Hover Research Next Generation Lending Protocols | Part One

Next Generation Lending Protocols | Part One' by Hover Research.

This is our research on the use of sustainable token economic models for lending protocols, divided into two parts. This is the first part.

The Hover team has spent a lot of time studying existing lending protocol structures. Our research reveals multiple challenges that these protocols face during their expansion and growth.

This series will discuss what these challenges are, why they are important, and how Hover addresses them in our new token economic design.

- A Quick Look at the Top Ten Winning Projects of ETHGlobal Superhack 2023

- What is happening in the intent-centric track? Which projects are worth paying attention to?

- Ethereum Ecosystem Privacy Use Cases and Project Overview

Historically, lending protocols typically use their tokens for two main functions: governance and issuance. With clear token utility, one might expect the performance and usefulness of the protocol to translate into token value. However, this is not necessarily the case, especially when considering the value these platforms bring to their ecosystems.

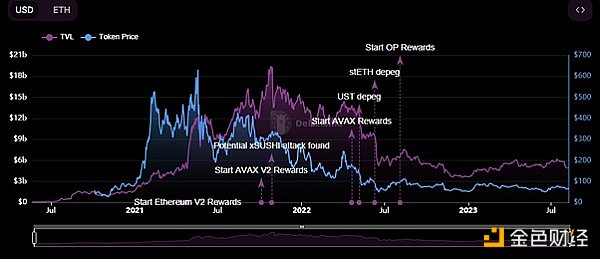

Instead, token activity becomes correlated with Total Value Locked (TVL) and unrelated to other factors. For example, AAVE experienced a 90% drawdown after reaching its peak in mid-2021. While this trend is highly correlated with overall market performance, token valuation also dropped shortly after the TVL declined.

AAVE Total Value Locked (TVL) vs Token Price (DefiLlama)

The performance of the Venus protocol was even worse, with a 97% drawdown from its peak. While such pricing factors are highly complex, and drastic price drops are considered normal in the DeFi space, it does not mean that such token declines are good or necessary.

Using the Venus protocol as an example, just to reach 50% of its all-time high, its market capitalization would need to be $2.3 billion at the time of writing. Considering that the all-time high of DeFi TVL was $174 billion and Venus’ circulating supply continues to increase, the likelihood of $XVS reaching that target again is very slim.

When considering the ratio of Venus’ price to TVL, we can see a trend that is almost identical to AAVE: the token value is determined by the TVL.

$XVS TVL vs Token Price (DefiLlama)

This analysis is not specific to AAVE or Venus, but it highlights a systemic challenge in the DeFi lending space: lending protocols rely on TVL to maintain token prices. This leads to the entire DeFi space focusing on driving the growth of TVL.

What is the simplest tool to increase TVL? Issuing tokens.

What is the easiest way to push down the price of a token?… Selling the issued tokens.

Shortcomings of Issuance

The fundamental reason for the performance of lending protocol tokens and platforms is their use of issuance to attract Total Value Locked (TVL) and increase token prices. As market participants utilize the obtained issued tokens and sell them, the token price will fall.

The protocol manager or core contributors first consider what steps to take to address this transition. They increase the circulation supply to increase the Total Value Locked (TVL). Due to the increase in circulation supply, it becomes exponentially difficult to approach the previous token price when a new round of issuance begins.

We speculate that the decrease in token value will decrease the Total Value Locked (TVL) as market participants look for alternative protocols with better token pricing or market rates. This overall pattern is a vicious cycle, where the market is flooded with devalued tokens to drive platform liquidity. However, in such a process, rational market participants will sell the incentives they receive, causing the value to drop again.

Lending protocols take a short-term approach to drive platform growth, driven by weak token utility and unsustainable liquidity solutions.

Shortcomings in governance

In addition to issuance, another value-driving factor often cited for lending protocols is governance. While this is beneficial for narrative purposes, the reality is that price-oriented short-term traders often do not vote frequently or utilize governance mechanisms. Let’s take MakerDAO, one of the largest DAOs in DeFi, as an example.

The maximum supply of MakerDAO (MKR) is 1,005,577 MKR, with 977,631 MKR in circulation. According to Etherscan data, there are over 93,000 holders of MKR on Ethereum. MakerDAO governance proposals average 100,000 MKR votes, meaning approximately 10% of the total supply is used for governance.

Even considering the circulation supply, this utilization rate is relatively low. One might argue that the community has reached the required quorum, but broadly speaking, the community is not actively involved in governance.

The number of participants is far less than 100, and each proposal has different voting weights. Assuming that 50% of MKR holders on Etherscan are smart contracts or custodial, unable to vote, it still means that 0.2% of holders participate in governance activities that account for 10% of the total supply.

This suggests that, at least for MakerDAO, governance is not a community-driven value proposition but a secondary use case for a large number of holders.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Observation | TVL exceeds 200 million in the first month. Why do both old and new projects love Base chain?

- Optimism Feast is Coming? A Comprehensive Overview of OP Stack Ecological Projects

- Why has RWA suddenly become popular this year? What are the players?

- The first Bitcoin Sovereign Rollup project Rollkit.

- The New Narrative of Cryptocurrency Investment in a Bear Market Unibot Project Analysis

- Cosmos ecosystem’s living water Entangle and Tenet, the dual heroes of the whole chain LSD.

- Reddit Avatar One-Year Anniversary Layout and Insights Behind the NFT Project with the Largest User Scale