Asset on-chain practice: how the emerging public chain Algorand 2.0 promotes real-world transactions with ASA

Author: LGC

Source: Chain News

Editor's note: This article has been deleted without changing the original intention of the author.

- Big coffee perspective: 20 investment tips from the founders of Messari and the crypto market outlook

- How to judge whether the STO project is compliant? ——Based on public or private equity

- Introduction | Sablier: Uninterrupted Wage Flow with Ethereum

If Bitcoin's dream is a peer-to-peer currency system, then Ethereum's vision is "the world's computer." Around Ethereum, quite a few application scenarios have appeared in the past few years. From the enthusiasm caused by the issuance of tokens to the popularity of Crypto Kitties, from stablecoins to Defi … However, the current application scope of blockchain public chains is still relatively narrow. On the one hand, the efficiency of various Dapp applications on the public chain is far inferior to that of the private and alliance chains. The real killer application has not yet appeared; on the other hand, the public chain that carries too many possibilities does not seem to Implementation of each specific industry.

In the real world, regardless of securities, bonds, real estate, credit points, airline miles, and various valuable collectibles, the transaction and confirmation of rights involves various legal and policy restrictions. The blockchain seems to still be running in the fairy tale world, and it is completely unable to cope with the complicated and bloated real world of finance. Assets on the chain are still a distant dream.

Perhaps there is a blockchain perspective that uses assets as a lens and penetrates various trading scenarios. The emerging public chain Algorand revealed such a perspective and ambition in its 2.0 upgrade.

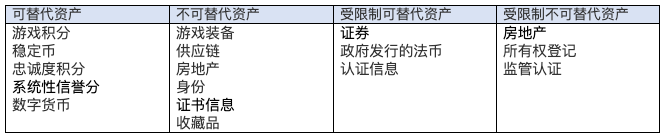

Algorand proposed a new concept-standard assets, namely Algorand Standard Assets, referred to as ASA. Looking at the real world from the perspective of ASA, a wide range of assets can be incorporated into a large table based on whether they are replaceable and subject to two unrestricted rulers:

The above asset list is actually the main applicable scenario of ASA.

ASA has powerful generalization and abstraction capabilities, which are in line with Algorand's genes. The initiator of this project is Silvio Micali, a cryptographic expert who is one of the creators of the Turing Award and one of the creators of zero-knowledge proofs.

The asset application scenario of Algorand ASA has given people anticipation and imagination. Below we explain the details of ASA standard assets in detail.

Asset classification and solutions from the perspective of ASA

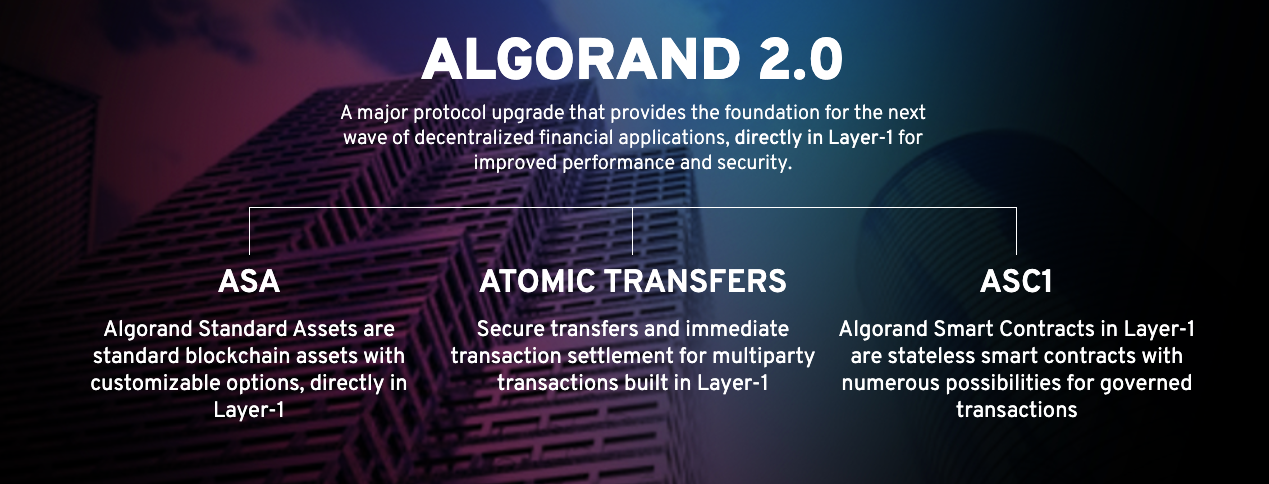

ASA is one of the three major elements in the Algorand 2.0 upgrade, which means that various asset types can be developed and implemented on Algorand. ASA has a key role in promoting Algorand's future application in various international compliance businesses. The other two major elements are Algorand Smart Contract, referred to as ASC, and Atomic Transfer, which can be used to confirm the transfer of multiple parties at the same time. Atomic swap.

In order to understand the difference between Algorand's standard assets (ASA) and assets in other public chains, we can use the ethereum that developers are familiar with as an analogy.

First, the current Ethereum tokens are generally divided into replaceable tokens and irreplaceable tokens, and are implemented by different smart contracts.

The difference between Fungible Asset and Non-fungible Asset is that the application scenario of the former is that there is no difference between holding this token and the other one, such as Algo, you hold 1,000 and then sell Drop it and buy 1,000 more. All these Algo tokens have no difference from each other and are exactly the same nature. Irreplaceable assets represent a certain type of certification and information and cannot be replaced. The crypto cat game that caused a lot of congestion on Ethereum before, its assets (each unique kitten) are unique. In the same way, our identity information, art treasures, etc. all have unique characteristics that cannot be replaced.

In order to create an alternative token on Ethereum (such as points in a game), engineers need to write a smart contract to implement all the functions defined in ERC-20, so that the token conforms to this standard. For tokens like points and tokens, the ERC20 standard is sufficient. But for unique items, the ERC20 interface can't handle it. For example, a famous Van Gogh painting and a Cezanne painting are obviously completely different assets. So there was the ERC721 standard for collectibles.

ERC20 tokens are replaceable, while ERC721 tokens are irreplaceable, and each ERC721 token is unique and indivisible.

From a security perspective, we have found that if there are bugs and errors in the application of the ERC-20 token, it may lead to hacking and property damage.

In contrast, Algorand's asset ideas are more abstract, or more considerate to developers and application scenarios. It implements the classification of replaceable and irreplaceable tokens directly on the first layer of Layer 1. This means that anyone can simply create a token on the Algorand blockchain using standard solutions, instead of implementing it through a second layer of smart contracts. This will make transactions of these assets safer and faster. Since Algorand's transaction fees and execution costs are low, this will provide developers and enterprises with a simpler way to issue assets and a smoother trading experience.

As we mentioned earlier, in addition to whether it can be replaced, ASA also uses another perspective to divide assets, that is, whether it is restricted. The tool to address this classification is called RBAC. The Token Manager can reserve some management rights for the token through Role Based Asset Control (RBAC). Specific permissions include forcing transactions or freezing tokens in one or more accounts. When an economic model and scenario require this kind of authority, people can add it to the smart contract of the token.

For example, Token Manager can not only freeze the tokens of users who are suspected of illegal behavior, but also can choose to lock and freeze all accounts before generating tokens. We can imagine various compliance scenarios, or more operational details of financing and lifting of bans, such as the need to meet KYC / AML requirements before the tokens in the account are unlocked, or after a certain release lock period or task has passed Only then can the tokens be unlocked, or transactions can only be made in specific whitelisted addresses.

With role-based asset control, Algorand enables a variety of compliance applications. On Algorand, people can issue tokens that comply with any national or international regulations.

It should be reminded that RBAC is optional, it is not mandatory. Role-based asset control, suitable for issuers and managers in their daily business, regulatory compliance, and other regulatory needs. For simple alternative tokens, most Token Manager personnel may choose to create Trustless Tokens that do not require any centralized management authority. With various RBAC options, one can create customized standardized tokens for specific use cases.

In summary, the ASA uses two dimensions to divide all assets, thus forming four major categories: replaceable assets, irreplaceable assets, restricted replaceable assets, and restricted irreplaceable assets.

Four application scenarios of ASA

In today's economy, there are still many problems with the digitization and tokenization of assets, such as how to integrate into the overall global digital market, 24×7 transferability at any time, instant settlement settlement, ease of use and execution of asset control Performance, management needs to consider efficiency issues such as compliance and reporting timeliness.

We select one type of case from each of the four major areas to illustrate the role of the ASA.

Algorand ASA's case in the field of alternative assets

Algorand ASA in the field of stablecoins and game credits

Algorand can be used to create stablecoin assets, such as USDT has announced that it will issue stablecoins on Algorand. Such assets are completely replaceable. Essentially, each USDT is the same, and can be divided and accumulated. The stablecoin issuance records and transfer transaction records will also be completely recorded on the chain. Game points are similar. If there is a trading market, users' game points can be traded with each other. Unlike game equipment, game points are a replaceable asset.

Application of Algorand ASA in the field of irreplaceable assets

Certificate Information: Proofplum

The proofplum blockchain certificate application developed on Algorand solves the problem of certificate anti-counterfeiting by creating a tamper-resistant digital certificate.

Documents, certificates, and identity information that currently involves individuals are scattered across many devices and cloud services, including many factual details such as ownership, authenticity, or achievement information. And anyone can edit a PDF or image certificate to change the name or achievement. In order to check the validity of a document, people need to go back to the publisher, and the publisher checks and verifies the authenticity according to their own database. Blockchain certificates like proofplum solve this problem by creating tamper-resistant digital certificates. When issuers create certificates, they anchor the claim information in the public blockchain. This means that even a small change in data can invalidate the certificate. This also fulfills the promise of the blockchain that individuals can own and prove the authenticity of transactions without an intermediary.

In such scenarios, each asset is unique, so it is an irreplaceable asset.

Algorand ASA in restricted alternative assets

Securities Issue: Securitize

When securities assets are trading with each other, such as shares of the same symbol, there is no essential difference between this one and the other. However, in almost all jurisdictions and countries, securities transactions need to pass the relevant investor qualification review to participate. In other words, not everyone anywhere can participate in the trading of a particular digital security. Therefore, securities are basically a restricted alternative asset.

The cooperation between Securitize and Algorand enables publishers to issue digital securities on the Algorand blockchain through Securitize's DS protocol. Because Securitize's mission is to provide a global solution for compliant digital securities, this partnership is a restricted alternative asset in four areas of the ASA. The issuance of compliant securities on Algorand can greatly increase the efficiency and reduce the complexity of the operation, and move the entire securities industry into a new era.

Application of Algorand ASA in restricted irreplaceable assets

Real Estate: AssetBlock

Real estate transactions generally have stricter compliance procedures and legal documents due to consideration of asset confirmation and investor protection, so they are restricted assets. There are two types of asset scenarios in real estate transactions. One is the asset tokenization of real estate projects that are difficult for ordinary investors to participate in, such as using Algo in exchange for certain shares in a real estate fund. Another scenario is that the transaction target is a tokenized asset of a complete house. The difference between the two is that if it is a pure real estate fund investment, it is similar to securities, which is a restricted alternative asset at this time. If it is an investment in the entire house or a specific value area, then it is completely unique and a restricted irreplaceable asset.

AssetBlock's joint venture with top luxury hotel asset management company Lodging Capital Partners (LCP) announced that it will provide exclusive $ 60 million hotel properties on the Algorand platform, all of which will be tokenized.

Recently, the Italian Authors and Publishers Association and Algorand also reached a cooperation on copyright management business. The association issues an average of more than 1.2 million licenses for its protected works every day. This cooperation, if implemented successfully, will represent the huge potential compliance and practicality of Algorand's use of copyright. Similarly, in cooperation with Algorand, the chess organization will adopt a hybrid IPO, which may also lead to a new wave of listing in the future, that is, the first issue of token financing, and then the formal stock exchange.

Algorand's vision is to use technology to promote frictionless finance. Other technology upgrades of ASA and Algorand 2.0 provide new and more efficient tools for traditional finance and decentralized finance, thereby further approaching the vision of frictionless finance. .

references

1. " Algorand 2.0 finishing three characteristics ," the authors: Algorand Foundation, 2019-11-22 2. " Algorand investment research report ", the author: Lee Geng Che Santi, 2019-10-28 3. " Algorand's first 2.0 tamper-proof digital certificate application Proofplum "author: Algorand Foundation, 2019-12-4 4." Assetblock launched Algorand based real estate investment platform "by: Algorand Foundation, 2019-9-17 5." Algorand 2.0 Technical Innovations the Use Cases and ", author:. Tobias W.Kaiser, 2019-11-29

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tencent Security Expert: How can blockchain technology be applied to digital construction of government affairs?

- One Piece Online Teaching | Digital Asset Security Management Answers

- First in the country! Judicial Application of Judicial Blockchain Smart Contract Technology in E-commerce Dispute

- New York Times article: Pursue innovation or avoid responsibility? Social media giant's decentralization movement questioned

- Hidden dangers behind the DeFi prosperity ecosystem and 2020 outlook

- Hong Kong's first trial virtual bank, Zhongan Bank, struck, using core technologies such as blockchain

- Ant Financial Services will change! New CEO: Blockchain is one of Ant Financial's fintech application chassis