How to find the address of a whale that earned 50 times in 3 days using existing resources?

How to locate a whale that earned 50x in 3 days using available resources?Original text: “How did I find the whale address that earned 50 times in 3 days?”

Author: litter bear

In the cryptocurrency market, whale investors have more resources and information, and their investment behavior often has a significant impact on the market. Therefore, it is crucial for investors to understand how to find and track whales who invest in tokens that perform well. This article will introduce how to find whale investors, understand and track their investment strategies and behaviors.

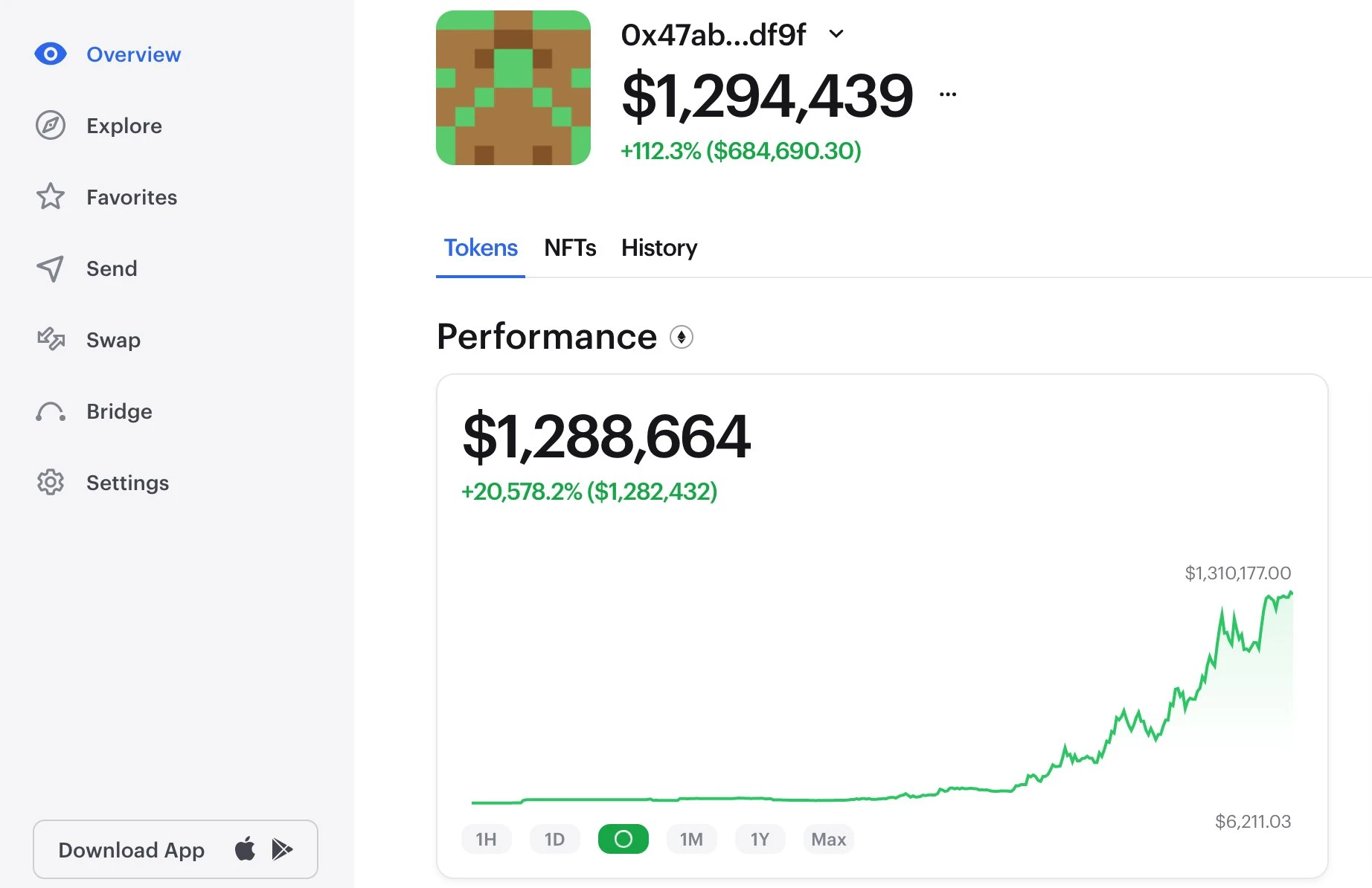

I recently found this wallet worth $25,000 on May 20th, and three days later it was worth $1,300,000!

- Analysis of Beijing’s Internet 3.0 White Paper (Full Text Included): Separating from Web 3.0, Focusing on Artificial Intelligence and Metaverse

- Blockchain Capital: Why did we lead the investment in Worldcoin? We believe it will become the largest gateway to the crypto world.

- Blockchain Capital: Why did we lead the investment in Worldcoin?

What coins did they buy to increase nearly 5000% in just a few days?

The wallet’s largest position is $RFD, which accounts for 99% of its investment portfolio, holding 13567175828 RFD (worth $1,327,042) with a first purchase price of $0.00000084, spending $16,300 to buy, and now worth $1,327,042, making a profit of $1,314,572.

How did I find the whale address that earned 50 times in 3 days?

How to find whale addresses?

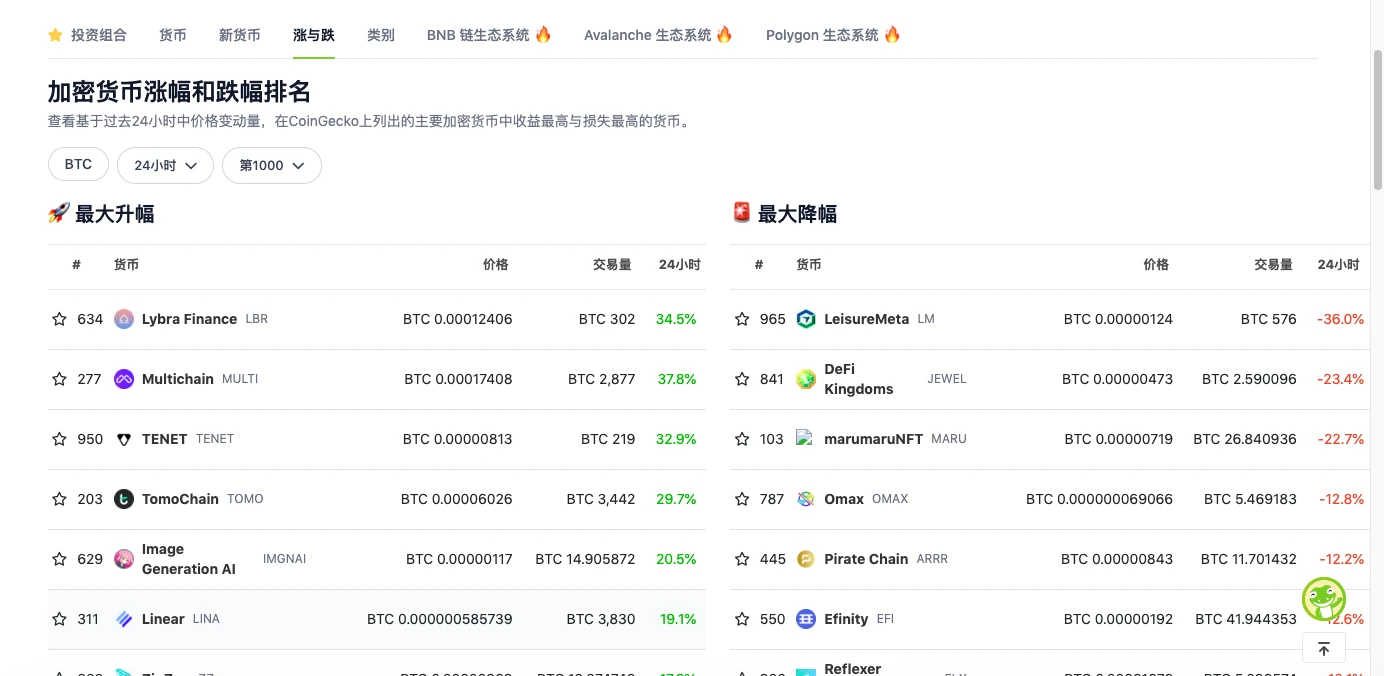

1. Use CoinGecko

We only want wallets that have invested in tokens that perform well:

- Go to the CoinGecko website

- Click on the token with the highest return

- Select the time range

- Select the tokens you are interested in

- Take note of the chain they are on

- Take note of the token address

- Take note of the date when the token was at a lower price

Now that we have some tokens that perform well, we’re going to try to find wallets that invest in these assets.

For individual investors, it is recommended to ignore wallets that hold a large amount of meme coins because the holders of these wallets tend to have a more gambling-oriented investment behavior. They may repeat such investment decisions in the future, but they rarely achieve decent returns.

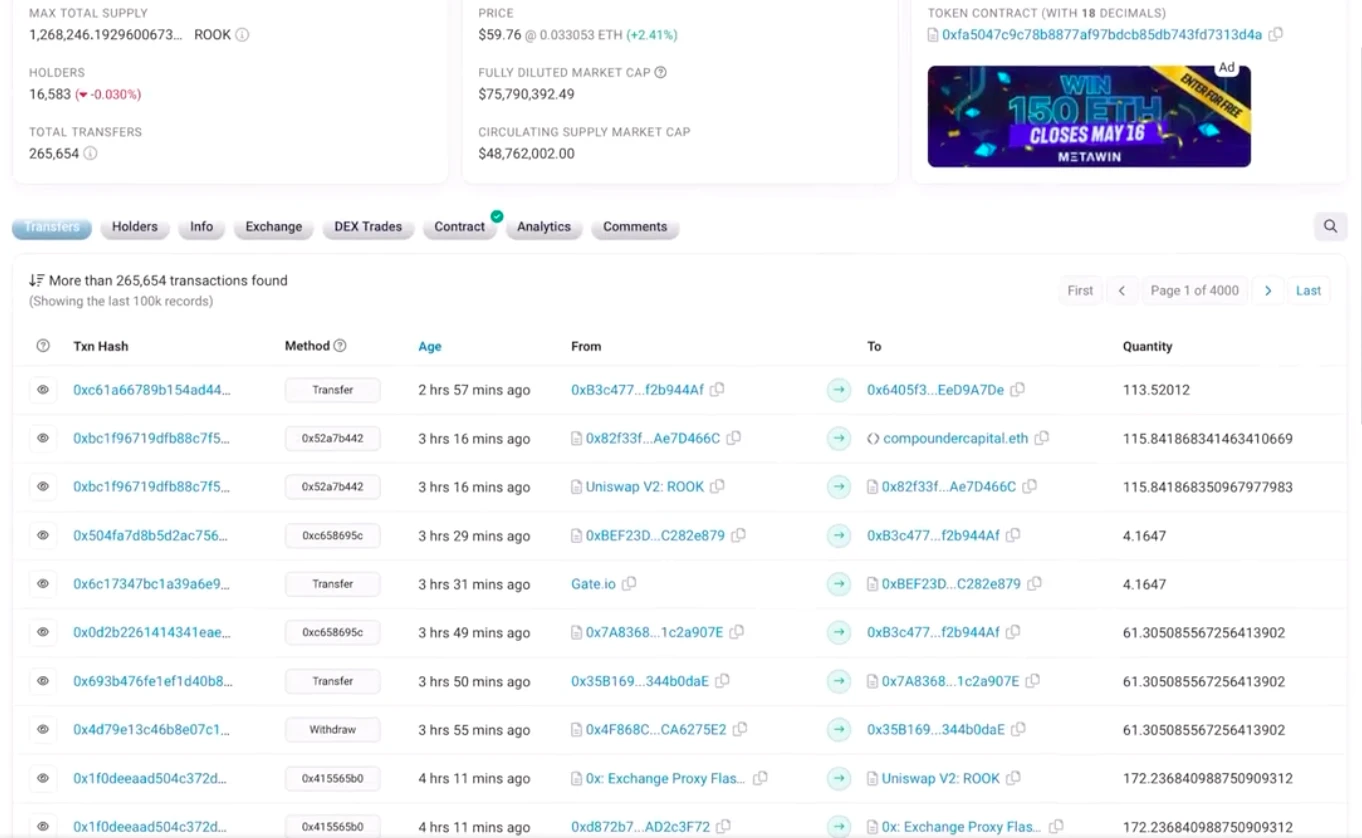

2. Use blockchain explorer

- Go to the relevant blockchain explorer

- Enter the token address

- Filter out addresses with large transactions

- Download a CSV list to look for a specific date

- Click on the address with the large transaction

- Avoid contract addresses

- Note down the address where you bought at a lower price date

- You can also filter by holders

- Note down whale addresses

This way, we can also compile some wallet addresses that may be useful.

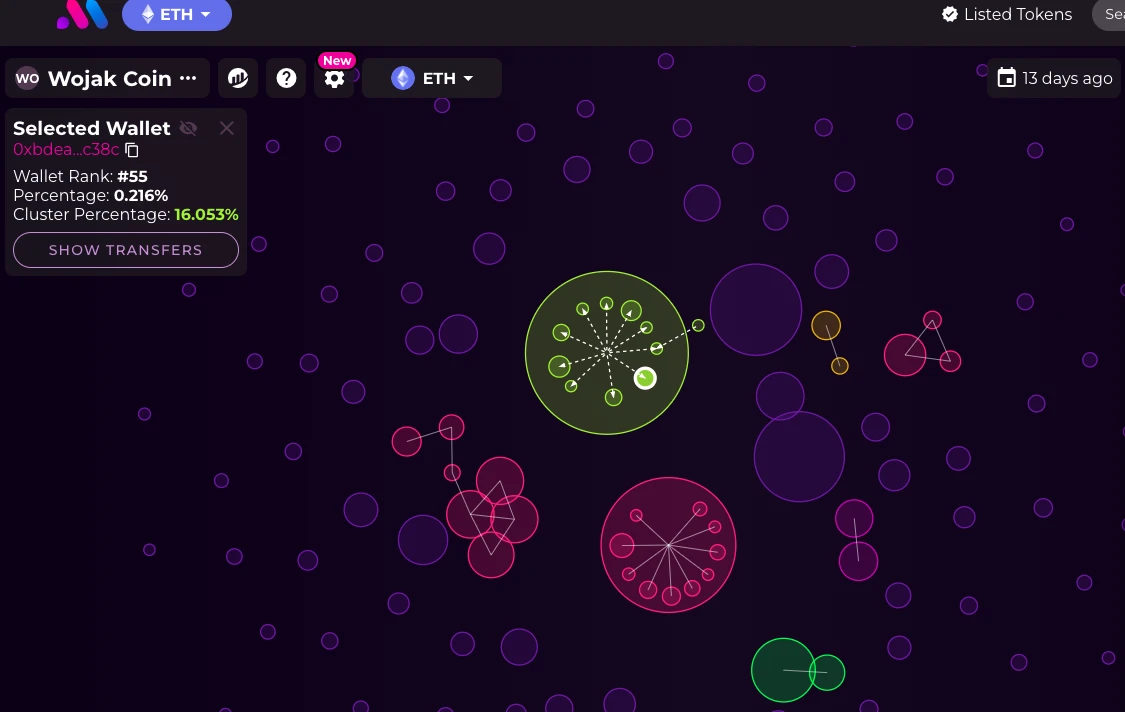

3. Use bubble maps

- Go to the bubble maps website @bubblemaps

- Enter the token address

- Select the time period of interest

- See top holders during that period

- Filter out pre-sale addresses

This is a very fast way to visually identify some top holders of the token and also filter out addresses that may hold a large amount of the token due to presales.

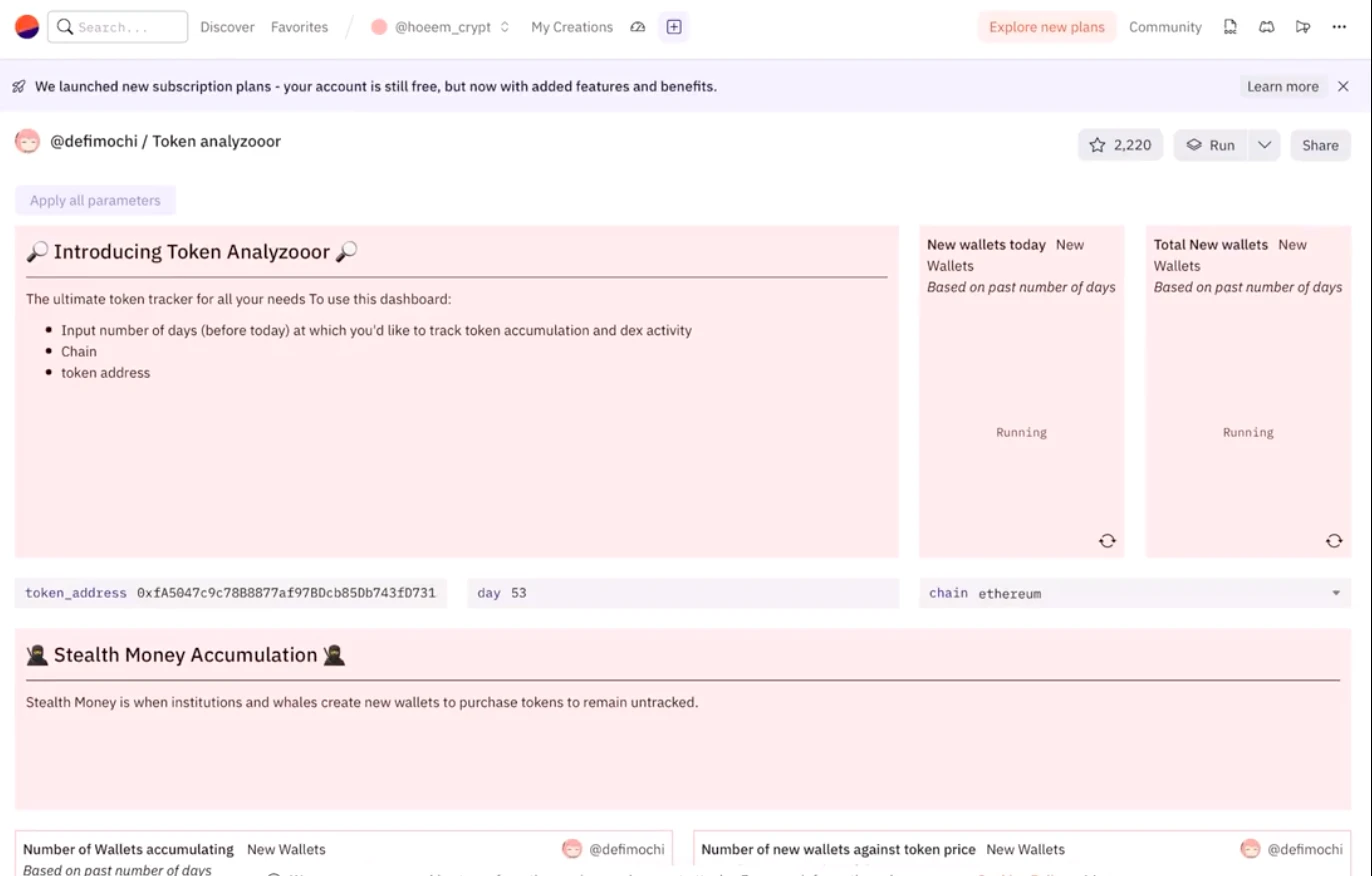

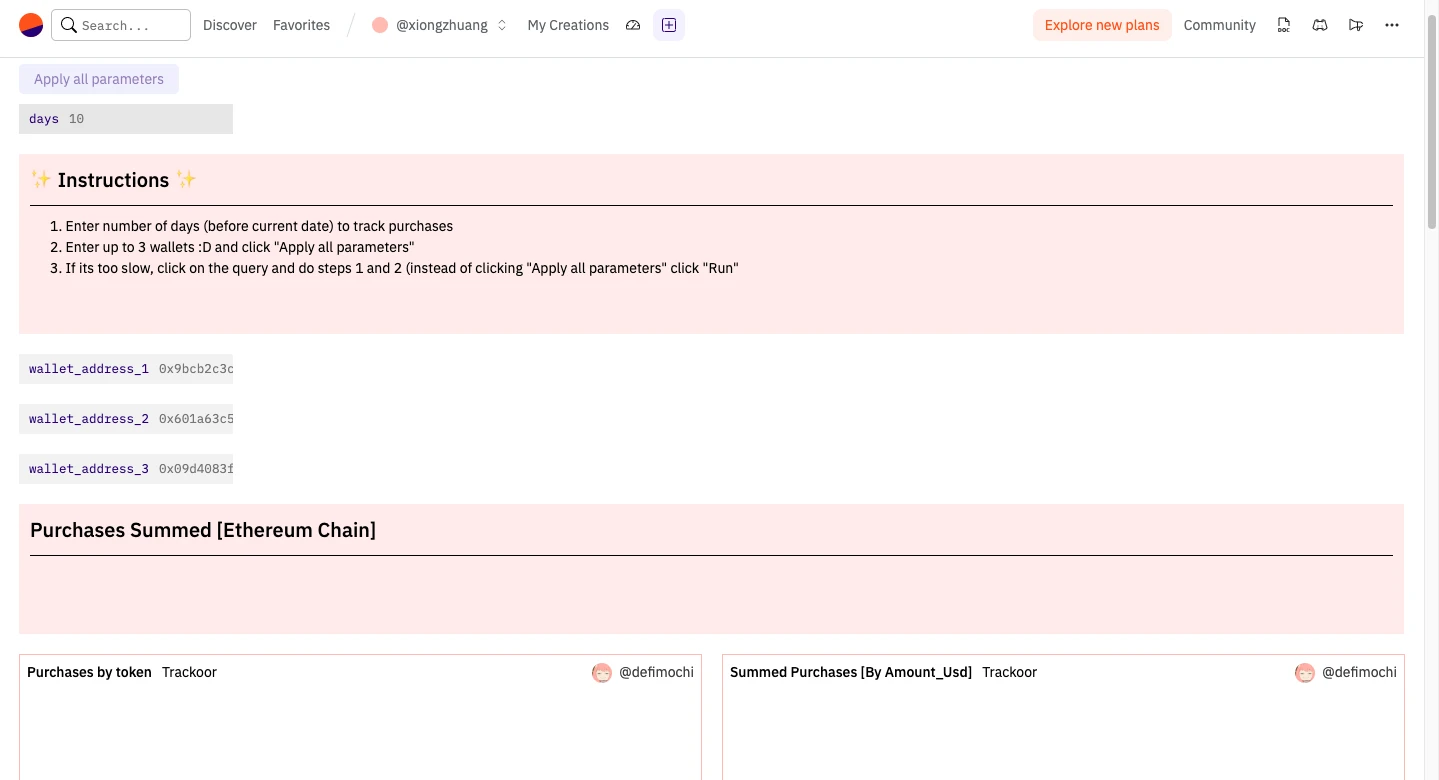

4. Use Dune Analytics

Dune dashboard created by Mochi (@defi_mochi) is very powerful.

- Search for “Token Analyzer”

- Select the chain

- Enter the token address

- Enter how many days ago you want to see someone bought

- Now, you can see the highest profit holder

- Click on the address of interest, ignore contract addresses, and note down other addresses

Now, we can get more addresses that bought the token at a lower price.

5. Filter wallets

Now that we have an interested list of wallets that bought well-performing tokens.

- This might be luck, so now we need to further filter:

- Enter wallet addresses into DeBank (@DeBankDeFi), Arkham (@ArkhamIntel), or Zerion (@zerion) websites

- Filter transactions

- Look for token purchases and sales

- See if there is a profit record

- If so, this is a wallet worth considering

Filter out profitable wallets

We now have a list of whales that we are specifically interested in.

Now we need to find the whales with large profits.

We will use a dashboard.

Enter “Wallet purchase visualizer” on Dune (@DuneAnalytics).

This dashboard was created by Mochi (@defi_mochi) and is free for anyone to use.

- Query details: query date, query wallet (up to three wallets can be queried), chain where the token is located (currently only supports Arbitrum and Ethereum);

- Analysis details: Now you can see the purchase history of this wallet in the past X days; check the time of buying tokens, check the price at the time of purchase, pay attention to the addresses and prices of these tokens;

- Quick comparison

Now you can quickly compare with CoinGecko.

Go to CoinGecko, search for any token address, and compare the price with the purchase price.

- Create a list

Delete wallets that do not meet your criteria and keep a list of wallets that meet your requirements.

- Use robots to monitor wallets

Monitoring tools include:

- Cielo

- Maestro Bot

- Etherdrops tracking bot

You will receive alerts whenever any smart wallet of the whales you are monitoring trades.

By understanding the investment strategies of whale investors, we can better predict market trends and find the most promising tokens. Of course, there are still risks in investment, and we should always remain rational and cautious and do risk management.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understanding the Launch Rules of Neutron, the First Consumer Chain in the Cosmos Ecosystem

- Worldcoin has completed a $115 million C round of financing, led by Blockchain Capital.

- How can we determine whether a stablecoin is an official native asset after Multichain’s shutdown exposed asset security issues?

- Summary of Hong Kong Securities and Futures Commission’s Cryptocurrency Consultation: Retail Trading, Temporary Ban on Stablecoins, and Inclusion in Indices are Minimum Standards

- LSD injects a shot in the arm for blockchain. What risks should users pay attention to?

- In-depth analysis of the new Starknet client Beerus: How to achieve trustless state verification?

- Latest article by Vitalik: Keeping it Simple and Avoiding Ethereum Consensus Overload