EthCC Experience Cryptocurrency VCs Not as Good as Dogs, Applications Upgraded to Infrastructure

EthCC Experience Cryptocurrency VCs Inferior to Dogs, Applications Upgraded to InfrastructureAuthor: Xin

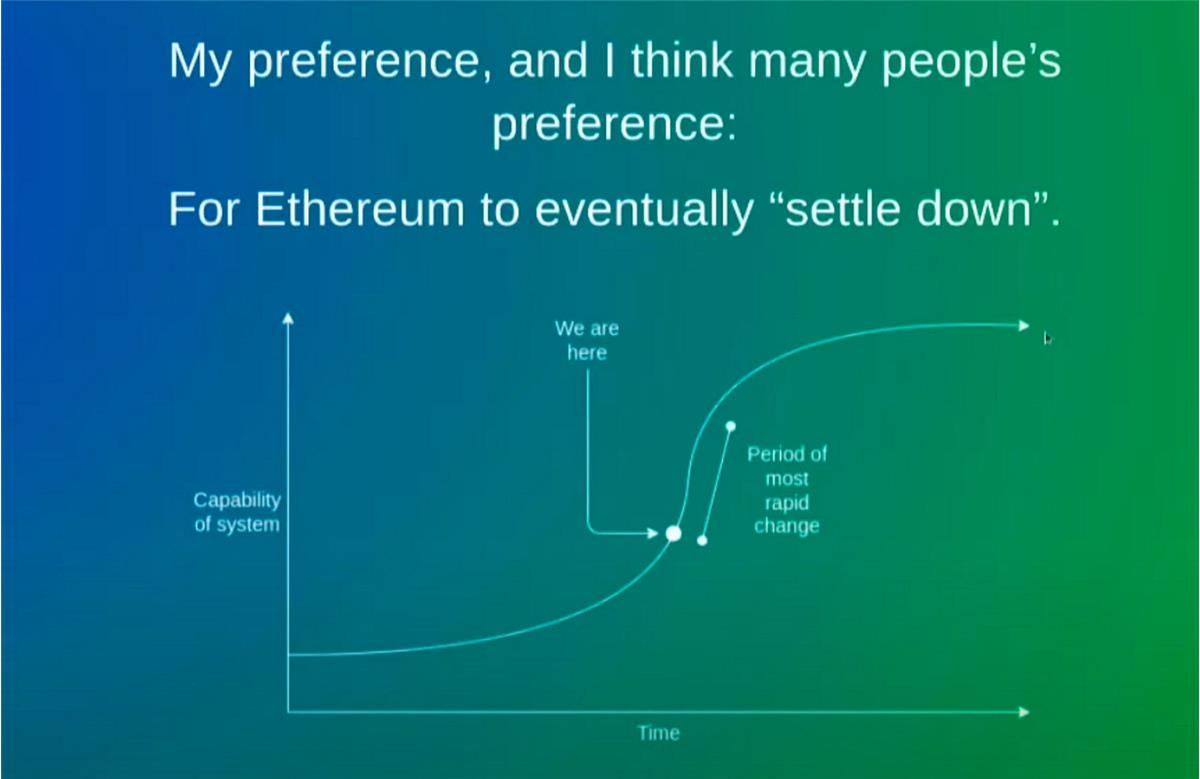

If, as Vitalik said, Ethereum was at the beginning of a steep climb last year, then this year, Ethereum has taken a big step towards the peak.

I made two Meme pictures to represent my most intuitive feelings about EthCC, which also reflect the current industry situation:

There are too many encrypted VCs, to the extent that a side event held by a unicorn project with a valuation of over 1 billion in a certain private placement round has implemented a policy of “VCs are not allowed in”. Unfortunately, these sessions are open to dogs. Therefore, VCs are not as good as…

- A Week After the Renaming Predicting the 8 Major Changes That Will Happen to the ‘New Twitter X

- How is the OP ecosystem now? Is it worth investing in?

- The Tech Giants’ Battle of X Digital Identity, Payments, Social Graph, AI, and Universal Basic Income (UBI)

Almost all projects that started doing applications half a year ago, whether it’s games, NFTs, or social networks, have all expressed that they are starting to do the underlying infrastructure, which is Infra, and every pore is using ZK, very smooth. Don’t believe it? Come and try our new Odyssey.

What’s New

During the EthCC conference, many projects released their own updates and progress. Here are some projects that I personally think are worth paying attention to:

1. Chainlink CCIP – “Packaging”

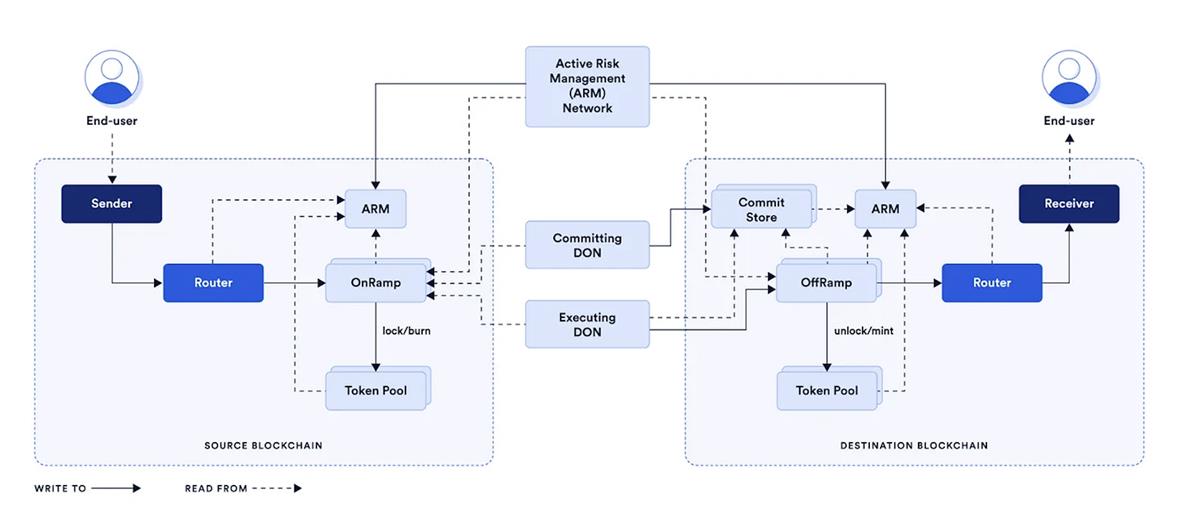

Chainlink, the leader in middleware, announced its entry into the cross-chain direction during the Oracle track at the EthCC conference on July 20th. Its cross-chain protocol CCIP has officially launched and supports the testnets of Ethereum and the testnets of four mainstream EVM L2 chains. Interestingly, this version is not called a testnet or a beta version, but is referred to as the Mainnet Early Access phase. Please appreciate the artistry of the language.

CCIP Overall Architecture Diagram

The overall architecture is divided into off-chain and on-chain parts. The off-chain part uses Chainlink’s DON node network to submit and verify cross-chain transaction Merkel Proofs, and ensures the finality of transactions on the original chain, as well as the risk control requirements of active risk management nodes (ARM) for cross-chain transactions.

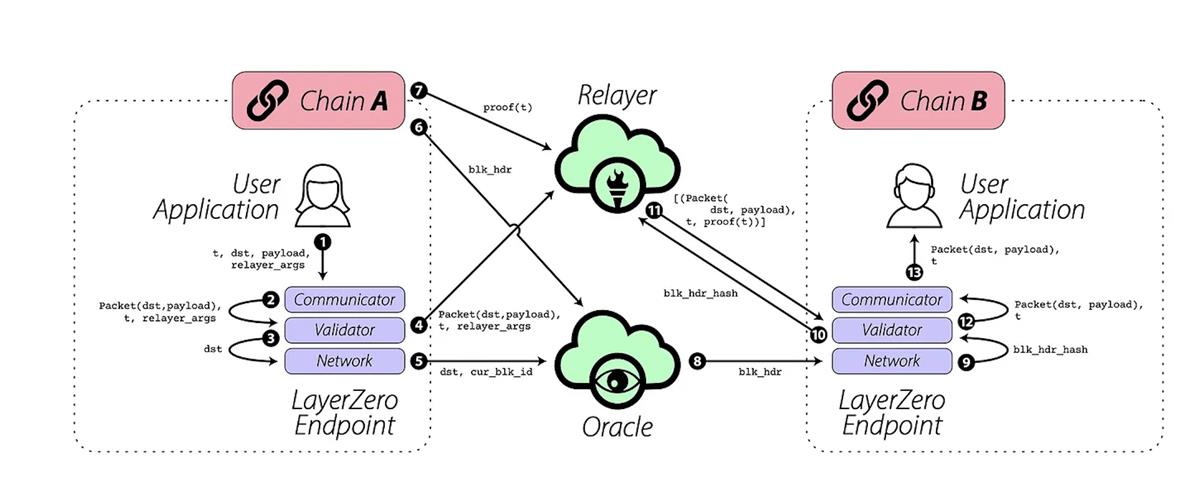

Those familiar with cross-chain projects may find the architecture in the above diagram familiar. The diagram below shows the structure of Layerzero, which is currently valued at $3 billion:

Layerzero Structure Diagram

Off-chain part: Relayer corresponds to Executing DON, Oracle corresponds to Committing DON;

On-chain part: Communicator corresponds to Router; Validator and Network correspond to on/off ramps. Chain A and Chain B correspond to two token pools.

The main cross-chain architectures of the two can almost be matched one-to-one. The difference is that Chainlink’s CCIP adds a layer of Rust-implemented Chainlink contracts and independent nodes to independently audit cross-chain transactions. More importantly, the underlying Oracle used by Layerzero is currently Chainlink.

This operation, in the latest popular terminology, can be seen as Chainlink “enshrining” Layerzero.

2. Uniswap X – “Decoupling”

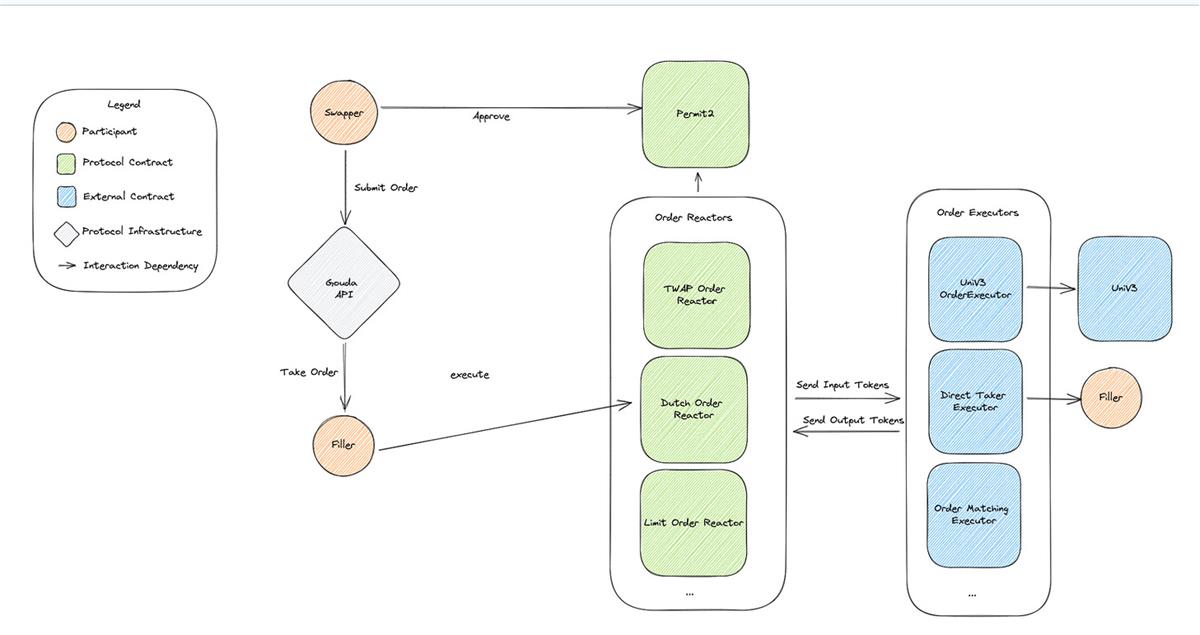

The Uniswap team is slow in terms of token empowerment, but very proactive in terms of product innovation. After announcing the Uniswap V4 product plan in June, they launched a new product called Uniswap X on July 17. To give a somewhat inappropriate analogy, Uniswap V4 is like Apple releasing a new generation iPhone, with the previous products being Uni V3, and Uniswap X is a new product line similar to iLianGuaid released by Apple.

Uniswap X Product Architecture Diagram

The core part of Uniswap X is to outsource the transaction routing and aggregated transaction functions to a new participant called Filter. Filter works with Uniswap’s Router to execute order placement and order matching tasks. Filter can be a transaction aggregator like 1inch, a market maker, an individual, or even an MEV searcher. In this way, due to the existence of a bidding mechanism, the potential MEV loss for traders will be compensated during the bidding process, so the value of MEV will be internalized.

This decoupling of system components to reduce the complexity of the core system is also the essence of Uniswap V4. Uni V4 decouples the establishment of liquidity pools from the core system and assigns this responsibility to a new role called Hook. Hook defines personalized rules for liquidity pools, thereby meeting the flexible needs of users while maintaining the stability of the core system.

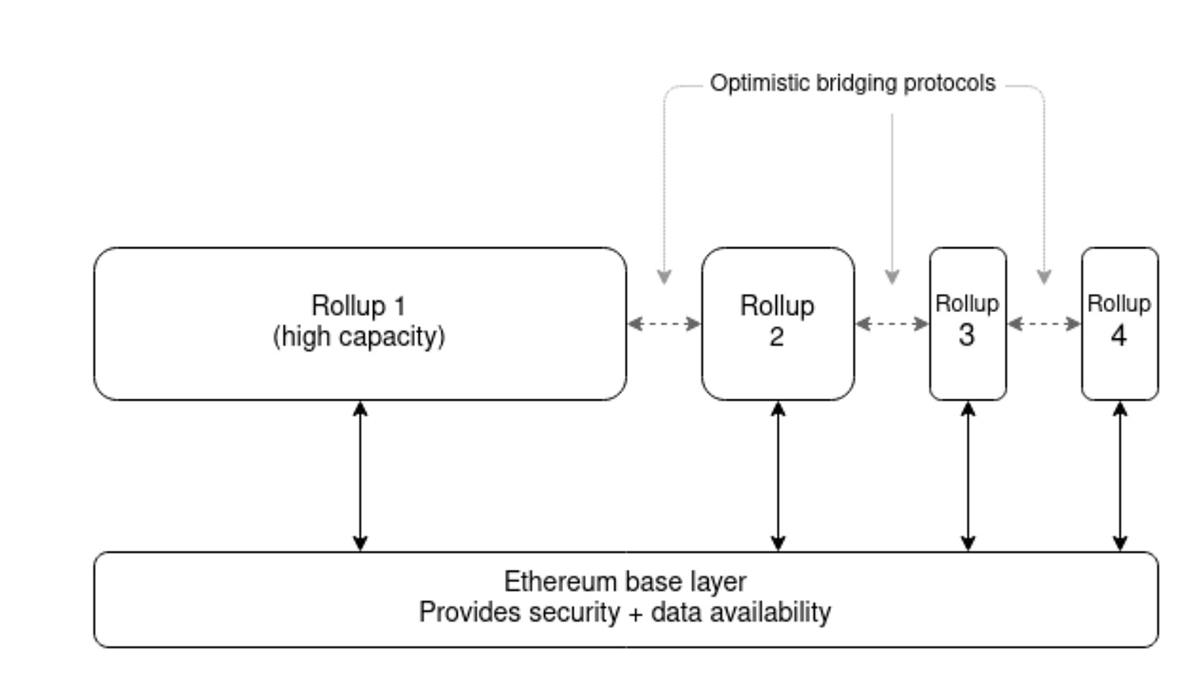

A similar system design logic is also part of the Ethereum Rollup-centric roadmap, gradually moving transaction scalability to various L2 Rollups, and continuing to decouple data availability, which has given birth to a large number of L2 and DA projects.

Of course, Uniswap X also brings important functional improvements to enhance user trading experience, such as Dutch auction orders, cross-chain transactions, and transaction fee optimization modules like Permit2. Additionally, it is worth mentioning that Uniswap X defines signed order as the underlying transaction object, setting the tone for an intent-centric on-chain transaction model.

3. Towards the Modular Blockchain Era – Endgame

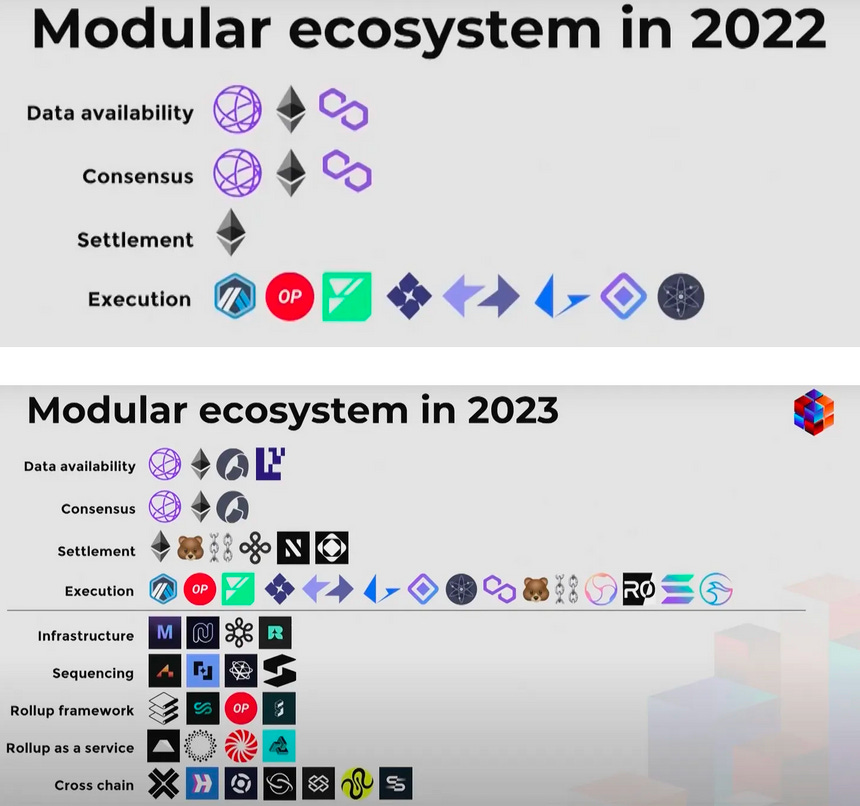

With many Layer2 solutions going live on the mainnet this year, and many announcing important milestones for their products during EthCC, it can be said that the era of Ethereum modularity has officially arrived.

- Linea, a subsidiary of Consensys, launches Alpha Mainnet

- Mantle, incubated by Bybit, launches Alpha Mainnet

- O(1) Labs’ Zero Knowledge Proof solution for OP Stack is selected

- Following OP Stack and Arbitrum Orbit, Starknet also released its own Starknet Appchains

Since around 2020, with the establishment of the Ethereum Rollup-Centric roadmap, the trend of Ethereum modularity has been foreseeable. This Ethereum scaling method, which uses Rollup to handle transaction loads, breaks down the monolithic chain functionality into modular chain systems and is referred to as Ethereum’s endgame by Vitalik. (Subsequently, the term “endgame” has become a hot term in Web3 and has been frequently used, such as in MakerDao.)

Ethereum will not only exist as a chain or L1 in the future, but as a highly secure DA layer and consensus layer solution. As Ryan, the founder of Bankless, said, “The Ethereum main chain is not for users, but for the chain,” specifically for different Rollups and Raas platforms.

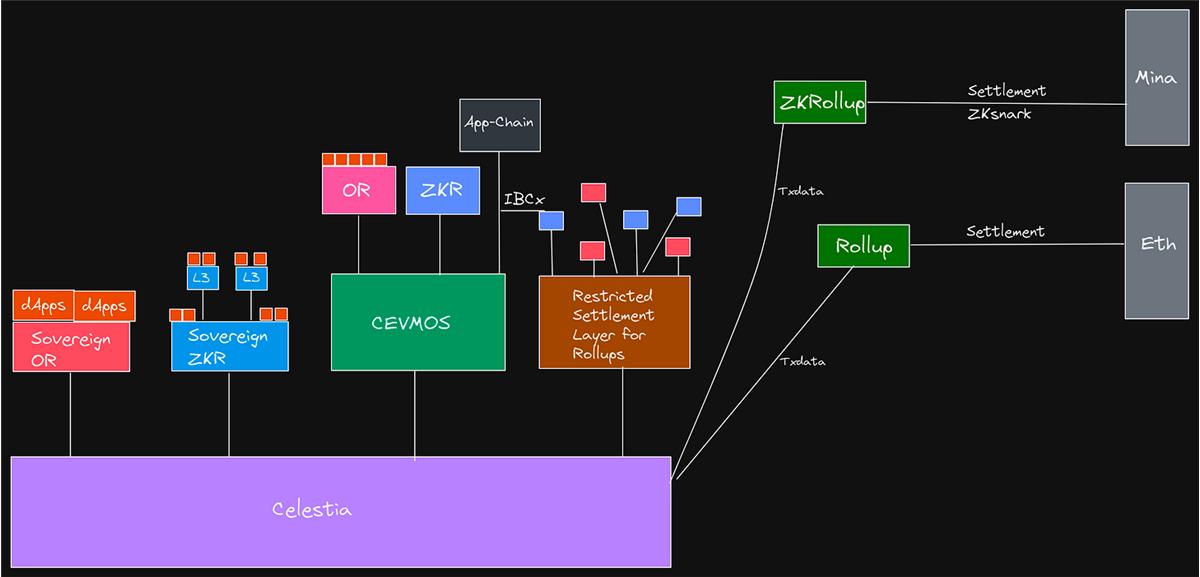

In the modular world, it is no longer simply classified as L1, L2, or L3 fractal scaling; it is a combination of various execution layers, DA layers, and consensus layers:

A modular ecosystem centered around Celestia

In the future, the focus of blockchain infrastructure builders will shift from various forms of L2 to various components of modular blockchains. This can be seen from the changes in speakers at the Modular Summit over the past year: more decentralized sequencers, faster execution layers, frameworks for adapting different types of application Rollups, and more.

In addition, there were many other new releases at this EthCC conference, such as Lens V2 and Gnosis Card. Since the conference still focused on infrastructure, this article will not go into too much detail.

To Be Continued:

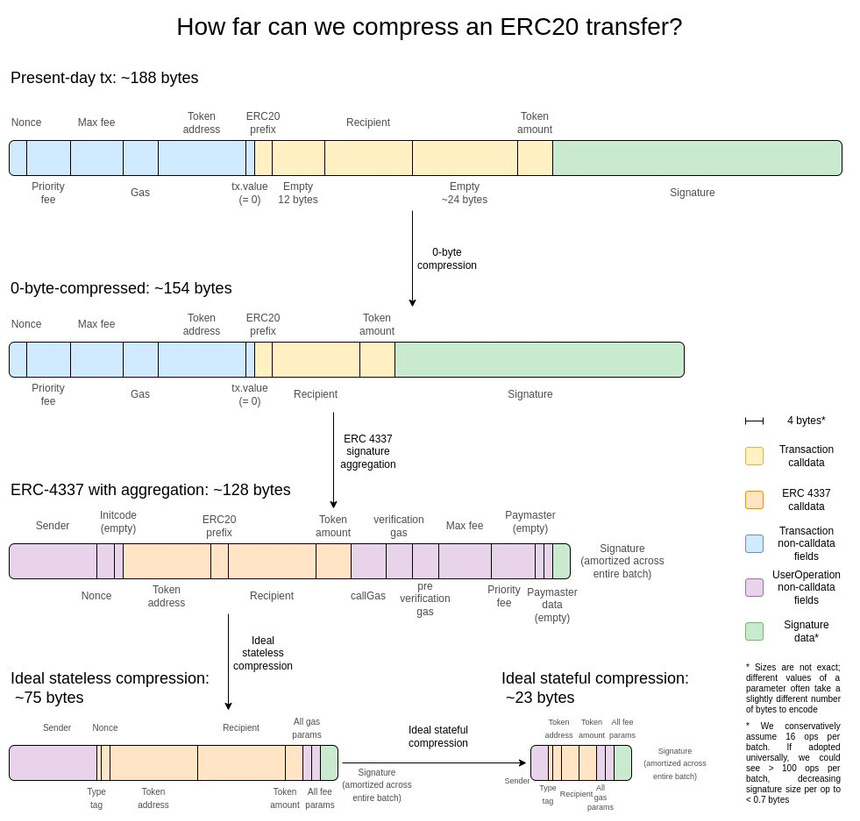

1. Vitalik’s speech at the main venue this time was about the development history of account abstraction. There were not many new things, but his speech on Aggregation at the Modular Summit was personally more interesting. He mentioned that one of the advantages of ERC4337 is the use of BLS aggregate signatures, which greatly reduces transaction size and saves Ethereum block space. Similarly, there is a lot of work being done to use SNARK proofs for aggregation to improve efficiency. The theoretical and technological progress in aggregation may be the breakthrough point for future Rollup upgrades.

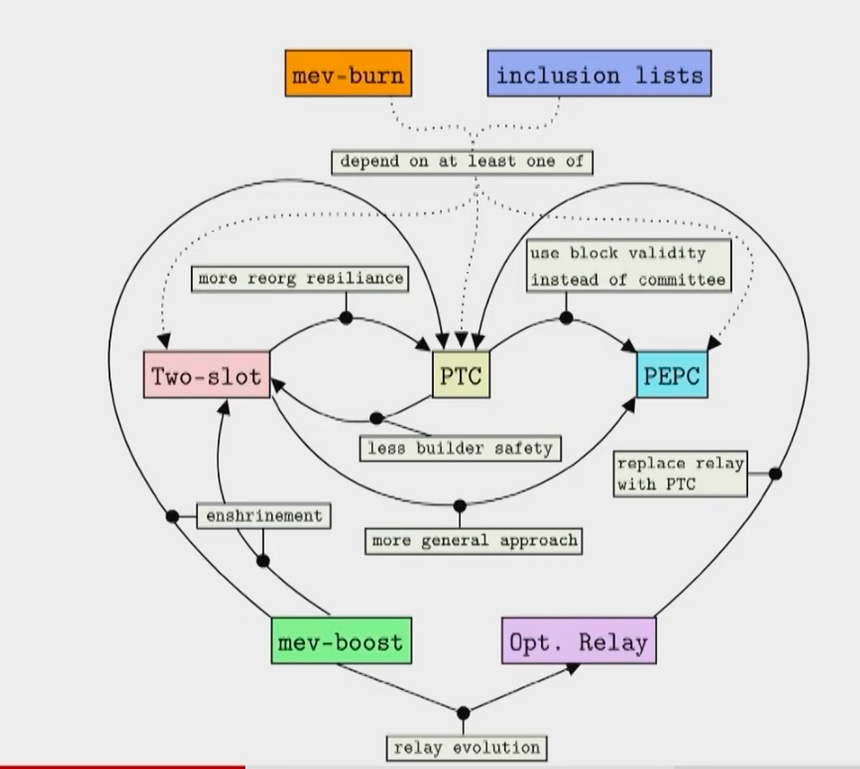

2. One of the largest side events at EthCC, the Modular Summit, had a whole day dedicated to discussing PBS (Proposer-builder seLianGuairation), which is also a well-known topic. The Ethereum Foundation’s R&D roadmap can be summarized in the following heart-shaped diagram, divided into in-protocol and out-protocol categories. The specific content is complex, and it can only be explained in a separate article in the future.

Finally, let’s look back at the “yesterday” while envisioning the future. At the 2022 EthCC conference, Vitalik’s expectation for Ethereum is to eventually “Settle Down,” meaning that Ethereum achieves enhanced system compatibility, reduced complexity, and a stable and long-lasting operating state. If, as Vitalik said, Ethereum was at the starting point of a steep climb last year, then this year, Ethereum has taken a big step towards the summit.

This HTML code represents a paragraph with an image embedded in it. The image source is a URL: “https://cdn-img.panewslab.com//panews/2022/7/30/images/7bd8c779dd175cdb7f15a8cec1f69032.png”.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After a massive layoff of 73%, can Star Atlas, a 3A masterpiece born in a bull market, still be launched as scheduled?

- After LSDFi, will the liquidity provided by derivative LPDFi trigger the next wave of DeFi narrative?

- Bybit Payroll Manager Steals Large Amounts of USDT, Singapore Court Elaborates on Cryptocurrency Property Attributes

- Binance Chain L2 pioneering application MEKE to start public testing on July 31st

- Involved in a transaction of 400 billion yuan, how do law enforcement agencies dispose of confiscated cryptocurrencies?

- How will the five market makers improve the liquidity of WLD compared to Zero as a market maker for PEPE?

- Analyzing UNI Long-tail Liquidity Scenarios How Does it Work?