CoinMarketCap: Overview of the Overall Status of Trading Platforms in the First Half of 2023

CoinMarketCap: Summary of Trading Platforms in H1 2023Main concept: Conduct a health check on trading platforms to gain insight into the true state of the cryptocurrency market. This analysis considers both centralized and decentralized trading platforms, examines the overall health, size, and activity level of the current cryptocurrency market. Factors analyzed include trading volume, market size, as well as geographical and currency coverage.

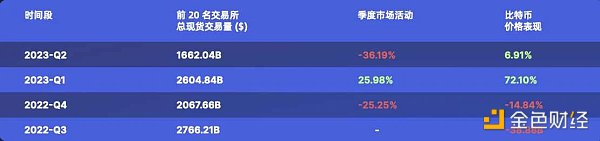

Daily total trading volume trend for the top 20 trading platforms (+BTC price): Examining market activity level

In the second quarter of 2023, the top 20 ranked trading platforms contributed $1.67 trillion in total spot trading volume, a 36% decrease from the previous quarter, indicating a significant slowdown in market activity. By comparison, the doubling of bitcoin prices in the first quarter of 2023 drove retaliatory active trading activity in the overall market at that time.

- An Explanation of Taproot: Consisting of Three Different Bitcoin Improvement Proposals

- Boring Ape’s decline continues, where should the NFT market break the ice?

- 2017 vs 2023: Fink’s Institutional Bitcoin Perspective

The current market trading volume is similar to the market conditions during the recovery phase after the FTX crash.

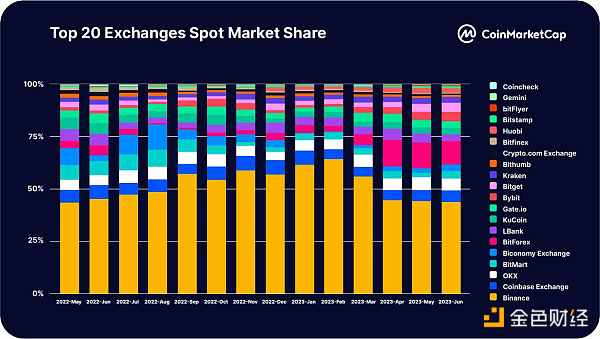

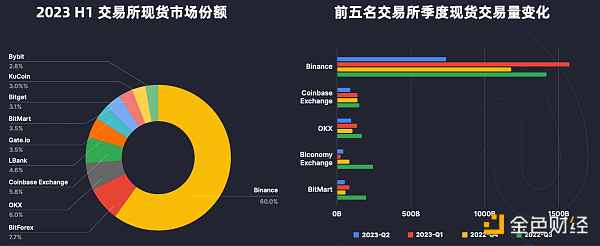

Trading volume, market share, number of trading pairs, and tokens for the top 20 cryptocurrency trading platforms

Binance continues to dominate the market in the first half of 2023, with a total spot trading volume share of 59.99%, relatively stable compared to the same period last year. The top 5 exchanges account for about 85% of the total spot market trading volume, showing a more obvious head effect in terms of liquidity and 24-hour trading volume. Binance, Coinbase, and Kraken have recently maintained the highest average liquidity scores>700.

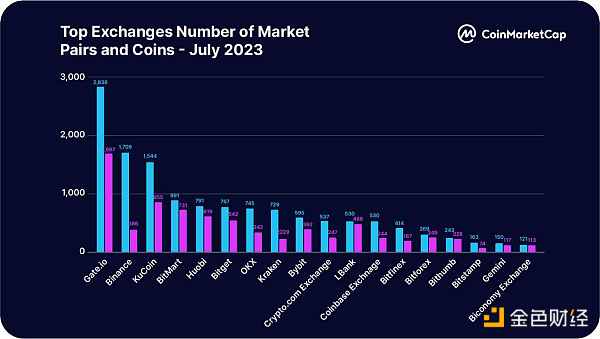

Number of trading pairs and tokens for major trading platforms – July 2023

In terms of market products, the current market provides rich trading pairs and tokens, and the number of new projects listed has continued to increase this year.

Binance continues to dominate liquidity in the large-cap field and has also taken a high-quality mainstream route in its listed tokens. In terms of the number of listings, BitForex and Bitget are among the most active new listing trading platforms during the meme coin season from April to June 2023, compared to the ratio of new listings to the number of existing listings at the beginning of the year.

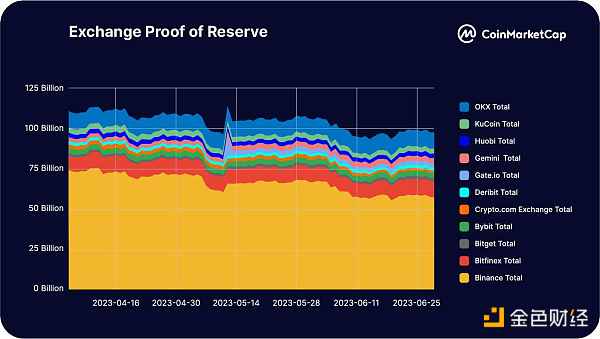

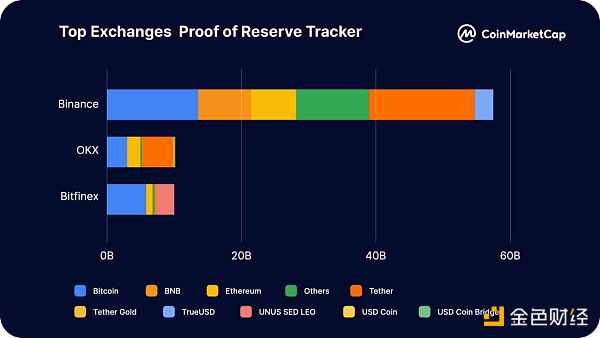

Reserve holdings on major trading platforms

Among the reserve holdings publicly disclosed by the trading platforms, Binance ($57 billion), OKX ($10 billion), and Bitfinex ($10 billion) showed the highest amounts of reserve proof assets. For most trading platforms, bitcoin and stablecoins make up the bulk of their reserve assets.

Over the past quarter, the total amount of reserve proof assets on major trading platforms has remained relatively stable. However, FUD (fear, uncertainty, and doubt) in the market over the past three months has led to a capital outflow from Binance, resulting in a $20 billion reduction in its reserve proof assets.

An encouraging sign within the industry is that despite experiencing significant capital outflows in Q2 2023, Binance still retains a healthy amount of reserve proof assets, and the composition of these assets is made up of currencies that are high in security and diversity.

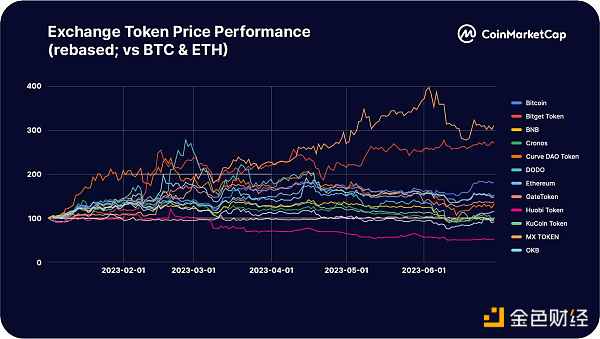

Trading platform token price performance (compared to BTC and ETH)

Most trading platform tokens realized a net positive return in the first half of 2023. However, due to bitcoin’s strong rise in the first half of 2023 (+182% YTD), most tokens failed to outperform bitcoin.

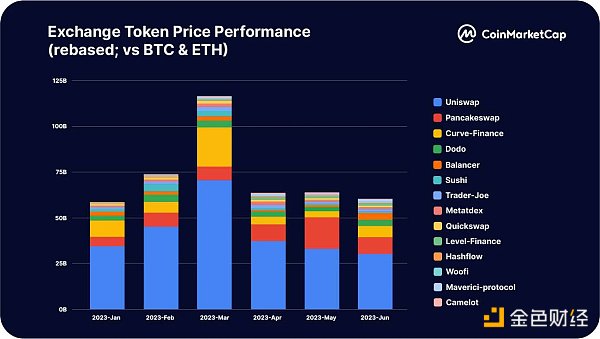

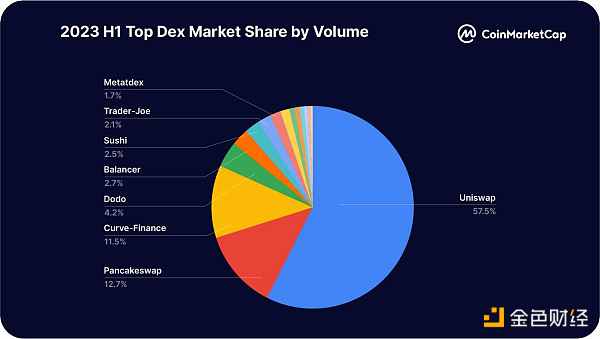

DEX trading volume and market share

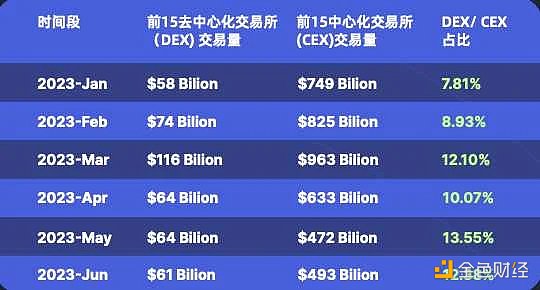

The trading volume of the 15 major decentralized exchanges (DEX) reached a peak in March of this year and remained stable in the second quarter. In Q2, the total trading volume of DEX reached $189 billion, a decrease of 24% from $249 billion in Q1.

Uniswap trading volume and price performance compared to Binance and Coinbase

Uniswap maintains a dominant position in the DEX market, with a 57.5% market share. Its monthly trading volume is on par with Coinbase’s spot trading volume. In the first half of the year, the top three DEXs — Uniswap, Blockingncake, and Curve — accounted for approximately 82% of the total DEX market.

Although centralized exchanges (CEX) are still the preferred choice over DEX, the proportion of DEX to CEX has increased to about 1:8. This can be attributed to various factors, including recent innovations in DEX products, market concerns over CEX driven by regulatory developments, a lower gas fee environment, and a higher proportion of native crypto participants in the current market conditions.

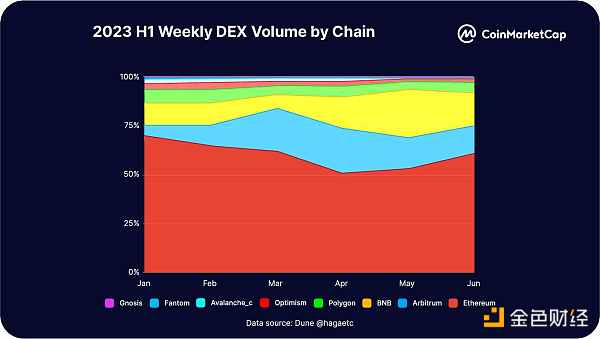

DEX Trading Volume by Chain

In the first half of 2023, about 80% of decentralized exchange (DEX) trading volume occurred on the Ethereum and its Layer 2 chains. However, in the second quarter, BNB quickly caught up and gained a larger share of the DEX trading market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the difference between the supervision and sharing agreement and the information sharing agreement, as institutions compete to include them in ETF filings?

- Will purchasing Bitcoin be a good move for a publicly traded company to enter the world of cryptocurrency?

- 6 Charts Reviewing Cryptocurrency Market Performance in Q2 2023

- Six Positioning Strategies in Current Financial Environment

- Market Trend Prediction and Potential Alpha: Inverse Finance and Symm

- Bitcoin engraved wallet UniSat Wallet will launch an NFT marketplace next week.

- Interpreting the data on the growth of the NFT market in 2023: Is it due to new funds entering or old funds circulating?