Synthetic assets in DeFi: uses and opportunities

Although speculation is still the main use of blockchain assets, I don't think it is a bad thing. Speculation is a key driver of the development of traditional financial markets and still plays an important role in the development of the financial industry. More importantly, speculators can bring liquidity to the market and make it easier for participants to enter and exit the market. In addition, speculation can reduce transaction costs and increase market participants' access.

Currently, the blockchain asset market is still immature and lacks liquidity. Unlike assets in traditional financial systems, most blockchain assets have only been in existence for a few years, and there is no liquidity benchmark built over decades. For example, in the 24-hour US dollar trading volume, Bitcoin trades about 700 million, and Apple stock trade volume is about 5.3 billion. Insufficient liquidity in blockchain assets limits the usefulness of its underlying agreements, and this problem is also exposed in decentralized exchanges and forecasting markets.

The blockchain asset market will develop in a similar way to traditional financial markets. For investment institutions and retail investors, more sophisticated financial instruments are needed, especially synthetic assets (“synthetic financial instruments”).

The main contents of this paper are as follows:

- Report: Ruibo sold 70% XRP less in the third quarter, and the token allocation rate was lower than the ETH inflation rate.

- Filecoin's Ultimate Guide: Digging the Filecoin White Paper

- BTC continues to fluctuate around USD 8000, short-term bearish pressure increases

-

Overview of Synthetic assets, illustrating their definitions and how they are used in traditional financial markets. -

Explain why synthetic assets are critical to the maturity of the blockchain asset market and introduce several projects that currently use synthetic assets. -

List examples of building new, “blockchain native” financial derivatives.

The first part mainly introduces the definition and examples of synthetic assets. If you are familiar with this part of the content (or feel that financial engineering is too boring), you can skip this part and read the second part directly.

What is a synthetic asset?

Synthetic assets can be used to simulate other financial instruments . In other words, the risk or benefit of any financial instrument can be modeled using a combination of other financial instruments.

A synthetic asset consists of one or more financial derivatives whose asset value is based on the value of the underlying asset (financial derivative) , including:

-

Forward commitments: futures, forward contracts and swaps. -

Or claim: options, credit derivatives (for example: credit default swaps, credit default swaps – CDS) and asset-backed bonds.

What can a synthetic asset do?

There are many reasons why investors choose to buy synthetic financial assets. E.g:

-

Financing -

Liquidity creation -

admission to market

Below I will explain the examples in traditional finance. Please note that these reasons can be coexisting.

Financing

Synthetic assets can reduce financing costs.

Total Return Swap (TRS) is a financing tool used to secure existing finances. The party holding the assets can obtain the funds from the existing pool of assets, that is, the funds pool is used as a guarantee to obtain the money, and the swap counterparty obtains the interest according to the funds provided. In this case, TRS is similar to a secured loan because:

-

The party that sells the securities and agrees to the repurchase is the party that needs financing, and -

The party that purchases the securities and agrees to sell is the party that provides the financing.

Liquidity creation

Synthetic assets can be used to inject liquidity into the market, thereby reducing investor costs .

A typical example is the Credit Default Swap (CPS) . CDS is a derivative contract between a credit-protected buyer and a credit-protected seller . The buyer pays the seller a series of cash and receives a promise that the seller will compensate for the credit loss caused by the “credit event”. For example: payment failure, bankruptcy or restructuring. This gives CDS sellers the ability to synthesize a single base asset, and CDS buyers have the ability to hedge their credit risk on a base asset.

In this article, the author discusses that the CDS market is more liquid than its underlying bond market . One of the main reasons is standardization : bonds issued by a particular company are usually divided into many different types, with different types of coupons, maturity dates, and terms. This division reduces the liquidity of these bonds. The CDS market provides a standardized place for the company's credit risk.

admission to market

Synthetic assets can reproduce the cash flow of any kind of securities through combination instruments and derivatives, thus opening up a relatively free market.

We can use CDS to replicate the exposure of a bond. When it is difficult to obtain bonds on the open market (for example, there may be no tradable bonds), CDS comes in handy.

Take the Tesla 5-year bond as an example. Its yield is 600 basis points higher than that of US Treasury bonds. Then we can:

-

Buy a $100,000 5-year US Treasury bond and use it as a collateral. -

Conclude (sell) a five-year, $100,000 CDS contract. -

After the contract expires, it receives interest on US Treasury bonds and an annual premium of 600 basis points for CDS.

If there is no default, the US Treasury coupon plus the CDS premium will give you the same rate of return as the 5-year Tesla bond. If the Tesla bond defaults, the price of the portfolio is US Treasury debt minus CDS expenditure, which is equal to the default loss of Tesla bonds. Therefore, no matter what happens (default or not), the return on the portfolio (US Treasury Bond + CDS) can be equal to Tesla Bond.

How is it a good synthetic asset?

In some cases, synthetic financial product development is possible only after the underlying assets have reached critical liquidity . If the underlying assets are too liquid, then developing synthetic assets does not make much sense, and may reduce economic returns.

The total revenue swap is a good example. Although the credit derivatives market has emerged since the early 1990s, total revenue swaps have been widely circulated in recent years. In fact, investors or speculators seeking to invest in a particular corporate bond or bond index are more likely to buy or short reference bonds or indices. As market makers begin to manage their credit portfolios more aggressively and adopt a two-way quotation strategy for some credit derivatives, (transactions) activities are gradually evolving, and opportunities for investors to participate in synthetic credit portfolios through total revenue swaps will also increase. . As a strong two-way market begins to take shape, the bid-ask spreads for synthetic financial products are squeezed, attracting more end users who are willing to buy or transfer credit products in combination. Since the underlying credit derivatives market is sufficiently liquid, active and well supported, the market is now able to support a wide range of credit references.

What is the magic of combining synthetic assets with DeFi?

Synthetic assets are meaningful for many types of participants in the Decentralized Finance (DFi) ecosystem for the following reasons:

Extended assets

One of the biggest challenges facing DeFi today is how to chain real-world assets in a way that is trustworthy. Legal tender is a good example. Although it is possible to create a counter currency stable coin in the chain like Tether, there is another way: by directly obtaining the price of the synthetic asset against the US dollar, without having to hand over the actual asset to a centralized counterparty. In the case, the same effect is achieved. For most users, the price is enough. Synthetic assets provide a viable mechanism for trading real-world assets on the chain.

Improve liquidity

The main problem at the moment in the DeFi field is the lack of liquidity. Market makers can greatly influence the liquidity of long tail and released blockchain assets, but financial instruments for risk management are limited. More generally, synthetic assets and their derivatives can expand their business size by hedging portfolios and protecting profits.

Extended technology

Another issue facing DeFi is the technical limitations of current smart contract platforms. Cross-chain communication issues have not yet been resolved, which has prevented many assets from entering decentralized exchanges. However, with synthetic assets, transaction participants do not need to own assets directly.

Expand users

While traditional synthetic assets are only open to large and experienced investors, smaller investors can also profit from synthetic assets on smart contract platforms like Ethereum. Synthetic assets allow more traditional investment managers to enter the DeFi space by adding a risk management toolset.

Synthetic assets in DeFi

In fact, synthetic financial assets have been widely used in the DeFi field. Let me give you a few examples of projects that use synthetic financial assets and a sketch of their asset creation process.

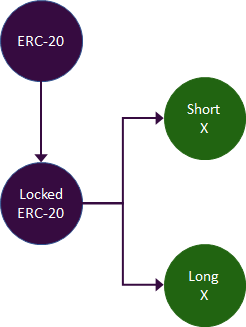

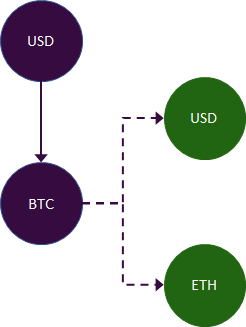

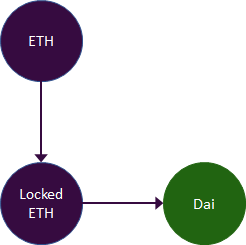

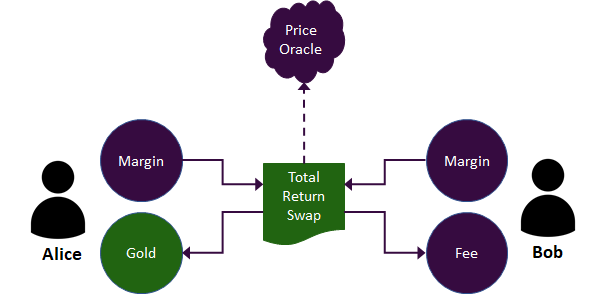

legend:

-

Purple: actual assets -

Green: synthetic assets

Abra

Founded in 2014, Abra is the OG (founder) of cryptographic composite assets. When an Abra user deposits money into the wallet, the deposited funds immediately convert the bitcoin and display it in US dollars in the Abra app. For example, if Alice deposits $100 into her Abra wallet, and if the price of Bitcoin is $10,000 at this time, she will receive 0.01 bitcoins and display her value of $100. Abra can hedge against BTC/USD to ensure that Alice can redeem $100 regardless of fluctuations in BTC or USD prices. In fact, Abra is building a stable currency that is endorsed with cryptographic assets.

In addition, because Abra immediately hedges its risk, it can redeem all transactions at any time. When users save money to their wallets, they are actually shorting bitcoin and doing more hedged assets, while Abra is doing more on bitcoin and shorting on hedged assets.

MakerDAO

Maker's Dai Stabilizer is probably the most influential and most used synthetic asset in DeFi. MakerDAO By locking the Ethereum into collateral, users can create a synthetic asset – Dai (which maintains a soft link to the US dollar). In fact, Dai's holders received a combined price exposure for the US dollar. Similar to the design in Abra, this “collateralized asset of collateral endorsement” model is also popular in many other agreements.

UMA

UMA proposes an Ethereum Total Revenue Interchange Agreement and provides synthetic exposure for a variety of assets.

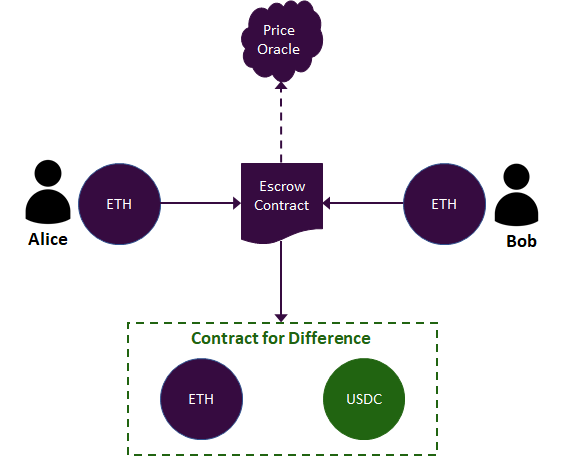

The Smart Contract contains the economic, termination and margin requirements for the bilateral agreement between Alice and Bob. It also requires a price oracle to get the current price of the underlying asset.

One implementation of the agreement is the USStocks (US stock) ERC20 token, which represents the US Standard & Poor's 500 Index and is traded on the Beijing-based decentralized exchange DDEX. This is achieved by fully collateralizing one of the UMA contracts and then tokenizing the margin account to obtain ownership of the long-term synthetic assets of the contract.

MARKET Agreement

Rainbow Network

The Rainbow Network is an under-chain unmanaged exchange that supports any liquid assets and is structured as a payment network. It consists of a number of "Rainbow Channels", a variant of the payment channel, and the channel settlement balance is calculated based on the current price of other assets. In other words, the Rainbow protocol includes synthetic assets and other assets in a payment channel.

In the Rainbow channel, each state represents a CFD, similar to the total revenue swap.

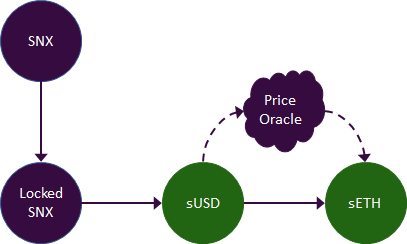

Synthetix

Synthetix is a synthetic asset issuance platform, a collateral, or an exchange. It allows users to issue a range of synthetic assets. Similar to Maker, users create synthetic assets by locking collateral assets and pay interest when redeeming collateral. In addition, users can complete “transactions” between synthetic assets through the oracle. Please note that there is no direct counterparty to the "transaction" in Syntheix – in fact the user is re-pricing the collateral according to the predictor. That is to say, due to the merger mortgage mechanism, SNX speculators collectively bear the counterparty risk of other users' synthetic combinations.

Currency derivative

The synthetic representation of real assets is an important step. I believe that the financial derivatives of the currency circle have a very large design space and are basically undeveloped, including: traditional financial derivatives designed by participants in the blockchain asset market. And cryptocurrency derivatives that did not exist in traditional financial markets.

Below I will list a few examples of two types of derivatives, many of which may not be feasible, or not large enough to provide liquidity.

Bitcoin difficulty swap

The derivative is expected to serve as a hedging tool for miners to reduce the risk of bitcoin production reduction due to increased difficulty in mining (ie, the “difficulty curve risk” of hedging miners). In fact, BitOoda is designing and providing such a financial settlement tool , which means that settlement is done by legal currency transfers rather than renting or lending physical calculations. In terms of scale, it is unclear how much influence the product can have on the seller (ie, the more difficult party) and the market maker (ie, the swap dealer). At the same time, large mines are also likely to manipulate the market (eg, conspiracy attacks).

Hash power exchange

The derivative means that the miner sells part of his calculation power to the buyer in the form of a fund to earn cash. This allows miners to achieve a steady stream of income without worrying about the underlying blockchain asset prices and allowing the fund to invest in blockchain assets without investing in mining equipment. In other words, since miners do not have to rely on the market price of the blockchain assets they are mining to maintain profitability, there is no need to worry about market risk. BitOoda builds and delivers this functionality through their physical settlement contract “Hash Computing Week Expansion Contract”.

Electricity futures

Electricity futures have been around for a long time in traditional commodity markets, but they still apply to cryptographic currency miners. Miners only need to sign a futures contract to purchase electricity at a predetermined time (for example, 3 months) to determine the price. This product allows miners to hedge the energy market risk due to the large increase in electricity costs that may make the mine unprofitable. In other words, miners buy electricity from a dynamic change to a fixed value by purchasing this product.

Equity return swap

Equity return swaps enable Proof of Stake Networks certifiers to hedge market exposures for the blockchain assets they choose. Similar to the Hash Competency Interchange, the verifier needs to sell some of their equity in exchange for cash. This allows the verifier to obtain a fixed amount of income from the locked assets, and the buyer also gains an equity exposure without the equity pledge.

The Vest platform now offers such services. In the Vest market, buyers can purchase future equity gains, and equity owners can also reduce their equity returns. The project is realized through an “equity contract”, and the buyer pays the amount of X to obtain the income of the Z token currency during the period T.

Slashing fines swap

Slashing fines swaps enable Proof of Stake Networks entrusted parties to hedge their operational risk exposure for selected certifiers. The margin penalty can be regarded as a credit event of the verifier, and the sudden penalty exchange is regarded as insurance for such events. If the entrusted verifier is fined, the entrusting party will receive a compensation to cover the loss. The seller of the penalty cut-off swap is actually looking at the efficient operation level of the multi-verifier, or the verifier itself can be the seller. However, once the scale of this product expands, protocol designers will enter an interesting dilemma – users who lack certifiers will have the incentive to destroy existing certifiers.

Stable rate swap

Although Maker's current stabilization rate is 16.5% (Translator's Note: currently 12.5%), from July 13 to August 22, 2019, this ratio is as high as 20.5%. CDP holders may wish to reduce the risk of a rising rate (variable interest rate), so they can enter into a swap agreement with the counterparty to pay a flat rate (interest rate swap) within a given time frame.

Airdrop option

An airdrop option is an option to purchase blockchain assets, and the transaction price is equal to the airdrop price. The contract buyer's income structure is similar to the option contract in the mass market, and at that time the market price of the airdrop is the premium of the option contract (the option fee). If the airdrop is successfully completed, the buyer executes the option and the seller pays the blockchain asset. If the airdrop does not complete successfully, the buyer waives the execution of the option and the seller receives the option fee.

Locked warehouse airdrop forward

The lock-in airdrop forward is a bilateral agreement that allows buyers to purchase blockchain assets at a determined price. In this type of contract, the buyer’s premium to the seller reflects the liquidity price of the locked asset (or the opportunity cost of the locked position), but this also allows the buyer to eliminate the need to hold the base required for the lock. The assets are involved in the lock-in airdrop.

to sum up

If you have seen it last, consider becoming a CFA! Synthetic tools are a complex financial instrument that has repeatedly plagued the global economy. Similarly, they may pose a risk to the security of the agreement in ways we don't know yet. Despite this, synthetic assets still play an important role in traditional financial markets and are becoming a key component of the DeFi trend. At present, the industry is still in its infancy, and we need developers and financiers to conduct more experiments in order to truly bring new financial products to market.

Many thanks to Dan Robinson, Kain Warwick and Matteo Leibowitz for their feedback on this article.

You can follow me on Twitter. (Finish)

(A lot of hyperlinks are provided in the article, please click to read the original text to get the EthFans website)

Original link:

Https://medium.com/zenith-ventures/synthetic-assets-in-defi-use-cases-opportunities-19b11f57a776

Author: Dmitriy Berenzon

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is Morgan Chase sour? Jamie Dimon commented on Libra: a brilliant idea that will never be realized

- Understanding the role of different roles in cryptocurrency exchanges

- Former Greek Finance Minister: Zuckerberg’s Libra Dream is a good thing, this design can be achieved by the IMF

- Telegram writes to investors: the delay in the hearing is a "positive step"

- HTC launches the first Exodus 1s smartphone that runs a complete node of Bitcoin

- The second batch of blockchain information services passed the record to help the industry develop

- The new chairman of the CFTC hinted that ETH futures may be launched soon, will it be the next big derivative to hit the market?