Uniswap Trading Volume Revealed Robots Account for 70% of Trading Activity

70% of Uniswap trading activity is conducted by robotsSource: bitcoinist; Translation: Blockchain Knight

In its latest weekly report, blockchain analytics firm Glassnode studied various key indicators related to Uniswap, including the distribution of platform trading activity among different types of traders.

One interesting finding is that the analysis firm differentiates the trading volume of DEX (the total amount of tokens flowing on the platform) between humans and robots.

- CertiK Detailed Explanation of Vyper’s $52 Million Loss

- Don’t just focus on the RWA track, the oracle track is also worth paying attention to.

- Interpreting FTX’s preliminary restructuring plan Cash compensation is adopted, excluding FTT holders.

These robots refer to automated programs that discover profitable trades by observing the blockchain and execute these trades. There are various types of these robots, but for the purpose of this discussion, only two types are worth noting: arbitrage and sandwich.

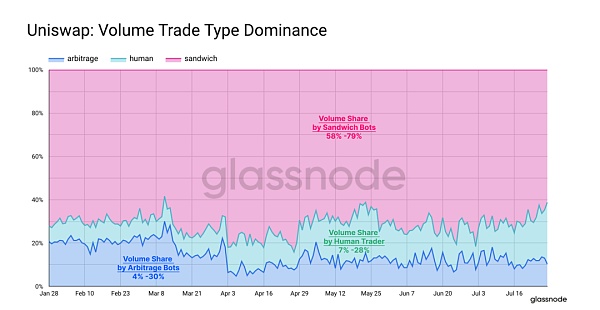

Below is a chart showing the percentage of trading volume on Uniswap over the past few months for these two types of robots and human traders:

From the chart, it can be seen that the share of trading volume from arbitrage robots reached 20% at the beginning of this year but has now dropped to 10%. Meanwhile, the share of human traders has increased and is currently close to 30%.

Throughout the year, most of the trading volume came from sandwich robots. However, recently, as human traders have expanded their dominant position, the share of sandwich robots has dropped to about 60%.

Data shows that approximately 70% of the trading volume on Uniswap DEX comes from robots.

However, trading volume may not be the most accurate measure of trading activity, as different types of robots may conduct different numbers of trades in a single transaction, which could inflate their trading volume.

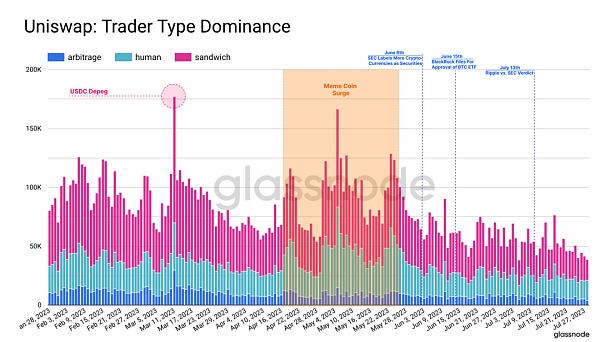

Therefore, in order to gain another perspective on trading activity, Glassnode also studied the pure number of transactions from each type:

In this comparison, the total sum of the two types of robots still seems to exceed that of human traders, although the difference in their advantages appears to be much smaller.

Uniswap is a decentralized crypto exchange, which means there is no central entity controlling the platform, and the exchange’s transactions are conducted using smart contracts.

In order to achieve governance, there is also a special governance token called “UNI” that any user can choose to hold and participate in decisions on the platform. The exchange’s code is also open source, but the license attached to the latest version of the platform, Uniswap V4, has sparked strong dissatisfaction among members of the open source community.

This license stipulates that although anyone can view and copy the code, no one can use it for commercial or production purposes before the four-year term expires.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Morning Post | US Media Zhao Changpeng Once Attempted to Shut Down Binance’s Exchange in the United States

- Messari Development Overview of Polygon in the Second Quarter of 2023

- What impact will the detailed analysis of the Curve attack incident bring?

- Are the 10 Web3 directions released by LianGuairadigm really the future of the industry?

- LD Capital An Analysis of KasLianGuai, a POW Public Chain Based on the GHOSTDAG Protocol

- How far can a decentralized sorter go?

- The Battle of Tech Giants Digital Identity, Payments, Social Graphs, AI, and Universal Basic Income