Is the dream of RWA assets being put on the chain a reality or an illusion in the cryptocurrency community?

Is the dream of putting RWA assets on the blockchain a reality or illusion in the crypto community?01 The crypto circle needs faith to recharge

The crypto circle needs faith, and faith needs to be recharged.

It’s becoming increasingly difficult for traditional projects to raise money. How do we sell dreams?

The profits for retail investors are getting smaller and smaller. How do we deceive institutional investors?

- Is Curve helpless in the face of a crisis? A perspective on response strategies from the perspective of DeFi mining.

- Uniswap Trading Volume Revealed Robots Account for 70% of Trading Activity

- CertiK Detailed Explanation of Vyper’s $52 Million Loss

Traditional funds want to go overseas. How do we find a sexy and legitimate reason?

These three naked questions directly hit the hearts of project teams and crypto service providers, making them toss and turn, and lose sleep.

What should we do? Let’s flip through historical documents and look for information. Let’s see if there’s anything that can be a large-scale social experiment like a DAO organization, something that sounds grand and relates to the fate of humanity but cannot be clearly explained, something that everyone can do but no one seems to be doing the same thing.

That’s the beauty of social science. It can only confirm, not falsify. You can say that I’m not doing well, but you can’t say that I’m doing it wrong. You firmly grasp the moral high ground of the industry.

Human history is not good at repeating itself, but it is good at repeating. With effort and determination, we have found a new narrative logic from the piles of old papers: RWA (Real World Asset).

I also tried to seriously study RWA.

But friends in the circle told me, “Don’t waste your time. Your lawyers don’t understand what Web3.0 and RWA mean.”

I said, “Friend, we have no grudges against each other. Why do you say this?”

He said, “In the eyes of the crypto circle, RWA is pointing at a set of unsold real estate or a bad debt in their hands, saying: Let’s put it on the blockchain.”

So the assets are put on the blockchain, forming an immutable Token.

So, netizens spread across the globe, under the decentralized concept, based on their high recognition of the project team’s work, can’t stop themselves from giving you their USDT or BTC.

You hold the virtual currency raised and feel lost, thinking about whether to have a party in Singapore or become a digital nomad in Bali.

If the project makes money, you say, “Let’s make a big play with the profits next time”; if the project loses money, you say, “We are all adults and we should take responsibility for our gains and losses.”

I said, “I’m not sure if what you’re talking about is RWA, but it sounds like illegal fundraising.“

He said, “I told you that your lawyers don’t understand RWA. This is called consensus.”

Not understanding the crypto circle’s consensus doesn’t prevent us from learning common knowledge. Let’s discuss these three points about RWA:

First: What is RWA?

Second: How to create successful cases of RWA?

Point 3: Is it reliable to do RWA in China?

Once again, it is declared that this article is from a very unprofessional Web3.0 lawyer and only represents the personal opinions of Lawyer Honglin. It does not constitute legal advice or recommendations on specific matters. Some statements and content in this article may make native Web3.0 experts uncomfortable.

02 What is RWA?

RWA (Real World Asset) refers to real-world assets that exist outside of the blockchain network, such as real estate, stocks, bonds, artwork, etc., and are mapped to the blockchain network in a certain way to interact with DeFi protocols, providing users with more asset choices and sources of income.

For example, USDT was one of the earliest RWAs, where real-world US dollars were tokenized and USDT tokens were created on the blockchain.

For example, users can use their own real estate as collateral to borrow stablecoins from a DeFi platform, or tokenize their own stocks and trade or invest through a DeFi platform.

Why do we need to bring real-world assets onto the blockchain?

Because it is beneficial. Tokenization can provide real-world assets with higher liquidity, transparency, and efficiency, and it can also bring more value and diversity to the blockchain ecosystem. For example:

-

Reducing transaction costs and time, improving transaction efficiency and convenience. For example, through blockchain technology, real estate can be fractionally traded, allowing more people to participate in real estate investment without paying high intermediary fees and transaction costs.

-

Increasing asset liquidity and accessibility, expanding the audience range and market size of assets. For example, through blockchain technology, artwork can be fractionally traded, allowing more people to appreciate and collect artwork without worrying about authenticity and preservation.

-

Improving asset transparency and traceability, enhancing asset trustworthiness and value. For example, through blockchain technology, gold can be traceably traded, allowing more people to know the source and quality of gold without relying on centralized institutions and standards.

In the pursuit of RWA, humans have always been persistent. In January 2017, RealT, based on the Ethereum platform, was established, allowing users to purchase partial ownership of US real estate and tokenize asset ownership. In June 2017, Centrifuge, based on Ethereum, was established, allowing businesses to tokenize their commercial invoices and accounts receivable and finance them through DeFi platforms. In October 2017, MakerDAO, based on Ethereum, launched the stablecoin DAI, allowing users to generate DAI by collateralizing different types of assets.

Next, let’s take MakerDAO as an example to see its narrative story.

03 How does Maker DAO work?

Maker DAO was founded in 2014 and is one of the earliest decentralized autonomous organizations on the Ethereum blockchain. Maker DAO can be understood as a decentralized financial system based on the Ethereum blockchain, which provides a stablecoin called Dai (a cryptocurrency pegged to the US dollar), a governance token called MKR, and a collateralized lending platform called Maker Vault.

The goal of Maker DAO is to create a public infrastructure that is not influenced by centralized authorities or managers, providing economic freedom and opportunities for individuals worldwide. The assets of Maker DAO have the following characteristics:

-

Diversification: Maker DAO supports various types of collateral, including cryptocurrencies (such as ETH, WBTC, BAT, etc.), real-world assets (such as real estate, art, etc.), and fiat currencies (such as USDC, TUSD, etc.). This helps to reduce the risk of single collateral and increase the liquidity and credibility of DAI.

-

Flexibility: Maker DAO allows users to freely choose the type and ratio of collateral, as long as they meet the requirements of minimum collateralization ratio and stability fee. Users can adjust their asset composition based on their risk preferences and expected returns.

-

Transparency: The asset composition of Maker DAO is fully transparent and verifiable. Anyone can view the current types and ratios of collateral, as well as the parameter settings for each collateral (such as minimum collateralization ratio, stability fee, liquidation penalty, etc.) through a blockchain explorer or third-party tools. This increases the trust and traceability of DAI.

-

Governance: The asset composition of Maker DAO is determined by MKR holders through voting. They can adjust the parameters of each collateral or add new types of collateral. This allows DAI to better adapt to market changes and needs, and allows MKR holders to participate in the governance of the system.

In the development history of Maker DAO, important events include the following. The parts related to RWA are highlighted in bold:

-

In 2014, Maker DAO was founded, becoming one of the earliest decentralized autonomous organizations on Ethereum.

-

In 2015, Maker DAO released the first version of the whitepaper, introducing the system of generating Dai by pledging Ether through smart contracts.

-

In December 2017, Single-Collateral Dai (Sai) was officially launched, becoming the first asset-backed stablecoin pegged to the US dollar.

-

In January 2018, the MKR token started trading on exchanges. MKR is the governance token of Maker DAO, used for risk management and parameter settings in the Maker protocol.

-

In March 2020, due to market turmoil caused by the COVID-19 pandemic and congestion on the Ethereum network, the liquidation mechanism of Maker Vault failed, resulting in significant losses for some users. The Maker DAO community voted to initiate an MKR issuance plan to compensate affected users and restore the system’s capital adequacy.

-

In May 2021, Maker DAO announced a partnership with LianGuaixos to include LianGuaixos stablecoin in the collateral list of the Multi-Collateral Dai system, and plans to introduce real-world assets (such as gold, real estate, etc.) into the system.

-

In July 2021, Maker DAO announced a partnership with Centrifuge to include Centrifuge’s Tinlake assets in the collateral list of the Multi-Collateral Dai system, marking the first time that real-world assets are tokenized and used to generate Dai.

-

On August 4, 2021, Maker DAO announced a partnership with Centrifuge to include Centrifuge’s Real World Assets in its collateral system, increasing the supply of DAI by approximately $5 million and providing more real asset support for DAI.

-

In May 2022, Maker DAO released a new governance model called MIPs (Maker Improvement Proposals), dividing the governance process into three stages: proposal, approval, and execution, increasing community participation and transparency.

-

In July 2022, Maker DAO became the first stablecoin project to achieve full decentralization, with all key decisions being voted on by MKR holders through a decentralized autonomous organization (DAO).

-

In November 2022, Maker DAO completed the support for RWA (Real World Assets), allowing users to collateralize real-world assets such as real estate, cars, art, etc. to generate Dai, increasing the types and value of collateral for Dai.

-

In January 2023, Maker DAO introduced a new risk parameter adjustment mechanism called RWAU (Real World Asset Units), delegating the risk assessment and management of RWA to professional asset management institutions, reducing the risk exposure of the Maker protocol.

-

In May 2023, Maker DAO successfully achieved integration with CBDC (Central Bank Digital Currency), allowing users to generate or exchange Dai using digital currencies issued by central banks, increasing the compliance and credibility of Dai.

-

In July 2023, Maker DAO announced partnerships with Visa, Mastercard, LianGuaiyLianGuail, and other global mainstream payment platforms, enabling users to use Dai for cross-border payments, e-commerce, peer-to-peer transfers, and various financial activities, enhancing the convenience and adoption of Dai.

According to data from makerburn.com, as of June 29, 2023, Maker is expected to generate an annual profit of $73.67 million, and there are few decentralized applications more profitable than Maker DAO, except for stablecoins and exchanges. Currently, the market value of MKR is about $820 million.

As a popular project, Maker DAO has naturally faced continuous questioning during its development. The main doubts are as follows:

For example, is the governance of Maker DAO truly decentralized? Some people question whether the governance process of Maker DAO is manipulated by a few large holders or the core team, and whether it can fully reflect the will and interests of community members.

For example, is the stability mechanism of Maker DAO reliable? Some people point out that the stability mechanism of Maker DAO relies too much on market mechanisms and liquidation penalties. In the event of extreme situations, it may lead to system collapse or token depreciation.

For example, is the collateral selection of Maker DAO reasonable? Some people believe that the collateral selection of Maker DAO is too conservative or too radical, without fully utilizing the diversity and innovation of blockchain, and without effectively controlling risk exposure and leverage ratio.

04 Can RWA be feasible in China?

According to a statistical data from BCG Boston Consulting Group, it is estimated that by 2030, the overall scale of the RWA track may reach $16 trillion.

The future seems promising, but I often see a painful expression on the faces of some blockchain practitioners in China, as if they feel that their homeland is not suitable for their ambitions to change the world and get rich.

So they often wander in different countries, holding Chinese passports, wanting to be global nomads. Their circle of friends focuses on the global market and discusses topics such as the Federal Reserve’s interest rate cuts and the latest speeches by ministers in Dubai, but they never consider one question: whether it is Web3.0 or blockchain, where are the greatest market dividends and opportunities? How can they be landed in a serious manner?

Before answering this question, we may need to digress and talk about some basic legal logic.

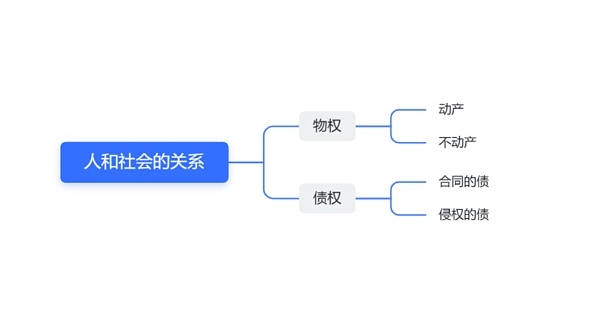

A person is the sum of a series of social relations. If we roughly classify these social relations from a legal perspective, there are roughly two types: property rights and creditor’s rights.

Property rights can be understood as the phone you are holding in your hand or the monitor you are currently looking at. If it can move, it is called movable property (such as a phone or a car); if it cannot move, it is called immovable property (such as a house).

Creditor’s rights can be understood as your right to demand something from others, whether it is because someone borrowed money from you or someone hit you and you need to be compensated for medical expenses. The former arises from a loan relationship and is therefore called a contractual debt; the latter arises from personal infringement by the other party, and is therefore called a tort debt.

Everything in the world can be simplified, and so can social relationships. It can be expressed in a mind map as:

The biggest difference between property rights and creditor’s rights is: Property rights are determined by you, while creditor’s rights depend on whether you enforce them or not.

For example, if you can’t stand reading this article anymore, you can throw your phone on the ground, and no one can stop you because the phone belongs to you. You have the right as the owner of the object.

But creditor’s rights are different. If someone owes you money and refuses to pay, no matter how hard you try to use your thoughts to make them pay or curse them, in the end, it still depends on them to pay.

So the question is, is RWA a matter of property rights or creditor’s rights?

To untie the knot, let’s take a look at how RWA tokenization works. Generally speaking, there are two main ways to tokenize RWA:

One is to transfer the ownership or income rights of physical assets to a specific blockchain address through a trust or legal contract, and then issue corresponding tokens. This method is called off-chain anchoring.

The other is to map the attributes or status of physical assets to the blockchain through smart contracts, and then issue corresponding tokens. This method is called on-chain mapping.

Regardless of the method, a trusted third-party institution is needed to verify and supervise the relationship between physical assets and tokens, to ensure the authenticity and security of the tokens.

But friends who truly love blockchain and are extremely unenthusiastic about humans understand: Once people get involved, things become unreliable.

The core problem that encrypted assets based on blockchain technology need to solve is that users can control and manage their digital assets without relying on any third party. However, according to the narrative logic of RWA, by packaging traditional assets, which may be unfinished real estate assets or long-overdue creditor’s rights that a company has on others, using RWA blockchain, it essentially turns property rights/creditor’s rights into fragmented creditor’s rights.

And the exercise of creditor’s rights requires the trust and enforcement of a third party. As a consumer and holder of RWA, when you buy RWA assets, legally speaking, you cannot directly exercise your rights, but you need to rely on offline centralized institutions.

After all, in the process of putting real assets on the chain, no matter how compliant it is, it is nothing more than making lawyers work overtime and construct various legal frameworks during the due diligence phase, and making the project party sign more pledge or guarantee agreements from a legal perspective. There is proof and progress in terms of compliance efforts, but there won’t be a qualitative difference in the matter.

In addition to deviating from the decentralized thinking of blockchain and departing from the original intention of trustlessness, RWA also faces some legal difficulties and obstacles. According to my shallow understanding, there may be several aspects that need to be addressed by experts in the field.

-

Issues of ownership and registration of RWA.

RWA refers to real-world assets, which usually need to be registered with relevant ownership registration agencies to prove their ownership and value. For example, when you buy a house in China, you need to register it with the real estate registration center and obtain a certificate to prove that the house belongs to you. If you want to sell the house to someone else, both parties need to register again. Legally, this is known as registrationism in property rights. Verbal agreements are not sufficient, only the registration by the real estate management bureau matters.

If a seller tells you that they will give you the house after you transfer the money and make a verbal promise, I guess your whole family would not agree to it.

In a blockchain network, RWA exists in a digital or tokenized form, and transactions are easily carried out. If a transfer or change of ownership of RWA occurs on the blockchain network, will it affect its ownership and value in the real world? For example, if a user tokenizes their real estate and sells it to someone else on the blockchain network, do they still have ownership of the real estate in the real world? If disputes or controversies arise, which legal system should be used to resolve them?

-

Issues of evaluation and auditing of RWA.

In the real world, assets undergo evaluation and auditing by professional evaluation agencies or third-party organizations to determine their authenticity and value before being tokenized on the blockchain. At this point, an interesting question arises: How can the value of RWA on the blockchain network be ensured to be consistent or close to its value in the real world? How can excessive fluctuations or manipulation of RWA on the blockchain network be prevented? How can the authenticity and credibility of RWA on the blockchain network be guaranteed?

-

Issues of regulation and compliance of RWA.

RWA are real-world assets that are usually subject to regulation by relevant regulatory agencies or laws and regulations to ensure their legality and security. If they exist in tokenized form, they often transcend existing regulatory boundaries and categories, which leads to a problem: How can relevant regulatory requirements and compliance standards be followed while maintaining the innovative and flexible nature of blockchain technology? How can effective regulation and management of RWA on the blockchain network be achieved without compromising user interests and privacy rights? How can interventions and dispositions be timely carried out in the event of risks or crises?

These issues not only relate to the feasibility and sustainability of combining RWA with DeFi, but also to the development and application of blockchain technology in the Chinese financial sector. To address these issues, it requires collective efforts from regulatory agencies, legal experts, evaluation agencies, blockchain enterprises, DeFi platforms, users, and others. Only by establishing a sound legal and compliance system can RWA be combined with DeFi, providing more possibilities and opportunities for financial innovation and development in China.

05 Summary

-

RWA is an idealism that many people in the cryptocurrency circle are fond of, just like DAO organizations are the ideal business for many project parties. However, the narrative logic of RWA that most people are currently discussing goes against the original intention of cryptocurrencies. Everyone hopes that asset transactions are decentralized, freely flowing globally, and can make fortunes through speculation. But they also hope that asset on-chain is centralized, assets are compliant, and asset value appreciation is reliable. This kind of operation confuses those who are not familiar with Web3.0.

-

The narrative story and demand of RWA, rather than being the fantasy of getting rich in the cryptocurrency circle, is more like the abacus of traditional financial institutions. Traditional asset management companies and fund groups have already harvested most of the big clients. How can they tell an exciting story to investors? The story of RWA is like a good show in the movie “Let the Bullets Fly,” where the county mayor and Huang Siliang team up to fight bandits in Jinshan. The name is not important, fundraising is the key. Once the money is in hand, each takes their own share.

-

RWA’s legal compliance involves aspects such as RWA ownership, registration, evaluation, auditing, and supervision. At this stage, it faces problems such as unclear regulation, imperfect laws, insufficient liquidity, and bad debt risks. RWA is feasible in China, but obviously the road ahead is long and far. Friends who want to make money in the long term should not be impatient. It might be better to let the bullets fly a little longer.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Don’t just focus on the RWA track, the oracle track is also worth paying attention to.

- Interpreting FTX’s preliminary restructuring plan Cash compensation is adopted, excluding FTT holders.

- LianGuai Morning Post | US Media Zhao Changpeng Once Attempted to Shut Down Binance’s Exchange in the United States

- Messari Development Overview of Polygon in the Second Quarter of 2023

- What impact will the detailed analysis of the Curve attack incident bring?

- Are the 10 Web3 directions released by LianGuairadigm really the future of the industry?

- LD Capital An Analysis of KasLianGuai, a POW Public Chain Based on the GHOSTDAG Protocol