LianGuai Observation | TVL exceeds 200 million in the first month. Why do both old and new projects love Base chain?

LianGuai Observation TVL exceeds 200 million in 1st month. Why do projects love Base chain?Author: Climber, LianGuai

L2 network Base, laid out by Coinbase, was first opened to developers on July 14th, and then officially opened to the public on August 10th. In just one month, many well-known project brands from inside and outside the industry have actively joined, and Base’s TVL has also soared, surpassing the $200 million mark.

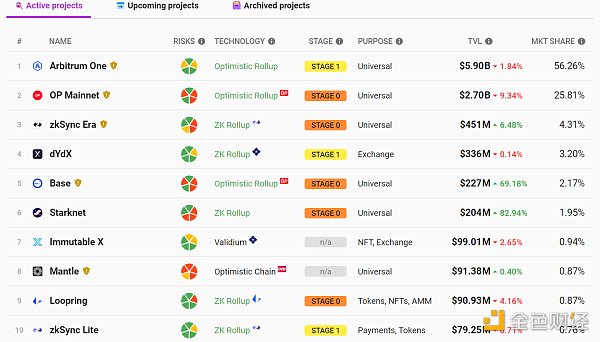

Since the launch of the Base mainnet, all data have shown impressive results. As of now, it ranks 15th on the DeFiLlama public chain TVL leaderboard. Base’s performance is indeed stunning.

However, Base has also faced challenges since its launch, with incidents such as attacks on BALD Rug, LeetSwap, and RocketSwap, as well as centralized questioning. Nevertheless, these events have not stopped new and old projects from favoring Base.

- Optimism Feast is Coming? A Comprehensive Overview of OP Stack Ecological Projects

- Why has RWA suddenly become popular this year? What are the players?

- The first Bitcoin Sovereign Rollup project Rollkit.

Apart from its strong background support, what other attractive features does Base have, considering it has made it clear that it will not issue tokens? Will this L2 network continue to move forward in the future?

1. Flourishing Base Chain and its Ecosystem

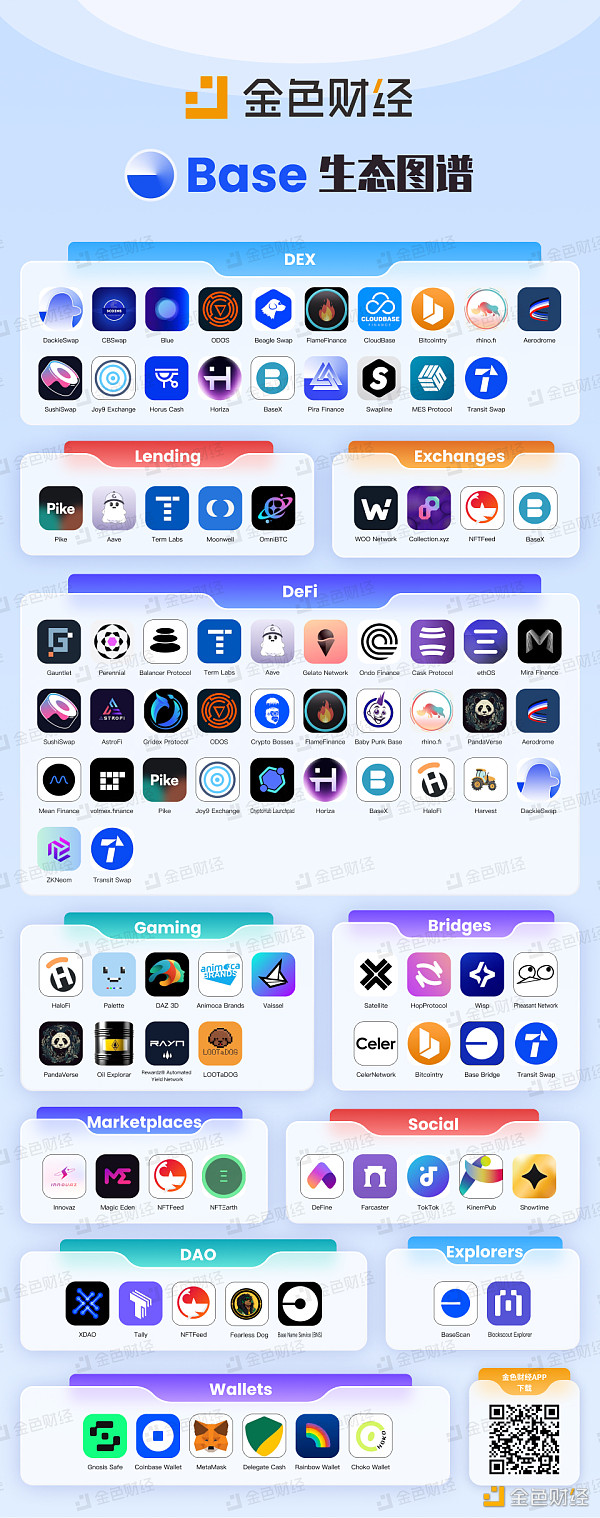

At the beginning of the Base mainnet launch, its ecosystem already gathered more than 100 Dapps and service providers. In just one month, the number of projects has increased to over 150, with various on-chain data continuously reaching new highs.

According to the latest data from L2BEAT, Base’s on-chain TVL has reached $230 million, with a 69.51% increase in the past 7 days, ranking fifth in Ethereum’s Layer 2 blockchain lockup amount.

According to data from Dune Analytics, on the day of August 10th, the Base mainnet had over 100,000 daily active users, reaching 136,000, and the total number of active users exceeded 1 million. In addition, the total on-chain transaction volume approached 7.5 million, with gas fees reaching 850.33 ETH.

As a popular L2 network, especially with the strong endorsement of Coinbase, it has attracted many well-known projects from both inside and outside the blockchain industry. Moreover, many projects have achieved good results with the popularity of the Base mainnet launch.

According to incomplete statistics from LianGuai, well-established blockchain projects that have been deployed or integrated into the Base mainnet include Compound, Uniswap, Aragon, 0x Swap, YGG, Balancer, Chainlink, Stargate, OpenSea, and many more. It can be seen that there are many categories of projects willing to join Base, most of which are blue-chip projects in the blockchain industry.

Among them, according to DefiLlama data, Uniswap achieved $43.12 million in trading volume on the Base chain on August 14th, which undoubtedly added new possibilities for its originally sluggish token price.

CyberConnect, a decentralized social graph protocol recently launched on Binance, has also been deployed on the Base mainnet in a timely manner. Other relatively new projects include NFT minting platform Manifold, digital asset platform Fireblocks, Web3 information distribution protocol RSS3, and more.

One event that particularly demonstrates Base’s recognition and acceptance is its collaboration with the well-known traditional industry brand Coca-Cola.

On August 14th, Coca-Cola announced the issuance of a series of NFTs on Base, combining world-famous paintings with Coca-Cola’s iconic bottle. As of the time of writing, nearly 60,000 NFTs have been minted, generating over $450,000 in revenue.

II. Frequent Accidents and Ongoing Controversies

With a large-scale project like Base, it has attracted a lot of attention since its early development. However, controversies and doubts have accompanied its mainnet launch, whether during the developer-oriented phase or the fully open phase.

At the end of July, the meme token BALD on Base experienced a thousand-fold increase in a single day. According to DEXScreener data, the project’s Fully Diluted Valuation (FDV) exceeded $40 million within less than 24 hours, with liquidity reaching $15.6 million.

However, just the next day, the deployer of BALD removed 10,000 ETH and 224 million BALD tokens from liquidity. In just a couple of minutes, the price of BALD plummeted from $0.09 to around $0.02, a drop of over 85%, and subsequently went to zero.

Since the Base mainnet has not been officially released to the public, the BALD tokens based on the Base network can currently only flow in but not out, although the project team can freely withdraw them.

Therefore, the BALD exit scam incident directly caused anger and disappointment among many crypto investors and supporters. Some even believe that despite Base’s recent launch, its prospects may not be too bright.

As a result, this incident also led to a drop in TVL (Total Value Locked) for another DEX project on Base, LeetSwap, to $4.2 million. Coincidentally, on the same day, the axlUSD/WETH pool on LeetSwap fell victim to a price manipulation attack, resulting in a loss of approximately $620,000. Subsequently, liquidity for one trading pair on LeetSwap was removed, causing the token LEET price to instantly go to zero.

Even after the Base mainnet was opened to the public, there were still incidents of projects being hacked or suspected of rug pulling.

On August 15th, RocketSwap suffered a hacker attack, resulting in a loss of 471 ETH. Due to the deployer’s private key being compromised, assets in the farm contract deployed on the Base chain were transferred to the attacker’s account. Currently, the funds are held in the attacker’s account and the Uniswap V2 LoveRCKT pool created by them.

The following day, another lending protocol, SwirlLend, was suspected of exit scamming, with its TVL dropping from $784,000 to $492 and its official Twitter account being deactivated. According to on-chain information, the price of its token SWI also dropped to nearly zero.

In response to the community’s long-standing concerns about accidents in projects on the Base chain and its own centralized operation model, Jesse Pollak, the protocol lead at Coinbase, also had to respond by stating that Base is permissionless, and Coinbase does not have unilateral control over the contracts nor the ability to freeze funds on the network.

III. Reasons for Favoring

Base Network has Coinbase as a strong backing and adopts OP Stack technology, these two advantages are well known to the community members. So why is Base, which clearly states that it does not issue currency, still so prominent?

1. Introduction of popular projects brings massive traffic

Although the previous BALD incident had a negative impact on Base, the wealth effect of a thousandfold increase still attracts many users. These people are trying to continue to explore other meme coins on the Base chain and find the next “golden dog”.

The leetswap platform mentioned earlier saw its native token LEET increase by more than 10 times under the influence of BALD.

And on August 11, Friend.tech, a web3 social project on the Base chain, became popular with a daily trading volume of over 2000 ETH.

Friend.tech is an invite-only Base native web3 social dApp that allows users to buy and sell “shares” of related Twitter (now renamed X) accounts, giving them the right to communicate directly with the account holder and the possibility of making a profit.

As an L2 network that has just been launched on the mainnet, the Base ecosystem already has two breakout projects, so it is natural to expect more popular projects in the future.

2. Rich ecosystem

As mentioned earlier, there are more than 100 Dapps and service providers in the Base ecosystem at the beginning of the mainnet launch. With the passage of time, this number has expanded to more than 150. In addition to the development teams continuously building projects on the chain, many well-known blockchain projects have also chosen to deploy the protocol.

For the Base ecosystem, LianGuai has carefully selected several noteworthy projects in various fields and will continue to update and release them.

3. Diverse marketing methods

On August 10, at the same time that the Base mainnet was open to the public, its Onchain Summer event also started simultaneously. As an online event organized by Base, it supports up to 50 projects and sets a reward fund of 100 ETH for contributors.

The Onchain Summer event lasts for a long time, starting from August 10th until the end of the month, providing users with sufficient time to participate. In addition, the event covers a wide range of activities, including online summer art creation activities, building tools and infrastructure, building applications: ERC 4337 and account abstraction directions, video competitions, etc.

In addition to the Onchain Summer event, Base has also launched the second round of Prop House funding to help developers build new protocols, tools, and infrastructure on Base.

Conclusion

Currently, Base’s overall performance in terms of on-chain data and market attention is unprecedentedly high. This has led some people who were previously skeptical of Base to change their attitudes, while more people believe that in the already erupted L2 scaling battle, Base is gradually showing the potential and momentum to dominate.

However, as a public chain with a relatively short time since its mainnet launch, it still needs time to prove itself. CZ has also stated before that he does not consider Base Chain as a threat. Therefore, if Base wants to have the last laugh in the L2 race, it still depends on how many killer applications can be born in its project ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The New Narrative of Cryptocurrency Investment in a Bear Market Unibot Project Analysis

- Cosmos ecosystem’s living water Entangle and Tenet, the dual heroes of the whole chain LSD.

- Reddit Avatar One-Year Anniversary Layout and Insights Behind the NFT Project with the Largest User Scale

- Worldcoin in the Polkadot ecosystem? Another money-spreading project Encointer analysis

- Quick Overview of Recent Popular DeFi Narratives and Innovative Projects

- Inventory of the 8 old projects of the transformation LSD

- Crossing the Bull and Bear The LSD Battle of the Project Party