Trillion-level business opportunity In-depth analysis of the prospects of security tokens in Hong Kong

Trillion-dollar business opportunity Prospects of security tokens in Hong Kong.Produced by | European Cloud Chain Research Institute

Author | Hedy Bi

“Digitalization is blurring the boundaries of traditional industries, which is a real financial revolution.”

As early as in 2017, McKinsey described the digital wave in its report “Competition in a Borderless World.” With the gradual acceptance of virtual assets globally, the potential behind it has also triggered discussions among regulatory agencies. When contemporary tokens are viewed as financial instruments, security tokens become the focus of regulatory agencies in various countries, including the Securities and Futures Commission (SFC) in Hong Kong.

- Unable to guard against Why are a large number of encrypted Twitter accounts hacked and used to publish phishing links? How to prevent it?

- Tornado Cash founder arrested, what original sin did the mixer commit?

- Why are Layer2 tokens not used for paying network GAS?

Since the beginning of this year, the European Cloud Chain Research Institute has been providing suggestions to the Hong Kong government on virtual asset platforms and engaging in in-depth exchanges with various sectors in Hong Kong.

Looking back at the “Policy Statement on the Regulation of Virtual Asset Trading Platforms” issued by Hong Kong on October 31, it reaffirms the potential and prospects of tokenization. In addition, just last month, Mr. Kelvin Wong, the head of the Fintech unit of the SFC, mentioned that security tokens and real-world assets (RWA) will no longer be classified as “complex” products, and there may be new regulations for Security Token Offerings (STOs).

The issuance and trading of financial assets usually require strict regulation, with securities being the most representative. Security tokens are similar to traditional securities, so regulating security tokens is one of the token types that regulatory agencies find it easier to expand their regulatory scope.

Regulatory Support in Hong Kong

The author believes that the SFC has a “supportive” attitude towards security tokens, specifically in the following aspects:

1. Type 1+7 licenses

The licensing requirements of Hong Kong regulatory agencies differ based on whether the provided trading services are security tokens and the nature of the institution. Specifically, virtual asset trading platforms in Hong Kong that provide or actively promote security token trading services are required to obtain the Type 1 regulated activity (dealing in securities) and Type 7 regulated activity (providing automated trading services) licenses issued by the Hong Kong SFC. Platforms that offer non-security tokens also need to obtain a VASP license.

For anyone or institution promoting and distributing security tokens (whether in Hong Kong or targeting Hong Kong investors), unless exempted, they must obtain a license or registration for Type 1 regulated activity (dealing in securities) under the Securities and Futures Ordinance.

2. Removal of the 12-month track record requirement after issuance

Security tokens no longer require a 12-month track record after issuance. However, licensed platform operators need to comply with the general token inclusion criteria under the “Guidance on Virtual Asset Trading Platforms” and the security token distribution guidance that the SFC will publish in the future.

3. Reasonable Due Diligence

The platform operator needs to conduct a reasonable due diligence on the security tokens to be included in the platform transactions and bears ultimate responsibility for this. At the same time, the platform operator also needs to ensure that internal monitoring measures, systems, technologies, and others can support any specific risks.

On-chain Trading, On-chain Compliance

When financial institutions face the issuance and trading of such high-speed and 24/7 financial instruments, in addition to the first step of licensing, platform operators, dealers, brokers, and other related parties should implement internal monitoring and risk management measures and focus on anti-money laundering and counter-terrorism financing (AML&CFT).

According to public information statistics, the total amount of anti-money laundering (AML) fines last year was nearly $5 billion. Most of the penalties were related to improper implementation of identity verification and “know your customer” (KYC) solutions or insufficient internal policies and risk management systems. In addition, in December last year, the Legislative Council passed the “2022 Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill”, which completed the regulatory framework, and Hong Kong has since made great strides in entering the Web3.

Source: Sumsub

When transactions are “on-chain”, AML compliance should also be “on-chain”. According to the recommendations of the Financial Action Task Force (FATF), which is internationally recognized, the three key focuses of AML&CFT, customer identity identification and risk assessment, ongoing monitoring and reporting, and control measures, need to be adjusted accordingly.

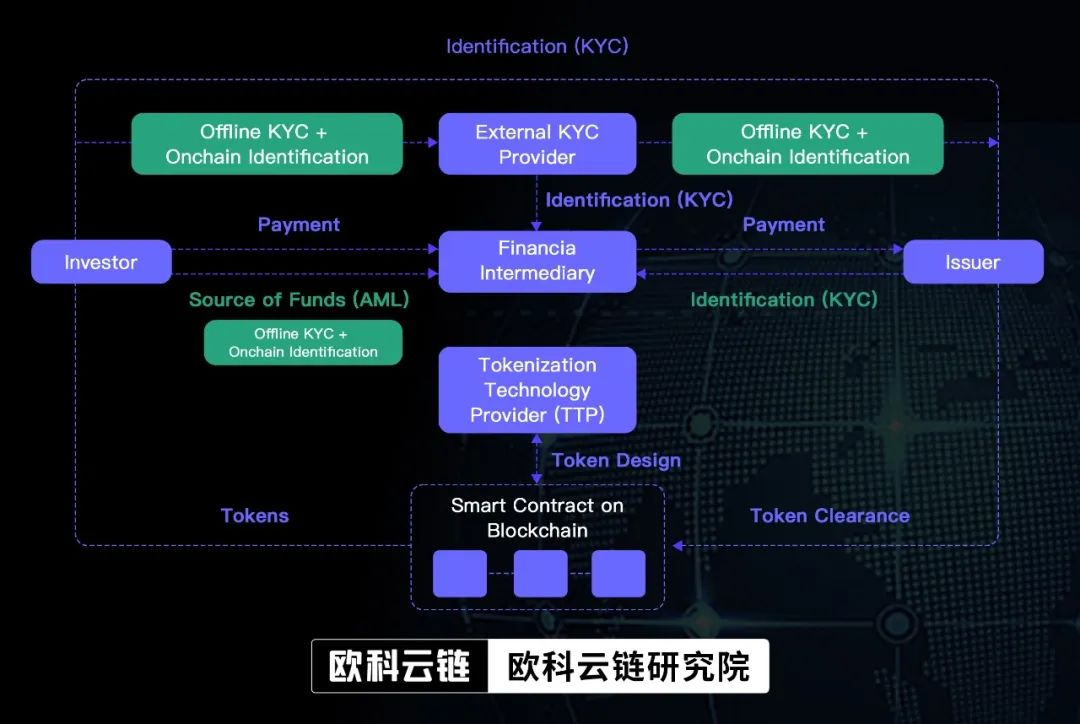

Take security tokens as an example. In the issuance stage, virtual asset trading platforms, dealers, brokers, etc., require trading parties to provide KYC, which is offline information collection for customer identification. This step is a conventional measure in traditional financial compliance. When investors provide on-chain account addresses (wallets) and conduct transactions with their on-chain assets, KYC should also continue to identify on-chain, as shown in the figure below, customer identity identification runs through the entire process.

Source: ResearchGate

When security tokens can circulate freely without relying on intermediaries, on-chain KYA (Know Your Address, Note 1) and KYT (Know Your Transaction, Note 2) become particularly important.

This is different from traditional securities, which are mainly centralized structures, and compliance in inter-institutional transactions relies on layered KYC to ensure. For financial institutions, the most effective approach is to use on-chain compliance tools such as OKLink, Chainalysis, Elliptic, etc., to track customers’ virtual asset movements on-chain, so as to achieve full-process supervision and full-chain tracking, aiming to prevent money laundering activities where accounts (on-chain addresses) are disconnected from real identities.

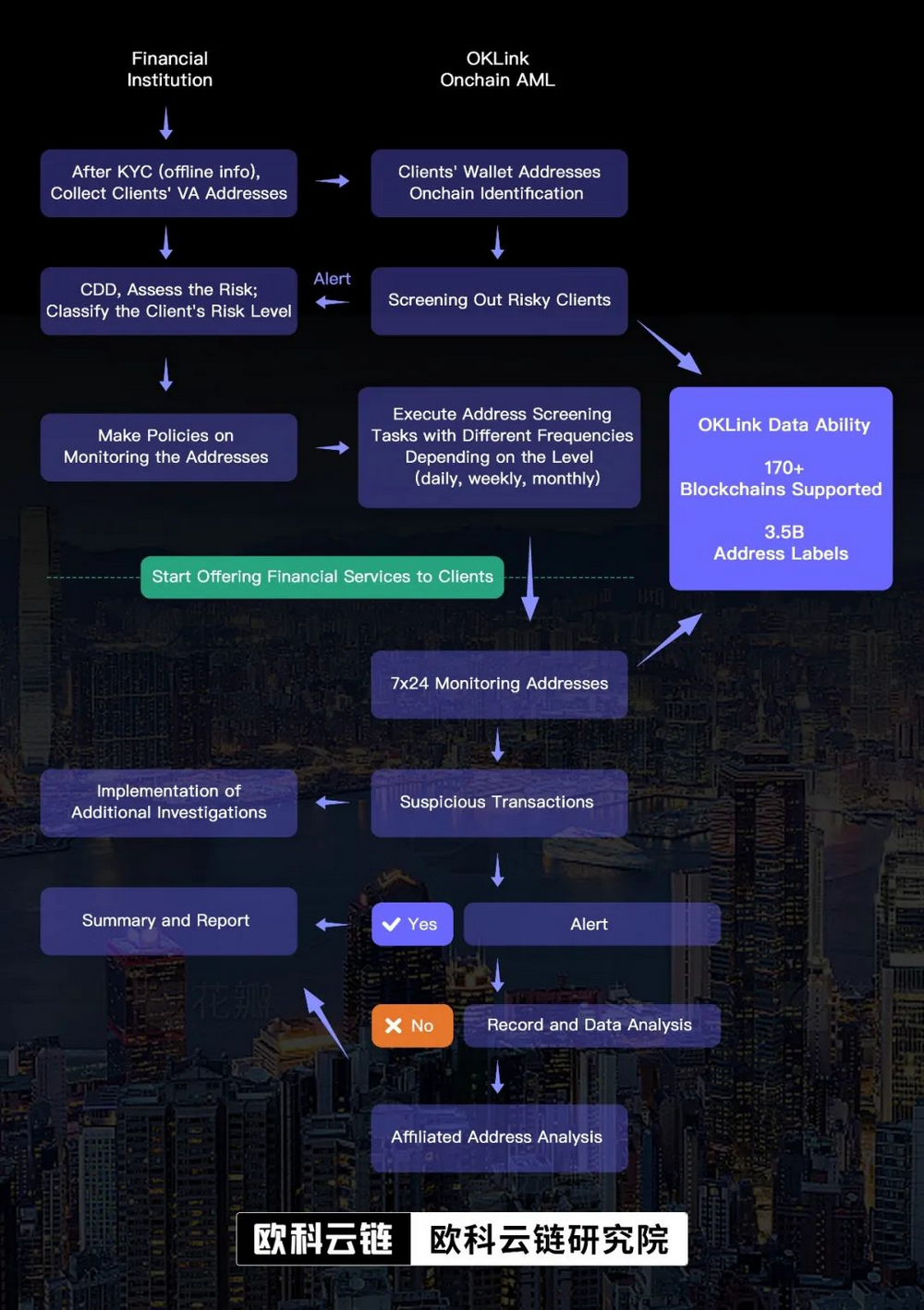

The following diagram will illustrate how financial institutions use on-chain compliance tools for full lifecycle risk management, achieving coordination between on-chain and off-chain:

Financial institutions like Barclays Bank in the UK have been experimenting with on-chain compliance tools since 2015 to identify risks and prevent risks associated with AML&CFT. Furthermore, financial institutions including banks and fintech companies such as payment providers have invested in on-chain compliance tools. According to publicly available information, the largest investment round raised $60 million, and the valuation of leading on-chain compliance tool companies has reached nearly $10 billion.

“We have been deeply involved in on-chain data for many years, and our ultimate goal is to become the on-chain navigator in this complex digital world. With the continuous acceptance of virtual assets by governments worldwide, including Hong Kong, OKLink, the on-chain AML solution launched by OKLink, will provide reliable compliance guidance for financial institutions and participants,” said Nick Xiao, Product Director of OKLink.

Security Tokens: The New Representation of Ownership

At its core, security tokens represent ownership of assets such as equities and real estate. The biggest difference between security tokens and traditional securities is that each asset is established on a blockchain in the form of tokens (according to the latest IMF article, tokens are units created in a digital ledger that uses encryption technology). Like securities markets, the issuance and trading of security tokens need to comply with financial regulatory rules and standards.

As the new representation of ownership, security tokens also mean that Web3 is breaking the boundaries of the securities industry with the digital form of its tokens, continuously expanding the boundaries of the traditional securities industry through features such as global accessibility, high liquidity, high security and transparency, and automation and intelligence. In June of this year, Leung Hon Keung, Director of Financial Services and FinTech of the InvestHK, stated that from the Hong Kong government’s perspective, asset tokenization (including security tokens) is seen as a multi-trillion-dollar business opportunity.

The integration of traditional financial instruments with blockchain technology is an eternal topic in the global financial industry. At the same time, this poses new requirements on the technological regulatory capabilities of regulatory agencies. However, this does not hinder the issuance of global regulations on tokenized securities or its positioning. In addition to the SFC in Hong Kong, OKLink Research Institute has compiled information on the regulatory status of security tokenization in major countries worldwide, as shown in the table below.

The original nature of future business will not change. Only when transactions are put on-chain and this “multi-trillion-dollar business opportunity” is opened while ensuring compliance and incorporating it into on-chain operations, will it be truly recognized by the mainstream as a new technology.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is an encrypted market maker the ‘behind-the-scenes dealer’?

- a16z Why It’s Said that Stateless Blockchain Cannot Exist

- a16z Research on the Impossibility of Stateless Blockchain

- a16z Crypto Partner discusses NFT Royalties How it Works, Evolution, and Solutions

- Why is data availability sampling important for blockchain scalability?

- How can NFT wearable devices lead the future of digital fashion?

- In-depth Analysis How did the blockchain data tool Dune rise rapidly?