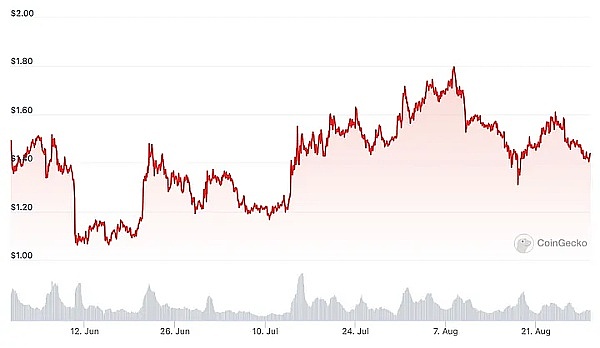

If you take a close look at the chart below (source: Coingecko), you can easily see how this token differs from others. Overall, ARB’s performance this year has not been outstanding. However, compared to most tokens that have plummeted by 90% since the peak of the bull market in 2021, ARB’s price chart is not as dismal.

This year, ARB has experienced several price increases, but there have been no fundamental reasons behind them. The most recent one was during the ETHCC event, where rumors circulated that the project team was about to make some major announcements (in reality, the announcements did not leave a profound impression).

In addition to some technical analysis predictions, I also have some theories about the reasons behind these price increases.

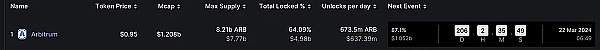

ARB still has a long way to go before the investor token unlock. According to DeFillama data, the first unlock of ARB will start 200 days later on March 22, 2024.

Therefore, since the token was launched, ARB has not experienced mass selling. In addition, assuming that most people who received ARB through airdrops have already sold them, this has caused some volatility and created some profit opportunities for traders.

As the unlock date approaches, we can be certain that the price of ARB will decline. But having spent enough time in the cryptocurrency market, I know that token prices tend to rise before the unlock. I know this may seem like a strange logic, but if you understand the game theory of the cryptocurrency market, you will know that investors will never sell their tokens cheaply. The rebound “helps” create FOMO and provide liquidity for the mass selling by these investors. Although this theory is just an urban legend, it still makes sense when you think about it.

Fundamentally, even in a bear market, Arbitrum has successfully solidified its position as one of the successful projects. It has found a niche market, which is to become the No.1 DeFi L2. Moreover, GMX, built on top of it, has become the “mascot” protocol that can attract new users and increase fee revenue.

In conclusion, the combination of token status + intrinsic value makes ARB a good volatile asset.

Optimium (OP)

At the time of writing this article, OP is experiencing token unlock time, and the price has fluctuated. (August 30, 2023)

OP, the native token of another leading L2 on Ethereum, Optimism, is an example of how the token has risen before the unlock event.

Within two months, OP rose from $0.89 to $1.8. In the recent meme coin frenzy, OP is also one of the relatively “prosperous” tokens that have risen along with tokens such as BALD or UNIBOT.

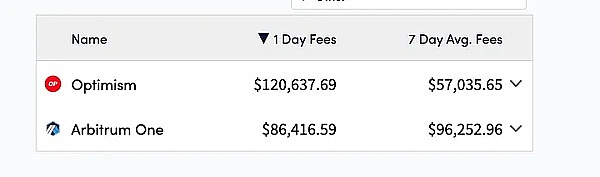

The reason for the rise (excluding any market irrational factors) is the recent improvement in Optimism’s reputation. Coinbase has built their Base chain on top of Optimism’s OP Stack and signed a revenue-sharing agreement that benefits both teams. Not to mention, the launch of OP Stack and the OP Stack chain ecosystem itself during the ETHCC event also contributed to the market’s excitement and price rise.

The establishment of the partnership between Coinbase and Optimism proves the top-tier position of Optimism L2 and poses a challenge to Arbitrum.

My personal experience in trading OP is that this particular token has strong demand. Reversals always happen quickly and fairly violently during downturns. On Binance, the trading volume of OP is considerable, making it one of the highest trading volume tokens, and the trading volume of its perpetual contracts is even larger.

Solana (SOL)

After the catastrophic moment of FTX last year, Solana is on the path of self-redemption. After a year of perseverance, the community seems to be turning around.

Due to the “SBF effect,” I may be biased towards Solana. (I dislike SBF, so I think everything he promotes is intimidating, including Solana.)

However, I have to admit that Solana is very resilient. Solana has its loyal user and developer community.

Since February, Solana has achieved zero downtime, setting a record for the longest consecutive normal operation time. This is something they can rightly boast about. In comparison, Arbitrum has experienced several interruptions just this year. For example, in June, the network was interrupted due to sorter errors.

In addition to SBF, Solana is also supported by a major “group” – Jump Crypto. It is worth noting that Jump Crypto is on par with Wintermute and Alameda in terms of “market-making”. Therefore, when SOL decides to make a comeback, I expect the SOL price to rise unexpectedly.

This year, the SOL price has often remained within a certain range. It is clear from the chart that whenever SOL reaches the lower range, it quickly rebounds.

Ethereum (ETH)

Speaking of prices not staying low for long, there is no token that can compare to Ethereum.

Cheap ETH is always in demand. For example, in the recent crash, while Bitcoin fell from $29,000 to $26,000, the Ethereum price dropped to around $1,400-$1,500, but it actually only lasted for a moment before quickly rebounding to $1,600.

Moreover, whenever there is a new “traffic explosion point” on the chain, the ETH price will quickly rebound along with the rise in gas fees.

Ethereum has some liquidity issues because most circulating ETH is pledged or locked in DeFi rather than on the open market. Therefore, recently ETH has not had much of a sense of rise and fall, which is a bit annoying for traders and hodlers.

Conclusion

August is one of the most disliked months in the crypto market for many years. Now that August is over, what comes next?

You need to understand that things won’t stay at the bottom or the top forever.

Usually, approaching the end of the year is a good time to accumulate positions. That’s why I believe it’s a good idea to share this list of volatile tokens. Because when the big market comes, you don’t want to miss out on the (crazy) rise, as you will also miss out on the (crazy) fall.

<END>

Note:

The above projects and opinions should not be construed as investment advice. DYOR. According to the “Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is for information sharing only and does not promote or endorse any business and investment activities. Please strictly comply with local laws and regulations and do not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What can the Intent-Centric architecture, the most domineering architecture of Web3, solve without looking at the process?

- Kansas Fed Huge Losses May Result from Purchasing Cryptocurrencies through Cryptocurrency ATMs

- After Friend.tech, how will Base ecology continue?

- What does the US court’s friendly judgment on Uniswap mean for DeFi regulation?

- Can PEPE make a comeback? What do traders and analysts say?

- Digital Asset Lawyer Cryptocurrency Industry in the United States May Be on the Verge of Recovery

- Uniswap wins collective investor lawsuit, becoming a precedent sample in the DeFi regulatory challenge