Popular Science | Blockchain Wallet: From Entry to Mastery

Author / Source: tokenbankteam

Editor's note: The original title was "Blockchain Wallet from Entry to Mastery". This article has been deleted without changing the original intention of the author.

- Babbitt Column | Which File Must I Know About Blockchain Entrepreneurship?

- What is the potential of blockchain + finance? A perspective on the layout of these 30 financial institutions

- U.S. traditional institutions improve Bitcoin financial infrastructure, good news in Q1 2020

Blockchain wallet development history

Speaking of digital currencies, digital currency wallets are inseparable. Bitcoin has been born for 10 years, and the blockchain has undergone three iterations of 1.0-3.0. During this period, the wallet evolved from a single-asset wallet and a single-chain wallet to a multi-chain and multi-asset wallet, from a single transfer payment wallet to a blockchain ecosystem service platform.

Wallet 1.0 Period (2009-2013)

In 2009, Bitcoin's main network was launched. The blockchain of this period has just started. As a huge distributed ledger, Bitcoin has only simple transfer and accounting functions.

Limited by the development of the blockchain, the wallet at this time is used to store Bitcoin. In the form of a single asset wallet, a wallet can only support one currency.

On June 29, 2011, Bitcoin payment processor BitPay launched the first Bitcoin e-wallet for smartphones. On July 6, the same year, a free Bitcoin digital wallet app appeared in the Android App Store, which was the first Bitcoin-related smartphone app.

Wallet 2.0 period (2014-2018)

In 2014, the launch of the Ethereum project announced that the blockchain has entered the 2.0 era, and smart contracts have begun to be applied to the blockchain. At this time, the wallet can also perform on-chain contract operations in addition to transferring and receiving money. However, because the blockchain speed at this time is slow, the wallet can only perform non-transient response contract services.

Ethereum's block production speed is 15 seconds. Regardless of the network environment and other issues, a transaction must be recorded on the blockchain, which takes about 15 seconds.

A smart contract is a set of computer programs that can guarantee the execution of a contract without the need for a third party. Anyone can perform calculations and develop application layers based on this.

Wallet 3.0 period (2018-present)

Beginning in 2018, the optimization of blockchain 2.0's slow speed and high miner fees has been optimized to achieve the high concurrency and high scalability of the blockchain. .

EOS's block generation speed is 0.5 seconds. Regardless of the network environment and other issues, a transaction is recorded on the blockchain in only 0.5 seconds.

In addition to the basic storage transfer function, the wallet at this time can also interact with the on-chain contract in real time; the wallet is no longer a simple asset management tool, but also a public chain ecological service platform; at the same time, the single chain wallet Unable to meet user needs, more and more wallets are developing in a multi-chain direction. Nowadays, users can experience asset management, asset trading, DApp, social, information, market and other functions through their wallets.

The wallet has gradually assumed its role as the entrance to the blockchain world.

Basic knowledge points of blockchain wallet

To learn to use a blockchain wallet, you must master the following five related noun definitions: public key, private key, mnemonic, Keystore, password.

Public key

Public key = account number = transfer address, which is equivalent to your bank card number. The public key can be freely disclosed to the outside world without any risk. Just like others know your bank card number, nothing can be done except to transfer it to you.

Private key

Private key = identity verification, equivalent to your bank card number + password. The private key is composed of numbers and uppercase and lowercase letters. The private key degrees of different blockchains are generally different. The public key can be derived from the private key. It should be noted that once your private key is lost or forgotten, it cannot be retrieved, so it must be kept in a safe place.

Mnemonic

Because private keys are not easy to remember, mnemonics have appeared, and mnemonics are just another form of presentation of private keys. It usually consists of 12 or 24 English words. For the convenience of domestic users, there are also mnemonic versions in Chinese characters. As long as you remember these words and type them into the wallet in order, you can restore the wallet and perform any operation. If someone else gets your mnemonic, it is equivalent to getting your private key, and you can control your assets.

Keystore

Keystore = card number. The essence of Keystore is the encrypted private key. Keystore must be used with your wallet password to be effective. The keystore, private key, and mnemonic are common to all wallets. The wallet service provider may only provide users with one or more of these methods due to product design reasons. There may be some problems with the wallet.

password

In order to further enhance security, most wallets will use a password to encrypt the private key twice. The encryption method and storage method of each wallet are different. This is why when you use a wallet for transactions, you always need to authorize it. This actually involves a complicated process such as the wallet using a password to decrypt the private key and then using the private key to sign the transaction.

Wallet security tips

- The public key can be exposed without affecting the security of your assets. It's the same as telling your bank card account.

- Once the mnemonic and private key are leaked, the asset will be at great risk to be controlled by others. At this time, you need to transfer the asset to another address immediately. The original address is no longer used.

- The keystore is leaked. No matter whether the password is leaked or not, there is a risk that others control the asset, so you need to quickly transfer the asset to another address.

- If the account private key of EOSIO (including EOS, BOS, WAX, etc.) and IOST is leaked, you can also replace the new private key to prevent others from controlling their assets.

- When storing private keys and mnemonic words, we recommend using an offline form (manual copying, printing, etc.) for data backup, while keeping the backed up content properly. It is very unscientific and error-prone to back up information such as keystore by copying, so users can store the keystore as a file, and then store it in a U disk, and then properly manage the U disk; It is not recommended that you take screenshots, network transmission (QQ, WeChat), cloud storage, etc. to back up, these methods may encounter hacking attacks, resulting in loss of assets.

Blockchain wallet classification

We will classify wallets from the two directions of private key storage and private key generation.

Private key storage

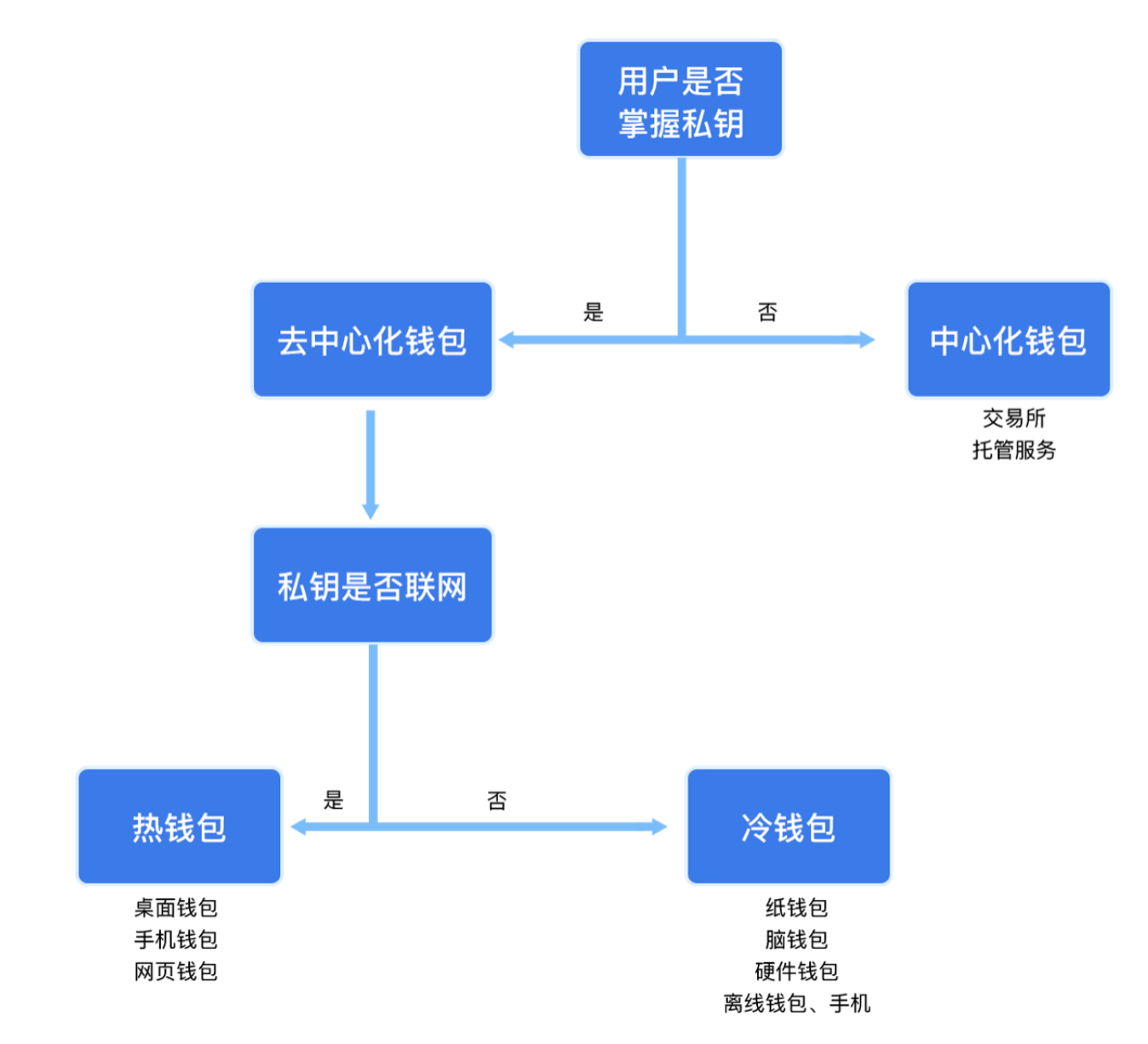

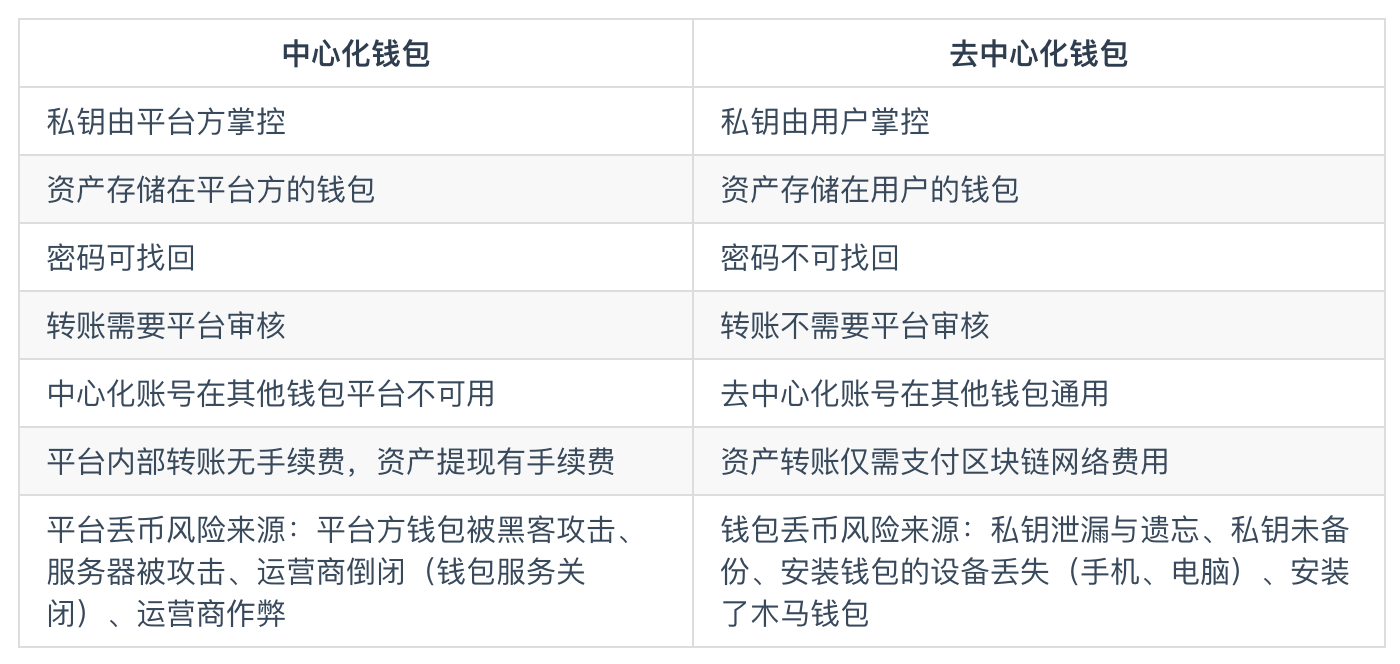

According to the storage method of the private key, that is, whether the user has the private key, we can divide the wallet into "centralized wallet" and "decentralized wallet".

The storage method refers to the existence. Only after the user holds the private key and imports it into the wallet, the private key is only stored on the user's device. , It is "centralized."

Decentralized wallets can be divided into "cold wallets" and "hot wallets" based on whether or not they have access to the network during the private key storage process; the contact network here refers to whether the wallet is online, not whether the private key is in the network. The meaning of transmission.

Common hot wallets are desktop wallets, mobile wallets and web wallets. Cold wallets generally refer to paper wallets and hardware wallets that are not connected or cannot be connected to the Internet.

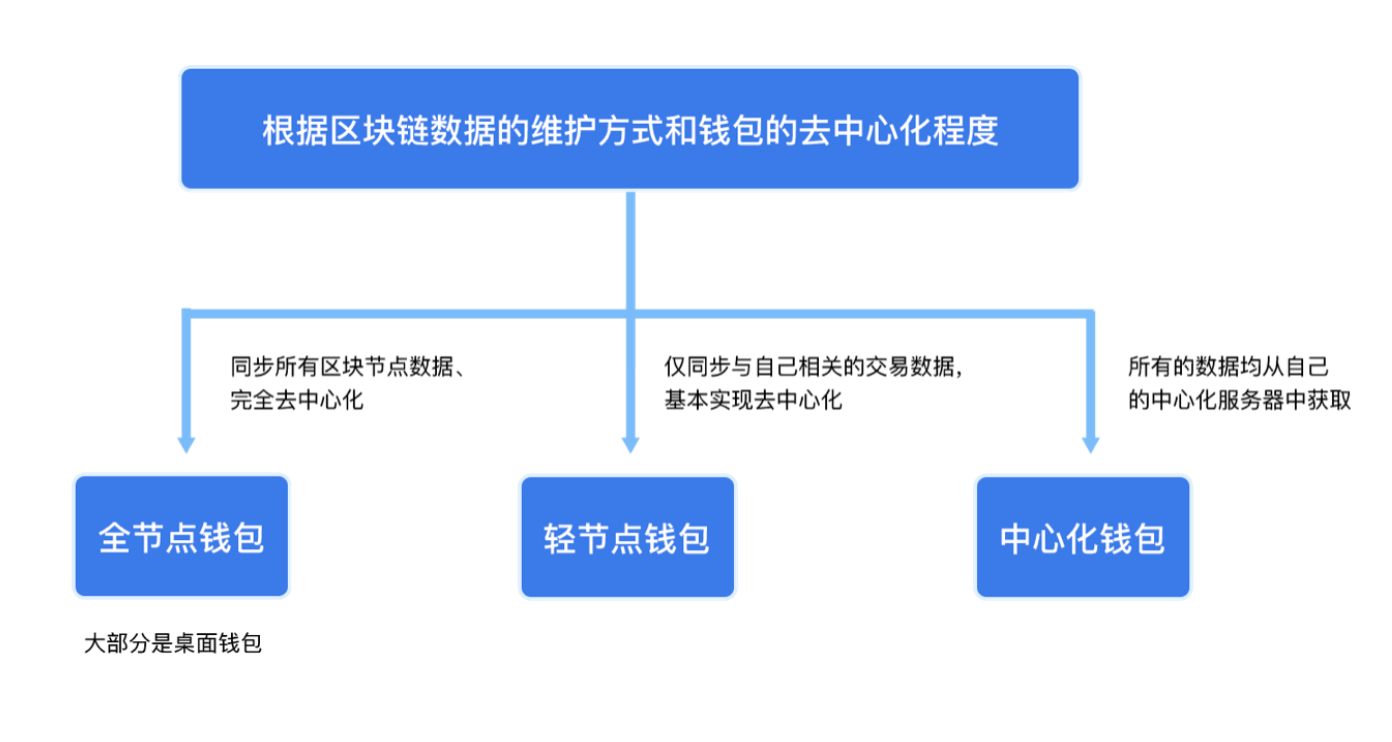

According to the degree of decentralization of wallets, wallets can be divided into full node wallets, light node wallets, and centralized wallets.

A full node wallet is to synchronize all data on the blockchain to the wallet, which will take up a lot of storage space, so most full node wallets are desktop wallets. Among the most representative are Bitcoin Core Wallet, Geth, Parity, etc. Because the full node wallet needs to synchronize all block data, it can achieve complete decentralization.

According to DApptotal data, as of September 2019: Ethereum's full node data size is 433GB, EOS's 430GB, and Bitcoin's 279GB.

Light wallets are wallets that rely on other full nodes in the blockchain network.

The data of the decentralized wallet are all data on the blockchain, while the data of the centralized wallet depends on the wallet service provider's own ledger. For example, our wallet on the exchange is a centralized wallet. We transfer money to an address specified by the exchange, and then the exchange records our recharge records on its own ledger. After that, we make recharge transfers and transactions every time. So he adds or subtracts directly on his account book. And this whole process did not happen on the blockchain at all.

Private key generation

This section is slightly more outline

From the generation of the private key, we can divide the wallet into "non-deterministic wallet", "deterministic wallet" and "hierarchical deterministic wallet", and the "hierarchical deterministic wallet" is Enhanced version.

Non-deterministic wallet

There is no relationship between the private keys generated in the wallet and they are independent of each other.

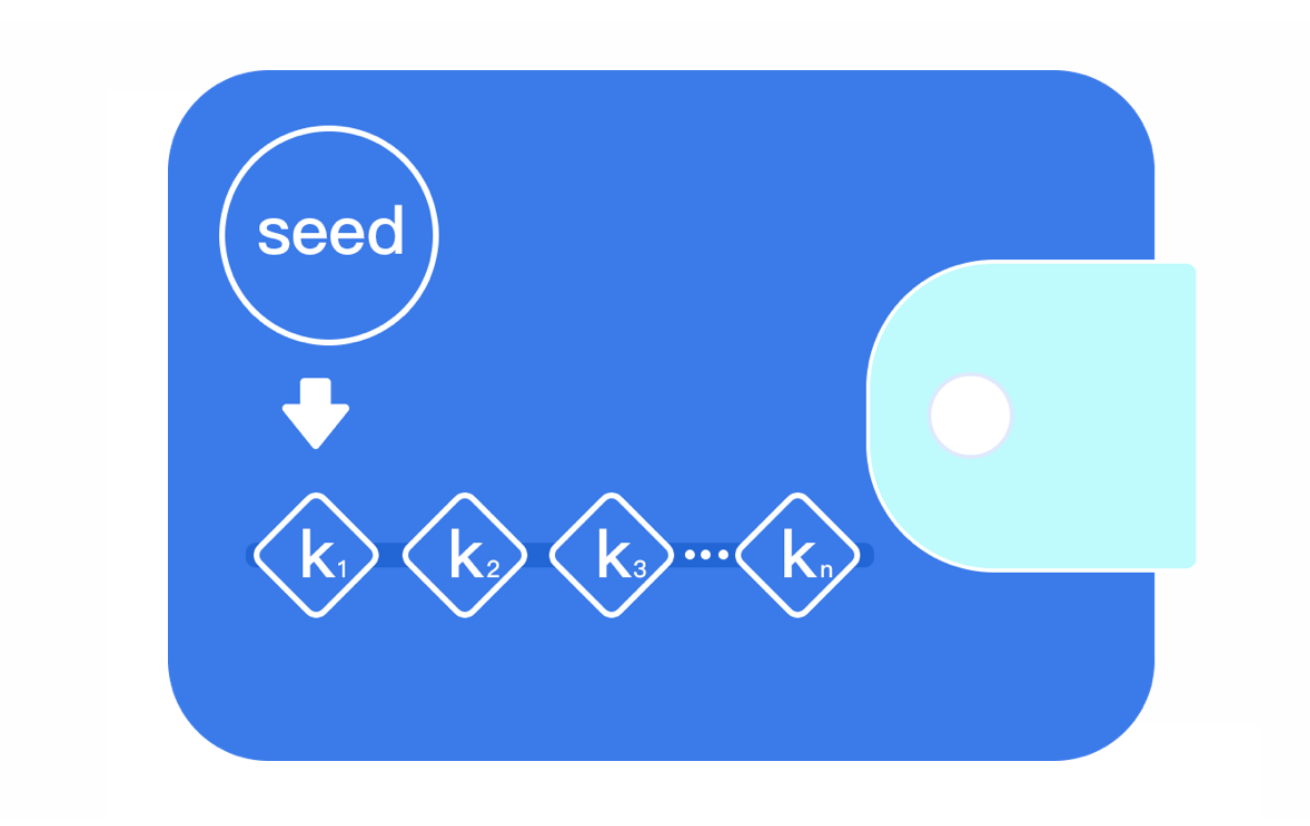

Deterministic wallet

The private key is algorithmically generated by a "seed", such as "mnemonic" is the form of a seed. The private key generated in this way, as long as the algorithm is consistent, the private key can be consistent; and a seed can derive unlimited private key addresses.

For better understanding, we can use "deterministic wallet" as a metaphor for a branch with different leaves in different positions on the branch, but as long as you choose the same position, the leaves in that position will always be the same piece. The leaf here is the "private key" we mentioned.

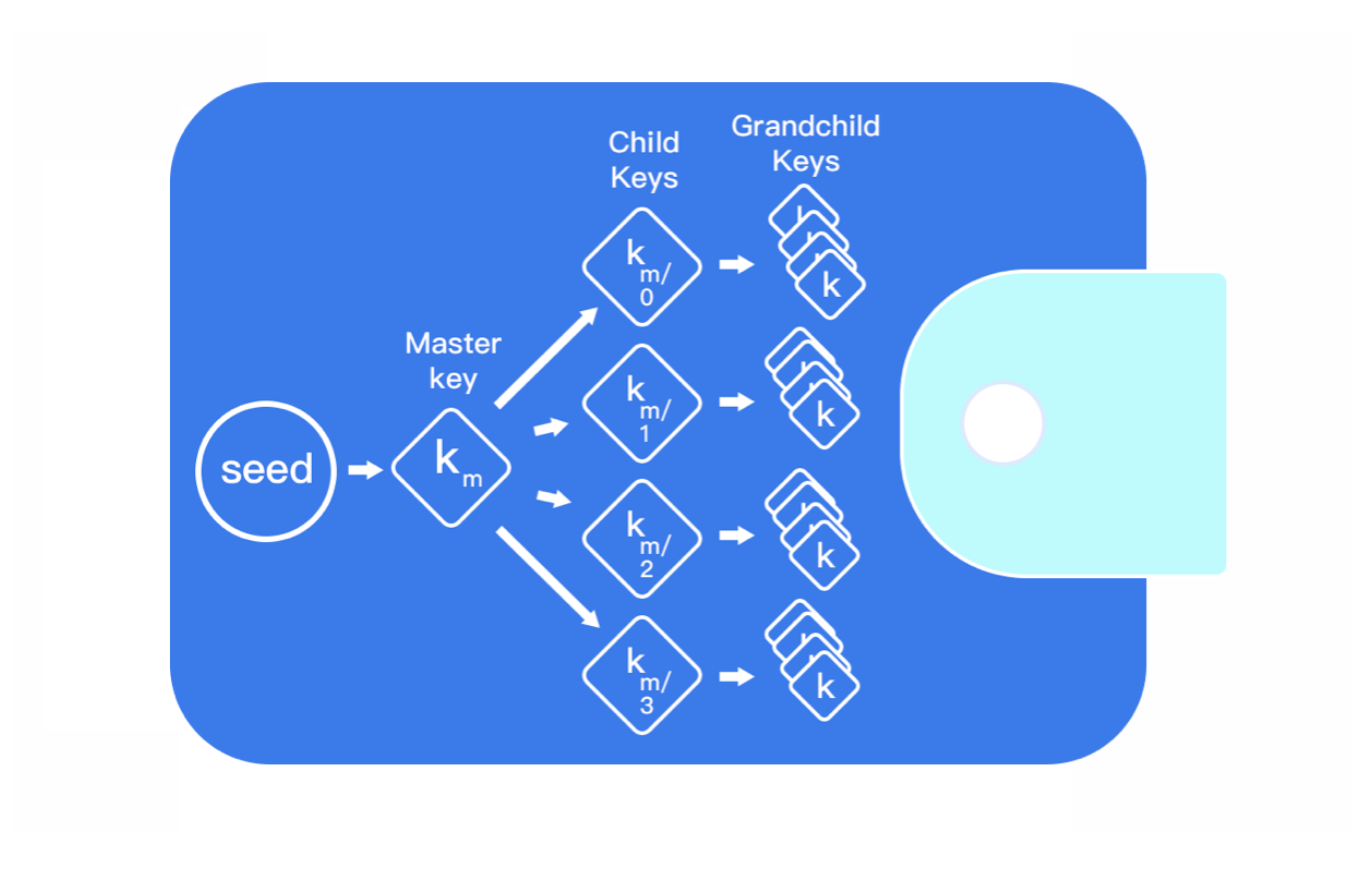

Hierarchical Deterministic Wallet

It is an enhanced version of the deterministic wallet. It introduces the concept of "master private key" for deterministic wallet, namely HD wallet. Its hierarchical structure is that the private key generated from the master private key can itself become a master private key, and then a deterministic wallet is generated by the above method.

Similarly, we can compare "layered deterministic wallets" to trunks; there are many branches on a trunk, and the leaves on each branch are certain. So, as long as we determine a certain position on a branch, that leaf is determined. That is, the private key is certain.

Blockchain wallet function introduction

The wallet is the entrance to the blockchain and has rich functions including asset management, which can meet the various needs of users.

Create a blockchain account

The display form of a blockchain wallet is divided into an address and an account, which we collectively refer to as accounts here; the accounts of different blockchains are different, and the degrees may also be different. The creation fee for different blockchain accounts is also different. For example, Ethereum and Bitcoin accounts are free, but EOS accounts need to be created at a certain cost.

Since the creation of a blockchain account is a complicated process, the existence of a wallet is to help users simplify these processes. Generally, during the account creation process, the wallet will guide the user to back up the private key or mnemonic, and then perform secondary verification to ensure that the private key or mnemonic backed up by the user is accurate. On the blockchain that needs to create an account through payment, the wallet will generally help users complete the payment process using traditional payment tools to reduce the difficulty of users.

Digital asset management

Digital assets mainly refer to various tokens on the blockchain. The existence of a wallet greatly facilitates the management of assets owned by users, mainly including transfers, receipts, viewing asset details, transaction details, etc. . The function is similar to a bank app. You can see what assets you currently own, how many, and how to transfer your assets.

It should be noted that assets between different blockchains cannot be transferred directly, that is, you cannot transfer BTC (Bitcoin) to an Ethereum account, and you cannot transfer ETH (Ethereum) to a Bitcoin account.

Digital asset trading

The digital asset transactions supported by the current wallet mainly include the following three cases: currency exchange, exchange transactions, and OTC transactions.

Currency exchange

Through currency exchange, you can exchange assets on different blockchains. For example, you can directly exchange BTC (Bitcoin) that you own into EOS.

Ordinary transactions can only be traded in the form of a basic pair, and then the final target currency is traded through the basic pair. For example, if I want to change from A to C, I need to achieve it through the intermediary B, A-> B, B-> C; and the currency exchange simplifies this process and directly converts A to C

Exchange trading

All three forms of current transactions are centralized exchanges, decentralized exchanges, and aggregate exchanges.

The centralized exchange requires us to deposit the currency in the exchange account, and then the transaction only occurs in the centralized data of the exchange. Decentralized exchanges do not need this process. This greatly reduces the risk of loss of user assets caused by theft or running of exchanges. In a decentralized exchange, users use their wallets to transfer coins to smart contracts, and smart contracts complete on-chain matching transactions before transferring coins back to users. Contract transactions, while improving transparency, have also greatly reduced dependence on the central medium.

Aggregation Exchange

Aggregated exchanges are a trading platform that aggregates all exchanges, allowing users to easily conduct cross-platform transactions without downloading many apps. Aggregation exchanges share the depth of other exchanges and trading pairs of other exchanges. For example, after you register an aggregated exchange account, every time you buy or sell BTC (Bitcoin), you can choose the most cost-effective from different exchanges to trade.

Some wallets have started to support aggregate transactions.

OTC

OTC (Over The Counter) trading is a point-to-point trading method that is guaranteed by a third party outside the exchange. OTC in the blockchain usually refers to one-to-one buying and selling transactions of fiat and digital currencies between OTC users. At present, the largest OTC is mainly OTC of the exchange, and some wallets have access to third-party channel providers that provide this service.

Participate in ecological construction

At present, in some public chain designs, users in the ecology are encouraged to actively participate in the public chain ecological construction. The main forms are node voting, referendum, staking, etc.

Node voting

Take EOS as an example. EOS has a total of 21 super nodes. Users can vote for up to 30 nodes by staking EOS in their hands. The purpose of voting is to allow users to choose nodes that can contribute to ecological development and contribute their own power. Thus promoting the stable development of the ecology.

Referendum

Referendum refers to the blockchain ecosystem in which participants can initiate proposals that they believe are beneficial to the community, and the entire blockchain coin holders will vote. When the number of votes exceeds a certain standard, the proposal will automatically take effect. The referendum approach is beneficial for community users to actively participate in blockchain governance.

Staking

Staking Chinese name equity pledge. At present, some public chains adopt the form of staking to encourage holders to pledge Tokens and generate stable nodes. For example, COSMOS pledge can enable the pledger to obtain a certain annualized income (settled by the pledge currency), similar to the fact that you have invested in a bank for current financial management.

Experience DApp

DApp is an abbreviation of Decentralized Application, which translates to decentralized application, which refers to application development based on the blockchain.

At present, DApps are mainly concentrated on Ethereum and blockchains such as EOS, TRON, and IOST. The relationship between DApp and the underlying platform is like the relationship between APP and iOS and Android systems.

For example, EOS DApps cannot run on the ETH layer, just as Android apps cannot run on the iOS system. You can experience the decentralized financial MakerDAO on ETH in the wallet, experience the EOS rewards in EOSRAcing, and you can also use the coin hunting pool on IOST for mining and wealth management.

At present, some large games are in the form of third-party independent APPs. When experiencing DApps in these APPs, you also need a wallet as a medium for login and transaction authorization.

Appreciation of assets

Wallets naturally have financial attributes. At present, wallets have integrated a variety of financial tools and functions including mining pools, wealth management, mining, project investment, etc., which can meet the needs of users' asset appreciation.

Mining pool

The current mining methods are mainly POW mining and POS mining. POW (Proof of Work) is computing power mining, which is also familiar to us, such as BTC (Bitcoin), ETH (Ethereum) mining; POS (Proof of Stake) mining is to imitate POW computing power mining, holder Tokens can be mortgaged to validator nodes to get reward dividends.

At present, the wallet mining pool is basically based on POS mining. Some wallets also support the purchase of cloud computing power for BTC (Bitcoin) mining.

Financial management

The wealth management products in the wallet are very similar to traditional wealth management products, the only difference is the settlement method. Usually, an estimated rate of return will be agreed. After purchasing the wealth management product with Token, the user will make regular settlement according to the agreed settlement date, which can be retrieved or renewed when it expires.

Mining

DApp mining is mainly used for mining. Some DApp mining machine products are integrated in the wallet. Using the mining machine can quickly and easily obtain the tokens that you want to mine. Taking the recent fire of EIDOS as an example, the EIDOS mining machine can help users realize automatic transfer mining. These mined tokens can be sold on the exchange to gain income.

Investment

Taking HOO Labs of Tiger Symbol Wallet as an example, you can use USDT to support projects on it, and obtain the token of the project according to a certain percentage based on the amount of USDT support.

Social

Some blockchain wallets also have social functions, and you can communicate with other users in the wallet.

Hardware wallet supporting management tools

A hardware wallet is usually paired with a software wallet as a management tool. Hardware wallet vendors such as Ledger, Trezor, and Kushen have developed their own software wallets.

Similarly, software wallet manufacturers will also cooperate with hardware wallet manufacturers to develop their own dedicated hardware wallets, such as Bitpie's hardware wallet, BitShield, imToken's imKey, etc.

Obtaining Blockchain Information

Most wallet users have transaction requirements, so usually wallets will incorporate Token prices into the product. In addition, content modules such as newsletters, articles, and even project tweets will be added to the product.

Different from other blockchain media, wallet news and articles are mainly related to the blockchain-related content supported by the current wallet, which is more targeted.

How to choose a blockchain wallet

First, we need to understand the difference between a centralized wallet and a decentralized wallet, and then choose based on our own needs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory: 4 important moments to change the trend of the crypto market in 2019

- Babbitt enters cross-border finance, joins banks to launch China's first blockchain re-export trade product

- Japan's KOL Bitcoin: Mad study, keep chasing, and strive to build a trusting society | 8 问 文 版

- Pioneering exploration of fiat currencies in European countries

- Research Report | Survey on Blockchain Application of Charity

- How to value DCG with three core businesses: Grayscale, Genesis and CoinDesk?

- Legal analysis of smart contracts: What is the difference between smart contracts and traditional contracts?