How can we determine whether a stablecoin is an official native asset after Multichain’s shutdown exposed asset security issues?

How can we determine if a stablecoin is an official asset after Multichain's shutdown revealed security issues?Recently, it was discovered on FTM that USDT/USDC is issued by Multichain, which surprised many people. When using cryptocurrencies, the most important thing is to ensure the security of your assets. Therefore, it is very important to understand the chain on which the cryptocurrency is located and its officially supported cross-chain bridge. In this article, we will show you how to determine which chains’ U is the official native asset and how to determine its cross-chain bridge support. The following is the main content:

USDT/USDC on FTM is actually made by Multichian? Many people were surprised to see that their own house collapsed.

Let’s briefly talk about how to know which chains’ U is the official native asset, and if it is not, how to know which cross-chain bridge supports it, SAFU!

- Summary of Hong Kong Securities and Futures Commission’s Cryptocurrency Consultation: Retail Trading, Temporary Ban on Stablecoins, and Inclusion in Indices are Minimum Standards

- LSD injects a shot in the arm for blockchain. What risks should users pay attention to?

- In-depth analysis of the new Starknet client Beerus: How to achieve trustless state verification?

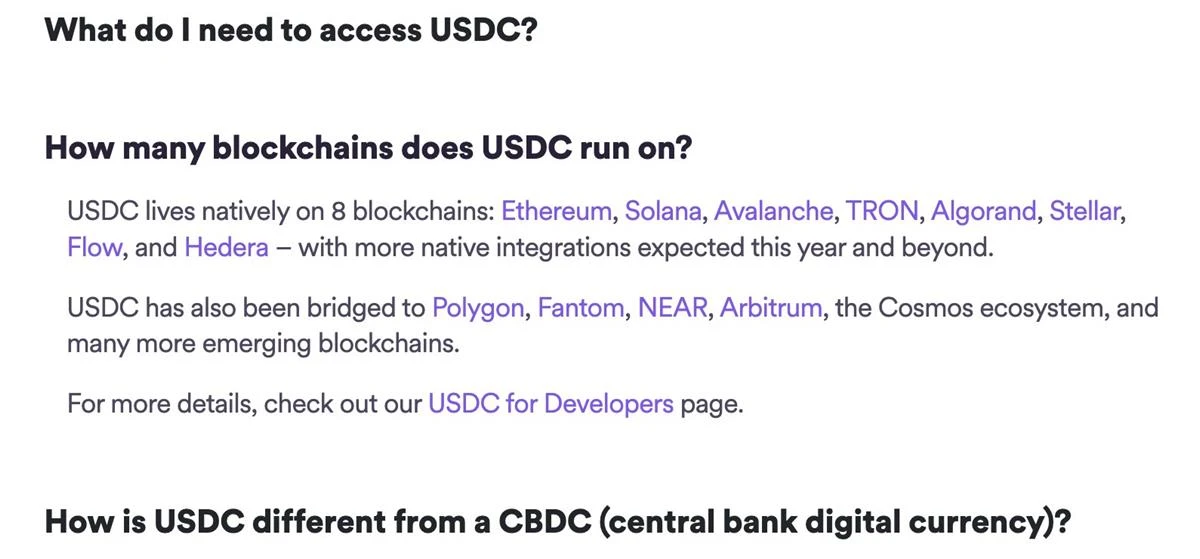

USDC: After entering the official website homepage, scroll down to the FAQ, and there is a description that USDC is native on 8 chains: Ethereum/Solana/Avalanche/TRON/Algorand/Stellar/Flow/Hedera, and is bridged on other chains.

Although USDC on Polygon has obtained the official support of Circel and can be deposited and withdrawn directly from the Circle account, it is still bridged by the Polygon official instead of being native. However, the fact that Circle is willing to support it indicates that it still has a certain degree of security recognition.

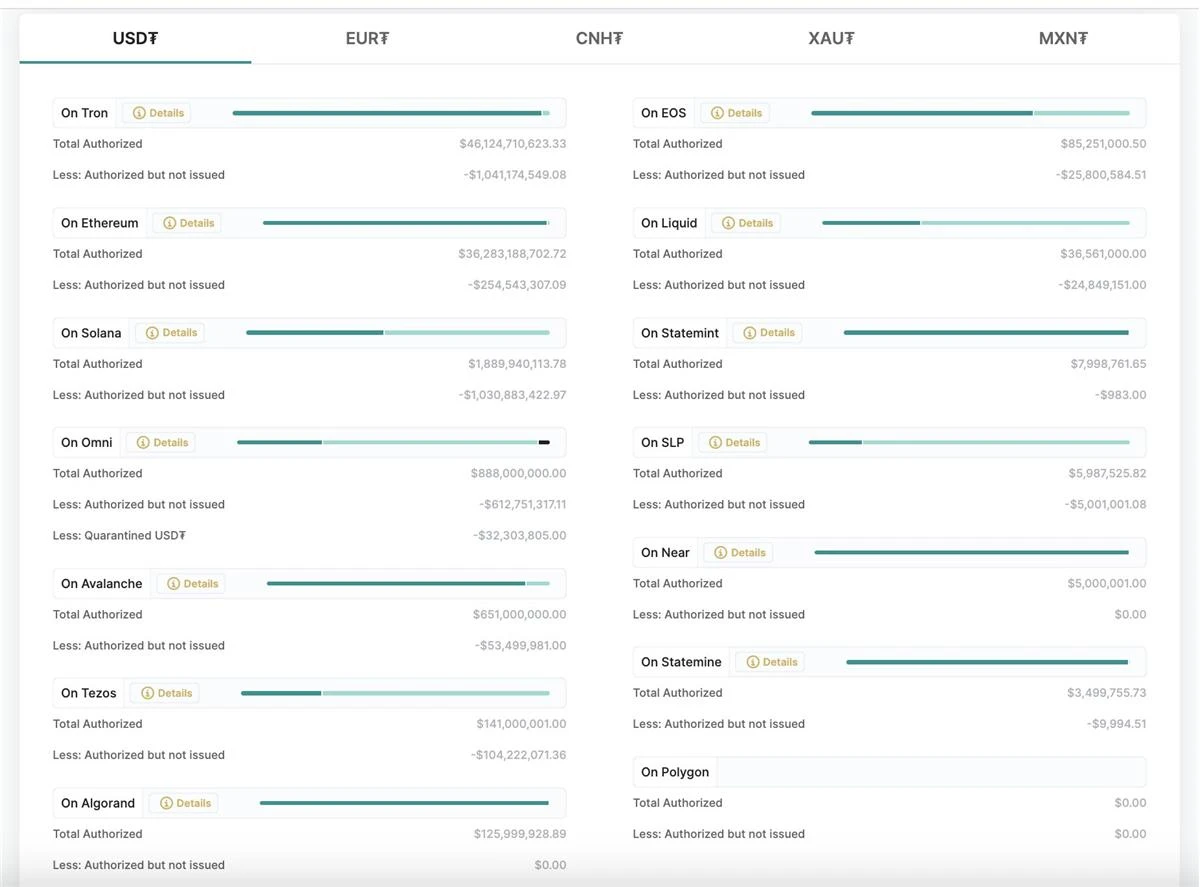

USDT: On the official website’s TrasBlockingnrency page, there are all natively supported chains. You can notice that “Omni” here is what OG frequently calls the ancestor of BRC20 and so on. USDT was originally issued on BTC/Omni.

If the chain is not a native asset, then what cross-chain bridge is supporting it?

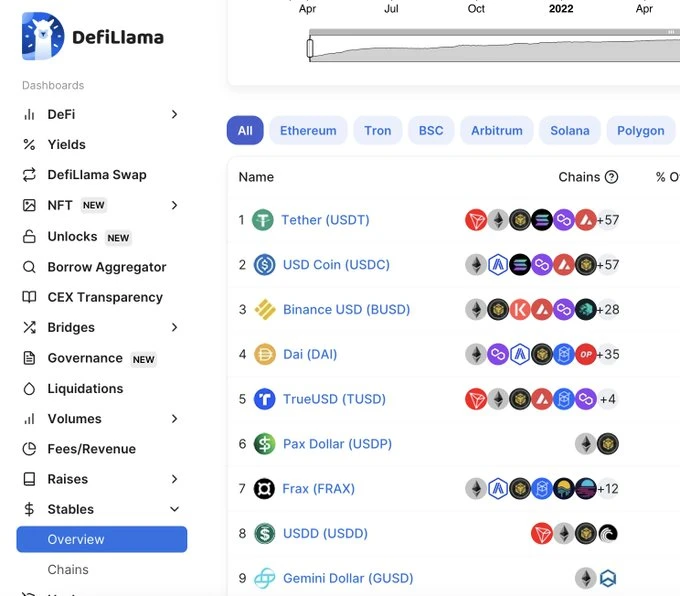

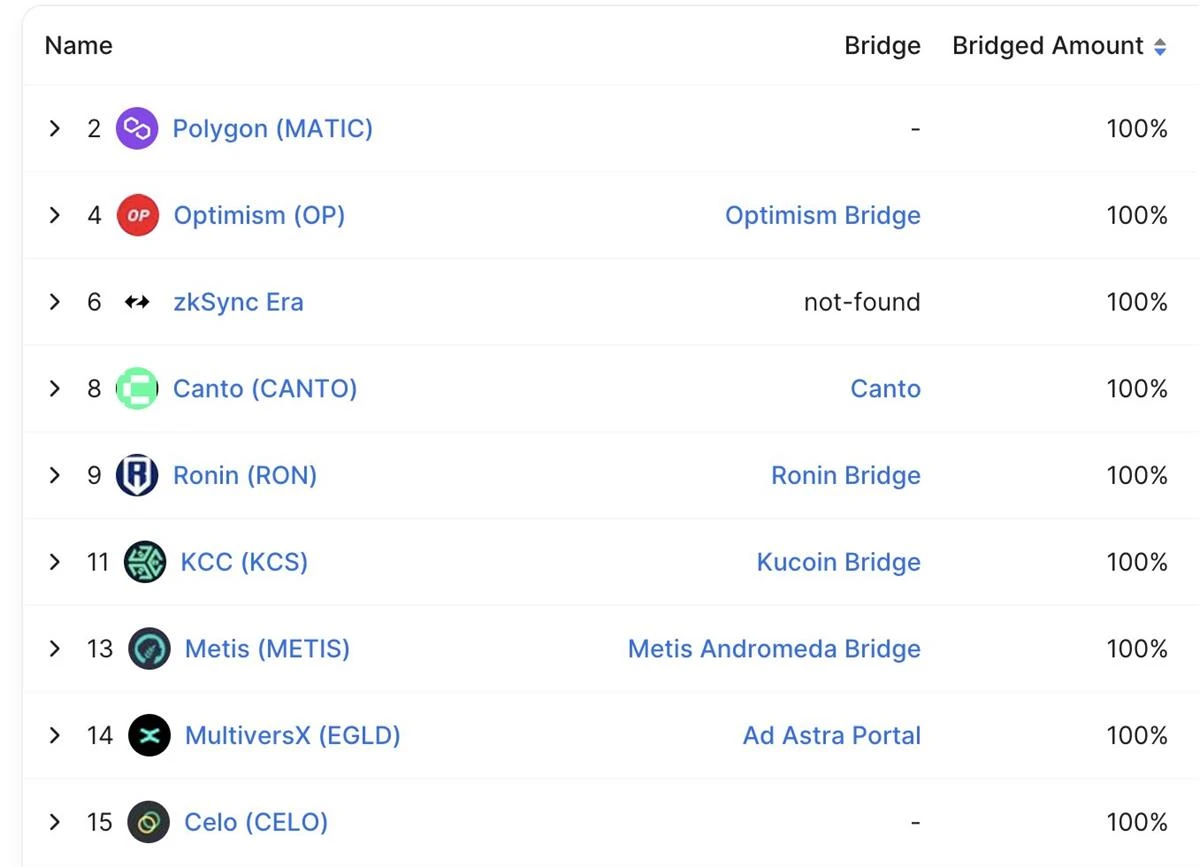

We can query through DeFillama, click on USDC after entering the Stablecoins TAB on the left, and then you can see what bridge supports USDC on each chain.

If DeFillama can’t find it, then you can only search on Google, or look for information on the blockchain browser. For example, FTMScan indicates that the USDC is supported by Multichain.

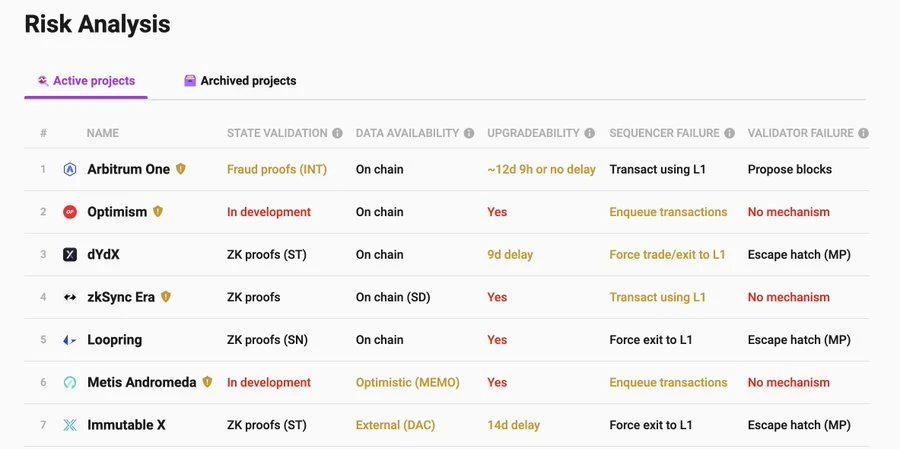

Of course, you will be surprised to find out that L2’s U is currently non-native. But don’t panic, L2 is based on XXXXXX technology, which means that the bridged assets of these mainstream L2s are generally safer than L1s. You can use l2beat to check their risks.

Yes, after reading this, you should understand that the complaint of OP team’s slow work is not unfounded.

In short, try to hold native assets on mainstream chains. Otherwise, it will become: Not your keys, not your coins. But your coins are issued by Multichain!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Latest article by Vitalik: Keeping it Simple and Avoiding Ethereum Consensus Overload

- NGC Ventures: Why we invested in Opside

- Investment tips for the next bull market: In-depth analysis of the development status and trends of 15 cryptocurrency tracks

- Game Dosi: First Impressions of LINE’s Web3 Game, the Japanese Communication Giant

- How to achieve zero-cost and permissionless benefits through off-chain NFT?

- Stablecoins: Not a Replacement for Banks, but a New Disruptor

- Flashbots: Restraining all parties, committed to thoroughly decentralizing MEV