What is the potential of blockchain + finance? A perspective on the layout of these 30 financial institutions

The financial field has always been regarded as an excellent application scenario of blockchain technology, and major domestic financial institutions' exploration and vocalization of blockchain applications has become increasingly frequent.

Recently, Yi Huanhuan, president of the Beijing Internet Finance Association Research Institute, predicted in an exclusive interview with the Securities Daily that blockchain + finance will be fully implemented in 2020, with stocks, loans, mortgages, products, smart property and smart contracts, etc. Will all be involved.

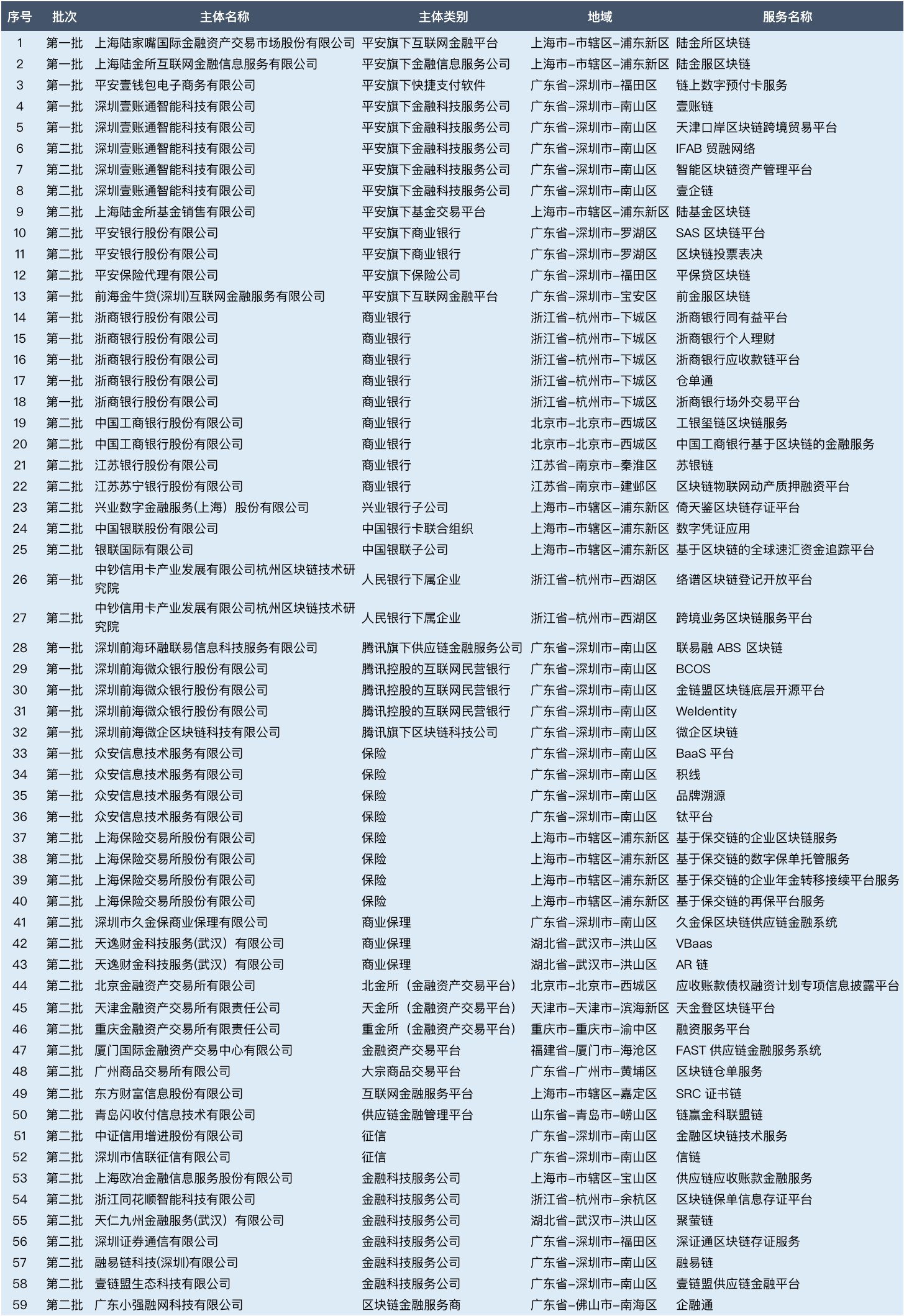

In addition, since February 15, 2019, the "Regulations on the Management of Blockchain Information Services" were formally implemented, the National Internet Information Office (hereinafter referred to as the "National Network Information Office") has published two batches of blockchain project filing lists, and accumulated There are 506 registered blockchain projects and 414 companies.

From this, Onion sorted out 59 blockchain projects submitted by financial service institutions for filing. Basically, we can see the overall industry layout of domestic blockchain + finance. At the end of the article, it also focuses on the analysis of blockchain in the field of supply chain finance. Application and development.

- U.S. traditional institutions improve Bitcoin financial infrastructure, good news in Q1 2020

- Inventory: 4 important moments to change the trend of the crypto market in 2019

- Babbitt enters cross-border finance, joins banks to launch China's first blockchain re-export trade product

Note: The "financial service institutions" here include organizations that specialize in financial activities, such as various banks and credit cooperatives, securities companies, insurance companies, trust and investment companies, fund management companies, and financial asset trading platforms. They also include business Factoring, financing guarantee, financial leasing and other financial institutions, as well as some companies specializing in providing financial technology services.

Self-revolution: financial machine constitutes the promoter of blockchain landing

According to the analysis of scallion, as of now, in the online information office record project, the major domestic financial service institutions have submitted 59 blockchain-related service products in total.

State-owned / private banks, insurance companies, financial product trading platforms, financial information service platforms, fintech companies and other related financial institutions and enterprises have layouts, mainly involving supply chain finance, cross-border payments, clearing and settlement, credit reporting, insurance, assets Various types of application scenarios such as securitization, asset custody, digital bills, and identification.

Ping An Group sits firmly on top

Among the many well-known financial institutions, China Ping An Group's companies have obtained the most number of blockchain service record numbers. Lujin Institute, One Account Express, One Wallet, and other financial technology and service companies such as Ping An Bank and Ping An Insurance have performed well.

On December 17, according to a special article of the People's Daily, the layout of Ping An of China on the blockchain, the article "Ping An of China-Joining the Blockchain to Become a Climber" pointed out that at present Ping An of China has applied blockchain technology to Financial, medical, automotive, real estate, smart city five ecosystems, and deployed more than 40,000 blockchain nodes, especially in the financial field has a wealth of practical experience in landing.

Ping An's Shenzhen One Account has submitted five record items in two batches of record lists, "One Account Chain", "Tianjin Port Blockchain Cross-Border Trade Platform", "IFAB Trade Finance Network", "Smart Blockchain" Asset Management Platform "and" One Enterprise Chain "have been successfully put on record, focusing on the application of blockchain in the field of trade finance. Financial One Account, as the bottom layer of the Ping An Group's key blockchain, has undertaken the needs of all Ping An blockchain applications.

In addition, Ping An Financial Technology Company Lu Jinsuo Holdings also submitted “Lu Jinsuo Blockchain”, “Lujinfu Blockchain”, “Former Jinfu Blockchain”, “Lu Fund Blockchain”, etc. The project is on record, and the underlying infrastructure of the relevant blockchain has been put into use.

According to Lufax's official WeChat public account, from 2018 to 2019, Lufax Holdings has applied blockchain to multiple operations of the platform, including the use of blockchain technology to assist user identity authentication, transaction tracing, and financial assets. On the chain (some asset management, trust, private equity products use blockchain technology) and many other businesses. As of the end of October this year, Lufax had traded over 10 million transactions through blockchain technology services, with a cumulative transaction value of more than 100 billion yuan.

Traditional banking institutions compete for layout

In this new wave of "blockchain + finance", traditional banking institutions are also very active.

State-owned large banks and commercial banks have begun to promote the application of blockchain on their business platforms, mainly in the application areas of supply chain finance, clearing and settlement, digital bills, cross-border payments, and identification.

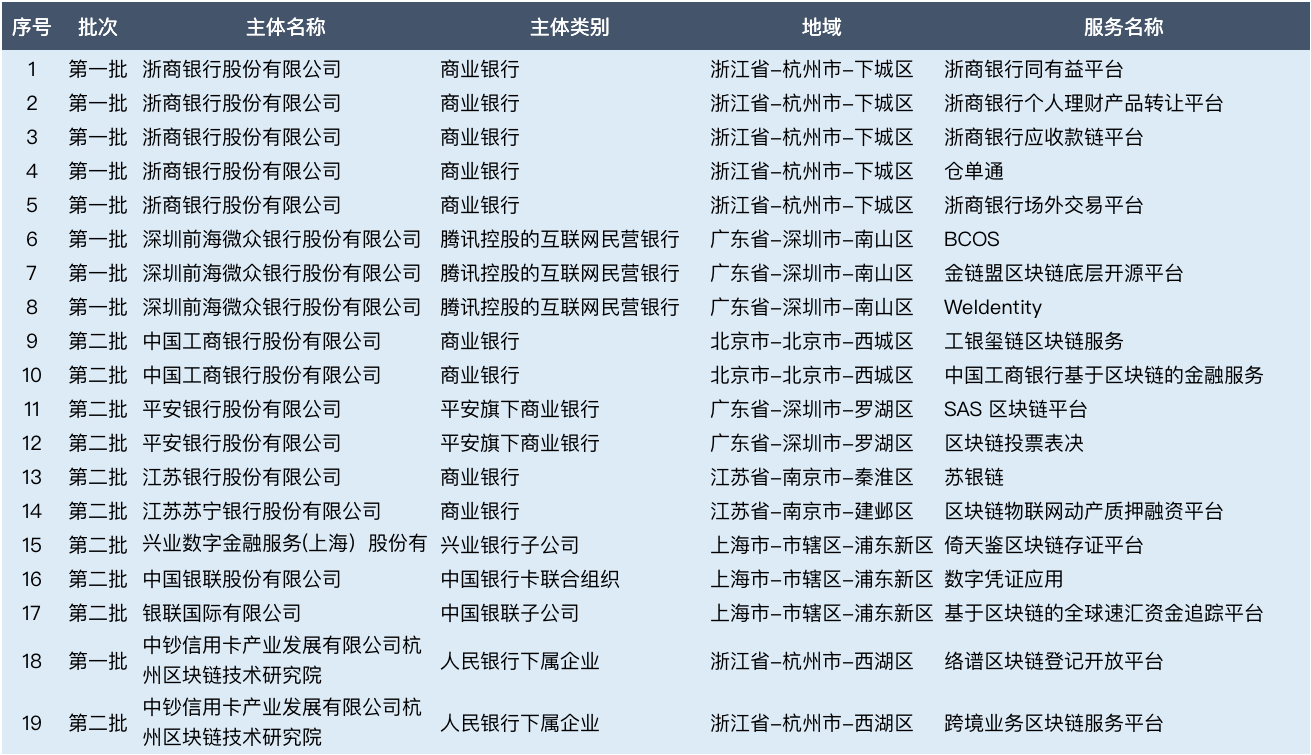

According to statistics from Scallion, the two batches of filing list information disclosed by the Internet Information Office show that nine banking institutions across the country have filed 19 blockchain projects, covering state-owned banks, stock banks, city commercial banks, and private banks.

1.Zheshang Bank

Among the traditional banking institutions, Zheshang Bank has the most records, with a total of 5 record projects, which can be called the pioneer of domestic commercial banks to explore and apply blockchain technology.

In 2016, Zheshang Bank launched a blockchain-based mobile digital money order platform, becoming the first bank in the industry to apply blockchain technology to its core business; after that, it successively developed receivable chain platforms and warehouses in 2017-2018. Dantong and others focus on the application of blockchain in the field of supply chain finance, as well as the "CaiYiYun" personal wealth management product transfer platform and the "TongWei" interbank asset trading platform, etc., which have realized blockchain technology in corporate business, retail business and Extensive coverage of financial market operations.

In August 2017, the “Receivables Chain Platform” launched by Zheshang Bank and FunChain Technology was mainly used to handle the issuance, acceptance, confirmation, payment, transfer, pledge and other businesses of the company's supply chain receivables. By transforming the credit of core enterprises in the supply chain, it helps upstream and downstream SMEs to revitalize accounts receivable, convert accounts receivable into electronic payment settlement and financing tools, realize "no capital" transactions in the circle, and reduce the overall cost of the supply chain.

According to the "Social Responsibility Report 2018" issued by Zheshang Bank, as of the end of 2018, Zheshang Bank has established a receivables chain platform for more than 1,400 core companies in the supply chain, helping more than 6,000 companies in its upstream and downstream to finance more than 100 billion Yuan funds.

On January 9, 2018, Zheshang Bank joined hands with more than 350 financial institutions to launch the establishment of a "total benefit" financial alliance and a "total benefit" trading platform. Lin Rong, head of the Interbank Headquarters of the head office of Zheshang Bank, introduced that the platform is intended to help interbank customers revitalize existing assets, reduce transaction costs, and improve business efficiency, and realize the transformation from "asset-holding" to "asset-trading" and promote Standardization of interbank business of financial institutions.

2.Weizhong Bank

Followed by Weizhong Bank, which was founded by Tencent, its three filing projects, "BCOS Platform", "Gold Chain Alliance Blockchain Underlying Open Source Platform" and "WeIdentity Platform", undoubtedly highlight the Internet. Giant Tencent's efforts in the field of "blockchain + finance" focus on building the underlying platform in the field of blockchain finance.

Weizhong Bank is not only a pioneer of Internet banking, but also a pioneer in exploring blockchain + finance.

As early as May 2016, Weizhong Bank led the establishment of the "Golden Chain Alliance" with more than 20 financial institutions and technology companies such as the Shenzhen Fintech Association, focusing on the application of blockchain in the financial field. Its member units are now There are nearly 80 companies, and 70% are financial institutions. In September of the same year, it also developed a blockchain application system for joint loan settlement and clearing business with Shanghai Huarui Bank, which is mainly used for personal small credit revolving consumer loans, that is, "microparticle loans."

In 2017, Weizhong Bank and the Golden Chain Alliance open source working group will jointly build the underlying chain platform FISCOBCOS for open source. BCOS (BlockChain OpenSource) is an open source platform platform for blockchain technology that focuses on enterprise applications. Financial branch. According to the Securities Daily report on December 2, Fan Ruibin, the deputy general manager of Weizhong Bank's distributed business technology development department and the leader of Weizhong Blockchain, introduced that tens of thousands of individual developers and more than 500 companies have gathered in the open source ecosystem of FISCOBCOS. Institutions and enterprises have developed more than 60 applications in different fields such as government affairs, finance, public welfare, copyright, supply chain, and education, and have developed into the largest open source ecosystem of domestic alliance chains.

In addition, the WeIdentity platform is a distributed identity management system based on FISCO BCOS. It is a set of entity identity and trusted data solutions developed by Weizhong Bank to support identity authentication and data cooperation between institutions.

3.Ping An Bank

Ping An Bank is the earliest bank in China to start the development of supply chain finance. After the rise of blockchain technology, it also quickly used blockchain to revolutionize and upgrade its supply chain financial services business.

As early as 2014, Ping An Bank established a "commercial factoring cloud" platform to provide commercial factoring companies involved in supply chain financial services with functions such as accounts receivable management, financing management, and repayment processing.

In 2017, Ping An Bank launched "Ping An EBay" based on the factoring cloud platform to provide accounts receivable management and transactions for supply and marketing companies in specific supply chains. At the end of 2017, "Ping An EBay" was officially renamed "Supply Chain Applications" Receivables service platform (Supply-chain Account receivable Service, referred to as "SAS").

The SAS platform aims to provide online accounts receivable transfer and management services for small and medium-sized enterprises upstream from core enterprises in a specific supply chain. The platform is equipped with the blockchain's super-ledger full-process information recording and interaction functions, and communicates with Zhongdeng.com Directly connected to automatically implement pledge and transfer registration of accounts receivable, use blockchain technology to identify assets in the supply chain, and at the same time create an open platform to securitize accounts receivable assets and promote the realization of accounts receivable financing .

4.ICBC

Among the state-owned banks, ICBC was the first bank to file a blockchain project. In the second batch of the list disclosed by the Internet Information Office, there are two blockchain information service records, which are “ICBC Xixi Chain” "Blockchain services" and "ICBC's blockchain-based financial services".

It is worth mentioning that ICBC has made outstanding achievements in cross-border blockchain trade. The “China-Europe e-Single” cross-border blockchain platform launched in October this year aims to use the blockchain to solve the international railway transport bills in the free trade zone. The cross-border trade finance project under focus on the application of import and export letter of credit and cross-border remittance scenarios.

According to the Sichuan Daily report on November 7, at present, the "China-Europe e-Single Link" platform has nearly 10 companies and nearly 100 businesses on the chain, and has successfully achieved data "second touch" with a number of overseas institutions along the China-Europe train line. The value of the goods involved is equivalent to nearly RMB 100 million.

Except for ICBC, other large state-owned banks have not yet submitted their blockchain information services for the record, but according to public information, several major state-owned commercial banks have basically implemented blockchain applications.

For example, Bank of China has launched a free digital wallet, and its blockchain service platform has successfully signed a number of domestic and foreign financial institutions. Its blockchain banking insurance platform has also successfully handled the industry's first blockchain international factoring business. .

CCB has cooperated with IBM to develop and launch a blockchain banking insurance business platform, and has launched the first blockchain rental housing application platform in Xiong'an New District, and has continuously explored the application of blockchain to international factoring business and Trade finance and other fields.

Agricultural Bank of China has launched the "e-chain loan" based on the blockchain-based agricultural Internet e-commerce financing system, and actively promoted the construction of financial digital point system to create a block chain point system.

The Bank of Communications also applied the blockchain to trade settlement related scenarios, and successfully processed the first blockchain domestic letter of credit issuance and notification business in May 2018.

5.Other banking institutions

In addition to the above-mentioned banking institutions, the two batches of banks also include banks such as Bank of Jiangsu, Suning Bank, Industrial Bank, UnionPay, and China Banknote. Although they only appeared in the second batch of lists in October this year, most of them were earlier .

China Banknotes Credit Card Industry Development Co., Ltd.'s subsidiary of the People's Bank of China, Hangzhou Blockchain Technology Research Institute, filed two documents: “Luopu Blockchain Registration Open Platform” (referred to as “Luopu”) and “Cross-border Business Blockchain Service Platform”. Blockchain projects.

The network spectrum that came out in March 2018 is the first domestic blockchain platform created and released by the "national team". Its purpose is to provide trusted data, digital identity and digital credential services through blockchain technology. Supervisory departments, judicial appraisal centers, public welfare organizations, enterprises and other application scenarios provide information such as existence, integrity, identity, time stamp, data relationship and voucher registration.

Jiangsu Bank launched the “Su Yin Chain” in 2017, and in November of the same year cooperated with Wuxi Rural Commercial Bank to complete the first bill “blockchain” cross-bank discount business transaction.

In September 2018, Suning Bank developed a "blockchain + Internet of Things" movable property pledge financing platform, which effectively monitors the flow of movable assets such as commodities with the help of the blockchain.

The "Yitianjian" blockchain certificate platform released by the Industrial Bank subsidiary " Industrial Bank " in 2017, relies on the bottom layer of IBM's blockchain and is an electronic certificate based on the blockchain alliance certificate and reliable electronic signatures. The platform, according to Mao Qianghua, the CPO of Xingye Shujin Innovation Group, can be used by users to sign e-contracts to realize notarization of processes, appraisal afterwards, and online issuance of certificates.

In addition to various banking institutions, China UnionPay has also submitted two filings, "Digital Voucher Application" and "Blockchain-based Global Money Transfer Tracking Platform", focusing on exploring the blockchain's application in letters of credit and cross-border remittances. application.

Exploration of Blockchain Application by Insurance Institutions

The financial and insurance industry has always taken "credit" as its foundation and naturally fits with the blockchain technology aimed at building a new type of credit system. The blockchain is expected to inject strong anti-risk, high recognition accuracy and rapid response capabilities into the insurance market.

In fact, various insurance institutions and enterprises are also the backbone of advancing the exploration of blockchain.

1.Zhongan Technology

In the first batch of filing lists of the Internet Information Office, Zhongan Technology, a wholly-owned subsidiary of Zhongan Insurance, which is jointly established by giants such as Ant Financial, Ping An of China and Tencent, can be regarded as a representative of the "blockchain + insurance" layout. Four filed projects were submitted.

Zhongan Technology has established a blockchain team since 2015 to explore the integration of blockchain technology and industrial innovation. So far, it has submitted a total of 129 blockchain-related patents, and 112 can be checked through public examination.

Zhongan Technology's layout on the blockchain is more business-oriented. In response to the common problems of electronic policy storage efficiency and claims privacy protection in the insurance industry, it has launched "titanium empty positions" and "titanium deposit certificates". .

Titanium empty warehouse is a distributed encrypted storage product that guarantees data security; and Titanium deposit certificate uses Zhongan chain smart contract, distributed storage, cryptography and other technologies independently developed by Zhongan to securely store the encrypted document.

Later, it was further extended and gradually formed titanium series products including titanium sun, titanium contract, titanium deposit certificate, titanium short positions, etc.

In addition, Zhongan also launched the ecological cloud service platform "Anchain Cloud" deployed on the chain, and developed dozens of blockchain products and solutions such as electronic policy management, anti-counterfeiting traceability, and supply chain finance based on Anchain Cloud. , Covering 10 areas including traceability, public welfare, government affairs, medical treatment, copyright, hotels, supply chain finance, insurance, points, and privacy data security.

On October 26 this year, Li Xuefeng, CTO of ZhongAn Technology, said in an interview with reporters, "In the future, the focus of Zhongan Blockchain will focus more on the exploration of insurance. We have begun to penetrate from simple and marginal businesses. Early health insurance policy deposits, to smart contract claims efficiency, and then to policy tokens, hoping to use technology innovation to release manpower, improve efficiency, reduce transaction friction and loss between collaborations, and create a truly new insurance. "

2.Shanghai Stock Exchange

As early as September 2017, the Shanghai Stock Exchange officially released its blockchain underlying technology platform, "Bao Jiao Chain".

Baojiao Chain is a blockchain BaaS platform open to members of the alliance. It aims to provide blockchain infrastructure for insurance transactions across the industry, open up the upstream and downstream of the insurance industry, share transaction data, and improve the efficiency of insurance business processing.

In view of the complexity of insurance business, the insurance cross-chain introduced the concept of "channels" and implemented a multi-chain architecture, allowing simultaneous support for multi-institutional risk data sharing, digital policy custody, co-insurance, reinsurance, alternative investment debt plans, and annuity operation management , Credit guarantee insurance, health care and other business scenarios.

It is understood that Baojiao Chain has successfully cooperated with China Insurance Asset Management Association, many subsidiaries of China Taiping, Yangtze River Pension Insurance Company, Tokyo Marine Daily, Mitsui Sumitomo Marine and Japan Property & Casualty Insurance.

3.Commercial factoring company

In addition, some commercial factoring service companies such as Shenzhen Jiujinbao and Tianyi Finance are actively exploring the application of blockchain in the field of supply chain finance.

Commercial factoring is a set of financial solutions based on factoring contracts signed between factoring and suppliers, including financing, credit risk management, accounts receivable management and collection services.

"Supply Chain Finance" becomes a focus

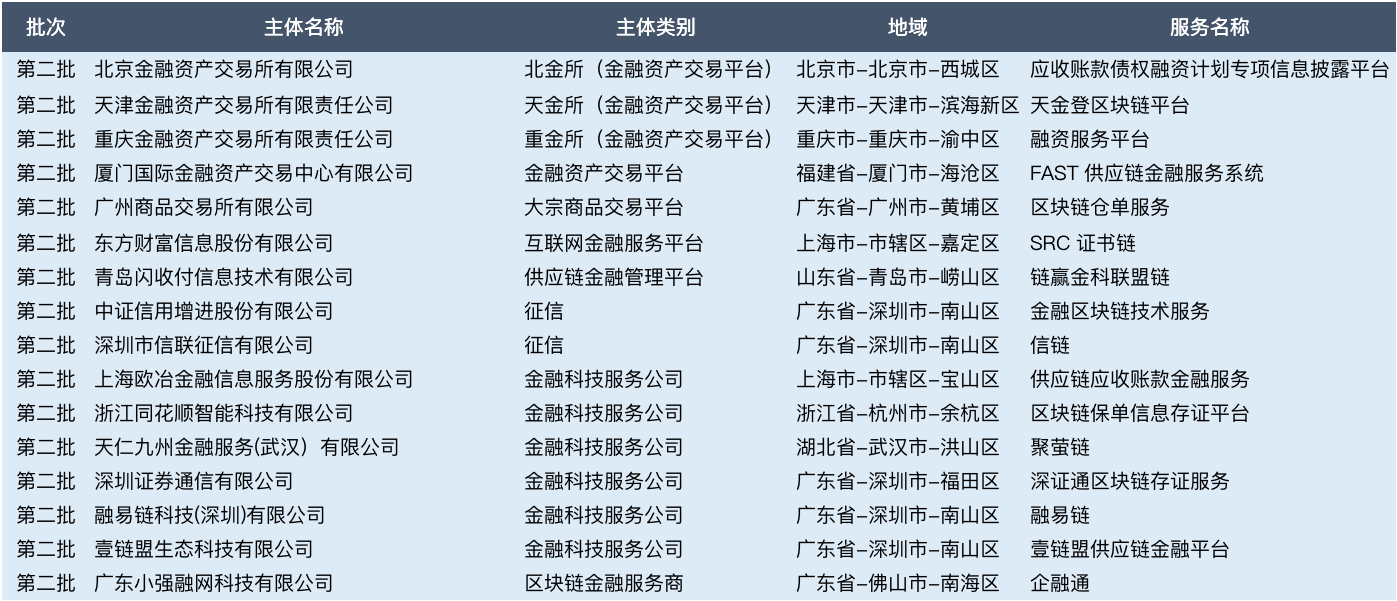

In addition to banks and insurance institutions, in the second batch of filing lists, more financial service companies appeared, such as Beijing Financial Exchange, Tianjin Exchange, Zhongjin Exchange and other financial asset trading platforms, Zhejiang Flushing, Rongyi Chain and other financial technologies. Service companies have filed blockchain service projects.

Judging from the record projects of these financial service companies, the field of supply chain finance is the top priority.

Such as the “Special Information Disclosure Platform for Accounts Receivable Credit Financing Plan” submitted by Beijin, the “Supply Chain Account Receivable Financial Services” submitted by Shanghai Ouye Financial Information Service Co., Ltd. “E-Chain”, “One-Chain Alliance Supply Chain Finance Platform” submitted by One-Chain Alliance, “FAST” Supply Chain Financial Service System submitted by Xiamen International Financial Assets Trading Center Co., Ltd., etc. all apply blockchain technology to the supply chain The financial sector. In addition, there are also a small number of filing services involving digital deposit certificates, digital warehouse receipts and other services.

Onion Note: Supply chain finance generally has three main modes of accounts receivable financing, confirmed warehouse financing, and movable property pledge financing, and accounts receivable financing is the most commonly used financing mode.

Supply chain finance is a typical "multi-centralized" solution. The main purpose is to solve the problem of how to be efficient among banks, core enterprises, and upstream and downstream enterprises (including first-, second-, third-level … N-level suppliers and distributors). Financing and borrowing at a low cost to enhance the competitiveness of the respective industry markets.

Multi-level credit penetration, difficulty in controlling risks, and difficulty in financing small, medium and micro enterprises that account for 80% of the entire supply chain are the main pain points in the current supply chain finance field.

In the eyes of the industry, as a distributed ledger technology, blockchain is naturally suitable for solving the problem of trust transfer between multi-level enterprises in the supply chain and the problem of untrustworthy information and data on the trade and capital sides. Good idea.

summary

The financial industry is based on information, and trust in the financial sector has the greatest cost.

Therefore, practitioners in the financial industry attach great importance to the technical mechanism of credit reconstruction, and hope to use the blockchain to refresh the financial business system and achieve more efficient and low-cost financial transactions.

As can be seen from the above-mentioned filing projects, there have been many attempts to apply blockchain technology in the financial field. Central to local major banking institutions, insurance institutions, securities companies, financial trading platforms, and fintech service companies are actively promoting the implementation of blockchain implementation. Supply chain finance, interbank clearing and settlement, digital bills, cross-border payments, Application scenarios such as trade finance, asset securitization, bank credit, identification and management are all covered.

Of course, the layout of most financial service institutions mostly stays in the pilot stage and trial state, and blockchain applications that have been used in actual production on a large scale have not yet been produced. The current blockchain technology itself is not mature enough, and it needs to gradually penetrate into the core business of finance after a large number of application attempts in peripheral businesses.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Japan's KOL Bitcoin: Mad study, keep chasing, and strive to build a trusting society | 8 问 文 版

- Pioneering exploration of fiat currencies in European countries

- Research Report | Survey on Blockchain Application of Charity

- How to value DCG with three core businesses: Grayscale, Genesis and CoinDesk?

- Legal analysis of smart contracts: What is the difference between smart contracts and traditional contracts?

- US SEC proposal proposes to expand the scope of "qualified investors"

- Inventory: Who will predict the price of Bitcoin in 2019?