Babbitt column | Digital currency relative valuation method

It is too difficult to estimate the value of a coin, but it is relatively easy to estimate the relative valuation of two currencies in the same sector.

BTC and BCH are very close in terms of technology and economic ecology. They are completely two coins in the same sector. Consider comparing some data comparisons to assess whether BCH is underestimated or overestimated relative to BTC.

The value of use can reflect the value of a coin to a certain extent. Let's compare the usage of BTC and BCH first.

The number of transactions sent in the past 24 hours, BTC is 316,940, BCH is 41,346. BCH_24htx/BTC_24htx= 41346/316940=0.1305 = 13%. (data of October 20, 2019)

- Li Lihui, former president of Bank of China: Digital currency, another restructuring of the monetary system

- The US group is ten years old, or is it no longer outside the blockchain?

- Bitcoin offline payments are now available via Lightning Network

The active address can reflect the amount of active users behind the coin to a certain extent, and can also reflect the value of the currency.

The number of active addresses of the BTC in the past 24 hours was 622,343, and the BCH was 27,138. The ratio of the two was 27138/622343=0.0436 =4.36%.

The above two levels of data can be read in the block, this website helps you sort out: https://bitinfocharts.com/

Trading is the most important function of the currency, and the volume of trading can measure the usefulness of the currency. Let's compare the 24-hour trading volume of BTC and BCH. We use the number of coinsmarketcap.com websites. The 24-hour trading volume of BTC is 13436610636 USD, and the BCH is 1194359680 USD. The ratio of the two is 1194359680/13436610636=0.0889=8.89%.

And the price, BCH/BTC=0.027=2.7%.

From the above indicators, the "use value" of BCH and BTC is 8% on average, and the price ratio is 2.68%. If the value of use reflects the price, then BCH is undervalued relative to BTC.

We can also look at several other cases.

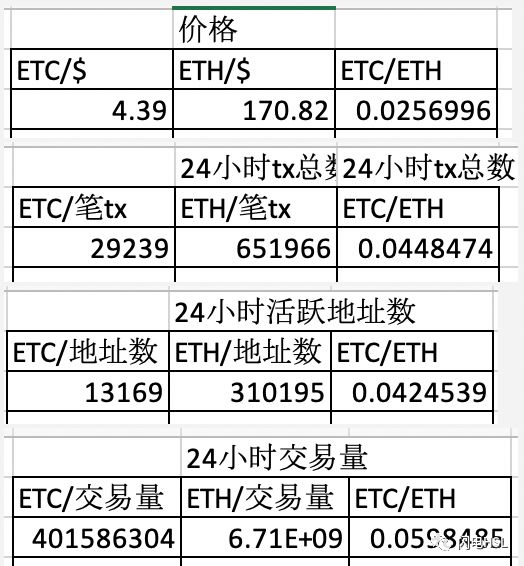

ETC is split by ETH, technically and economically close, and may be suitable for this relative valuation method. We can collect relevant data to observe.

Use a table to render.

It can be observed from the data that the ratio of the use value of ETC and ETH is about 4.5%, and the ratio of the two is 2.5%.

The BSV is split by the BCH, and the BCH is split from the BTC. The technical and economic ecology between the three is close. We collected and observed the data of BSV and found that the data on the chain of BSV is very good. The number of transactions and active addresses on the BSV chain is very high, almost 50% of the number of BTCs. However, the trading volume of BSV on the exchange is very low, only 2% of BTC. The price of BSV is only 1.1% of BTC. According to this model, it must have a serious deviation.

A possible explanation is that BSV was born in a relatively short time, BSV has stress tests, and several very loyal and active users are developing on the BSV network, they have created the main chain data of BSV. Such data cannot deduce the network effect, nor can it reflect the same level of users, and it will not reflect the market price. So maybe this model is not suitable for BSV.

In addition to the contrast between the split coins, is there any currency suitable for this relative valuation assessment? We mainly observe whether it is in the same sector from the three aspects of technology, function, and economic ecology.

For example, Anonymous, Monroe, Dashi, Zero Coin, Grin, and Beam may have comparative value.

The time overlaps roughly, and the dominant group is roughly the same currency. For example, the domestic ICO may have comparative value.

Products in a concept, such as the Atom and dot of the cross-chain concept, may also have comparative value.

Is the above reasoning reliable? Record it for a long time, record it once a week, and watch it for half a year.

If this method works, then a user who holds both coins can establish a currency exchange strategy. This way you can change your own currency more and more.

For new users, it is also a potential strategy to evaluate which currency to buy.

Author: Huang Shiliang

Welcome to the WeChat public account: Lightning HSL, H13116885

Welcome to BTM: bm1qefc720au672awrgazgw5c3kx7etr5kejju02p7

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra or a stable currency that anchors a single currency, not a basket of currencies

- Li Lin: 5G, Internet of Things, AI and blockchain will become the new accelerators of the digital economy

- The medium-term view remains unchanged and the adjustment is not over.

- JPMorgan CEO: Facebook's Libra is "an idea that will never be realized"

- Will the blockchain infrastructure created by the “National Team” make the blockchain at your fingertips?

- How to solve the trust problem of financial transactions? Academician of the Chinese Academy of Engineering, He Hezhen: Using technologies such as blockchain

- BTC once again held $7,800 support, short-term bearish trend eased