LianGuai Observation | Understanding the July Cryptocurrency Market in 7 Pictures DeFi Unaffected by Curve Vulnerability

LianGuai Observation | July Cryptocurrency Market in 7 Pictures DeFi Unaffected by Curve Vulnerability

LianGuai Blockchain News, August 6th – Despite the Curve vulnerability causing a lot of pain in the cryptocurrency market at the end of July, the industry has still shown great resilience. The data paints a different picture – user participation in cryptocurrencies has not decreased, and the market is full of vitality and optimism. Let’s use 7 charts to interpret the situation in the cryptocurrency market in July.

1. Overview of the Dapp Industry in July

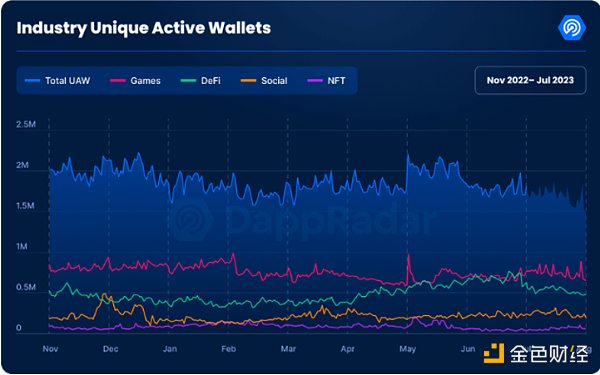

In July 2023, the independent active wallets (UAW) in the Dapp industry experienced a shrinkage, with an overall decrease of 13%, dropping to an average of 1.7 million wallets per day. To be frank, there are several factors contributing to this decline. On the one hand, the continued regulatory uncertainty in the United States may have led to a slight decline in user activity. On the other hand, the excitement in the cryptocurrency market earlier this year led to some projects relaxing their vigilance, resulting in several security incidents this month.

- Infinite ‘Bullets’? Discussing the Hidden Concerns of the Largest BTC Listed Company MSTR

- War against Coinbase MEKE forays into the Binance Smart Chain Layer 2 market.

- The only opportunity to participate in the speculative frenzy in the cryptocurrency circle.

As shown in the chart above, in the Dapp categories:

– The gaming vertical has made a comeback, reclaiming its dominant position with a 41% share of independent active wallets. Last month, the gaming market share hit its lowest level since 2021, with a slight decrease of 0.5% in independent active wallets to 712,611.

– The DeFi vertical was not greatly affected by the Curve vulnerability. After a surge in users last month, the share of independent active wallets decreased by 26% to 510,654, but still accounted for 30% of the total user activity.

– Social Dapps have remained relatively stable, with a 2% decrease in the share of independent active wallets to 257,726, maintaining a stable market dominance of 15%.

– NFTs continue to decline, with a 19% decrease in the share of independent active wallets to 70,338, accounting for only 4% of the total user activity.

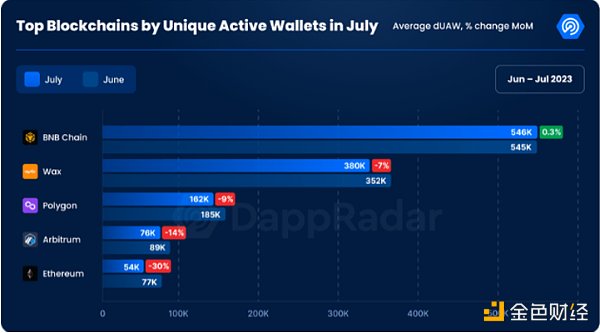

In terms of blockchain performance, as shown in the chart above, BNB Chain has become the leader with 546,779 independent active wallets, accounting for 21% market dominance. WAX and Polygon, despite slight decreases, are still significant participants. However, Ethereum and Arbitrum have both slowed down, with Ethereum experiencing a 29.8% decrease in independent active wallets, mainly due to a weak NFT market.

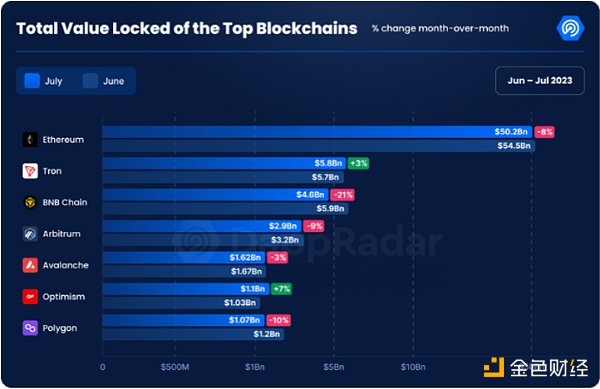

2. DeFi TVL Slightly Decreased in July, Not Significantly Affected by the Curve Vulnerability

In July, the total value locked (TVL) in DeFi decreased slightly by 2.27% to $75.91 billion. This marginal decline is mainly due to the numerous risk events that occurred in the DeFi sector this month, such as:

l The reentrancy lock of the smart contract programming language Vyper 0.2.15, 0.2.16, and 0.3.0 versions is invalid. Malicious actors use reentrancy attacks to repeatedly re-sign contracts, resulting in unauthorized operations or funds being stolen. Several important projects, including Curve Finance, have suffered attacks. Both black hat hackers and MEV bots have been manipulating and front-running funds through reentrancy, with an estimated amount of up to $70 million being exploited.

l The Memecoin project “Bald” on the Base blockchain was subjected to a Rug Pull. The deployer “BaldBaseBald” initially added 6,870 ETH liquidity to the pool, then spent 1,360 ETH to buy BALD tokens at an average price of 0.0004 ETH, and ultimately withdrew 10,704 ETH.

Ethereum still dominates the DeFi field, but the proportion of locked assets has dropped by 8% to $50.2 billion. Tron successfully regained the second place, with a 3% increase in locked assets to $5.852 billion in July. However, the locked assets on the BNB Chain dropped by 21% last month, while Optimism saw an increase of about 7%.

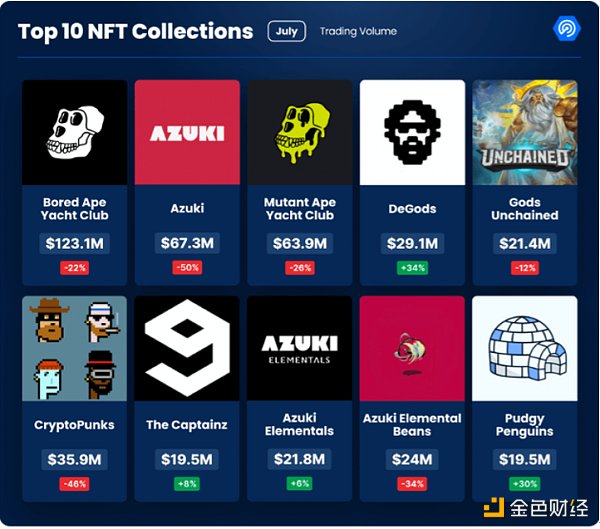

3. In July, the NFT market had a trading volume of $632 million and a sales volume of 3.7 million transactions.

In July, there were significant changes in the NFT market, with a continuous decline in trading volume. In the first week of July, the NFT trading volume was about $182 million, but it sharply dropped to around $57.5 million in the fourth week, a decrease of nearly 68% in just three weeks. The total trading volume for the month was $632 million, a decrease of 29% compared to the previous month. At the same time, the number of NFT sales also decreased from approximately 727,413 transactions to 368,331 transactions, a decrease of nearly 50%. However, the decrease seems less significant on a monthly basis, about 23%, with a total sales volume of 3.7 million transactions.

The decline in trading volume in the NFT market does not necessarily mean a decrease in overall interest in NFTs. On the contrary, it may indicate a shift in people’s interests. Historically, the rise of DeFi has often accompanied a stagnation or decline in the NFT industry, and vice versa.

Interestingly, the trading volume of NFTs on the Polygon chain saw a significant increase in July, with a monthly registered trader count of 772,424. This trend may indicate a shift in the NFT market towards more affordable blockchains. Additionally, despite the overall downward trend in the NFT market, the generative art vertical has performed quite well, with several generative art NFTs such as Fidenza, Ringer, and Squiggles selling for over 50 ETH.

4. Will Yuga Labs lose control over the NFT market?

Yuga Labs, the parent company of “Bored Ape Yacht Club” (BAYC), seems to be slowly losing its once unshakable dominance in the NFT market. Although BAYC is still the largest NFT collection in terms of trading volume, only two Yuga Labs ecosystems made it into the top ten NFT collections in July. This is in stark contrast to a few months ago, raising an interesting question: Are we witnessing the end of Yuga Labs’ monopoly and the rise of a more diverse NFT industry?

However, it should be noted that although Azuki has three ecological series in the top 10 in terms of transaction volume, Azuki has not fully recovered from the slump of the previous month. Only the sales of Azuki Elementals achieved a strong growth of 55%.

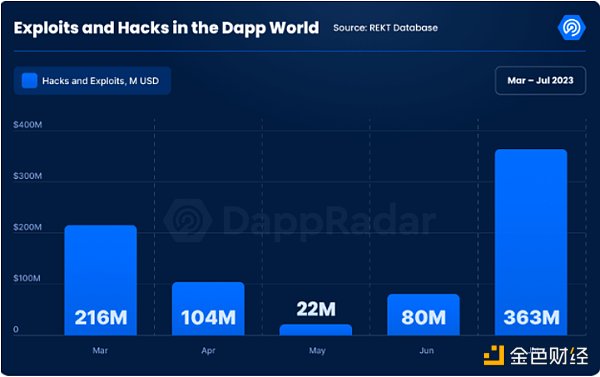

5. Loss of $363 million due to vulnerabilities and hacker attacks in July

According to the latest data from REKT, July 2023 was a turbulent month for the Web3 world, with a total of 47 vulnerability incidents causing a total loss of up to $363 million, setting a record high for such incidents this year. Ethereum suffered the most attacks, reaching 29 times, followed by 13 times on the BNB chain, and the rest occurred on other blockchains such as Avalanche.

Among them, two vulnerability incidents involving Multichain and Curve were notable for their scale and impact. Although the past few months have been relatively calm, several security incidents in July highlighted the continued importance of security measures in the Web3 industry. In the rapidly evolving digital environment, security is always a top priority.

Summary

July 2023 was a month of dynamic changes and relative contraction in the cryptocurrency industry. Although the decrease in the number of daily active independent wallets indicates a slight slowdown in market activity, the changes in various vertical fields indicate that the industry is constantly evolving.

The revival of gaming dominance and the significant increase in trading activity on the Polygon platform clearly demonstrate the continued diversification and market resilience and adaptability of the blockchain and Web3 ecosystems. Although DeFi and NFTs experienced a downturn in July, they did not come to a halt. The growth in the DeFi field and the NFT market continue to follow trends, and practitioners are actively seeking new potential growth paths. In fact, the decline in NFT trading volume may represent an industry readjustment rather than regression. With the continuous maturity and development of the industry, this transformation is likely to become the norm, as the importance of the market will change according to various factors.

Overall, the cryptocurrency industry still maintains a vibrant and rapidly changing pattern. Although certain trends and changes may appear negative, they actually reflect the ability of the cryptocurrency industry to innovate and adapt to changing user preferences and market conditions. Looking ahead, prioritizing security and maintaining innovation will be the key to a vibrant and long-term successful cryptocurrency ecosystem.

Some content in this article is compiled from Dapprader.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Advertising for Bitcoin? Biden shows off a coffee cup with the ‘laser eyes’ logo of the crypto community.

- How does the outflow of stablecoins affect the price of Bitcoin?

- Ecological airdrop season is coming, can DFINITY return to its peak?

- In-depth Explanation of ZeroSync Starkware’s Zero Knowledge Proof System Developed for Bitcoin

- In-depth Analysis of ZeroSync Starkware’s Zero-Knowledge Proof System Developed for Bitcoin

- Interpretation and Comparison of the EU’s Cryptocurrency Market Regulation Act (MiCA)

- Halving Narrative and Reflexivity LTC falls instead of rises, can BTC halving still bring a bull market?