TRB, the oracle mining coin project, has experienced a skyrocketing price against the trend. Is it due to improved fundamentals or speculative capital?

Has TRB's price surge been driven by improved fundamentals or speculative capital?Author: Duoduo, LD Capital

Recently, the cryptocurrency market has been weak, with continuous outflows of funds. Bitcoin and Ethereum have low volatility and are in a downward oscillation phase, with low trading volume. Existing funds are mainly concentrated on individual projects for short-term speculation. So, how can we find trading opportunities in terms of funds?

The author has observed and tracked the short-term fund situation of TRB (Tellor Tributes, providing oracle services), trying to find some signals before the start of an uptrend; and then understanding the fundamentals, mainly looking for positive or negative factors. From August 25th to the early morning of August 28th, the TRB token price rose from $9.6 to a high of $16, an increase of nearly 66%, and then entered a correction.

1. Fund Situation

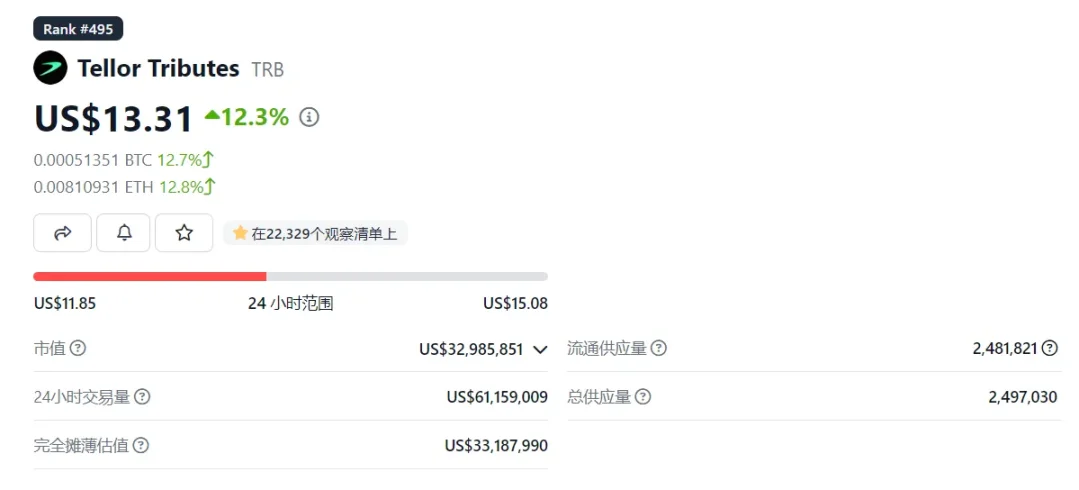

First, let’s look at the basic information of the token. The total supply of the token is about 2.49 million, and the circulation is about 2.48 million, which is basically in a fully circulating state.

- EigenLayer Official Inventory of 12 Early-stage Projects in the Ecosystem

- Product Expansion and Mechanism Update of Lybra V2

- An Analysis of the ‘Nintendo’ Treasure DAO in the Cryptocurrency World

The top 10 holdings on August 26th are as follows, with Binance holding over 43% of the tokens, indicating a high concentration of tokens.

After the sharp drop on August 18th, the price of TRB entered the bottom price range for this year and also the bottom range since 2021. After a few days of oscillation, the daily chart found support near $9.5.

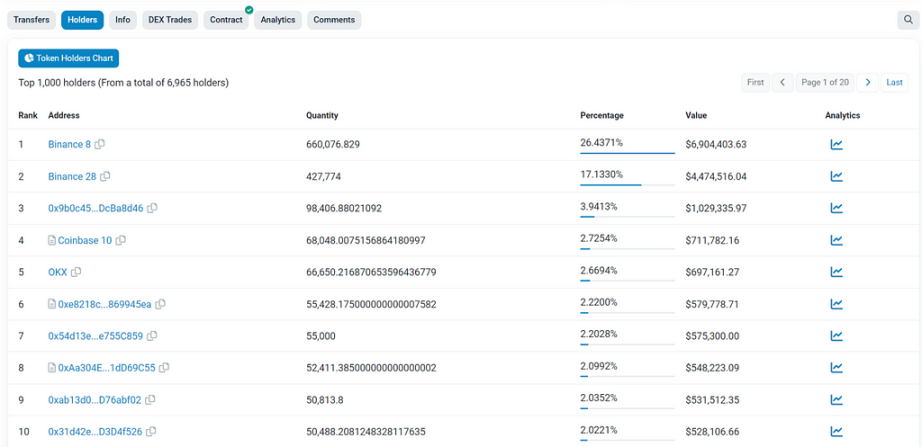

On August 21st, a large amount of transfer was observed on the chain, reaching the highest level since January this year, far exceeding previous data. At the same time, the price did not change significantly, staying around $10. We believe that someone may be building positions on the chain at this time, so we further pay attention to the changes in contract trading volume and positions. However, abnormal on-chain transfers do not necessarily indicate building positions and need to be considered in combination with the token’s price range, whether there are abnormal events, subsequent trading volume, and price movements.

On the morning of August 26th, steady increases in contract trading volume and positions were observed. At the same time, the price broke through the upper range of the 4-hour bottom price range.

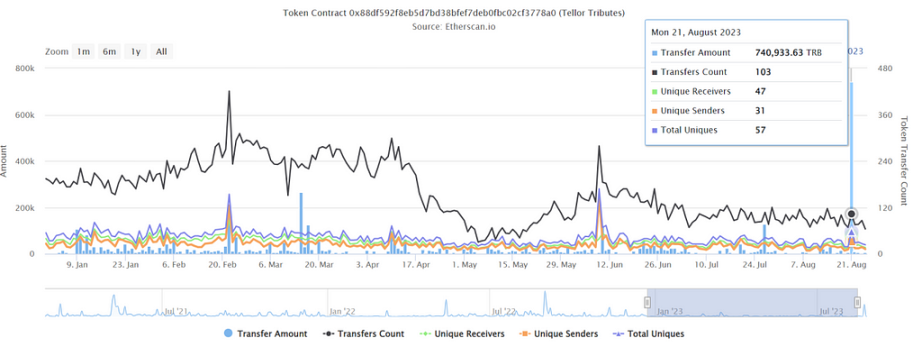

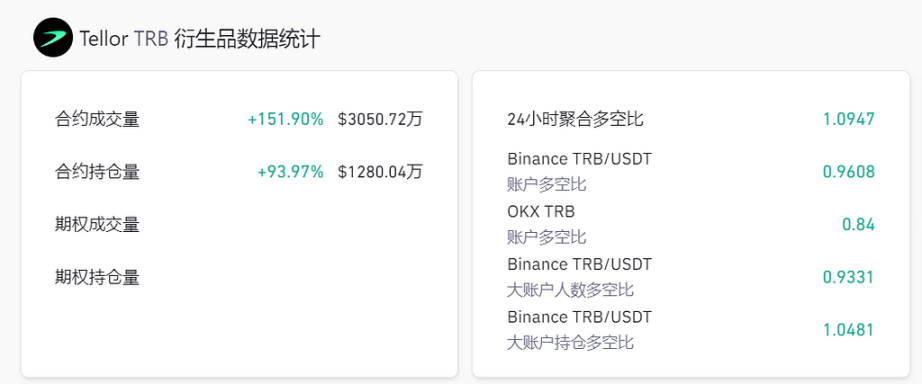

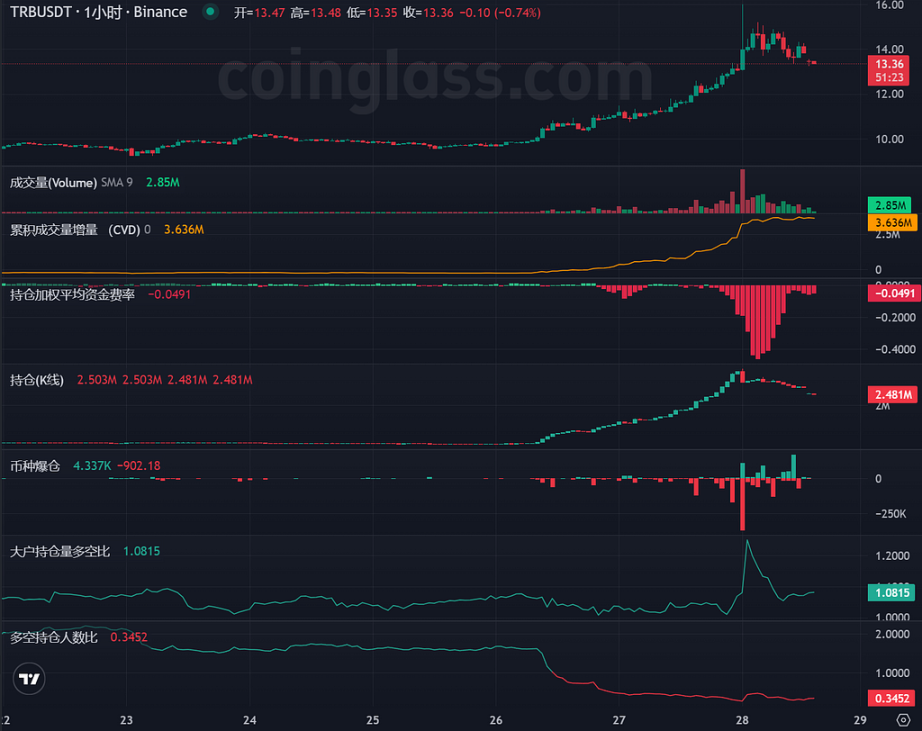

The following chart shows the derivatives data on the morning of August 26th, with a 151% increase in 24-hour contract trading volume and a 93% increase in contract positions. Large account positions are in a long state, while the long/short ratio is 0.96, indicating a large number of retail investors shorting. Therefore, we believe that there is a high probability of short-term funds entering TRB and the token rising.

In the following two days, the contract transaction volume and position volume of TRB have both experienced significant growth. In the past 24 hours, its contract trading volume reached $1.6 billion, and the position volume was approximately $68 million.

The figure below shows the changes in the major indicators of TRB contracts as of August 28th. It can be seen that the position volume continued to grow until the early morning of August 28th. At the resistance level of $16, there was a large short position liquidation accompanied by a decrease in position volume. Subsequently, the position volume changed from a growth trend to a downward trend, and the price also oscillated downward. The change in funding rate reached the maximum negative premium after the resistance level of $16 was pierced.

Currently, large holders are still in a long position. The long-short position ratio is 0.3452, indicating that a large number of retail investors are participating in short positions. The funding rate is still at a negative premium but has returned to a relatively normal level.

II. Fundamental Situation

Understand the fundamental information of the project, confirm the current status of the project, and whether there are obvious positive or negative factors.

Tellor Tributes is a project launched in 2019 and belongs to the decentralized oracle protocol. It incentivizes open, permissionless data reporting and data verification networks, ensuring that data can be provided by anyone and checked by everyone.

Tellor uses a mining mechanism to achieve an Oracle system and realize a decentralized off-chain data query mechanism. The entire system consists of a network of data providers (miners) who competitively add data points to the on-chain database through the “Tributes” (TRB) token incentive system.

TRB adopts a token issuance model that combines POS and POW, with no fixed token supply. Nodes stake TRB tokens, complete POW puzzle challenges, and the first five nodes to unlock can submit data and receive TRB token rewards. Starting from Ethereum block height 9619370, the block reward decreases by 0.003% per block until it reaches 1 TRB, and then remains unchanged. At this time, 5.5 tokens are emitted per block, and the inflation rate is 17%. The reward has entered the 1 TRB stage in 2021.

Based on the current circulating supply, the annual inflation rate is 17%, resulting in an annual increase of 420,000 tokens and a monthly increase of 35,000 tokens.

The community is still maintaining active development and community interaction. The main files on Github were updated 3 days ago, indicating a relatively high update frequency. There are 32.5K followers on Twitter with 1488 posts, and tweets are generally posted on weekdays, indicating a high level of activity. There are 1.28k subscribers on Youtube with 229 videos, and weekly development meetings are published, with the latest release being the content of the previous week’s meeting. There are 4.7K followers on Discord, with dozens of recent daily messages in the discussion area, and a few messages when it is less active. The latest update on the blog was on August 9, 2023.

The business development is average. According to the official website disclosure, the currently deployed public chains or Layer 2s are shown in the following figure, including recently popular L2s such as op/arb/base.

The project has not disclosed the following specific information: the number and distribution of nodes participating in the network and providing data reporting services; the actual DApps using this oracle; the total amount of data provided by the oracle; the situation of service fee income, etc.

Overall, Tellor Tributes is in the stage of maintaining operations, and there are no major breakthroughs and progress in technology and business, and the project’s competitive advantage is insufficient.

III. Conclusion

The short-term price increase of Tellor Tributes (TRB) is mainly driven by funds. After reaching a high point in the early morning of August 28th, the holding volume decreased and the price also experienced a significant decline.

When looking for trading opportunities in the current market, you can pay attention to the following points:

1. Whether the token price range (for tokens listed on Binance futures) is in the bottom area of a period of time.

2. The concentration of token chip distribution and who holds the majority.

3. Whether there has been abnormal on-chain activity recently.

4. Whether the token contract trading volume and holding volume have shown significant growth and maintained for a period of time.

5. The specific situation of the long/short ratio of large account holdings and the long/short ratio of the number of holders.

6. If the holding volume continues to increase and is followed by a price spike and a subsequent decline, it may form a short-term price top.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reviewing the exciting developments and data highlights in the DEX sector over the past two weeks

- Inventory of Intent-driven Cryptocurrency Projects

- Reviewing the ‘Intent-driven’ Projects Brink, basedmarkets, Versa…

- The wave of Layer1 and Layer2 has arrived An inventory of the token bridging steps and potential opportunities for various new chains.

- LianGuai Observation | Counting the Latest Potential Projects in the Modular L2 Mantle Ecosystem

- Top 10 Projects in the Starknet Ecosystem, L2 Market May Experience a Big Explosion in the Second Half of the Year.

- Weekly Update | Web3 Security Incidents Result in Approximately $1,996.3 Million in Losses