Bald Runaway How a Low-Level Scam Deceives Everyone

Bald Runaway Low-Level Scam Deceiving EveryoneAuthor: LianGuai Reporter Jessy

Recently, there has been unrest on Coinbase’s own project, Base Chain, which is a layer 2 project.

Firstly, the largest Meme coin project on Base Chain, called Bald, experienced large-scale funding injections in the early stage, followed by repeated capital withdrawals from the liquidity pool, which raised suspicions of market manipulation. As a result, the price of Bald skyrocketed by 2000 times in less than 24 hours and then plummeted close to zero. At one point, this project achieved a market value of over $100 million in just 2 days, with liquidity in the pool exceeding $25 million.

Under the influence of Bald, the total value locked (TVL), number of users, and trading volume on Base Chain all experienced significant increases. On July 30, the assets on Base Chain began to surge, surpassing the total assets on this chain. On July 31, during the surge of Bald, over $80 million was added, of which $60 million was added on July 30 and July 31.

- Semafor US Department of Justice considering fraud charges against Binance

- The Future of Worldcoin

- Has DeFi resumed business under the positive and negative news of regulation in 2023?

Due to the impact of Bald, other Meme projects on Base Chain also experienced a sharp decline, with most of them dropping by 90% or even more. During the surge of Bald, these projects also saw at least a tenfold increase.

Currently, the problem is that if users want to transfer their assets from Base Chain to another chain, they also need to wait for a considerable amount of time because the official cross-chain bridge provided by Base is not yet open to all users. Third-party cross-chain bridges cannot handle large-scale cross-chain transfers, including over 10,000 ETH belonging to the Base project team, which is still stuck on Base Chain.

As one wave subsides, another wave rises. Next, the largest DEX on Base, LeetSwap, claimed that its liquidity pool may have been attacked and has temporarily suspended trading for investigation.

On August 2, the deployer of Bald announced on Twitter that all the profits obtained from Bald would be donated to non-profit organizations. Did Bald, this meme project that multiplied its value overnight, exit scam? How did a not-so-clever scam deceive so many people?

Blatant Market Manipulation

This is a story of blatant market manipulation, not uncommon in the cryptocurrency industry. However, it is rare to see a project experience a 2000-fold increase in value within two days and then have the project team exit.

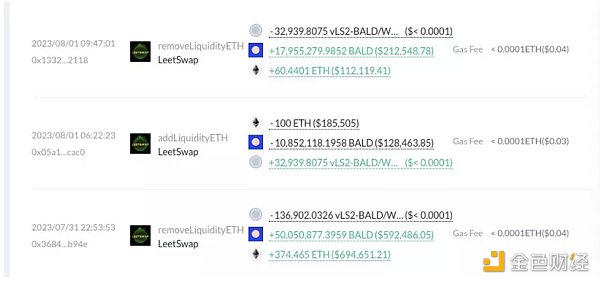

Through data analysis on Debank, we can see that starting from 02:58:33 on July 30, 2023, the deployment address of the project began injecting ETH into the liquidity pool of Bald. The address transferred multiple ETH into the liquidity pool, totaling over 6,470 ETH. Then, starting from 19:38:55 on July 31, the address began withdrawing ETH from the liquidity pool, with a total of over 10,704 ETH withdrawn in four transactions. After that, starting from 20:49:01 on July 31, the address injected a total of 400 ETH into the liquidity pool in three transactions, followed by subsequent withdrawals and injections, but each time only a few hundred ETH were involved. Finally, at 09:47:01 on August 1, the wallet of the project’s deployment finally stopped operating in the liquidity pool, with the last transaction being a withdrawal of 60 ETH.

According to the analysis and summary by data analyst Yu Jin, on July 31st at 7:00 PM, the BALD project team started a buyback of 29.78 million BALD tokens using 1160 ETH ($2.17M), causing the price of BALD to rise from $0.055 to a peak of $0.09. During the buyback, the project team withdrew 10,704 ETH ($20M) and 224 million BALD tokens from the liquidity pool, leading to a sharp drop in pool depth and market panic, causing the price of BALD to fall from $0.09 to $0.02. After the drop, the project team only added 400 ETH ($0.75M) and 180.8 million BALD tokens back into the liquidity.

At 9:00 PM on July 31st, the project team also withdrew the recently added 400 ETH ($0.75M) and 180.8 million BALD tokens… Now the BALD pool has only 8 ETH in depth, and the price of BALD has dropped to $0.004.

According to Dexscreener data, as of the time of writing, the price of BALD is $0.0006062, and the liquidity is only $153,000.

The BALD project experienced a crazy surge of over 2000 times in less than 24 hours after its launch. Like many projects, it cannot escape the high degree of control by the project team. In the early stages of BALD’s operation, the project deployer continuously added liquidity to the pool. For a newly launched blockchain and a newly launched meme token, the amount of investment is astonishing. It is because of the project team’s aggressive market-making that many people speculate that Coinbase is behind the project, and speculators have also injected funds into the base chain. Indeed, it is under the influence of Bald that a large amount of funds has poured into the base chain. With the surge of Bald, assets on the base chain began to skyrocket, and now there are already over $80 million, with $60 million added on July 30th and July 31st.

It can be said that it was the FOMO (fear of missing out) sentiment towards Bald that drove the surge in funds on the Base.

In addition to being a project with high control by the project team, there are also insider trading activities. According to the detection by LookIntoChain, four addresses extracted 0.5 ETH from Bybit to Base at the same time, and purchased 50 million BALD tokens with 0.534 ETH four minutes after Bald opened, accounting for 5% of the total supply of BALD. Later, during the rise of BALD, 37 million tokens were sold, converted into 554 ETH.

A FOMO that only goes in but not out

Looking back at the incident, Bald is not the kind of project where all the code is designed in the contract to prevent users’ funds from being withdrawn, like a mythical beast. A blockchain technology engineer told LianGuai reporters that the problem with Bald is that it did not achieve a “fair launch”. Generally, most Memecoins will throw the LP (liquidity provider) tokens into a “black hole”, which refers to an address that no one has the private key to, similar to addresses starting with “0x0”. This ensures that the pool is not controlled by anyone. Users can go to the blockchain explorer to check if the LP token’s owner is a black hole address, which can determine if the project has a fair launch.

However, it is obvious that the LP of Bald’s project is not a black hole address. But such a vulnerability did not attract everyone’s attention. After the Fomo sentiment started on Base, people had already lost this basic common sense.

Base Chain is currently not officially launched on the mainnet. Its official cross-chain bridge is still in the developer access stage. For security reasons, the official Base cross-chain bridge currently only supports the entry of ETH and does not support the crossing back to the mainnet for ETH minted on Base Chain. Because Base Chain is still in the development and testing stage, there may be issues such as Ethereum over-issuance due to security problems or vulnerabilities.

The myth of a thousand-fold rise on Base, with various Meme coins soaring, is also related to the fact that Base Chain is not officially launched on the mainnet yet. Because currently funds can only enter and cannot exit, funds are moving between various Meme coins, and then various scenes of skyrocketing and then plummeting by tens or hundreds of times are created.

(Although it is currently not possible to extract ETH back to the mainnet through the official cross-chain bridge, it can be achieved by running a withdrawal script. However, this method is too complicated and requires waiting for seven days to implement.)

The private key of the pool is held by the protocol deployer, and the project party can control the project at any time. Moreover, the contract of this project itself has not undergone a security audit. Underneath these illusory prosperity, lies a lie that is very easy to expose.

When caught up in the Fomo sentiment, these basic common sense have long been overlooked. People are concerned about whether they can get in and make a profit, and believe that they will not be the last one to hold the bag. Many big V accounts on Twitter who often promote projects have also suffered from this. @币圈慈善家 tweeted that after he bought in, the project party withdrew the pool within ten minutes, and the funds he invested plummeted by 80%. And blogger @Maswei.zk invested 10,000 U, but in less than 24 hours, only 300 U was left.

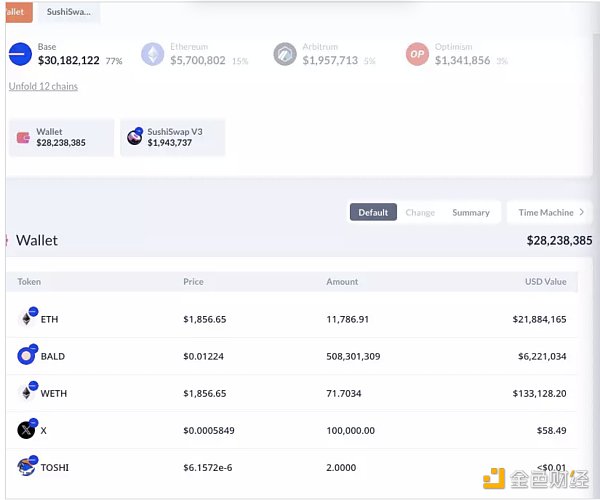

However, in the wallet of the project deployer, there is a huge amount of 2823 million US dollars in funds on the Base Chain.

The fruit belongs to the brave, not the fools

One wave subsides, another wave rises.

On August 1st, the largest DEX on Base Chain, LeetSwap, was reported to have been hacked. The attacker obtained a total of 340 ETH, about 630,000 US dollars, and the official team had to suspend all transactions because of this.

According to the analysis of the Web3 security team Beosin, the reason for the attack was confirmed to be the price manipulation attack on the axlUSD/WETH pool in the LeetSwap platform. The hacker mainly used specific public functions in the pair contract to allow the transfer of axlUSD in the pair contract, thereby driving up the price of the token. The attacker then sold the token to obtain ETH profits.

And on July 31st, LeetSwap attracted a large number of retail investors due to the surge of BALD, and the 24-hour trading volume once exceeded 230 million US dollars. And among this trading volume, 49% came from BALD. Among the top ten trading pairs, except for their own platform token LEET, the rest are all Meme coins.

An unopened Layer 2 that has attracted so much funding, and for Base, it is also a big test. Obviously, Base did not pass this test because of the negative impact of Bald’s exit scam. Users now refer to Base as the “exit scam chain”. However, more importantly, many people who lack intelligence and rush in with hot heads to make quick money have failed to see some obvious pitfalls.

In addition to the sharp drop in Bald, there are also many Meme coins on the Base chain that are like “Pixiu plates”. This means that according to the contract, only designated users can sell tokens, and other users’ funds can only go in but not out. Based on the revelations of crypto investor Axel Bitblaze, projects like BASED are typical examples of “Pixiu plates” – only the creator of the contract and a few whitelisted individuals have the right to sell tokens. When Axel Bitblaze wanted to sell his token that had increased tenfold, he received a message saying “Internal JSON-RPC error” and was unable to sell. LianGuai reporters also saw a set of source code being sold in the community for MEME coins on Base, which could be purchased for 2000U.

The crypto market is indeed a dark forest, and gambling on a Layer 2 that is not fully open to users should carry greater risks. Only the brave who can bear risks are likely to reap greater rewards, but the prerequisite is that these brave individuals must have a clear mind.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A Quick Overview of the AA Smart Contract Wallet Launched by Europe Easy OKX

- Will the IT team be able to survive while Web3 heads south to ‘make a fortune’?

- Is the dream of RWA assets being put on the chain a reality or an illusion in the cryptocurrency community?

- Is Curve helpless in the face of a crisis? A perspective on response strategies from the perspective of DeFi mining.

- Uniswap Trading Volume Revealed Robots Account for 70% of Trading Activity

- CertiK Detailed Explanation of Vyper’s $52 Million Loss

- Don’t just focus on the RWA track, the oracle track is also worth paying attention to.