Big coffee perspective: 20 investment tips from the founders of Messari and the crypto market outlook

Cryptocurrency research company Messari recently released a report on the cryptocurrency market, and organized and analyzed 120 trends and opportunities in the crypto space.

Scallion will translate the investment experience and the trends of Bitcoin and Ethereum. This article will only compile investment tips (Scallion Note: All of the following do not constitute investment advice, for reference only).

The 20 investment tips listed by Messari founder and CEO Ryan Selkis are:

I. Analysis of 20 top currencies with market capitalization

- How to judge whether the STO project is compliant? ——Based on public or private equity

- Introduction | Sablier: Uninterrupted Wage Flow with Ethereum

- Tencent Security Expert: How can blockchain technology be applied to digital construction of government affairs?

1.BTC: Digital Gold

2.ETH: Defi lock-dominated (before 2018: ICO dominated)

3.XRP: Too-Big-To-Jail Coin

(Scallion Note: too big to fail is an economic concept. It means that when some large-scale or critically important enterprises in the industry are on the verge of bankruptcy, the government should not take them lightly to avoid those companies fail (The huge chain reaction that is caused has caused more serious harm to the whole society, which is called "too big to fail.")

4.USDT: Surprise! USDT has more reserves than most large banks. (2018: Surprise! USDT is solvent)

5.BCH: Bitmain's chips

6.LTC: BTC betanet4

7.EOS: There is a monopoly alliance (cartel). (2018: Is this legal?)

8.BSV: FaketoshiCoin

9.XLM: Destroy tokens because no one buys them. (2018: Cool. Full of mystery)

10.BNB: Unregistered security token.

11.LINK: Widely welcomed by XRParmy, Ripple's hashtag community.

12.ADA

13. XTZ: Staking services will never be counterproductive.

14. Algo: If no one redeems, the market value may return to the top 20?

15: TRON: fake-it-til-you-make-it coin

16.XMR: Fluffy Pony Watch Fund

17.LEO: Securities-like virtual assets

18.ATOM: a supplement to ETH

19.NEO: Chinese version of Ethereum

20.HT: Securities-like virtual assets

Second, Bitcoin will continue to lead, altcoin will lose blood and go down

The rise of Bitcoin in 2013 and 2017 was mainly driven by new investors. And Bitcoin is the asset most likely to once again attract the next major new buyer (such as an institution).

However, this time, the price of Bitcoin is likely to only rise slowly. Ryan Selkis believes that Bitcoin will reach a new high before we enter the macro "Risk off" again.

(Scallion Note: Risk off means that all funds have escaped the stock market, commodities and precious metals due to fear of risk, and bought USD and US Treasuries.)

The sell-off will continue

I mentioned in my previous paper that most tokens will fall more than 99% from their all-time high. This is mainly because once the team and internal investors start to liquidate positions, it will cause huge selling pressure.

For token projects that have raised a large amount of funds in 2017, once the transaction is opened or started, the situation may become overwhelming and will proceed in a very rapid manner.

Competition between cryptocurrencies and the US dollar

If citizens' mistrust of most governments continues to rise, then cryptocurrencies will be a relatively strong asset.

V. "crypto + gold" investment portfolio

If you are a gold investor, why not buy 2% of your gold portfolio for Bitcoin? The potential distribution of Bitcoin can be seen from the age distribution of Bitcoin investors.

Update crypto portfolio

Crypto asset portfolios can be updated, such as stablecoins, bitcoins, platform coins, security tokens, etc.

Staking rewards in the inflation model

8. In the medium term, I am very optimistic about Staking rewards

In the medium term, I am optimistic about Staking rewards. However, Staking is likely to be monopolized for a period of time, just like the proof-of-work (PoW) mining mechanism that runs today.

Crypto-securities markets are disappointing

As predicted last year, cryptocurrencies have not made much progress in the securities market. Few tokenized real estate / private company stocks / corporate bond projects flow into the market.

Ten, in terms of scale, stablecoins will soon surpass Bitcoin

The stablecoin scuffle is heating up, and of course this is the best choice for the long-term development of cryptocurrencies. If central bank digital currencies in some countries can be issued smoothly, the size of interoperable global stablecoins may exceed Bitcoin in the short term.

Eleven, the returns of most crypto funds are lower than expected

Most crypto fund managers have a negative alpha, which means that actual returns are lower than expected returns.

Twelve, I am still optimistic about crypto funds

Compared with previous expectations, more top-level funds seem to have longer lock-up periods and more reliable LPs (limited partners, ie investors), so liquidation may not be out of control.

Thirteen, passive products

When Bitcoin's market capitalization dropped to 36%, I predicted that most crypto funds would not perform as well as Bitcoin and Ethereum. In this case, a large amount of funds will flow into passive index funds. But I overestimated the potential for crypto ETFs to be approved within two years, which has continued to make crypto funds popular.

Fourteen, gray products

This refers to the "ETF" of Grayscale Investments, especially the Bitcoin Investment Trust and Ethereum Investment Trust. (Does not constitute investment advice)

Fifteen or three indicators

When it comes to emerging basic indicators, I like these three indicators the most:

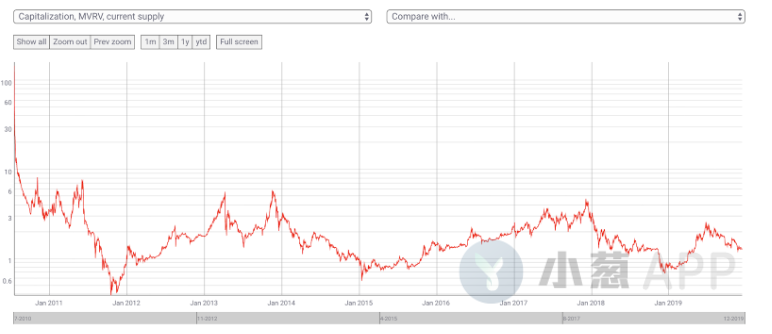

1. Market Value / Realized Value Ratio (MVRV). Bitcoin's MVRV ratio fell below historical lows twice in January 2015 and November 2018, and these two Bitcoins happened to be at the bottom of the cycle.

Since this summer, LTC's MVRV has fallen by 50% and ZEC is only 0.32.

However, this indicator is only valid if you believe in the fundamentals of an asset.

2. Liquidity Coverage Ratio

Dividing the real trading volume of the exchange by the daily dollar value of newly sold / mined cryptocurrencies in a given network gives you liquidity coverage. This will let us know if the asset is sufficiently liquid to handle the new liquidation without significantly reducing the price.

3. Network fees as a percentage of new circulation

Network transaction fees can be the driving force for such tokens.

16.Macro competition

The next year or two may determine whether encryption will become an important asset class in the 1920s.

17.Ecological funds are still developing

The ICO market will eventually have a clearing day, just like the Internet bubble collapsed. However, some projects have sufficient capital to deploy the future. What they need is a keen understanding of how to allocate funds to support their networks.

18.Decentralized Autonomous Organizations (DAOs)

The investment shares of decentralized autonomous organizations (DAOs) are the original securities tokens. DAO is an investment fund, and its decisions are made directly by investors, rather than entrusted to dedicated managers. This may be one of the most exciting areas in the cryptocurrency market after 2020.

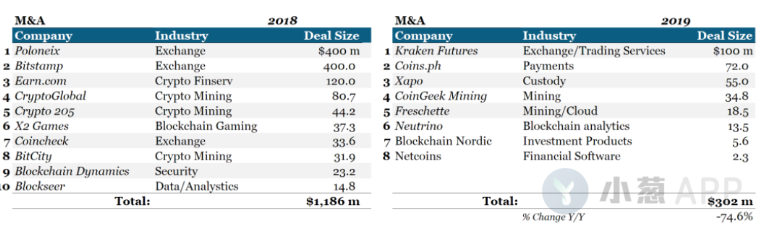

19. M & A activity will continue to increase

A few bitcoin whale, miners, and major cryptocurrency exchanges own the vast majority of bitcoin. BitMEX, Coinbase, Binance, Kraken and Huobi are expected to make nearly $ 1 billion in acquisitions over the next 24 months.

The following figure shows the large-scale merger and acquisition activities carried out by cryptocurrency exchanges and some projects organized by TokenData.

Twenty, on-chain migration and agreement merger

In the past year, we have seen many ERC-20 tokens migrate to native blockchains, rather than ERC-20 tokens to Ethereum (such as Tether).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- One Piece Online Teaching | Digital Asset Security Management Answers

- First in the country! Judicial Application of Judicial Blockchain Smart Contract Technology in E-commerce Dispute

- New York Times article: Pursue innovation or avoid responsibility? Social media giant's decentralization movement questioned

- Hidden dangers behind the DeFi prosperity ecosystem and 2020 outlook

- Hong Kong's first trial virtual bank, Zhongan Bank, struck, using core technologies such as blockchain

- Ant Financial Services will change! New CEO: Blockchain is one of Ant Financial's fintech application chassis

- Year-end summary | 2020 panoramic view of the digital asset industry, these may be your most concerned