Infinite ‘Bullets’? Discussing the Hidden Concerns of the Largest BTC Listed Company MSTR

Hidden Concerns of MSTR, the Largest BTC Listed Company

On August 1, Nasdaq-listed company MicroStrategy (MSTR) released its Q2 2023 report, announcing a significant increase in its BTC holdings. The market is generally concerned about the company’s leveraged purchase of Bitcoin. MicroStrategy has spent $4.53 billion to purchase Bitcoin, and more than $4 billion of the funds were obtained through bond issuances or stock financing. Generally, excessive leverage is not a good thing, but for MicroStrategy, this has become a low-cost and low-risk strategy. However, due to the limited development of its software business, the company actually has no surplus cash flow. Currently, it seems difficult to raise funds in the bond market, so the company can only roll over its debt through share issuance to finance its debt, which is equivalent to deeply tying its fate to the price of BTC. If BTC cannot increase significantly before the debt repayment period in 2025, MicroStrategy’s game may not continue.

- War against Coinbase MEKE forays into the Binance Smart Chain Layer 2 market.

- The only opportunity to participate in the speculative frenzy in the cryptocurrency circle.

- Advertising for Bitcoin? Biden shows off a coffee cup with the ‘laser eyes’ logo of the crypto community.

Bitcoin Holdings:

As the largest Bitcoin holder among publicly traded companies, MicroStrategy initially acquired Bitcoin as a defensive strategy to protect its balance sheet, but it has now become their second core strategy. MicroStrategy has two corporate strategies: acquiring and holding Bitcoin, and developing its enterprise analytics software business. They believe that these two strategies make their business stand out and provide long-term value.

The company initially stated that more than $50 million of excess capital would be invested in Bitcoin, but in subsequent statements, it mentioned that it will continue to monitor market conditions to determine whether additional financing will be conducted to purchase more Bitcoin.

MicroStrategy started investing in Bitcoin in August 2020, shortly after the outbreak of the COVID-19 pandemic. As of July 31, 2023, the company holds 152,800 Bitcoins, with a total cost of $4.53 billion, or $29,672 per Bitcoin, which is almost the same as the current market price (August 1, $29,218). Among them, 90% of the Bitcoins are unencumbered, which means that these Bitcoins are not used as collateral for any loans or debts.

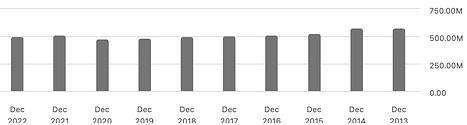

Chart showing MicroStrategy’s BTC holdings changes (MacroStrategy is a subsidiary of MicroStrategy)

It can be seen that MicroStrategy purchased Bitcoin at a faster pace before Q1 2022, and then almost remained inactive during the next three quarters as the market declined significantly. In 2023, with the recovery of the market, the pace of purchasing accelerated.

Financing Structure:

Their methods of expanding the balance sheet mainly include equity, debt, and convertible bond issuances.

Bond Issuances:

Although MicroStrategy has been increasing its Bitcoin holdings every quarter, and the price of Bitcoin has dropped since the end of 2021, the company’s debt structure is relatively stable. It has approximately $2.2 billion in debt, with an average annual fixed interest rate of 1.6% and an annual fixed interest expense of approximately $36 million. This is mainly because the company has used convertible notes to finance its debt.

As of the latest financial report for the second quarter of 2023, the company’s major debts include:

- 6.125% senior secured bonds due in 2028 (secured by 15,731 bitcoins), with an issuance amount of $500 million and annual interest expense of approximately $30.6 million. (Issued in June 2021)

- 0.75% convertible senior bonds due in December 2025, with an issuance amount of $650 million and annual interest expense of approximately $4.9 million. (Issued in December 2020)

- 0% convertible senior bonds due in February 2027, with an issuance amount of $1.05 billion and no annual interest expense. (Issued in February 2021)

MicroStrategy has no debts maturing from 2023 to 2024. Its debt maturity dates start from 2025 and latest by 2028. In other words, MicroStrategy can smoothly pass the Bitcoin halving in 2024 at least.

Among them, convertible bonds are hybrid financial instruments that have both characteristics of bonds and stocks. Taking the $1.05 billion convertible bonds issued in 2021 as an example:

Issuance amount: The issuance amount is $900 million, including the initial purchasers’ right to purchase an additional $150 million of notes within a 13-day period.

Nature of notes: Unsecured senior debt with no regular interest and the principal amount will not appreciate. They will mature on February 15, 2027.

Redemption: MicroStrategy can redeem the notes in cash on or after February 20, 2024, subject to specific conditions, at a redemption price equal to 100% of the principal amount plus any accrued but unpaid special interest.

Conversion: The notes can be converted into cash, MicroStrategy’s Class A common stock, or a combination of both. The initial conversion rate is 0.6981 shares per $1,000 principal amount of notes, equivalent to an initial conversion price of approximately $1,432.46 per share. This represents a premium of about 50% over the last reported sale price of MicroStrategy Class A common stock on NASDAQ of $955.00 per share on February 16, 2021. Noteholders can also convert their notes before the maturity date, provided that the trading price of the stock is at least 130% of the exercise price of $1,400.

By issuing convertible bonds, MicroStrategy has raised funds without the need to directly bear a large interest expense. At the same time, it has controlled the immediate dilution effect on equity.

Why do investors choose to invest in zero-coupon convertible bonds? The main reasons include:

- Potential stock price appreciation: Convertible bonds can be converted into the company’s common stock under specific conditions. If the stock price of the company rises above the target price, investors can choose to convert the bonds into stock and enjoy the benefits of the stock price appreciation. This is one of the main motivations for investors to choose zero-coupon convertible bonds.

- Capital protection: Compared to directly purchasing stocks, convertible bonds offer better capital protection. Even if the stock price of the company falls, investors can still redeem the face value of the bonds, and the bonds have priority in repayment compared to stocks. This provides investors with a way to reduce investment risks while enjoying the potential for stock price appreciation.

So convertible bonds are equivalent to holding both bonds and call options on MicroStrategy stock. However, considering that the current stock price of MSTR is only $434, the stock price needs to rise more than 3.3 times by February 2027 for investors to profit. Therefore, once the stock price of MSTR, or strictly speaking, the price of Bitcoin cannot rise more than 3 times from now on, MSTR has effectively used this money for free for 6 years.

Stock Issuance

MicroStrategy issued a total of $1.723 billion of class A common stock in 2021, 2022, and 2023, with an average selling price of $424 per share. The main purpose of these stock issuances was to purchase Bitcoin in each quarter of the stock issuance and to repay debt in the first quarter of 2023.

The issuance dates of these stocks are as follows:

- In the third quarter of 2021, financing of $404 million was raised through a rights offering, with an average issuance price of $728 per share.

- In the third quarter of 2021, financing of $596 million was raised, with an average issuance price of $694 per share.

- In the fourth quarter of 2022, financing of $47 million was raised, with an average issuance price of $213 per share.

- In the first quarter of 2023, financing of $341 million was raised, with an average issuance price of $253 per share.

- In the second quarter of 2023, financing of $335 million was raised, with an average issuance price of $310 per share.

Figure: MSTR stock issuance prices and scale from 2021 to present

On August 1, 2023, with the release of the second quarter report, MSTR announced the launch of a new $750 million rights offering, the largest in the history of rights offerings, with the aim of continuing to support the company’s strategy of large-scale purchase and holding of Bitcoin.

Financial Health Analysis

MicroStrategy’s annual revenue has been relatively stable in recent years, reaching $499 million in 2022. However, since 2013, it has basically remained at around $500 million, which is somewhat worrisome for a software company that is unable to expand software sales revenue during the prosperous period of technology companies.

Figure: MSTR annual total revenue (annual)

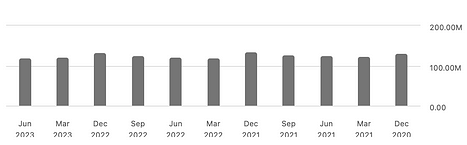

Furthermore, the revenue has remained almost unchanged since the beginning of this year, maintaining at the level of $120 million.

Figure: MSTR annual total revenue (quarterly)

Figure: MSTR net profit (annual)

Although MicroStrategy recorded a net profit of $483 million in the first half of this year on its financial report, its software business operations are still not profitable, with an operating loss of $30 million in the first half of the year. The net profit is mainly due to the recognition of $513.5 million in income tax benefits.

These benefits do not represent the actual cash received by the company, but rather various tax incentives and exemptions that the company can deduct from its total revenue when calculating pre-tax profits, mainly due to the previous depreciation of Bitcoin. In terms of accounting treatment, a company’s asset impairment and business losses may generate income tax benefits, as it can use these losses to offset future taxes.

Chart: MSTR Net Profit (Quarterly)

In addition, despite having revenue of $500 million, the company actually has no extra cash flow. Although the average cost of debt is only 1.6%, the debt generates interest expenses of more than half of the company’s cash reserves, totaling $36 million annually, forcing the company to continue issuing new bonds or issuing new shares to raise interest. If the cash reserves hit bottom, it may jeopardize the investment in the software business, further affecting operating income.

Chart: MSTR Cash and Cash Equivalents Reserves (Quarterly)

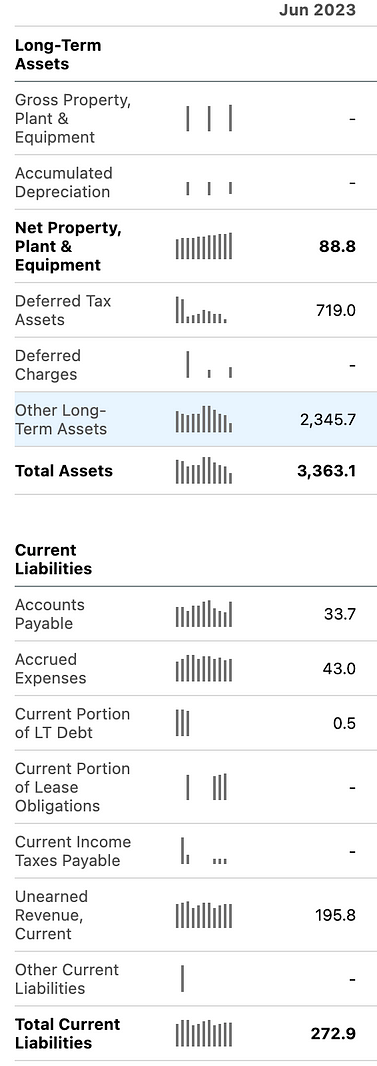

From the current balance sheet of MSTR, total assets of $3.363 billion ($2.346 billion in BTC) are actually undervalued. This is mainly due to the calculation of the value of BTC only considering the depreciation compared to the cost, even if the price subsequently rises back, it will not be included in the statistics. Therefore, there is a non-permanent impairment loss of $2.2 billion. In fact, at the current BTC price of nearly $30,000, MSTR’s total assets should be $5.56 billion, corresponding to a debt of $2.73 billion.

Chart: MSTR Balance Sheet (2Q 2023)

Although MSTR has tried its best to reduce debt pressure through its business model, the overall performance of the company is deeply tied to the outlook of the traditional business and the price of Bitcoin. If the price of Bitcoin cannot sustain a continuous rise at the current level, MSTR’s continued fundraising may become difficult. For example, this quarter MSTR announced the launch of the largest $750 million equity offering plan in history, and it is currently unclear how it will proceed. However, the day after the announcement, the company’s stock fell by 6.4%.

From the specific situation of MicroStrategy, it can be seen that the cost of issuing new shares directly is lower than that of conventional bonds, while the difficulty of issuing convertible bonds is slightly higher. It requires carefully designed terms to attract investors, which is obviously not easy in the current bear market of digital currency.

It can be seen that MSTR’s three main bonds were issued during the peak of the last BTC bull market (December 2020 to June 2021), while after the third quarter of 2021, the main financing method was rights offering. This also reflects the difficulty that MSTR may face in financing in the bond market, or the difficulty in bearing high interest rates. After all, the benchmark yield for junk bonds in the United States is 8%+, and it is unsustainable to roll over existing debts at this cost. It can only bet on a significant increase in BTC before the 2025 maturity date.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How does the outflow of stablecoins affect the price of Bitcoin?

- Ecological airdrop season is coming, can DFINITY return to its peak?

- In-depth Explanation of ZeroSync Starkware’s Zero Knowledge Proof System Developed for Bitcoin

- In-depth Analysis of ZeroSync Starkware’s Zero-Knowledge Proof System Developed for Bitcoin

- Interpretation and Comparison of the EU’s Cryptocurrency Market Regulation Act (MiCA)

- Halving Narrative and Reflexivity LTC falls instead of rises, can BTC halving still bring a bull market?

- Hashed Partner The next bull market will be mainly driven by the Asian market, and bottom-up innovation may emerge in Asia.