Inventory of Intent-driven Cryptocurrency Projects

Intent-driven Cryptocurrency Projects InventoryAuthor: Dr.DODO, Translation: LianGuaixiaozou

Want to get involved in the “Intent” narrative capture opportunity early? This article almost exhaustively lists all “Intent-driven” projects except for CoW Swap, 1inch, and Anoma. Please read carefully and discover early opportunities that are suitable for you.

1. Brink

Brink is an intent-driven trading platform tailored for ERC-20 and NFTs. It includes web front-end, smart contracts, APIs, and execution networks that use Brink’s APIs and smart contracts. Users can seamlessly integrate trading into their DeFi or NFT applications. Gain in-depth understanding of innovative strategies through a blend of order types and even introduce new strategies by leveraging the platform’s primitives.

- Reviewing the ‘Intent-driven’ Projects Brink, basedmarkets, Versa…

- The wave of Layer1 and Layer2 has arrived An inventory of the token bridging steps and potential opportunities for various new chains.

- LianGuai Observation | Counting the Latest Potential Projects in the Modular L2 Mantle Ecosystem

Brink’s execution network ensures the best on-chain execution of signed transactions by matching orders with liquidity from various DeFi and NFT markets, aiming to achieve maximum returns. While many intent-based platforms mainly focus on limit orders, Brink positions itself as a design solution for generating multi-purpose intents, not limited to limit orders.

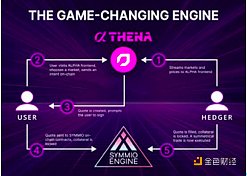

2. SYMMIO

SYMMIO provides a tool that seamlessly integrates bilateral over-the-counter derivatives and intent execution. This provides convenience for permissionless leveraged trading of any asset, accompanied by highly efficient and timely liquidity.

In this system, A proposes a transaction and B responds. Once successfully matched, both parties deposit collateral for the transaction. Afterwards, they must maintain sufficient collateral and margin at all times. Third-party liquidators and regulatory bodies ensure that everyone has the ability to pay. The system operates on a trustless and permissionless basis. In the liquidation process, each party is treated fairly and independently, ensuring that losses are limited to specific trading pairs. Additionally, it can run without an oracle, highlighting its capital efficiency.

3. Based-markets

Based-markets is a perpetual trading DEX developed based on SYMMIO. It eliminates concerns about infinite slippage, LP risk, and low capital efficiency by removing LPs, limit orders, and oracles. Self-proclaimed as Cowswap for trading perpetuals, Based-markets offers leverage of up to 40x and takes pride in having the lowest fees. Currently, it supports over 180 trading assets on the base chain. Users can trade and earn BASED tokens, which have been issued through a fair launch.

4. THENA

THENA is developing its own perpetual trading DEX, ALPHA, based on SYMMIO. Numerous innovative features integrated into the backend of these intent-based actions are truly exciting to see.

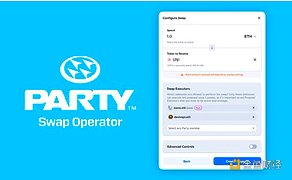

5. LianGuairtyDAO

LianGuairtyDAO provides an open-source protocol for on-chain group coordination, allowing groups of any size to participate in DeFi, collect NFTs, play games, and manage projects, among other things. Through a unique mechanism called “operators,” LianGuairtyDAO authorizes groups to operate at market speed. These operators use intent-based proposals for token exchange and NFT purchases, which set on-chain operational constraints while retaining flexibility in execution details.

Once a proposal is approved, authorized executors can implement it with specific parameters, optimizing the balance between consensus and speed for on-chain groups.

6. EnsoFinance

EnsoFinance provides a financial framework for developers to integrate or enhance DeFi interactions within their apps. They have launched the first intent-based DeFi API, optimizing routing execution, DeFi operation integration, and native cross-chain bundling.

Enso’s Intent API offers developers a powerful DeFi integration toolkit, featuring native transaction bundling, various DeFi operations, optimal routing execution, and fully standardized metadata. As a non-custodial aggregation platform, Enso connects users, DEXs, and DeFi protocols, supporting EOA and smart wallet interactions. In collaboration with launch partners (CoW Swap, Soket, Safe), Enso’s API generated over $50 million in trading volume within weeks.

7. Versa

Versa is a groundbreaking intent wallet built on Scroll, combining account abstraction with intent to enhance security, customization, and efficiency.

Versa utilizes ERC-4337 and introduces Validators, Hooks, and Modules to improve the wallet experience. Validators perform general validations, Hooks allow custom logic before and after transactions, and Modules support off-chain data integration and advanced functionalities. This design ensures not only robust security but also user-friendliness, serving both everyday users and complex applications. Through its core architecture, Versa provides a universal and secure approach to account abstraction and intent-driven interactions.

Currently, Versa is running on the testnet, but alpha testing is available with the invitation code ONSCROLL.

8. Sail

Sail is an intent-based order book DEX running on the Fuel network, with no further specific information available.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Top 10 Projects in the Starknet Ecosystem, L2 Market May Experience a Big Explosion in the Second Half of the Year.

- Weekly Update | Web3 Security Incidents Result in Approximately $1,996.3 Million in Losses

- Hover Research Next Generation Lending Protocols | Part One

- A Quick Look at the Top Ten Winning Projects of ETHGlobal Superhack 2023

- What is happening in the intent-centric track? Which projects are worth paying attention to?

- Ethereum Ecosystem Privacy Use Cases and Project Overview

- LianGuai Observation | TVL exceeds 200 million in the first month. Why do both old and new projects love Base chain?