Understanding the Launch Rules of Neutron, the First Consumer Chain in the Cosmos Ecosystem

Launch Rules of Neutron, the First Chain in Cosmos EcosystemAuthor: Jiang Haibo, BlockingNews

On March 15th, the Cosmos Hub completed the Lambda upgrade and officially launched Replicated Security, also known as Interchain Security, which is a shared security model designed by the Cosmos Hub.

Applications chains that utilize Replicated Security are also known as consumer chains. They will no longer need to maintain the security of their own blockchain, as the block production will be done by the Cosmos Hub validators. These validators will also receive additional native token rewards, increasing the value capture ability of ATOMs.

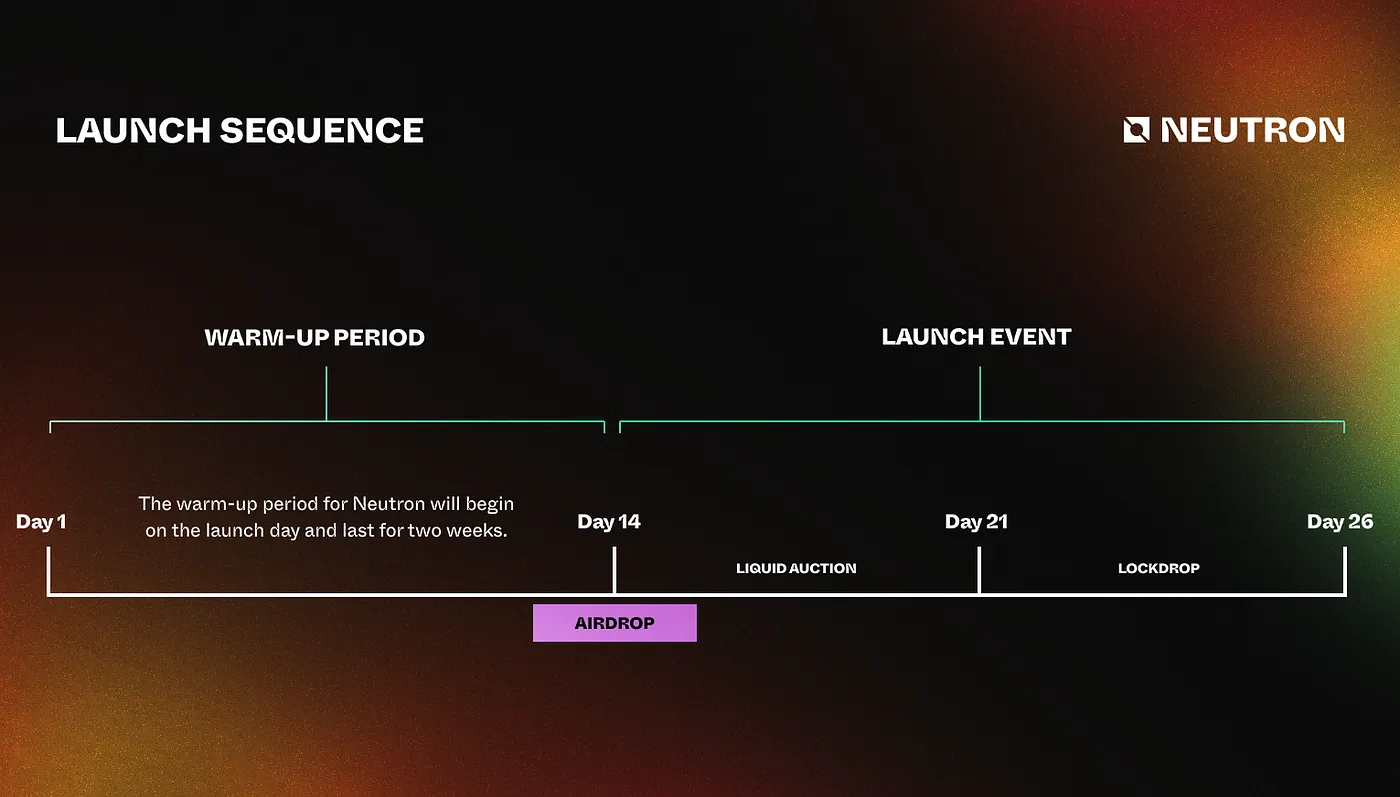

Neutron is the first consumer chain launched using Replicated Security. It was approved by the Cosmos Hub community through Proposal 72 last year, and received 50,000 ATOMs from the Cosmos Hub community pool to develop Neutron as the DeFi Hub in Cosmos. Well-known projects including Lido are also directly deployed on Neutron. Today, Neutron’s mainnet has launched and airdrops have begun. Neutron is an unlicensed smart contract platform based on Tendermint and built using the Cosmos SDK. With approximately $2 billion worth of ATOMs staked in the Cosmos Hub, Neutron will be one of the most secure cross-chain smart contract platforms through the use of Replicated Security. It will also enable DeFi applications to scale across dozens of blockchain networks. For more information about Neutron, see the article on BlockingNews. The following section will introduce the launch rules for Neutron. Before the launch event on May 24th, Neutron had a two-week warm-up period to ensure the stability and security of the Neutron blockchain.

- Worldcoin has completed a $115 million C round of financing, led by Blockchain Capital.

- How can we determine whether a stablecoin is an official native asset after Multichain’s shutdown exposed asset security issues?

- Summary of Hong Kong Securities and Futures Commission’s Cryptocurrency Consultation: Retail Trading, Temporary Ban on Stablecoins, and Inclusion in Indices are Minimum Standards

Airdrop rules: 7% airdrop, snapshot time is November 19, 2022

Time: Three months starting from May 24th

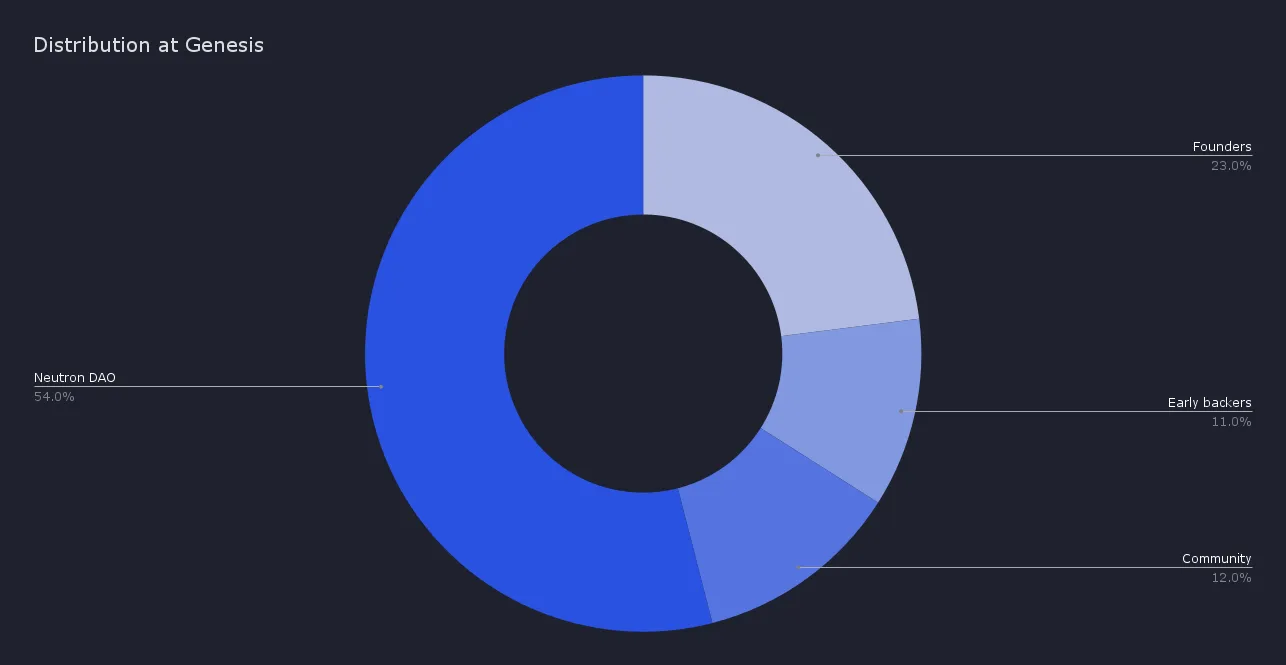

According to the token economics of Neutron, its native token is NTRN, with a total supply of 1 billion. It can be used as gas fees in Neutron and has governance rights. Neutron has received continuous support from the Cosmos Hub, and therefore 7% of the total tokens have been allocated to ATOM stakers, with the initial allocation as follows:

- Founders allocate 23% of the tokens, which are locked for 1 year and then linearly unlocked over a 3-year period.

- Early supporters allocate 21% of the tokens, which are locked for 1 year and then linearly unlocked over a 3-year period.

- The community allocates 12% of the tokens for airdrops and launch activities.

- Neutron DAO allocates 54% of the tokens, which can only be transferred and used after governance voting.

The airdrop token comes from the community’s allocation of 12%, with 7% used for airdropping. Specifically, 4% is allocated to accounts that staked more than 1 ATOM on block #12900000 (November 19, 2022); 3% is allocated to accounts that participated in the Prop 72 vote. Eligible users can claim the tokens within the first three months after the launch of Neutron, which started on May 24. Tokens that are not claimed by the end of this period will be transferred to the Cosmos Hub pool. The airdropped tokens will be unlocked within three months after the end of the Neutron launch event (about 9 days after the launch), and the airdrop portion accounts for 58.3% of the initial circulation.

The airdrop addresses first exclude addresses with less than 1 ATOM staked, which accounts for 38% of the staking addresses on Cosmos Hub. The airdrop quantity is mainly distributed based on staking quantity, excluding the possibility of a Sybil attack, but also disadvantageous to individual users. If the staking amount of a single account is greater than 1 million ATOM, it is calculated as 1 million ATOM. Users who hold more than 1 million ATOM through multiple addresses need to report it actively, otherwise they will be excluded from the airdrop when discovered.

Users who staked liquidity using Stride at the above block height can also claim the airdrop, but any US users, users in sanctioned countries, centralized exchanges, and custodians are excluded.

Liquidity Auction: 4% of the tokens are used for auction

Time: May 24 to May 31

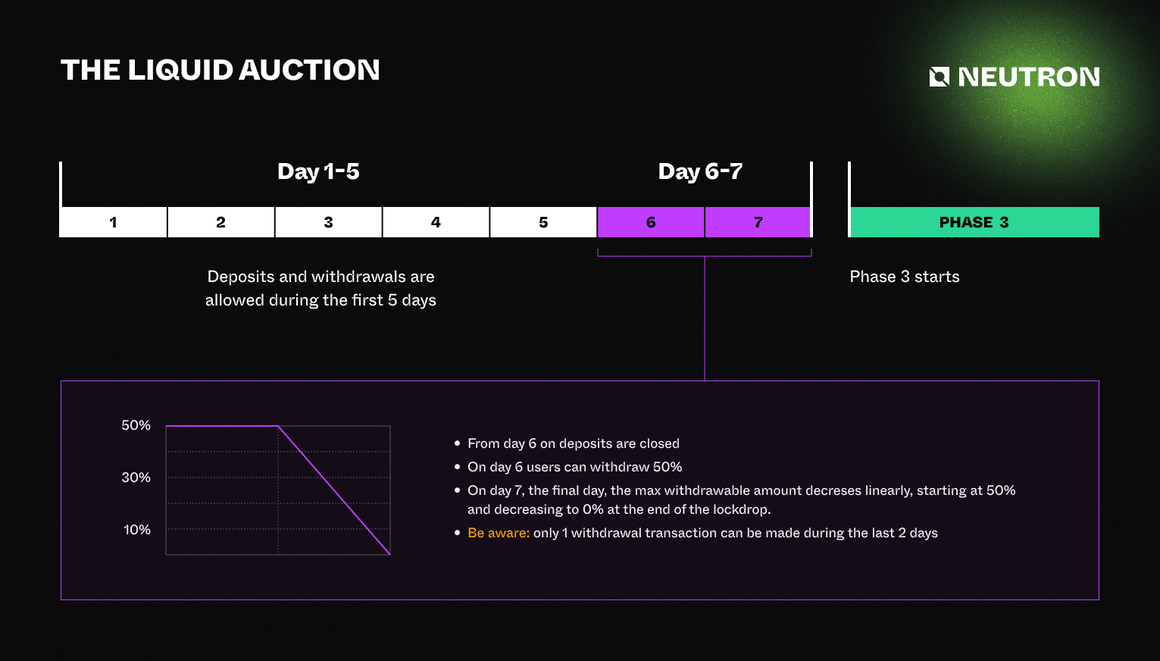

The liquidity auction will help Neutron complete the price discovery process, and participants will be able to determine the price of NTRN tokens and start influencing the Neutron governance system.

Neutron will evenly distribute 4% of the tokens from the community allocation to two virtual liquidity pools, ATOM and axlUSDC (USDC cross-chain to Neutron by Axelar). Neutron Treasury will provide NTRN tokens, and users can participate with ATOM and axlUSDC. Finally, LP tokens will be distributed uniformly based on the proportion of everyone’s participation funds, which means that Neutron Treasury will automatically receive 50% of the LP tokens, and both ATOM and axlUSDC will be settled at the same price.

The liquidity auction is divided into two stages. The first stage is the free period, which lasts for 5 days and allows participants to freely increase or decrease their participation funds. The second stage is the end period, which lasts for 2 days and does not allow additional auction funds to be added. Only one withdrawal transaction can be initiated during this stage, and on the first day, 50% of the funds can be withdrawn, while on the second day, the percentage of funds that can be withdrawn will gradually decrease from 50% to 0.

At the end of the auction, all participating funds are deposited into the liquidity pool of Astroport in the form of LP tokens.

Even if you do not participate in the subsequent lock-up airdrop, the LP tokens obtained from the auction will need to be linearly unlocked within three months after the start of the activity, just like the airdropped tokens. This part of the LP token can also receive other mining rewards from Neutron or Astroport.

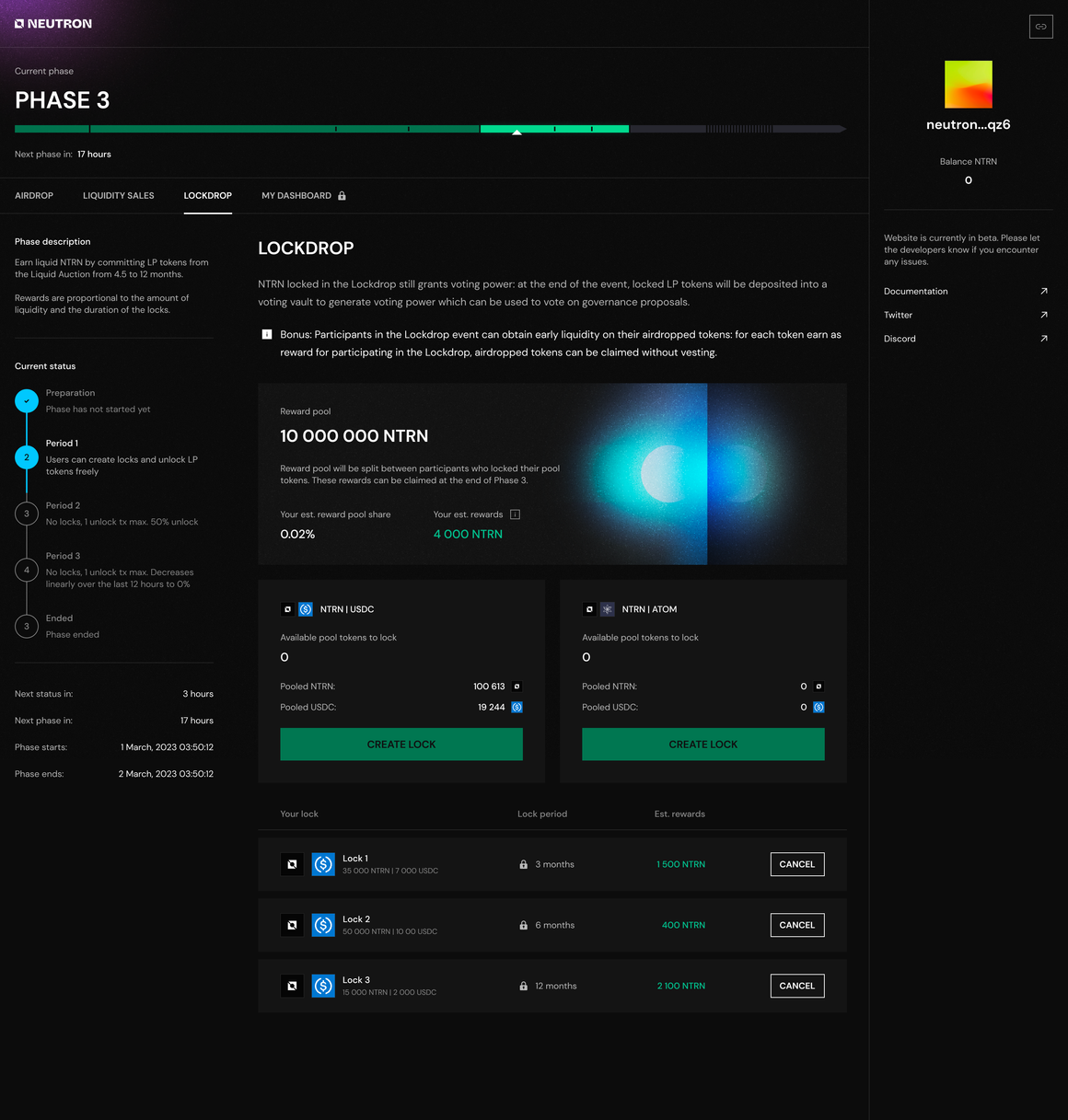

Lock-up Airdrop: Lock-up for 4.5 to 12 months and distribute an additional 1% of the total tokens

Time: May 31st to June 5th

Users participating in liquidity auctions can participate in the subsequent lock-up airdrops, which is a reward mechanism provided to liquidity auction participants. They can choose to lock their LP tokens for 4.5 to 12 months and receive lock-up airdrop rewards. The reward tokens in this phase also come from the community allocation part, accounting for 1% of the total tokens.

The lock-up airdrop is a liquidity mining plan. Users who want to participate in the lock-up airdrop can create lock-ups with NTRN-ATOM or NTRN-USDC LP tokens they hold, and the same user can create multiple lock-ups with LP tokens divided into different times.

The lock-up airdrop is also divided into two stages. The first is a 3-day free period, during which participants can create lock-ups for the LP tokens obtained from their liquidity auctions, and can also cancel them at any time. Then there is a 2-day ending period. During this stage, lock-ups cannot be created, but can be cancelled. Up to 50% of the lock-ups can be cancelled, and the maximum cancellation ratio will decrease over time.

Neutron’s lock-up airdrop mechanism incentivizes longer locking, where the time multiplier is superlinear, and the longer the lock-up time, the larger the reward share. For example, the reward rate for locking up for 4.5 months is 0.5, the reward rate for locking up for 7.5 months is 1, and the reward rate for locking up for 12 months is 8.

Unlike other activities, the rewards obtained from the lock-up airdrop can be withdrawn at any time.

Through Replicated Security, application chains in the Cosmos ecosystem will no longer need to maintain the security of the blockchain, and Cosmos Hub can also increase its value capture ability for ATOM. Now, the first application chain, Neutron, has begun to start and distribute airdrops. Projects including Lido will be directly deployed to Neutron, and the Cosmos ecosystem may receive more attention.

Risk Warning: This article aims to help everyone understand the rules of Neutron’s airdrops, liquidity auctions, and lock-up airdrops, but it is not investment advice. All investments come with risks and may result in the loss of all principal.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LSD injects a shot in the arm for blockchain. What risks should users pay attention to?

- In-depth analysis of the new Starknet client Beerus: How to achieve trustless state verification?

- Latest article by Vitalik: Keeping it Simple and Avoiding Ethereum Consensus Overload

- NGC Ventures: Why we invested in Opside

- Investment tips for the next bull market: In-depth analysis of the development status and trends of 15 cryptocurrency tracks

- Game Dosi: First Impressions of LINE’s Web3 Game, the Japanese Communication Giant

- How to achieve zero-cost and permissionless benefits through off-chain NFT?