Messari Overview of SandBox Development in Q2 2023

Messari Q2 2023 SandBox Development OverviewAuthors: Micah Casella & Jennifer Obem; Translation: Huohuo/Baihua Blockchain

Key Points:

1) The nominal active growth of Sandbox’s NFT minting total (59%), primary sales total (52%), and active buyer total (22%).

2) Non-land primary sales increased by 30%, real estate sales increased by 18%, resulting in a decrease of only 15% in total revenue on a month-on-month basis, while the other five revenue indicators decreased by more than 25%.

- EthCC Experience Cryptocurrency VCs Not as Good as Dogs, Applications Upgraded to Infrastructure

- A Week After the Renaming Predicting the 8 Major Changes That Will Happen to the ‘New Twitter X

- How is the OP ecosystem now? Is it worth investing in?

3) The U.S. Securities and Exchange Commission filed a lawsuit against Coinbase and Binance, claiming in the lawsuit that many cryptocurrencies and tokens, including SAND, are securities. In addition, the outcome of the SEC’s lawsuit against Ripple Labs may affect the current and future regulation of cryptocurrencies in the United States.

4) The Sandbox has partnerships with brands such as LianGuairis Hilton, Cipriani, Warner Music, Marathon City, Metafight, and Playground. Several other brands and companies are also focused on building virtual experiences in the Web3 industry.

5) According to The Sandbox’s roadmap, it plans to release new features at the end of the third quarter, such as the ability to publish experiences on the map. It will also enable users to create estates and rent/lease land and estates in the fourth quarter of 2023.

1. Getting Started with Sandbox

Sandbox is a metaverse game where players and creators can create 3D assets and experiences (such as games) that can be monetized through NFTs. The following are the tokenized and gaming features utilized by The Sandbox:

1) SAND – an ERC-20 token and digital gaming currency used for purchasing, monetization, and asset creation

2) LAND – digital ownable land within The Sandbox virtual world

3) ESTATE – a combination of land to create larger plots

4) ASSETS – assets created using the VoxEdit application, which are converted into ERC-1155 tokens when uploaded to the Sandbox marketplace

5) GEM – burned tokens to give assets attributes

6) CATALYST – burned tokens to define asset layers/scarcity

7) Game Maker – a toolbox that enables users to create 3D games and experiences within The Sandbox virtual world

Due to the tradability of SAND tokens and other assets within the Sandbox virtual world, Sandbox provides a Minecraft-like game with digital ownership and a more powerful in-game economy.

Sandbox provides various in-game NFTs as well as user-generated NFTs. The VoxEdit NFT builder is used to create 3D objects (assets) such as characters, devices, wearables, and artwork.

The Sandbox was originally launched as a 2D mobile game by software development company Pixowl in 2012. Pixowl was founded by Arthur Maddrid and Sebastien Borget in 2011. As of April 2018, the Sandbox mobile game had accumulated over 40 million downloads through iterations. In May 2018, The Sandbox was rebranded as a 3D virtual universe game and began development centered around blockchain technology. In August 2018, Pixowl and The Sandbox were acquired by Animoca Brands, a game-focused software development company, and a venture capital fund.

2. Key Performance Indicators

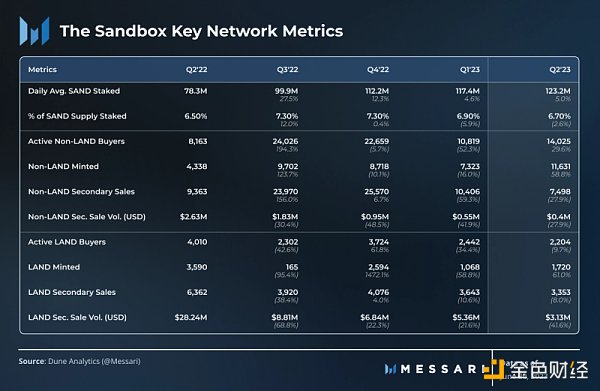

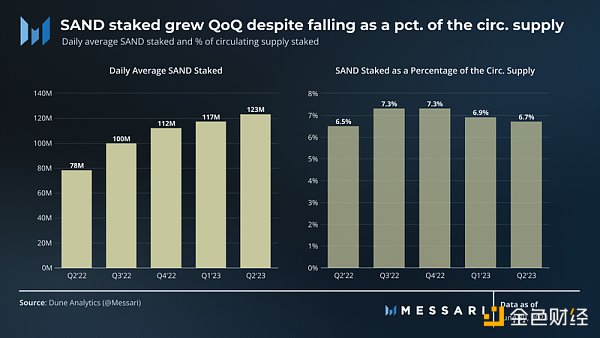

In the second quarter of 2023, key network indicators of active non-LAND buyers, non-LAND forging buyers, and LAND forgers in the first quarter of the Sandbox generally rebounded after a decline. Although the average daily SAND staking volume continued to increase, the percentage of SAND supply decreased due to more SAND being unlocked and entering circulation.

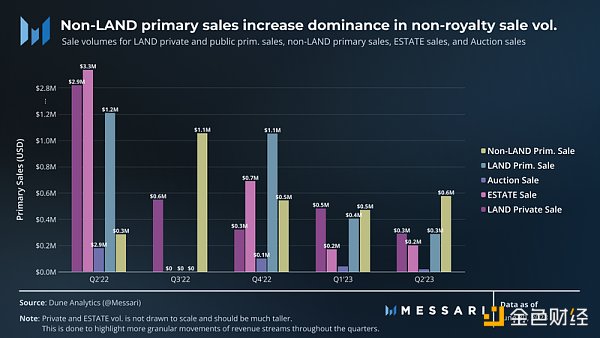

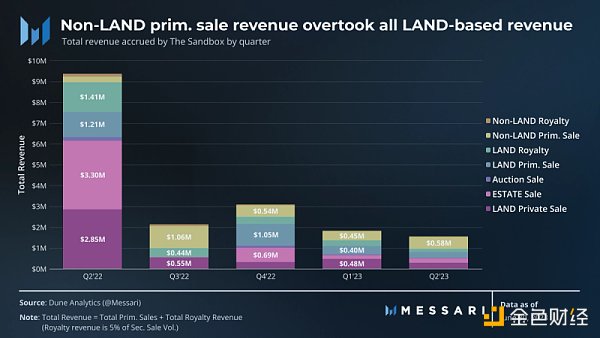

Financially, sales volume of non-LAND primary increased by 30%, while real estate sales increased by 18%, anchoring the revenue. Therefore, the total revenue only decreased by 15% compared to the previous quarter, while the other five revenue indicators decreased by more than 25%. With the increase in non-LAND primary sales volume, it surpassed private LAND sales, accounting for 37% of total revenue (higher than the previous quarter’s 24%).

3. Performance Analysis

1) Unique Active Buyers

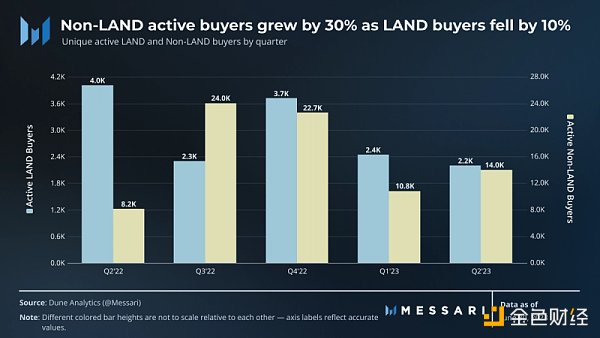

Active buyers measure the number of different wallets purchasing land and non-land assets.

Activities on Sandbox are conducted through digital real estate called LAND NFTs. Therefore, LAND is valued for its fundamental role. Non-land NFTs have lower value, although they are still necessary for various types of activities in the Sandbox metaverse (e.g. catalysts for creating assets and gems that grant asset attributes).

Due to the difference in general monetary value, LAND is more difficult to acquire (at the time of writing, OpenSea’s minimum ETH price for LAND is 0.28 ETH), resulting in a smaller buyer group. Non-land assets have lower prices (at the time of writing, OpenSea’s minimum ETH price for non-land assets is 0.0001 ETH), thus having a larger buyer group. These differences are exacerbated by poor market conditions, which may lead to a continued decline in the number of active land buyers (a 10% decline compared to the previous quarter) and an increase in the number of active non-land buyers (a 30% increase compared to the previous quarter).

2) Primary Sales Volume

Primary sales volume measures the amount of sales for Sandbox assets. Sandbox retains the revenue from primary sales.

Although land sales volume exceeds non-land primary sales, non-land primary sales volume has grown by 30%, surpassing any single type of land sales. Throughout the second quarter of ’23, users were able to forge different non-land assets from various famous series such as Hell’s Kitchen and Paris Hilton, which also held events throughout the quarter.

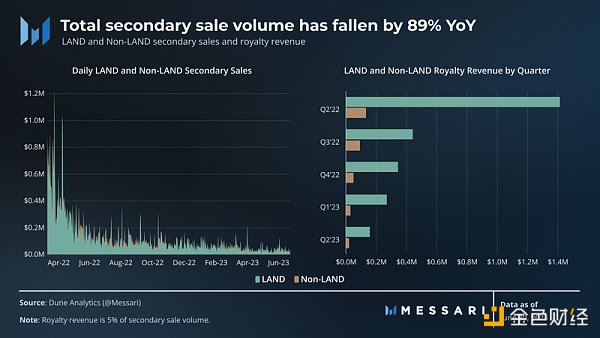

3) Secondary Sales Volume and Royalty Fee Revenue

Secondary sales volume measures the amount in USD that Sandbox assets are sold on secondary trading platforms such as OpenSea and LooksRare. Sandbox retains a 5% royalty fee from secondary sales volume.

Even though the base price of LAND has fallen, LAND continues to dominate secondary sales, dropping from over 0.5 ETH in early April to below 0.4 ETH at the end of June. Nevertheless, both land and non-land assets have experienced a decline in secondary transactions each quarter over the past year. While the drop in base price may result in a decrease in transaction volume, the continued poor market conditions may also hinder secondary market activities.

4) Total Revenue

Total revenue is the sum of primary sales volume and total royalties. Royalties account for 5% of the total secondary sales volume.

Historically, Sandbox’s revenue primarily comes from land sales. However, this quarter saw another exception as non-land sales accounted for 37% of The Sandbox’s total revenue. The rise in non-land primary sales occurred amidst a decline in non-land royalties (-28%) and land royalties (-42%), private sales (-40%), auctions (-50%), and primary sales (-29%) compared to the previous quarter. The growth in non-land native sales volume (30%) and real estate sales volume (18%) resulted in only a 15% decline in total revenue compared to the previous quarter.

5) Daily Average SAND Staking

Includes the percentage of SAND staked out of the circulating supply to observe the percentage of staked SAND that lacks liquidity and is temporarily immune to selling pressure.

The daily SAND staking amount continues to grow, with a 5% increase compared to the previous quarter. Although the amount of SAND staked has increased, the ratio of staked SAND to circulating supply has decreased by 2% due to a 3% increase in circulating supply. Despite the nominal increase in SAND staked each quarter over the past year, the newly unlocked SAND has released more liquid SAND into the economy. The increased liquid SAND may exert greater selling pressure on the SAND token.

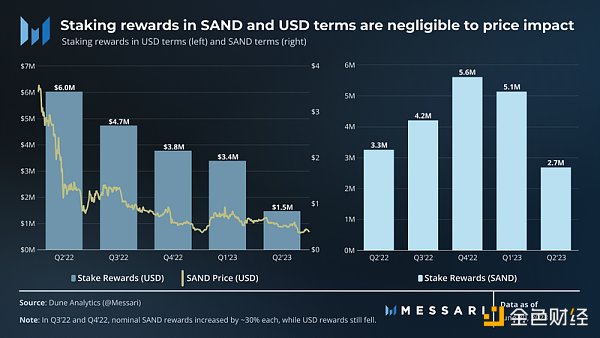

6) SAND Staking Rewards

SAND staking takes place on the Polygon network and involves two staking pools: one for landowners and another for other individuals. Landowners can stake up to 2,000 SAND for each LAND asset in the pool. In the other pool, any SAND holder can stake their SAND, although landowners receive a multiplier based on the number of LAND they own. A total of 150,000 SAND is allocated to both pools each week.

The SAND staking rewards display the total amount of USD earned by staking SAND tokens. It is compared to the price to show the frequently weighted relationship. The USD-denominated SAND staking rewards are also influenced by the amount of SAND rewarded.

In the second quarter of year 23, the staking rewards in terms of SAND decreased by 48% when calculated in SAND and 57% when calculated in USD. Although the rewards calculated in USD have been declining over the past year, the SAND rewards in the third quarter of year 22 and the fourth quarter of year 22 increased by approximately 30% compared to the previous quarter. Users who seek rewards through staking SAND seem to be more affected by the USD price of SAND than the nominal SAND rewards. The distribution of SAND from staking accounts for less than 0.2% of the newly minted SAND entering the market, making the selling pressure from SAND staking rewards negligible. The price seems to be largely a result of trends in the gaming industry market.

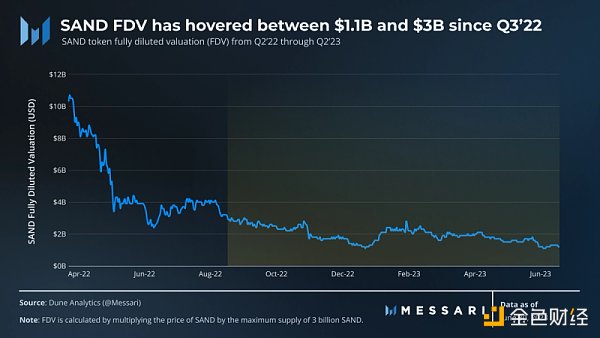

7) SAND FDV

The change in Fully Diluted Valuation (FDV) reflects the price of the asset. In addition, tracking FDV complements price fluctuations by the scale of asset importance.

The fully diluted valuation of SAND has not fallen below 1.1 billion USD. In the second quarter of year 23, it ranged between 2.1 billion USD and 1.1 billion USD. However, SAND’s FDV eventually reached 1.22 billion USD, only 1% higher than the beginning of 2023. From the beginning of the second quarter of 2023 to the end of the year, the price of SAND dropped by 35%. The decline in the price of SAND is in line with the overall trend of the cryptocurrency gaming market. The price of the second largest gaming token also experienced a similar decline, with MANA falling by 36% throughout the quarter, AXS falling by 30%, and GALA falling by 41%.

8) Qualitative Analysis

In the second quarter of 2023, Sandbox held events, announced new partnerships and integrations, and updated its future roadmap. Despite mixed signals in terms of regulations, Sandbox remains focused on building and improving its gaming ecosystem.

Notable events, partnerships, and integrations:

With the new partnerships and integrations announced in the second quarter of 2023, the Sandbox ecosystem continues to evolve. Many projects have collaborated with The Sandbox to provide customized metaverse experiences for its users. Below are a few notable projects:

– Fitness Brands – Gym Aesthetics, Salsation, Go24, Cycliq, Stages, Playinnovation, Trib3, and Myzone.

– DanceFight – A popular dance battle app that has released an exclusive avatar collection based on 10 world-class street dancers on The Sandbox.

– Marathon City – Launching a metaverse experience themed around “Nipsey Hussle’s Universe” to honor the legacy of the late rapper.

– Cipriani – Announced collaboration with Cipriani to offer experiences featuring iconic venues such as Harry’s Bar.

– Playground – Launching a unique digital environment for NBA star LaMelo Ball’s fans on The Sandbox.

Paris Hilton (LianGuairis Hilton) – Launched the first avatar collection of Paris Hilton (LianGuairis Hilton) (sold 5,555 pieces).

Open Campus – Acquired LAND in Sandbox to provide a Web3 education-themed metaverse experience.

SBS Content Hub – The subsidiary of the Korean radio station SBS Content Hub is collaborating with The Sandbox to introduce popular media content into its metaverse.

Nuclear Blast – Independent record company collaborating with The Sandbox to create a heavy metal-themed virtual universe experience called “Blast Valley”.

Gamer Arena – The leading gaming platform in Turkey is launching Sandbox interactive gaming experiences for its users.

Affyn – Singapore-based Web3 company Affyn is collaborating with Sandbox to launch an interoperable metaverse experience, with a focus on the global creator and collaborator community.

MMA Management Game – MetaFight is launching an exclusive, limited-time MMA-themed experience, which is independent and complementary to the MetaFight game, with unique game activities and rewards.

Infinite Pulse – A music-themed community with major artists and record companies such as Warner Music Group, Jamiroquai, and Elvis, which kicked off with the first sale of its 1015 LAND.

4. Roadmap and Updates

The future upgrades planned for LAND owners are as follows:

Ability to publish experiences on the map, which is planned to be released by the end of the third quarter of 2023. This feature will be initially launched to creators. By the end of the fourth quarter of 2023, the ability to mint and sell in-game assets with NFT functionality on the blockchain will be realized.

SAND Staking Program, with a weekly reward of 100,000 SAND, limited to the SAND and LAND owner pool. This program will end on July 4, 2023.

Starting from April 2023, LAND owners who have held LAND for more than three months are eligible to receive an exclusive NFT. Land sales for Movie Verse, Sports LAND, as well as more local community LAND sales from brands such as Warner Music Group, Adidas, Lionsgate, and more are planned for the third/fourth quarter of 2023.

Ability to create estates and lease land and estates, planned for release in the fourth quarter of 2023. In the fourth quarter of 2023, experiences hosted on Premium LAND will gain additional visibility on the map.

Mega City 3 LAND Lottery – Sandbox launched a lottery event for Mega City 3, a virtual city that integrates various aspects of Greater China. The virtual city features 17 brands and IPs, offering 222 regular LANDs, 12 premium LANDs, and a series of exclusive NFTs. In addition, OpenSea also auctioned off 6 estates and 12 1×1 LANDs.

5. Coinbase and Binance Actions

The U.S. Securities and Exchange Commission (SEC) has filed lawsuits against Coinbase and Binance, accusing them of operating unregistered securities trading platforms in violation of U.S. law. The position of these lawsuits is that many cryptocurrencies and tokens are securities, including SAND.

Shortly after the lawsuits were filed, the court overseeing the separate lawsuit brought by the SEC against Ripple ruled that XRP is essentially not a security. However, it also ruled that certain transactions involving the initial sale of XRP constituted “investment contracts” and securities under U.S. law. This ruling could impact current and future enforcement actions and regulations related to cryptocurrencies in the United States, including the lawsuits against Coinbase and Binance.

6. Summary

Despite a challenging quarter with declining revenue (-15%), staking rewards (calculated in SAND -48%), and SAND price (-19%), Sandbox continues to persevere by facilitating new partnerships and launching new asset collections (such as LianGuairis Hilton, The Wild Ones) to enhance the experience for current users. Due to the regulatory uncertainty brought by the mixed signals from the SEC classification and court rulings, the Sandbox ecosystem will continue to face an uphill battle. However, with the growth in new partnerships and the increase in NFT minted volume (72%), primary sale volume (52%), and active buyer count (22%), there is hope that Sandbox can expand its network marketplace at the next turning point.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Tech Giants’ Battle of X Digital Identity, Payments, Social Graph, AI, and Universal Basic Income (UBI)

- After a massive layoff of 73%, can Star Atlas, a 3A masterpiece born in a bull market, still be launched as scheduled?

- After LSDFi, will the liquidity provided by derivative LPDFi trigger the next wave of DeFi narrative?

- Bybit Payroll Manager Steals Large Amounts of USDT, Singapore Court Elaborates on Cryptocurrency Property Attributes

- Binance Chain L2 pioneering application MEKE to start public testing on July 31st

- Involved in a transaction of 400 billion yuan, how do law enforcement agencies dispose of confiscated cryptocurrencies?

- How will the five market makers improve the liquidity of WLD compared to Zero as a market maker for PEPE?