APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

APR Winter? Analysis of high-yield DeFi projectsAuthor: Fungi Alpha, Crypto KOL; Source: Author’s Twitter @FungiAlpha; Translation: Leo, BlockBeats

DeFi projects are still worth paying attention to due to their high returns. Crypto KOL Fungi Alpha has selected DeFi projects that can earn high returns based on blockchain standards. The compilation is as follows:

Crypto narrative has dominated the development and innovation of DeFi, but this does not affect the high-yield projects in DeFi. The following are the DeFi projects I have selected worth paying attention to:

Ponzi speculation is interesting but also high-risk, so we need to focus on security, speculation, and narrative. Let’s start with the BNB chain. Whether you have noticed it or not, it has a huge user base and a broad prospect for opBNB!

- 20 Worth-Watching Unreleased Coin Projects

- What does the SEC action mean by treating NFT projects as unregistered securities for the first time, and what does the related legislation say?

- Understanding the Cross-Chain Leveraged Trading Aggregator MUX in One Article

BNB Chain

KTX.Finance

KTX.Finance is a decentralized derivatives and social trading protocol on the BNB chain that allows leverage of up to 50 times. The platform is operating and developing according to plans, and the team recently announced deployment on Mantle. A safe option is to provide liquidity in the KLP pool (similar to the GLP model). The project offers an APR of 143%, with 27% APR paid in BNB.

Arbitrum Chain

HMX

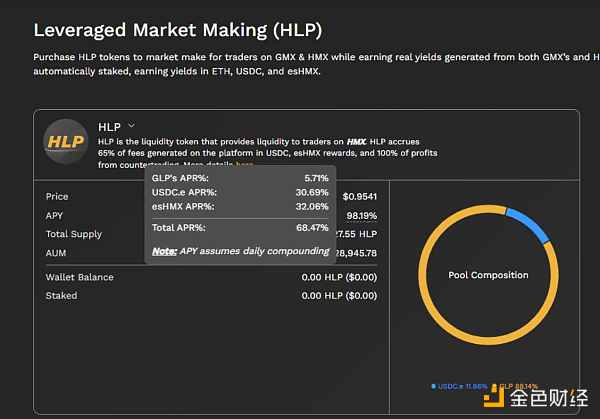

Arbitrum is quite popular for real yield and perps dex projects, so there are many opportunities to earn high returns on Arbitrum, which is relatively safe (but risks associated with DeFi always exist). HMX is a decentralized perpetual protocol on Arb, providing cross-chain margin and multi-asset collateral support.

The TVL data of HMX is quite impressive, which is reflected in the yield of HLP (HMX’s liquidity token), with a total APR of 68%, of which about 31% APR belongs to USDC.e, which is also the reason why HMX is widely adopted.

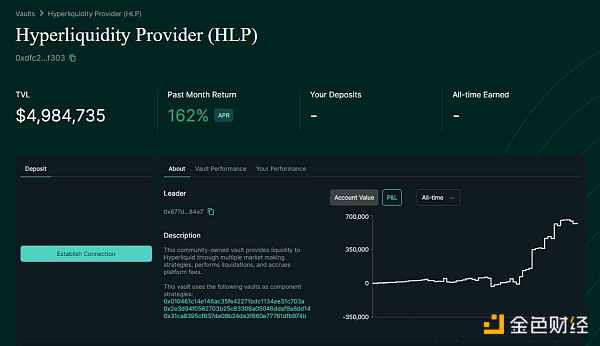

The HLP treasury of Hyperliquid is also very good, with a TVL of over $5 million and treasury profit of over $600,000. The current APR is 162%, and USDC is deposited to accumulate fees from traders’ PnL.

Good Entry

Good Entry is a perp Dex on Arbitrum, which is currently not widely known. Users can avoid liquidation when trading with leverage. Another highlight is ezVaults, where most rewards are native tokens. It is recommended to participate early.

Stella

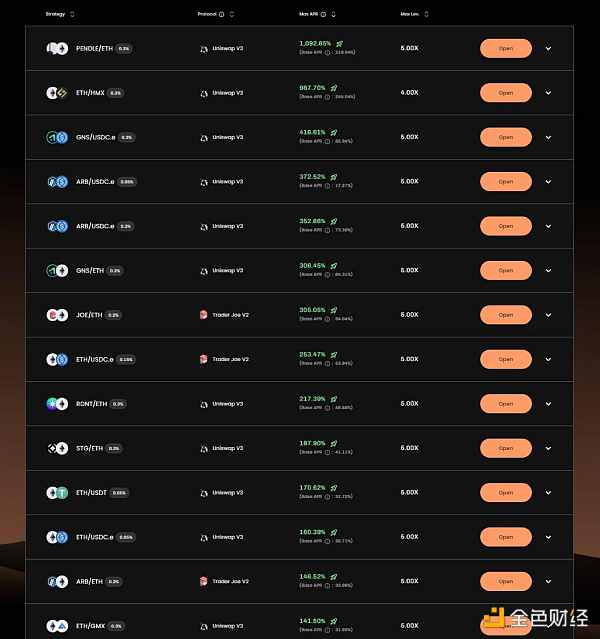

Stella is a zero-cost lending leverage strategy protocol on Arbitrum, providing leverage liquidity mining strategies and its unique real-time payment cost model. The annual interest rate table below shows the annual interest rate data under maximum leverage, but the basic annual interest rate is also worth paying attention to. The project currently does not have a token.

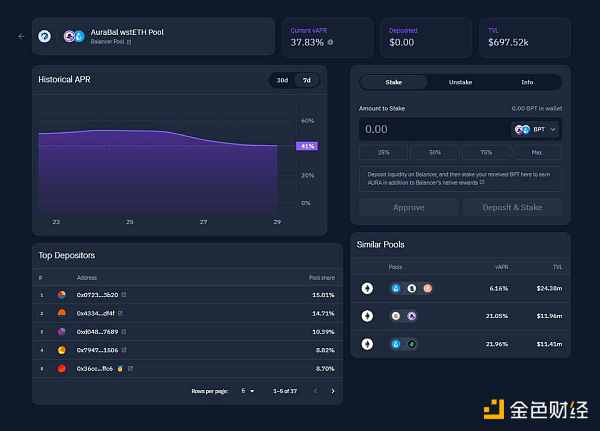

Aura Finance

Aura Finance is a protocol built on top of the Balancer system. It provides the maximum incentives for Balancer liquidity providers and BAL stakeholders through the social aggregation of BAL deposits and Aura’s native token. The operation is simple: users first provide liquidity on Balancer, and then use BPT to obtain additional income on Aura. The pool currently provides an APR of about 38%.

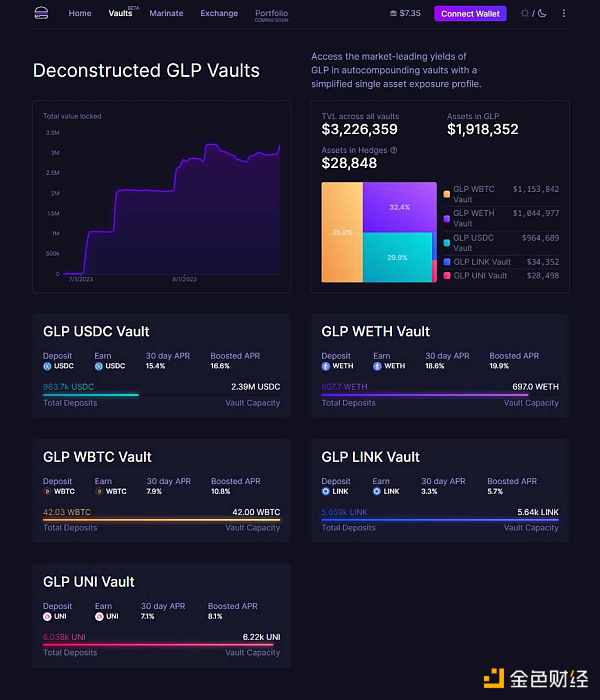

Umami DAO

Umami DAO is a non-custodial DeFi yield protocol that aims to create and launch a series of DeFi yield products and return fees to UMAMI holders. Users can earn decent APR by depositing tokens such as BTC, ETH, USDC, UNI, LINK, etc. into the protocol. The APR for USDC or ETH is higher, at around 15.4%-19.9%.

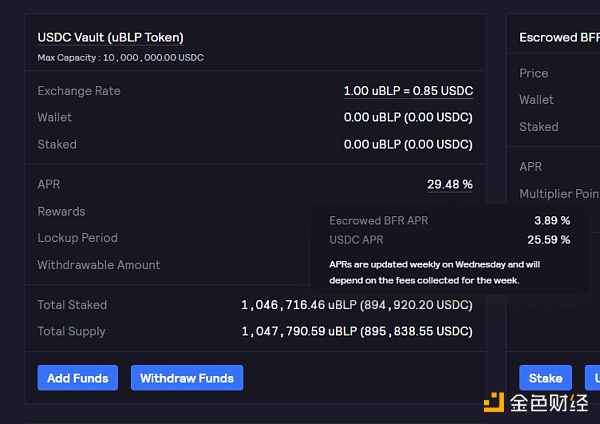

Buffer Finance

Buffer Finance is a non-custodial options trading platform and a well-established project on Arbitrum. Users on this platform can choose from four time ranges: 5m/15m/1hr/4hr. They can stake BFR and/or BLP to earn real income from generated fees. The USDC Vault APR on Buffer is 25.59%, making it a good yield project on Arbitrum.

Trader Joe

Trader Joe is a well-known one-stop DeFi platform on Arbitrum, covering a wide range of businesses, including spot Dex, decentralized lending, NFT trading platform (Joepeg), and launchLianGuaid (Rocket Joe). Its APR data has always been good.

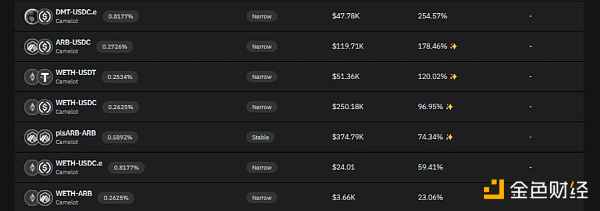

Gamma

Gamma is a protocol designed for centralized liquidity, non-custodial, automated, and active management. Users can deploy funds into liquidity pools to earn high returns. The APR data for this protocol is also very high, and users can confidently add assets to the pools due to its superior liquidity management mechanism.

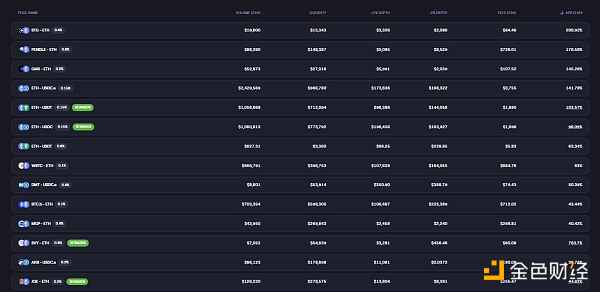

MUX Protocol

MUX Protocol is a decentralized leverage trading protocol that enables zero price impact and up to 100x leverage trading. Traders have no counterparty risk and it provides an optimized on-chain trading experience. Additionally, MUX is a multi-chain native protocol that aggregates liquidity across multiple deployed chains to maximize capital efficiency. Currently, the protocol has a trading volume of $14.5 billion and an ETH APR of 21%.

Optimism Chain

UniDex Exchange

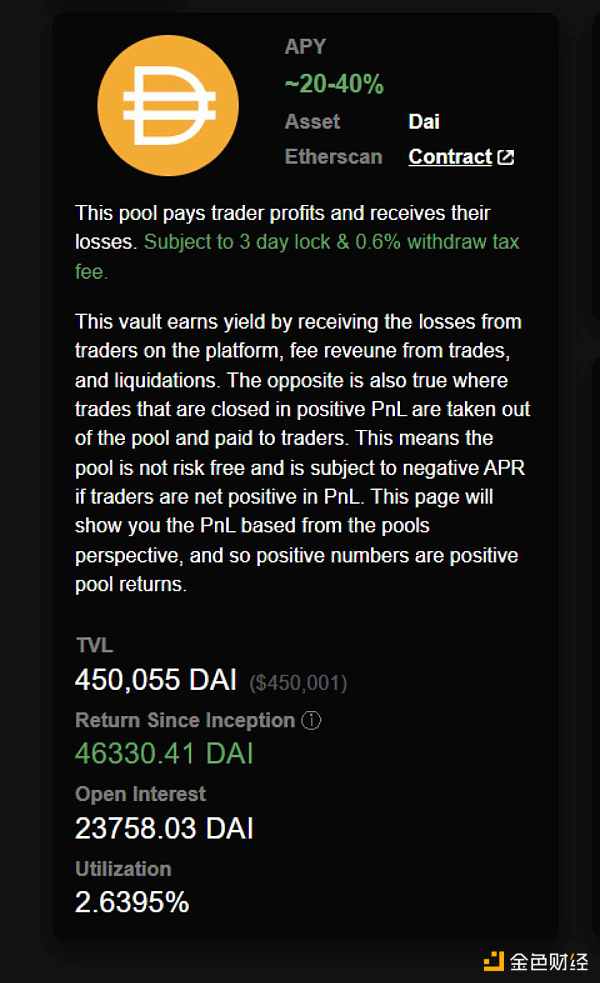

UniDex Exchange is a DeFi platform similar to NASDAQ, where traders can place orders for any type of financial instrument. UniDex sends orders to the best available price based on hundreds of sources and matches orders. The platform currently offers options, contracts, cross-chain transactions, and other trading tools. UniDex recently improved its UI and increased the income share for stakers. In addition, UniDex is also developing the UniDex Chain, with a DAI deposit APR of about 20%-40%.

The Granary

The Granary is a cross-chain lending protocol, with an APR of 27% for DAI deposits on Granary.

Kyber Network

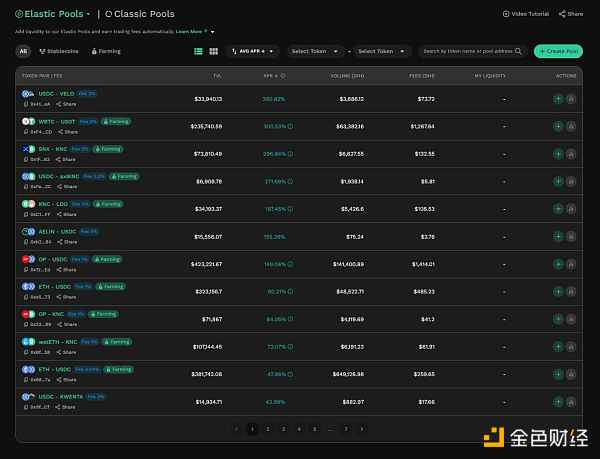

Kyber Network is a multi-chain cryptocurrency trading and liquidity hub that connects liquidity from different sources to achieve optimal exchange rates. Its product KyberSwap is a DEX aggregator. Kyber Network is also a well-established DeFi project, and its Elastic Pools are very popular, especially on the Op chain, with a very high APR.

Base Chain

Aerodrome

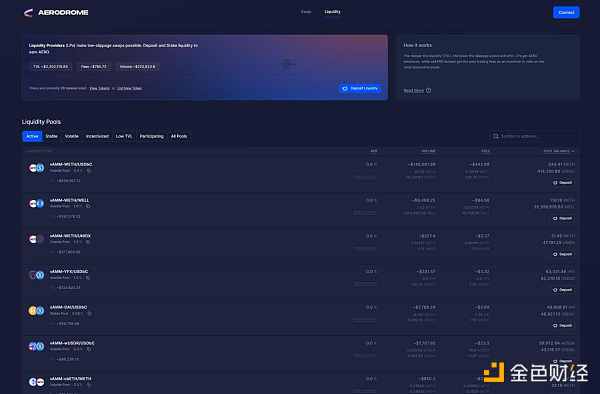

When it comes to the hottest DeFi project on the Base Chain, Aerodrome is definitely one of them. It is a branch of Velodrome and a DeFi project worth paying attention to. As of the time of writing, according to Defillama data, Aerodrome’s TVL has exceeded $200 million.

Polygon Chain

Metavault.Trade

Metavault.Trade is a decentralized spot and perpetual trading platform. The APR for MATIC deposits on Metavault’s MVLP is about 27% and it is very secure.

Pearl

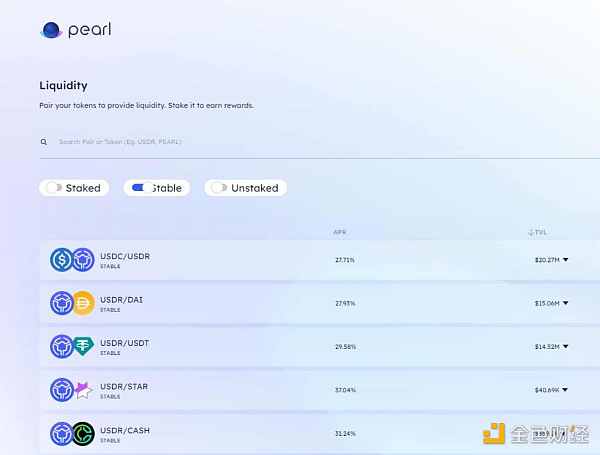

Pearl is a Solidly fork protocol. In addition, Pearl also collaborates with USDR (a revenue-generating stablecoin from Tangible) to bring high returns. Some stablecoin LP APR in this project is 27%-37%.

Retro

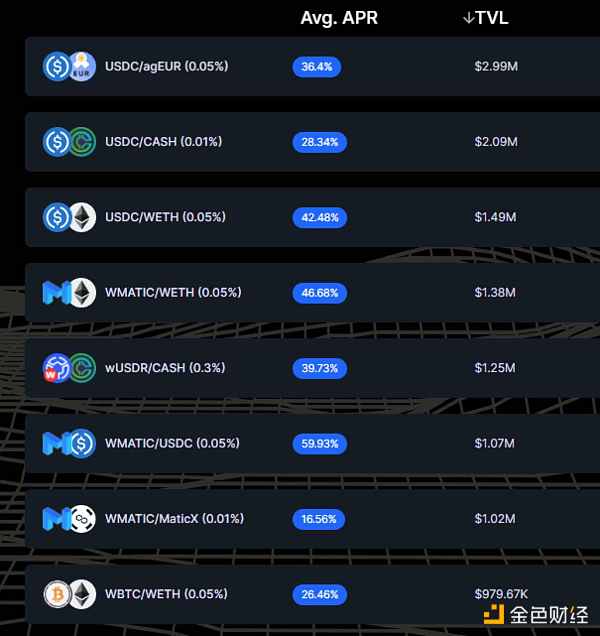

Retro is an AMM DEX on Polygon. In addition, Retro also brings higher returns to the protocol through Soligly forks. The average APR data of the protocol is also impressive, such as the USDC/agEUR pool.

Ethereum Chain

After talking about so many L2s, we cannot ignore the high-yield DeFi protocols on Ethereum.

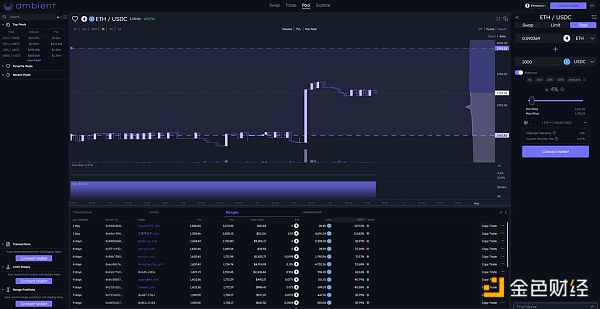

ambient

ambient (formerly known as CrocSwap) is a DEX that allows bilateral AMM combining concentrated and ambient constant product liquidity on any pair of assets. There is also news that the protocol will be deployed on Berachain. It seems that deploying liquidity on ambient in the future may be beneficial (perhaps with airdrops).

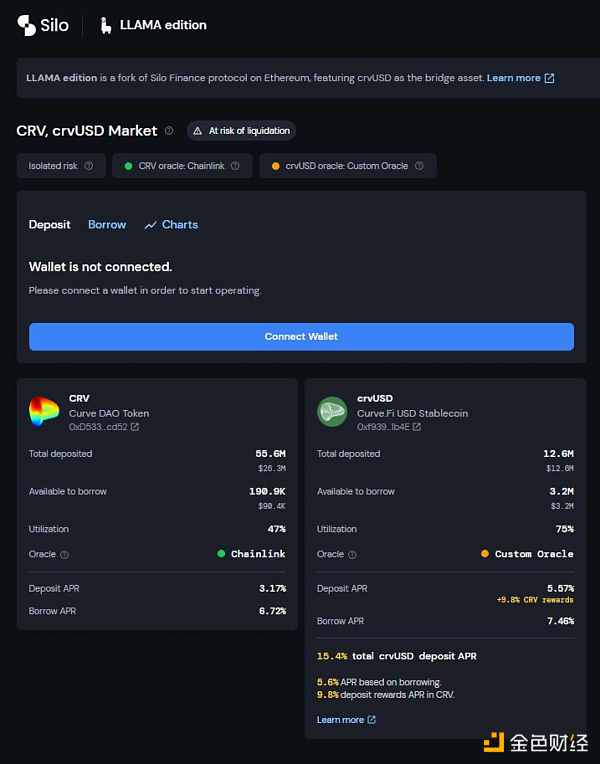

Silo Labs

Silo Finance is a decentralized lending protocol that recently launched Silo Llama on Ethereum. Silo Llama is a fork of the Silo protocol that allows users to borrow against crvUSD and earn CRV rewards.

Sommelier Finance

Sommelier Finance is a decentralized asset management protocol based on Cosmos SDK. Its FRAX and ETH vaults offer 12% APY.

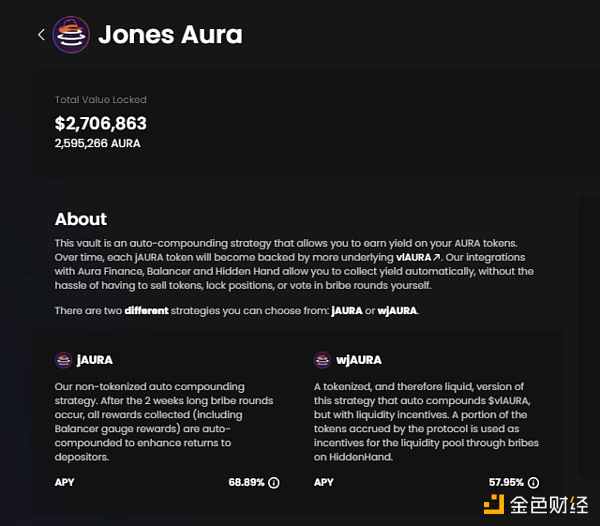

Jones DAO

Jones DAO is a protocol targeting high returns, strategies, and liquidity. It contains vaults that provide one-click access to institutional trading strategies, unlocking DeFi liquidity and capital efficiency through interest-bearing token yields. Its jAURA vaults have great returns, allowing AURA holders to maximize their AURA holdings’ earnings.

The above does not constitute financial advice, but rather some good projects that can increase users’ asset returns. Hopefully, this can help you. Do Your Own Research (DYOR)!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Two-tier reversal, friend.tech still agreed for you to be friends with the imitation platform.

- TRB, the oracle mining coin project, has experienced a skyrocketing price against the trend. Is it due to improved fundamentals or speculative capital?

- EigenLayer Official Inventory of 12 Early-stage Projects in the Ecosystem

- Product Expansion and Mechanism Update of Lybra V2

- An Analysis of the ‘Nintendo’ Treasure DAO in the Cryptocurrency World

- Reviewing the exciting developments and data highlights in the DEX sector over the past two weeks

- Inventory of Intent-driven Cryptocurrency Projects