Hidden dangers behind the DeFi prosperity ecosystem and 2020 outlook

Author: Cao Yin, general manager of the Digital Renaissance Foundation Director

Source: Chain News

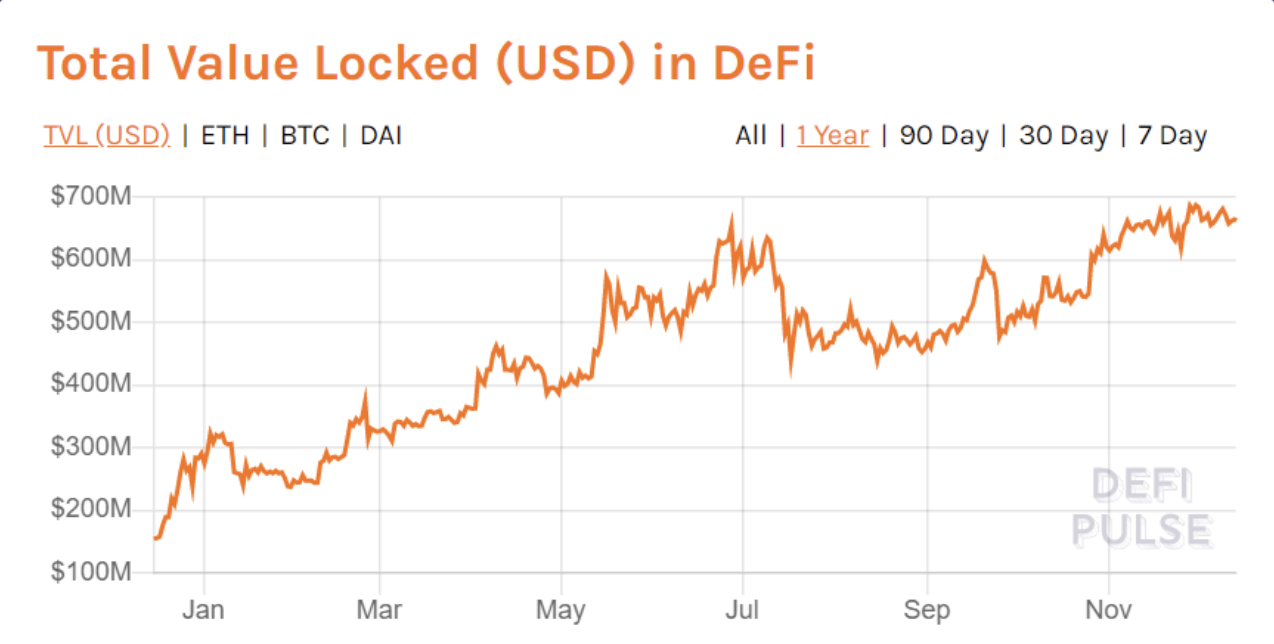

In 2019, many people call it the year of DeFi. From January 1 to December 13, 2019, the total amount of assets pledged in various DeFi applications increased from US $ 275 million to US $ 665 million, an increase of more than 240%.

- Hong Kong's first trial virtual bank, Zhongan Bank, struck, using core technologies such as blockchain

- Ant Financial Services will change! New CEO: Blockchain is one of Ant Financial's fintech application chassis

- Year-end summary | 2020 panoramic view of the digital asset industry, these may be your most concerned

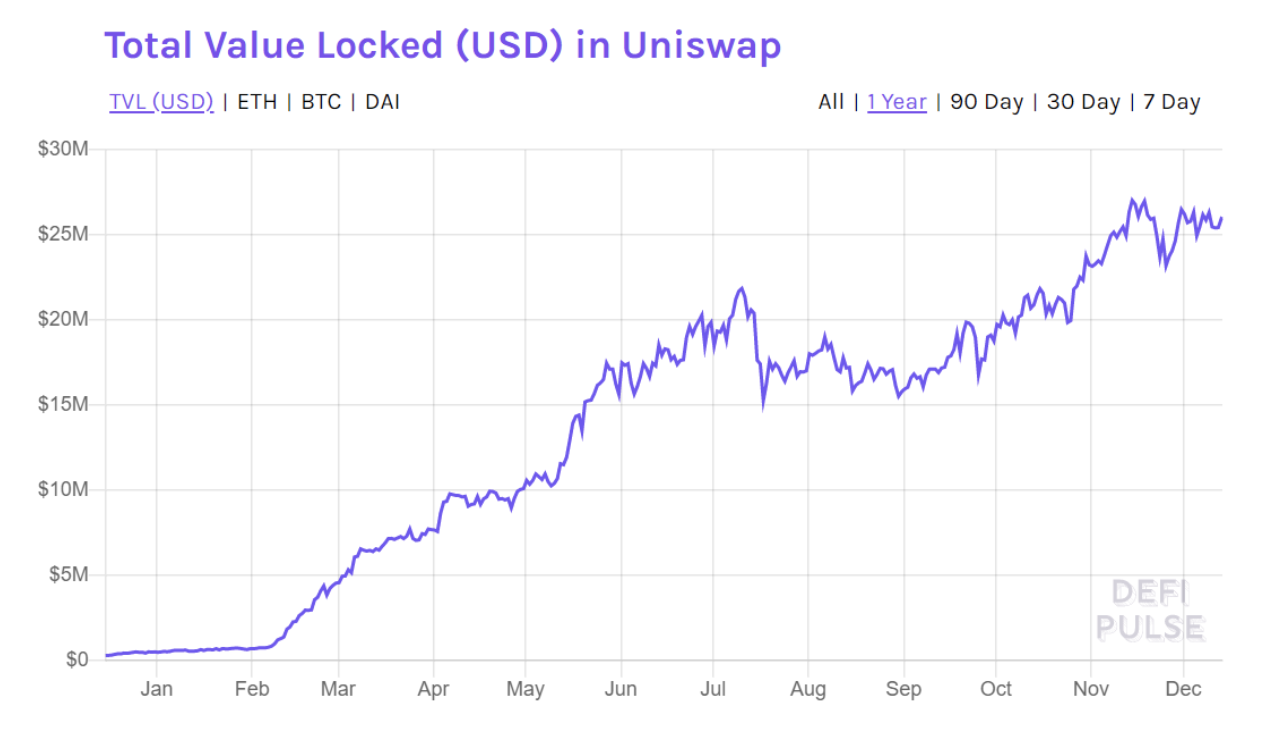

The assets pledged in Maker alone increased from 250 million US dollars to 335 million US dollars, an increase of more than 130%. The decentralized exchange Uniswap, which was launched in mid-December 2018, is more representative. January 1, 2019 Uniswap only pledged $ 470,000, and by December 13, $ 26 million had been pledged in Uniswap, a 55.3-fold increase.

In addition to the rapidly growing asset scale, many new DeFi business models and DeFi star projects have emerged in 2019, supporting Maker 2.0 with multi-asset collateral, a decentralized exchange Uniswap, a decentralized margin trading platform dYdX, and decentralized The UMA Protocol, the decentralized lending agreement Compound, launched version 2.0 of the protocol, the decentralized asset synthesis protocol Synthetix, the decentralized insurance agreement Nexus Mutual, the Cosmos-based cross-chain stable currency protocol KAVA, and the cross-chain BTC WBTC, imBTC, xBTC, and InstaDapp, which aggregates various DeFi protocols, etc.

In 2019, we, like migratory birds, worked with global DeFi developers from New York, to London, to Berlin, to Shanghai, to Osaka, to San Francisco, to Helsinki and witnessed through developer conferences. The Cambrian explosion of open finance has shown that in the world of blockchain encrypted assets, various DeFi protocols have filled business models such as insurance, borrowing, derivatives, risk-free interest rates, and asset securitization in the traditional financial world. The niche of being able to participate is a great luck and opportunity for blockchain practitioners.

However, although I have no doubt that DeFi has a bright and beautiful future, it does not mean that there are no obstacles and traps on this bright avenue. We have discovered 4 fatal risks that may cause the 2020 DeFi ecosystem to be overturned.

I. Compliance Risk

Any freedom is bound to come at a price and a border, especially free finance. Heath Tarbert, the new chairman of the United States CFTC, said in November that when ETH is transferred from POW to POS, CFTC may consider ETH as a security according to the Howay test , because ETH from POS provides sustainable income. Compared with the SEC, CFTC has always held crypto assets. With a more open attitude, if the CFTC considers ETH as securities, then the SEC has no reason to still use POS ETH as a commodity. As a result, all DeFi agreements with ETH as the underlying asset are likely to be recognized as securities business by US regulators.

This means that all projects that provide DeFi services to U.S. customers and platforms that acquire customers for the DeFi agreement must be licensed to operate. Although it is reasonable to say that the DeFi project party is only a protocol developer and does not directly provide services to customers, but Now, most of the DeFi project parties develop their own clients and directly face the customers, and the risks are not small. Also, consider whether regulators in other countries will follow the US.

In addition to the threats defined by the CFTC and SEC securities, DeFi also faces threats from the US National Security Agency. Recently, Virgil Griffith, a scientist at the Ethereum Foundation, was arrested in the United States by the FBI on suspicion of helping North Korea circumvent U.S. financial sanctions, facing up to 20 years in prison. Regardless of whether Virgil is convicted or not, this case will cause the US government to notice DeFi. At present, all DeFi do not require KYC / AML. The US government is really serious. All DeFi are illegal financial activities and violate a series of US anti-terrorist financing. And sanctions bills , as long as DeFi customers have citizens or companies in the sanctioned country, they are within the jurisdiction of the US long arm, which is more fatal than the crime of illegal securities business.

In addition to the United States, other countries, such as China, may also take high-pressure regulatory measures against DeFi. However, the scale of DeFi is too small now, which does not constitute a condition for large-scale capital flows. After the release of the DeFi agreement, it is difficult to completely eliminate it. Therefore, Higher regulatory costs and lower regulatory benefits.

However, DeFi developers may have troubles. Deion aggregators such as Zerion, Instadapp that provide services directly to customers may have troubles, and wallets integrating DeFi clients may also have troubles.

Systematic risk

The so-called systemic risk refers to the failure or attack of one or several DeFi protocols, and the failure of other DeFi services caused by the interconnection between the DeFi protocols. DeFi has an endogenous basis for systemic risk.

First, dependencies between DeFi projects.

Many DeFi projects directly call the functional protocols of other projects. Many DeFi projects use the 0X transaction protocol and the Uniswap protocol for liquidity. InstaDapp opens CDP directly on the Maker and imports Compound, let alone for various types. The dependence of the oracle protocol, in addition to the protocol dependency, the asset dependency between DeFi projects is greater. DAI has become the basic currency of DeFi, and the CToken of Compound is also circulating between some DeFi projects. As various DeFi assets are in DEX Starting to circulate on the Internet, the composition of dependencies between DeFi assets will become more common. This phenomenon of close dependence between stacked protocols and assets is called DeFi Lego.This phenomenon played an important role in the early rapid development of DeFi, enabling crypto assets to flow smoothly between closed-loop protocols and avoiding them. It makes no sense to repeat development.

However, this dependency may also be an important reason for the DeFi systemic risk outbreak. Assume that in this building block system, one or more DeFis have large-scale debt defaults (unable to close positions) due to various reasons, and have not responded to the plunge. The current risk compensation mechanism may cause risks to be quickly transmitted through the agreement channel or asset channel to other agreement assets, resulting in a series of liquidation between DeFi assets. There can be many factors that trigger systemic liquidation, such as failed protocol design, such as price fraud caused by oracle attacks, malicious modification of interest rates caused by governance loopholes, mortgage rates, such as failure to cover short positions caused by severe ETH network congestion, etc. .

If it is too abstract and unimaginable, look back at how BitUSD failed. Suppose the current DeFi ecosystem is built on BitUSD instead of DAI and USDC (in fact, DAI is not particularly stable). What will happen? Suppose ETH plummets by 34% in a short time, and what happens when the eth network is attacked by malicious DoS?

Second, DeFi systemic risks may arise through panic transmission and mimetic runs.

Even though the DeFi project has a relatively complete firewall between protocols and assets, it can prevent risks from being transmitted in the system, but it cannot prevent risks from being transmitted through the emotional channel through participants as the medium.

In the traditional financial world, when a bank fails, other bankers may think that their bank will also fail, so they can withdraw their deposits, which causes these banks to fall into a liquidity crisis and eventually to collapse. This phenomenon also exists in the DeFi world. The herd mentality of investors can be easily exploited by malicious short sellers. For the purpose of shorting the target DeFi token, the attacker may focus on attacking a vulnerable DeFi protocol and penetrate the DeFi's excess mortgage lifeline causes collective malicious or passive defaults. Risks may not be transmitted to other DeFis through protocol channels and asset channels, but may be transmitted to other DeFis through emotional channels, causing group panic, runouts, or the occurrence of DeFi assets. Stomp sales.

In the end, there is no final bottom line.

In the traditional financial world, even if the most serious systemic financial risks occur, there are still central banks exercising the role of ultimate lender to set aside all debts. Although the result will cause a serious oversupply of currency and dilute the wealth of the whole society, the central bank ’s finalists The role is similar to Dinghai Shenpin, which has played a role in stabilizing market expectations. Of course, in reality, most central banks' rescue is not very effective in many cases, especially in developing countries where foreign exchange reserves are already stretched. However, even if the central bank can't afford the bottom, there are still IMF, World Bank, and international syndicates as The bottom line of the reinsurance system is that even if the results are very bad, you can refer to South Korea after the Asian financial turmoil and recommend watching the movie "Day of National Bankruptcy".

But in the DeFi world, there is no real bottom line, code is law, everything is code, and it is still decentralized. As a result, it is impossible to cut off the chain of risk transmission. Although Maker, known as a decentralized central bank, can take the responsibility for CDP debt through the global clearing mechanism, the result of global clearing is that the entire DAI-based DeFi ecosystem is overturned, and there are governance loopholes in Maker's global clearing mechanism. Possible hijacking.

In addition to Maker, there are now several decentralized central banks that benchmark Maker. Take Synthetix as an example. These stablecoins use their own tokens as basic assets and issue stablecoins. The credit of the tokens depends on the market's confidence in the project. . Just like the currency of a small country in a deep structural economic crisis, if investors believe that Synthetix will fail completely, then SNX is waste paper. No one will pay for SNX with real money. The result is a vicious circle. The more SNX sends, , The less valuable SNX is, the less one has to pay for Synthetix's debt. Therefore, regardless of whether it is Synthetix or Maker, it is possible that due to the black swan incident + deliberate attack + protocol loopholes, it is impossible to get the bottom line, and the entire DeFi ecosystem built on it will fall like a domino chain until the debt is passively cleared. The system restarts and starts a new cycle.

At present, most DeFi assets are Ethereum assets, including the native token ETH, and the erc20 contract token. If there is a major problem during the upgrade of Ethereum 2.0 in 2020, all Ethereum assets will be affected. It may trigger the above-mentioned systemic risks, which are quickly transmitted to the entire DeFi system through the protocol channel, asset channel, and emotional channel, resulting in collective panic stamping on Ethereum asset holders, selling ETH and erc20 assets, penetrating parts and even The bottom line of risk for most DeFi protocols has led to the destruction of the entire existing DeFi system.

3. Liquidity risk

At present, the scale of DeFi's pledged assets and generated assets are very small. The transaction mechanism is either flashed through a decentralized fund pool, similar to the product conservation principle of uniswap, or a decentralized orderbook. This decentralized The trading infrastructure may be manipulated by a large number of malicious selling and buying orders, causing excessive slippage in the transaction, distorting the transaction price, resulting in distortion of the overall market price, and even affecting the feeding mechanism of the oracle. DeFi contract is liquidated.

If it cannot be controlled, allowing this risk of liquidity depletion to pass between the DeFi protocols may trigger the systemic risks described earlier. Moreover, in 2020, ETH will begin to officially convert to POS, and it will experience multiple Phases and upgrades. Each upgrade is a thrilling breakthrough in Ethereum. It may be used by others and combined with malicious market manipulation, it will make waves in the DeFi market.

Fourth, involution risk

At present, the users of DeFi are mainly speculators, and many of them are used to increase leverage to speculate in coins, or even bet on contract derivatives, such as the now popular Synthtix. Directly, contract gambling that does not require delivery, naked gambling. I participated in an investment contest more than a month ago and bet on Synthetix's token snx. Now it has ranked second among more than a hundred targets. From the increase in snx, we can see the current DeFi ecosystem. If DeFi can only be used as a speculative tool and cannot serve the real economy, the funds in DeFi are likely to swell quickly, and then disappear quickly as most people gradually close out their positions. Its crisis path is like the 97 Asian financial crisis. In the Southeast Asian countries, the influx of hot foreign capital in the early stage has raised asset prices, shared capital dividends, raised asset prices to unreasonable high levels, created a large amount of debt, gradually sold assets and fled, and allowed follow-on funds to take over. The financial system of the entire country was instantly destroyed.

Therefore, DeFi must now find a path to connect the real economy as soon as possible and step out of the speculative circle. The Maker team has the same understanding as me. They have been looking for physical assets. We are also working on a project now. We can cooperate with mortgage applications such as Maker to introduce the stable cash flow assets of the physical world for the DeFi world and import the DeFi funds flow to Productive financing in the real world.

Outlook

Before 2020, the digital currency market has begun to storm. In 2020, we will experience BTC halving, ETH upgrade 2.0 to POS, Libra issuance, central bank digital currency issuance, the second phase of the Sino-US trade war negotiations, and the US presidential election . Any factor has a bearing on life and death for digital currencies and DeFi. Impact, if our DeFi practitioners cannot come up with an effective solution to the above four challenges, then DeFi is like a boat sailing in a storm and will be overturned at any time.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research: double spend is not worth it, Bitcoin transactions do not have to wait for 6 confirmations

- Babbitt Column | Stupid Protocol and Smart Terminal, Why Bitcoin's Simple Design Is Right

- European Central Bank's legal digital currency PoC first exposed, small transactions can be anonymous

- Popular Science | Blockchain Wallet: From Entry to Mastery

- Babbitt Column | Which File Must I Know About Blockchain Entrepreneurship?

- What is the potential of blockchain + finance? A perspective on the layout of these 30 financial institutions

- U.S. traditional institutions improve Bitcoin financial infrastructure, good news in Q1 2020