Featured | Billionaires: Bitcoin's chances of becoming a global reserve currency have increased

Satoshi Satoshi ’s notes: 5 latest high-quality articles on cryptocurrencies are selected each time. Today ’s content includes: 1) Coinbase: how to identify blockchain free grant scams 2) ConsenSys: Ethereum in the global market shock caused by the coronavirus How it behaves 3) CryptoCompare: March Exchange Watch 4) Forbes: Billionaires say the chance of Bitcoin becoming a global reserve currency has increased 5) MyCrypto: You should be your own bank

1) Coinbase: how to identify blockchain free grant scams

This is an article written by Coinbase on "How to Identify Blockchain Free Grant Scams". The example given was initiated by a scammer against Coinbase, but it can still be applied to other blockchain projects or exchanges.

This type of scam attempts to deceive users of encrypted assets to convince them that exchanges or celebrities are holding free grants. To obtain a grant, a certain amount of encrypted assets must be sent to an address owned by the scammer, and the transaction of encrypted assets is irreversible , Which also means that once sent, users will completely lose these assets.

The types of free grant scams include:

- Mining Monthly Report: The market plunged and the computing power was lowered. Where should miners go?

- Opinion | The evolution of money in the New Crown epidemic: Cryptocurrencies are becoming more attractive

- The three death spirals of mining: two pictures to understand what happened to Jianan?

- Fake Exchange Twitter

- Fake celebrity Twiiter

- YouTube live scams, where scammers use real videos from the past, but add details about free grant scams to the videos to induce audience participation

- Send emails containing free grant scam content

Satoshi Satoshi ’s tip: The premise of a successful free grant scam is based on the belief that the content sent by the account is authentic, the blockchain is not a warm treat, and there is no free lunch in the sky. Scam.

Other types of scams, including sending phishing links to steal private keys of encrypted assets, false market news caused by market fluctuations, etc., the crypto asset industry is uneven, everyone should be vigilant and be fooled!

Full text link: https://blog.coinbase.com/crypto-giveaway-scams-and-how-to-spot-them-59e24d220616

2) ConsenSys: How does Ethereum perform in the global market shock caused by the coronavirus

In mid-to-early March, the global financial market experienced great shocks, and US stocks and crypto assets showed correlations. US stocks experienced the largest one-day decline since the crash in 1987. Bitcoin fell below US $ 4,000 and ETH fell below US $ 90.

This article is an overview of the Ethereum network based on the analysis of network activity data from last month by ConsenSys, a deep stakeholder in Ethereum.

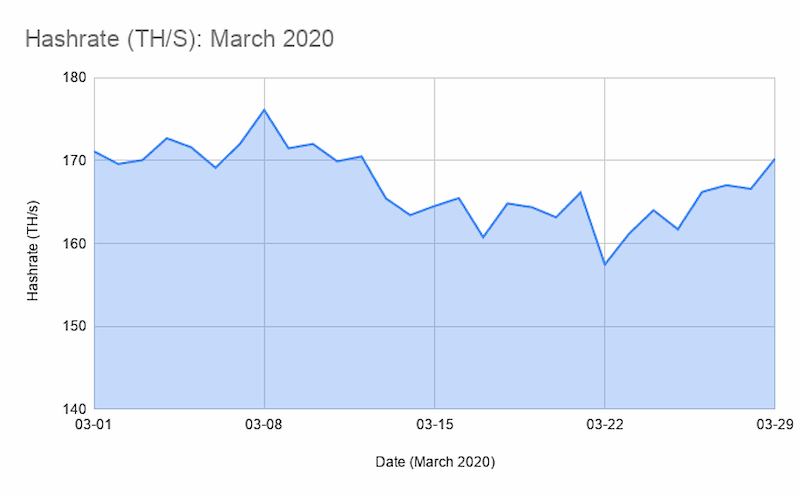

I- Ethereum's computing power remained stable, miners did not leave

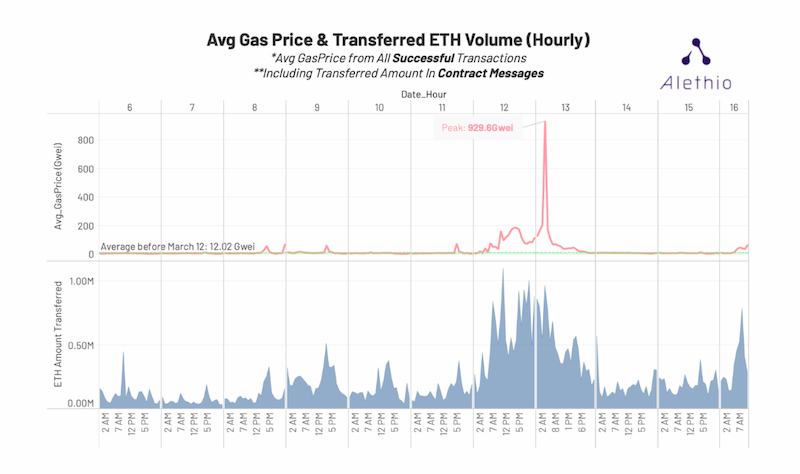

II–Gas price surged, but soon returned to normal, Ethereum ’s incentive mechanism worked

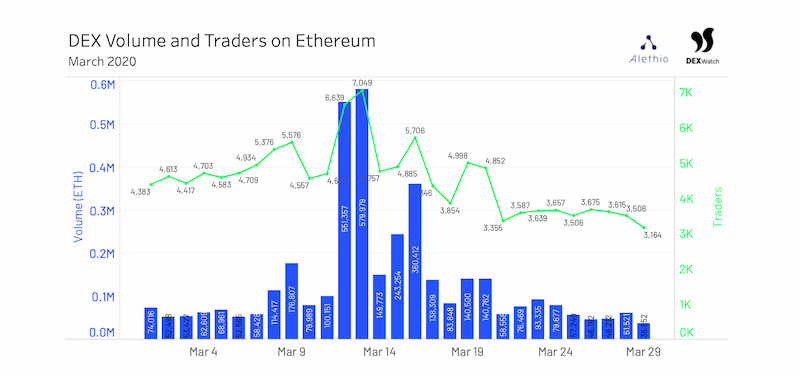

III- Decentralized exchange DEXs are not down, trading volume hits a record high

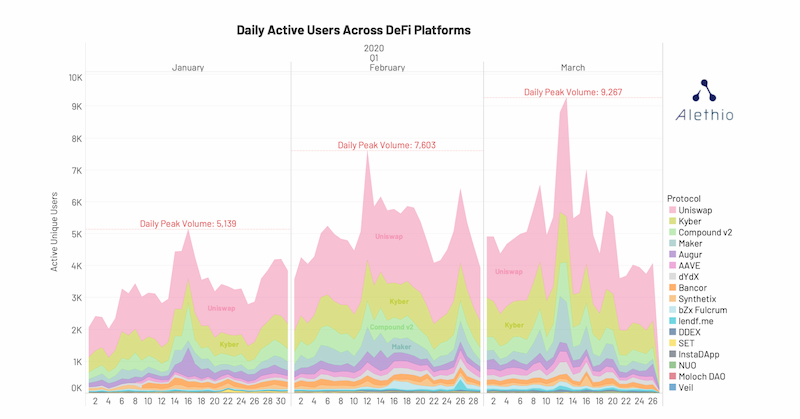

IV – The interoperable DeFi protocol allows users to quickly transfer assets and interact within different platforms

On March 13, the DeFi agreement reached a peak of 9,267 active users in 24 hours, and this figure was 11.5% of the total number of independent users (80,000) in the first quarter.

V-The demand for stablecoins is huge, and the insufficient value of DAI's collateral has tested Maker's commitment to complete decentralization and the viability of stablecoins with crypto assets as collateral in the short term

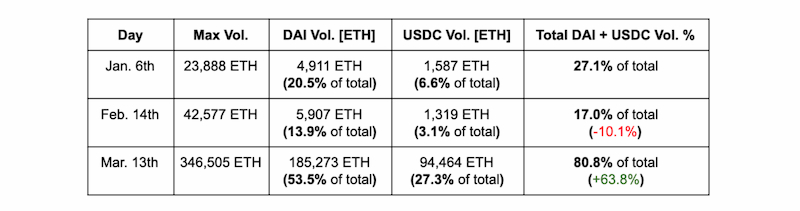

On March 13, 80.8% of Uniswap's trading volume was concentrated on Dai and USDC.

VI-Encrypted assets are related to traditional assets, but data transparency makes everything completely different

Satoshi Satoshi commented: The full text tends to sing more Ethereum. Although similar extreme situations are rare, the impact is huge and far-reaching, which also means that the performance of the underlying blockchain is measured by the amount of daily network activity One-sided, extreme circumstances must be considered.

Full text link: https://consensys.net/blog/news/how-the-ethereum-blockchain-network-performed-during-the-global-market-shocks-of-the-coronavirus-pandemic/

3) CryptoCompare: March Exchange Watch

The data analysis platform CryptoCompare analyzes the March data of mainstream exchanges and draws this report. The following are some of the main points:

- Single-day trading volume hit a new high of 75.9 billion US dollars on March 13

- Spot trading volume soared in the first quarter of 2020, and the average trading volume of many top exchanges increased by 35% compared to February

- Derivatives trading volume hit a record high of US $ 600 billion in March, and the top four largest derivatives exchanges OKEx, BitMex, Huobi, and Binance totaled US $ 514 billion, accounting for 86%

- Derivatives exchange rookie Binance and FTX trading volume soared, Binance and FTX trading volume soared 27% (to 958 billion US dollars) and 94% (to 35.8 billion US dollars), Binance and FTX accounted for 14% of the total in January Market share, and in March this figure rose to 22%

- The volume of transactions generated by institutional investors plummeted. The volume of CME transactions decreased by 44% compared with February. The total transaction volume in March was 7.36 billion US dollars, and it was 13.1 billion US dollars in February.

The report also includes the following: major progress in mainstream exchanges in March, changes in the trading volume share of various exchanges during the plunge on March 12, and the proportion of various types of legal and stablecoins in bitcoin trading volume in the past two years The situation, the comparison of the volume of spot and derivative transactions in the past year, etc.

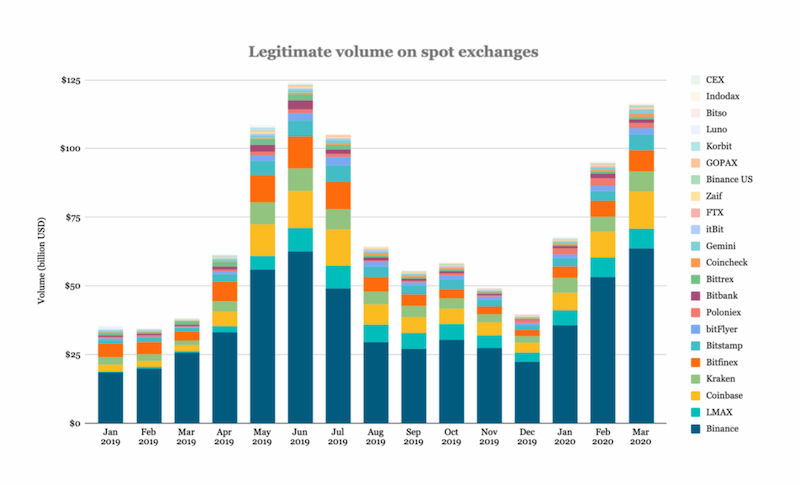

TheBlock's report on the exchange the day before yesterday also showed that the number of registered users and trading volume of the exchange have increased recently. The above is a comparison chart of the trading volume of the mainstream exchanges in the spot market.

Full text link: https://docsend.com/view/ja3v3uv

4) Forbes: Billionaires claim that Bitcoin's chances of becoming a global reserve currency have increased

Social Capital CEO and former Facebook executive Chamath Palihapitiya was an early bitcoin investor. He bought many cryptocurrencies in 2013, when the price of bitcoin was about $ 80 per piece. He claims that at a certain moment, he owns 5% of the entire Bitcoin currency (total) base.

Although he believes that Bitcoin is too volatile to be adopted on a large scale, Palihapitiya believes that the probability of Bitcoin as a global reserve currency has increased in the past few months. If the probability that Bitcoin is valuable is 1%, then this probability may now be 5% or 10%.

Palihapitiya said: Either zero or one million.

Full text link: https://www.forbes.com/sites/ktorpey/2020/04/05/billionaire-explains-the-path-to-a-1-million-bitcoin-price/#73c92d582c79

5) MyCrypto: You should be your own bank

This is an introductory article written by Ethereum wallet MyCrypto, introducing the differences between custodial and non-custodial financial solutions.

For hundreds of years, people in the world ’s most developed regions have relied on third parties to store assets securely. Institutions such as banks hold customers ’cash and other valuables. One of the key reasons is security, but it also brings The trade-offs include: loss of control, personal information being collected, service costs, and the inability of the population in developing countries to enjoy the corresponding services.

For all these reasons and more, people will benefit from a safe way for individuals to own their assets. With blockchain technology, this has become possible.

The novelty of blockchain technology is that payment requests can be processed in a decentralized manner, which means that no third parties like banks are needed. This includes ensuring that funds are not reused. By using blockchain technology, for the first time in history, human beings can store and control their own digital assets without intermediaries.

However, encrypted assets can also be held in managed and unmanaged environments, both of which have pros and cons. For example, Coinbase is a blockchain-based custody solution. The main attractions are good user experience, inability to directly control its own assets, and direct connection to fiat bank accounts. The trade-off is that users need KYC and Coinbase to face the risk of being hacked.

Blockchain-based non-custodial solutions, such as the open source MyCrypto, allow users to become their own banks. The benefits include: users have complete control of funds, personal information is not collected, etc. The trade-off is that there is a learning threshold. The key cannot retrieve assets, etc.

Full text link: https://medium.com/mycrypto/you-should-want-to-be-your-own-bank-8489352c2902

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Contribution takes "credit currency", a town in Hangzhou explores a new way of blockchain rural governance

- Viewpoint | The birth of blockchain has financial attributes and is a frontier in the investment field

- Mining companies: Bitcoin mining is basically not affected by the epidemic, and the price is the most worrying

- The central government issued the first element market-oriented configuration file: accelerating the cultivation of the data element market

- Cognitive disruption of front-line practitioners of blockchain: Bitcoin, token economy and DeFi

- Popular Science | State transition in the Ethereum 2.0 beacon chain

- Jianan Yunzhi released 2019 financial report: full year net loss of 148.6 million US dollars