War against Coinbase MEKE forays into the Binance Smart Chain Layer 2 market.

MEKE enters the Binance Smart Chain Layer 2 market, challenging Coinbase.On July 30th, a meme coin called BALD was deployed on the coinbase L2 network BASE and began trading on LeetSwap. Overnight, this meme coin without any application achieved a thousand-fold increase, causing the BASE TVL to triple overnight, reaching over $60 million.

Although BALD was removed from the liquidity pool shortly after going online, this wave of events brought significant traffic and influence to BASE. Whether it was intentional by coinbase or unintentional by other individuals, there is no doubt that this event marked the first shot in the battle for L2 networks among exchanges.

The exchange that was most anxious to see the popularity of BASE was undoubtedly Binance, another major global exchange. Coinbase and Binance are both universe-level exchanges in the cryptocurrency world, occupying more than half of the global market together. The two exchanges have a lot of competition in their business, and users in the crypto world often compare the capabilities of these two exchanges. Coinbase and Binance are like two powerful lion prides on the African savannah, competing with each other and remaining vigilant. Once one side makes a move, the other side will respond.

Just after the popularity of BASE, the Binance Chain team announced on August 2nd that Binance Chain L2 opBNB will soon go live. It is evident that this is a challenge from Binance to Coinbase and a war between the two major exchanges’ L2 opBNB and BASE. opBNB is officially at war with BASE! It is well known that whether an L2 solution can rise depends on whether it deploys killer applications. BALD has already fired the first shot on the BASE chain, so which project will be the vanguard for opBNB? The on-chain derivative trading protocol MEKE, which has been popular in the global crypto world recently, may be the one.

- The only opportunity to participate in the speculative frenzy in the cryptocurrency circle.

- Advertising for Bitcoin? Biden shows off a coffee cup with the ‘laser eyes’ logo of the crypto community.

- How does the outflow of stablecoins affect the price of Bitcoin?

MEKE is an on-chain derivative trading platform developed by a team in the United States. It can be used to trade perpetual contracts of various mainstream cryptocurrencies such as BTC and ETH, and in the future, it may also consider trading futures of physical assets such as gold, oil, and US bonds. Initially, MEKE will focus on trading crypto asset derivatives, but in the future, it will consider entering the RWA market with trillions of dollars in assets.

As early as 2021, during the DeFi Summer, MEKE began its development. In order to provide global crypto traders with a decentralized trading experience similar to centralized perpetual contracts, the MEKE team spent more than two years polishing the product before launching it in the market and ultimately deploying it on the Binance L2 network opBNB.

As a decentralized on-chain derivative trading protocol, user traffic and product experience are vital to the entire product. As the hope of the Binance ecosystem’s L2, opBNB is supported by the massive traffic from Binance on one hand and has high concurrency, fast processing capabilities, and extremely low gas fees on the other hand. The network has a block time of 1 second, a gas fee for transfers as low as $0.005, and a transaction per second (TPS) capacity exceeding 4,000, already outperforming existing scaling solutions.

Considering the above factors, MEKE chooses to deploy on opBNB. Due to its strong performance and huge market potential, as well as being one of the first applications to be launched on opBNB, MEKE has attracted attention from cryptocurrency enthusiasts worldwide, and has been reported by top global blockchain media cointelegraph.

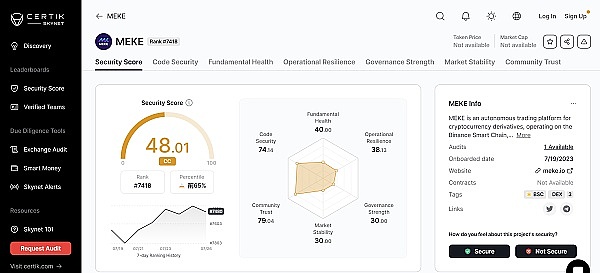

Currently, MEKE has been deployed on the opBNB testnet and has passed the security audit by Certik, a well-known global auditing company. The first phase of public testing for MEKE started on July 31st and has been extremely popular, leading to a rapid increase in trading volume on the opBNB testnet.

This testing activity will end on August 10th.

If BALD is considered the vanguard of BASE L2, then it can be seen as a small scattered soldier with a lot of noise. As the pioneer of opBNB, MEKE is more like a well-equipped special forces unit. After all, compared to meme coins with no real-world applications, MEKE has strong value support. In the cryptocurrency derivatives trading market, which has a daily trading volume of nearly billions of dollars, MEKE, as a leading player in the cryptocurrency derivatives trading platform, has significant market potential.

On July 31st, Binance founder CZ stated in an AMA that there are many interesting areas in the crypto world, and Binance plans to invest heavily in these areas, with DeFi being one of them. In an article published by the Binance Chain team on August 2nd titled “opBNB, from testnet to mainnet,” it was mentioned that they will strongly support developers in developing valuable projects on opBNB, and MEKE may be one of them.

The first phase of public testing for MEKE is progressing rapidly. According to incomplete statistics, the number of interactive wallet addresses has exceeded tens of thousands. This is not only due to MEKE’s market influence, but also the rewards that MEKE brings to users participating in the public testing. Similar to projects like DYDX, Optimism, and Arbtirum, MEKE also provides rewards such as airdrops and fee dividends to users participating in the public testing, and the earlier the participation, the more generous the rewards. The token issuance on the MEKE platform is limited, and the platform has designed a unique issuance mechanism, where early participants receive more benefits and later benefits gradually decrease. It is worth mentioning that opBNB, as the underlying blockchain system for MEKE, has not yet issued tokens. Will MEKE and opBNB together make a big impact on the entire market? It is worth looking forward to!

The first phase of public testing for MEKE will end on August 10th. For more information, please long-press to copy and enter the official MEKE community:

Official website:

https://meke.io

Telegram:

https://t.me/MEKE_Global

Discord:

https://discord.gg/meke

Twitter:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ecological airdrop season is coming, can DFINITY return to its peak?

- In-depth Explanation of ZeroSync Starkware’s Zero Knowledge Proof System Developed for Bitcoin

- In-depth Analysis of ZeroSync Starkware’s Zero-Knowledge Proof System Developed for Bitcoin

- Interpretation and Comparison of the EU’s Cryptocurrency Market Regulation Act (MiCA)

- Halving Narrative and Reflexivity LTC falls instead of rises, can BTC halving still bring a bull market?

- Hashed Partner The next bull market will be mainly driven by the Asian market, and bottom-up innovation may emerge in Asia.

- Fortune Magazine From ambitious to defensive, what twists and turns has the crypto queen Katie Haun experienced?