BTC US Dollar Trading Market July Monthly Report

1 Introduction

From July 1st to July 31st, Bitcoin fell 6.26%, which is also the first month since February this year. Among the top five cryptocurrencies in the market capitalization, Bitcoin performed best. Our monthly report details the net inflow/net outflow, hourly fluctuations, volume, buy/sell one spread, and chain trading trends of Bitcoin's three exchanges in Bitstamp, Bitfinex and Coinbase. .

2. Net inflow / net outflow

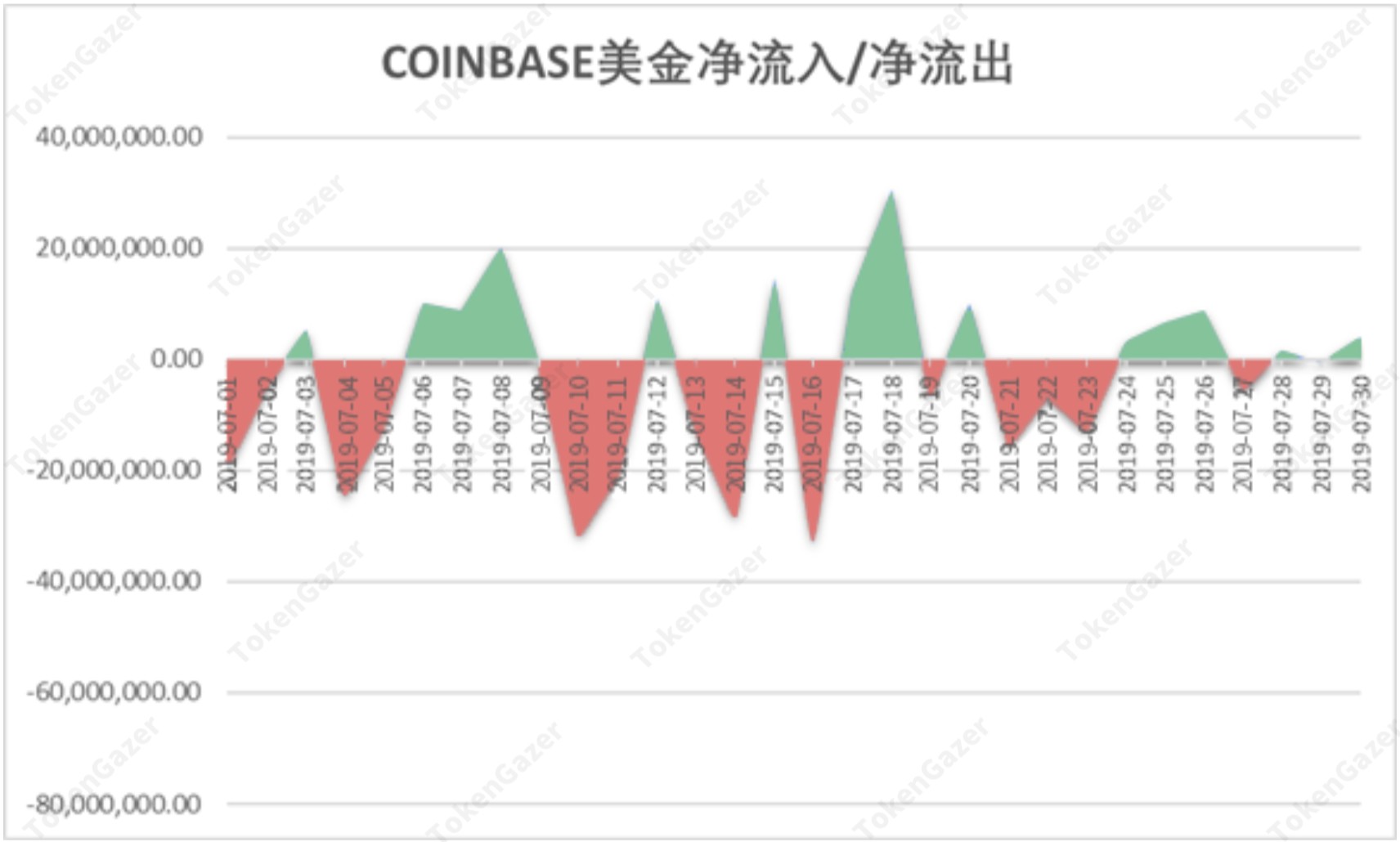

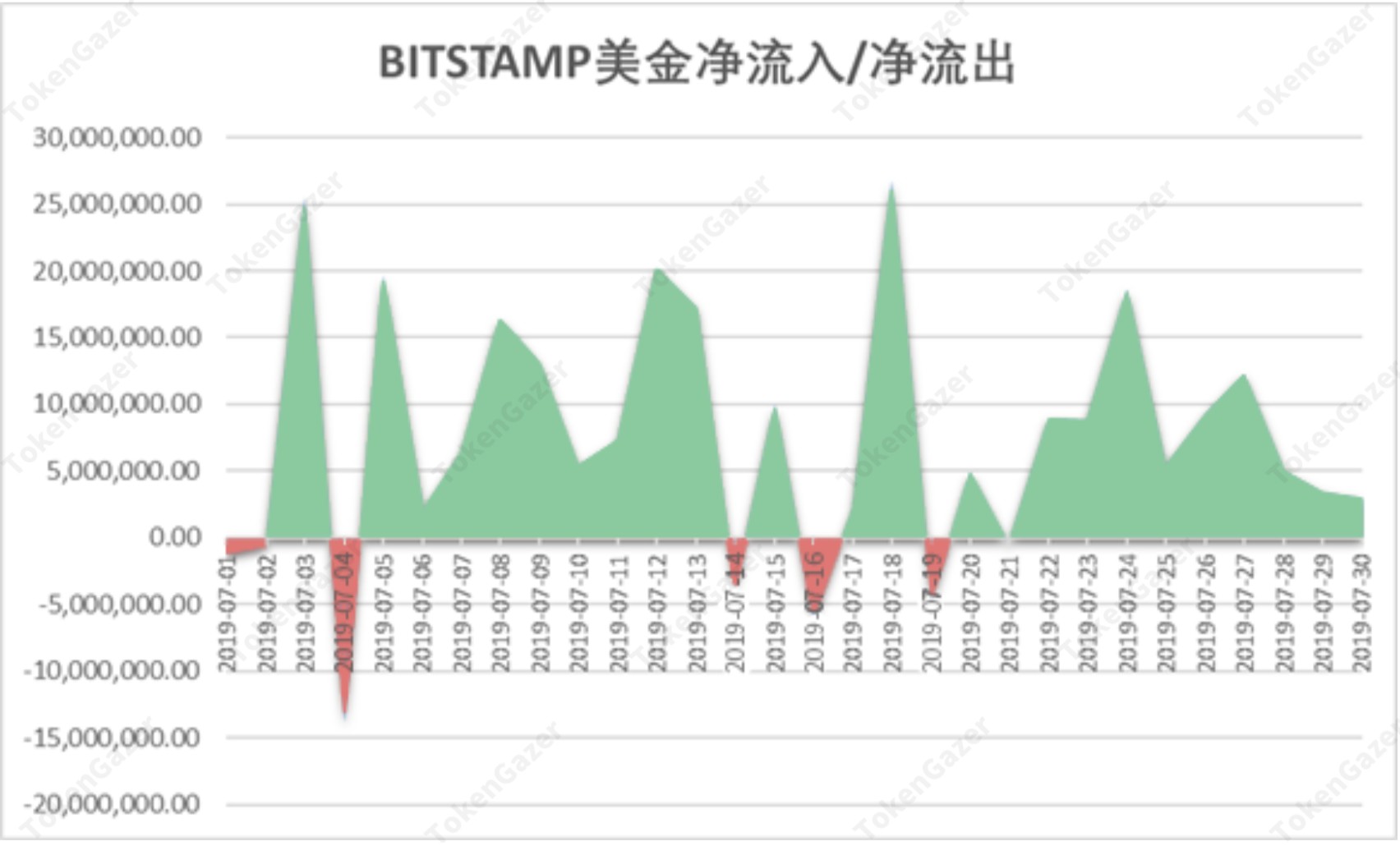

In TokenGazer's daily market observation process, it was found that Bitstamp is more likely to buy this month; Bitfinex is more inclined to sell; Coinbase's buying, selling and price trends are very close, and often buy when prices rise. More, when the price falls, it sells more.

- Is cryptocurrency regulation unpleasant? But you have no reason to reject the 7 benefits that it will bring.

- Samsung smartphones quietly support Bitcoin, but only these 7 countries can use

- Blockchain game: Where are the opportunities?

We analyze the order on the Buy/Sell side and try to observe the tendency of the main force on the buying and selling side. According to the traditional definition, when the active buy order is greater than the active sell order for a period of time, it is called net inflow. Conversely, when the active sell order is greater than the active buy order, it is called net outflow.

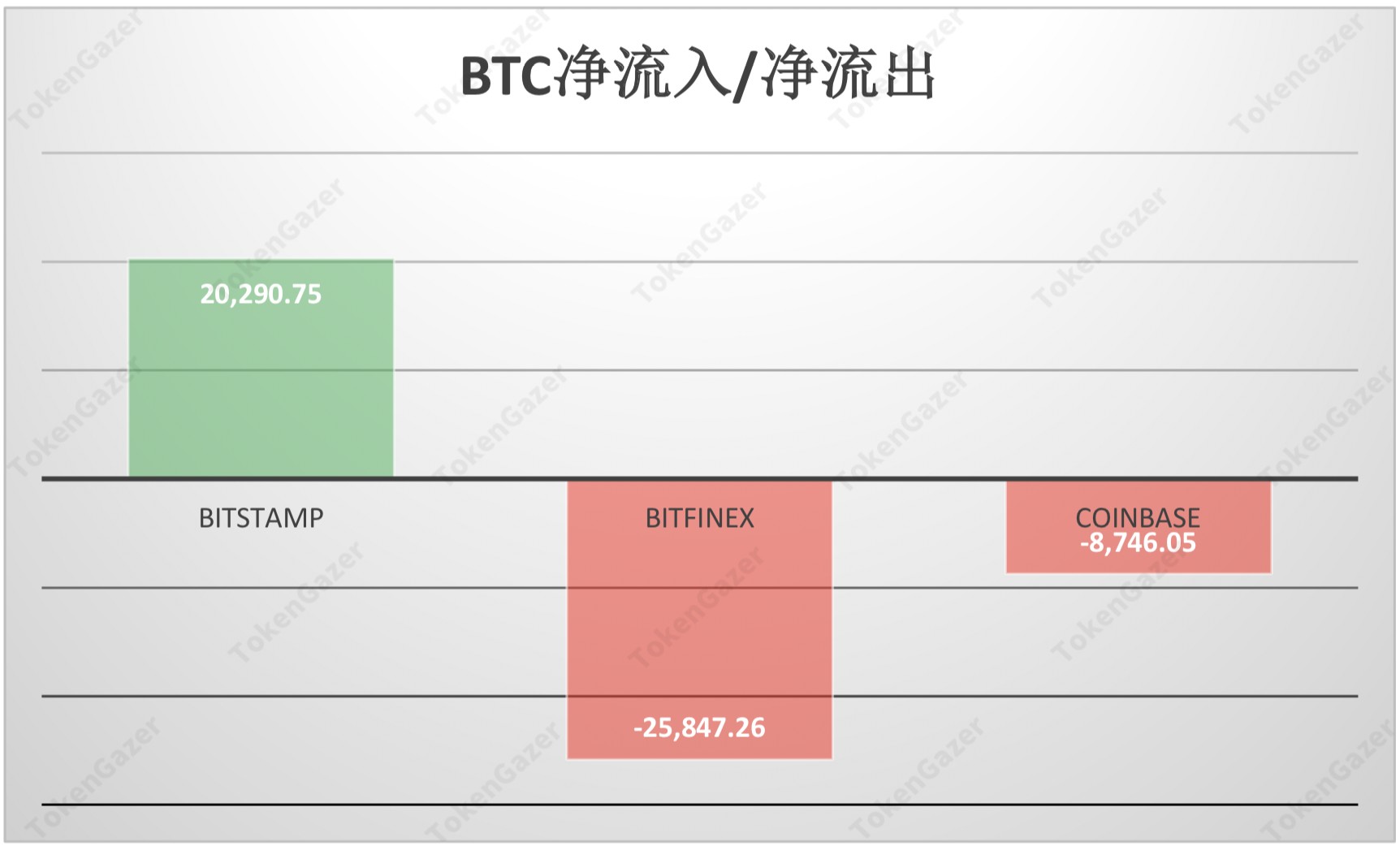

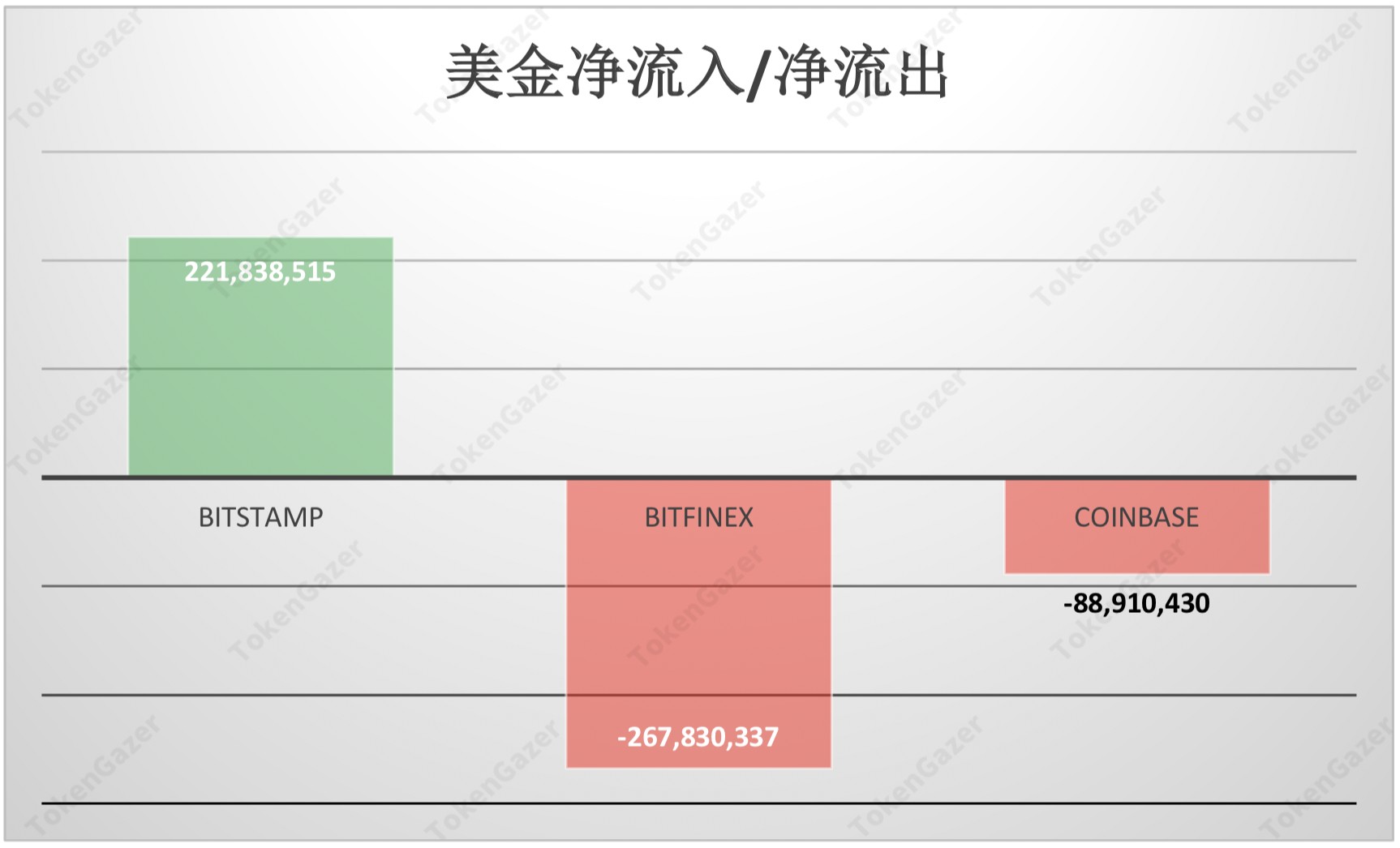

The net outflow data for the three exchanges for the whole month of July is as follows:

Throughout July, Bitfinex and Coinbase showed a net outflow, while Bitstamp still showed a net inflow.

The bitcoin monthly line closed in July, and the net outflow of the whole month was a reasonable phenomenon, but Bitstamp still showed a net inflow. One possibility is that Bitstamp's regional factors contribute to this difference. As a veteran exchange in Europe, Bitstamp's net inflow of funds may be related to the political situation in the UK and Europe. The arrival of the new British Prime Minister Johnson led to fears of no agreement to leave the EU. The rise in temperature, the UK's bitcoin search index soaring, and the weaker economic performance in the euro zone may have strengthened the attractiveness of Bitcoin in the region. In July, GBP/USD fell 4.26% and EUR/USD fell 2.58%. Many people believe that if the UK really has no agreement to leave the European Union, the pound will fall further.

Bitfinex's net outflow of USD has partially returned to the market through the net inflow of USDT/USD, but there is still a large amount of funds to choose and watch on the whole month. For historical reasons, the dollar in the Bitfinex field lacks the legal currency channel and cannot be withdrawn, so we judge This part of the dollar returning to the market is only a matter of time. NYAG's hearing on July 31 had an opportunity to become a trigger for this part of the US dollar returning to the market, but the hearing was announced for a three-month extension of the final judgment, which also gave the US dollar more time and space.

3. Hourly rise and fall

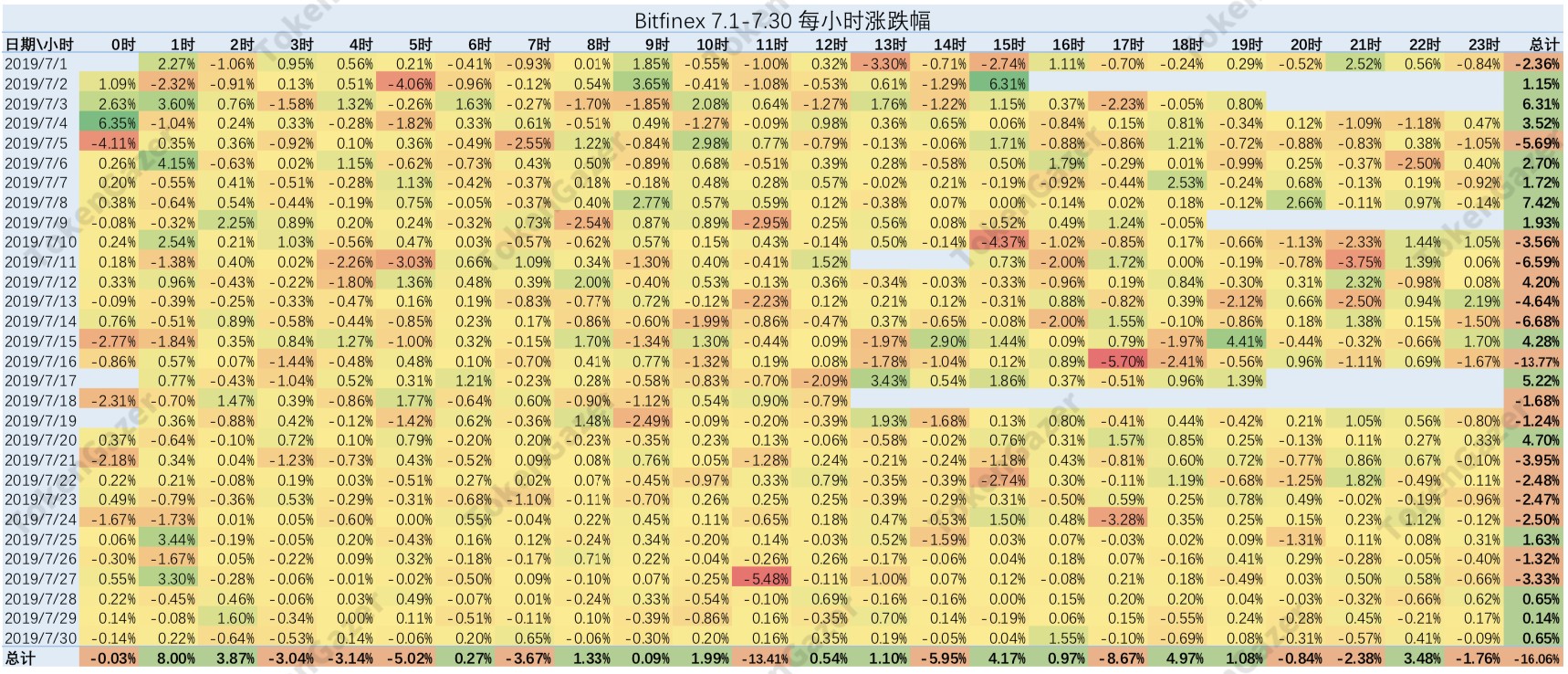

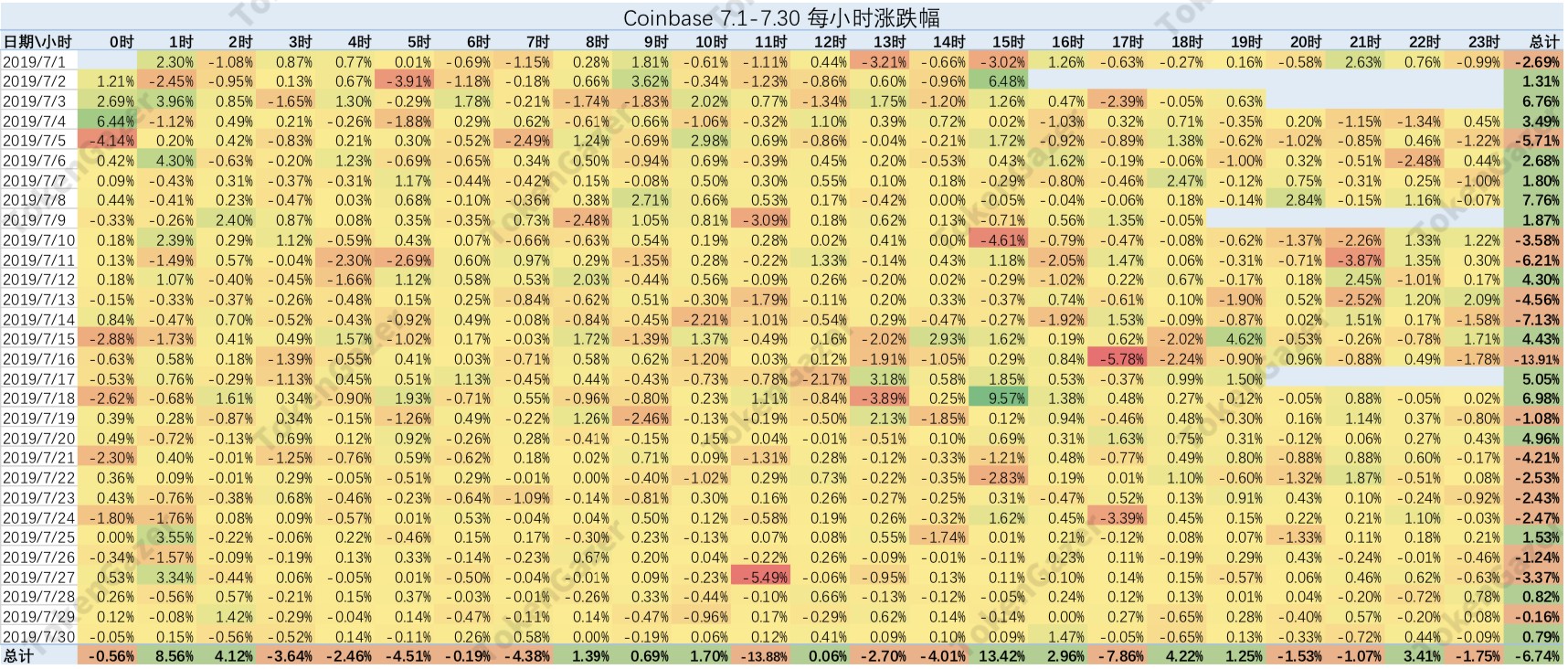

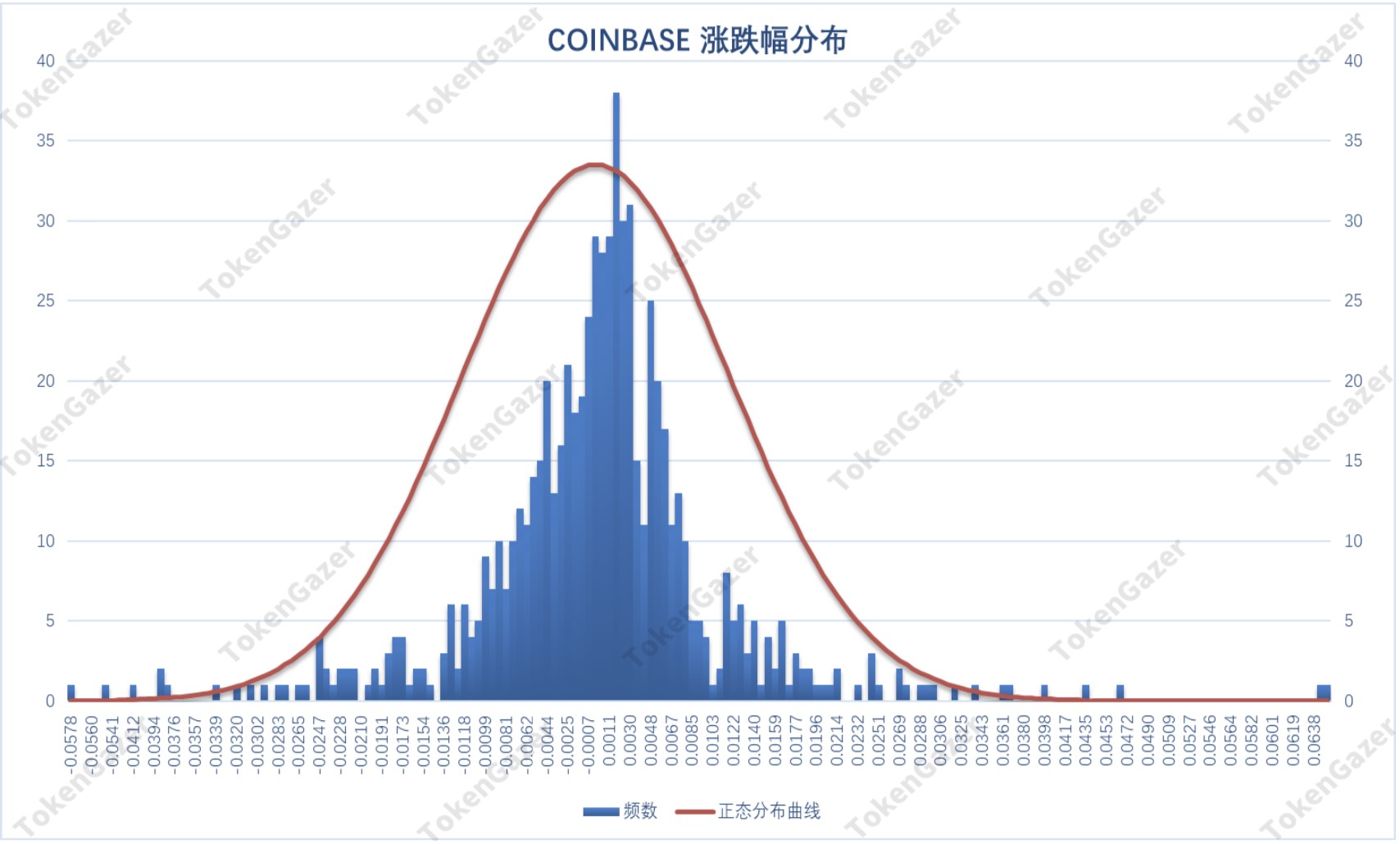

The prices of Bitcoin in the three exchanges of Bitstamp, Bitfinex and Coinbase are generally not much different, and the rise and fall of the three exchanges are basically similar. Take Bitstamp as an example. The date of the fall in July was July 16th, a drop of 13.95%. The most time to fall is between 11:00 and 12:00. The rise and fall have a certain continuity, but there is not much law. The hourly fluctuations of the three exchanges are as follows:

The hourly fluctuations of the three exchanges in July are as follows:

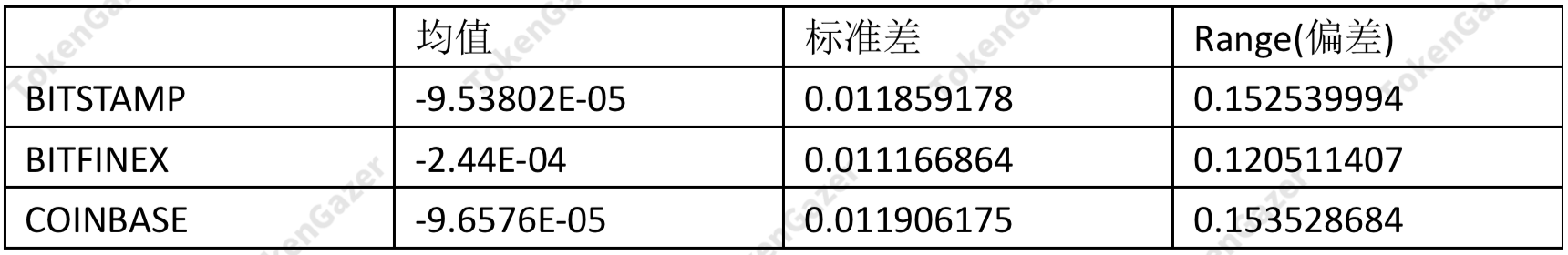

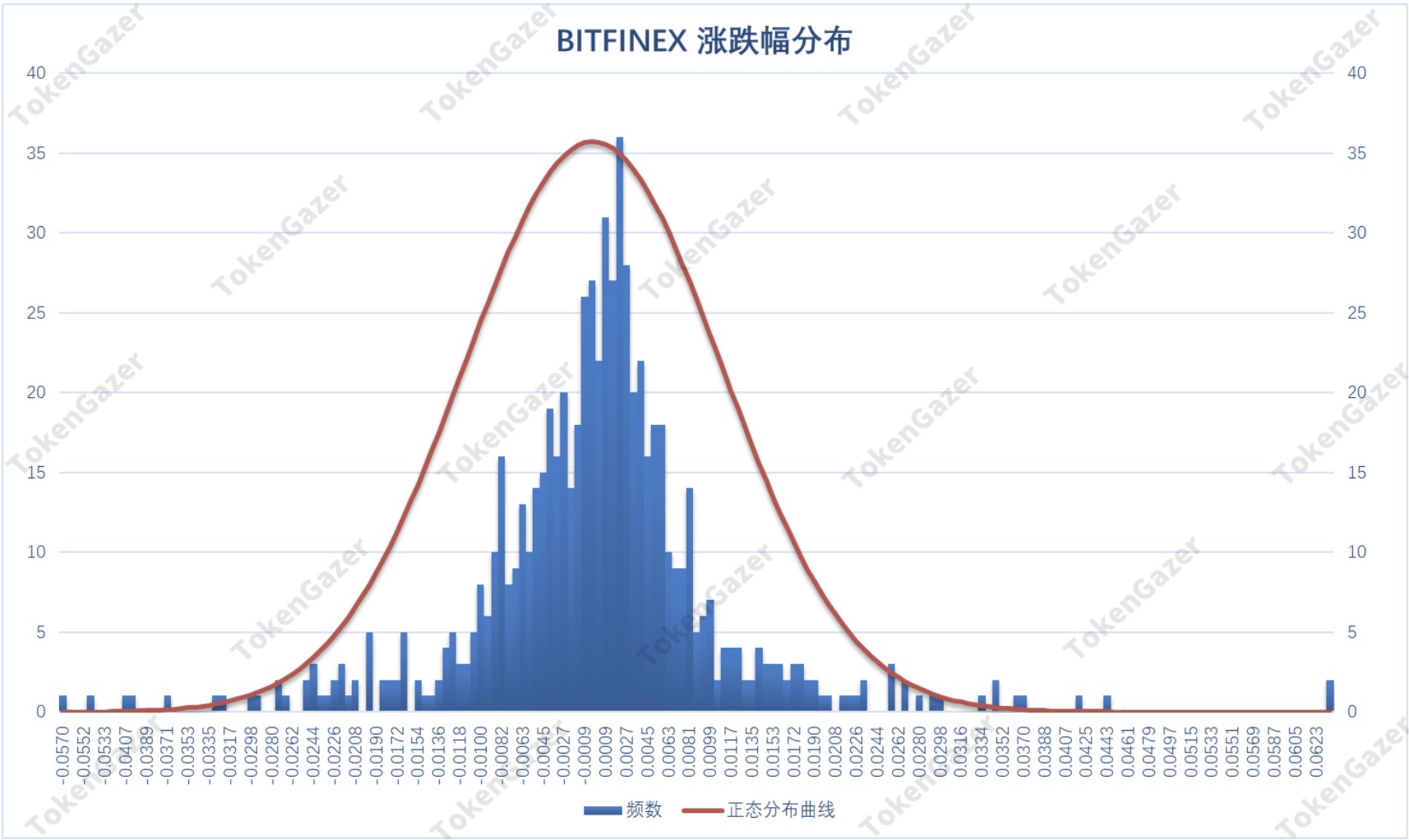

The average price of the three exchanges was slightly negative, and the standard deviation and deviation of Bitfinex were relatively small, while the fluctuation of Coinbase was relatively large.

4. Hours of volume

According to the UTC time, in general, the transaction volume of Bitcoin has shown a downward trend and a rising trend every day. The trading volume of the four consecutive hours from 14:00 to 18:00 is relatively large, and the volume of two hours from 00:00-01:00 and 20:00-21:00 is relatively large. The trading volume between 5:00-9:00 is relatively small.

5. Buy one / sell one price difference

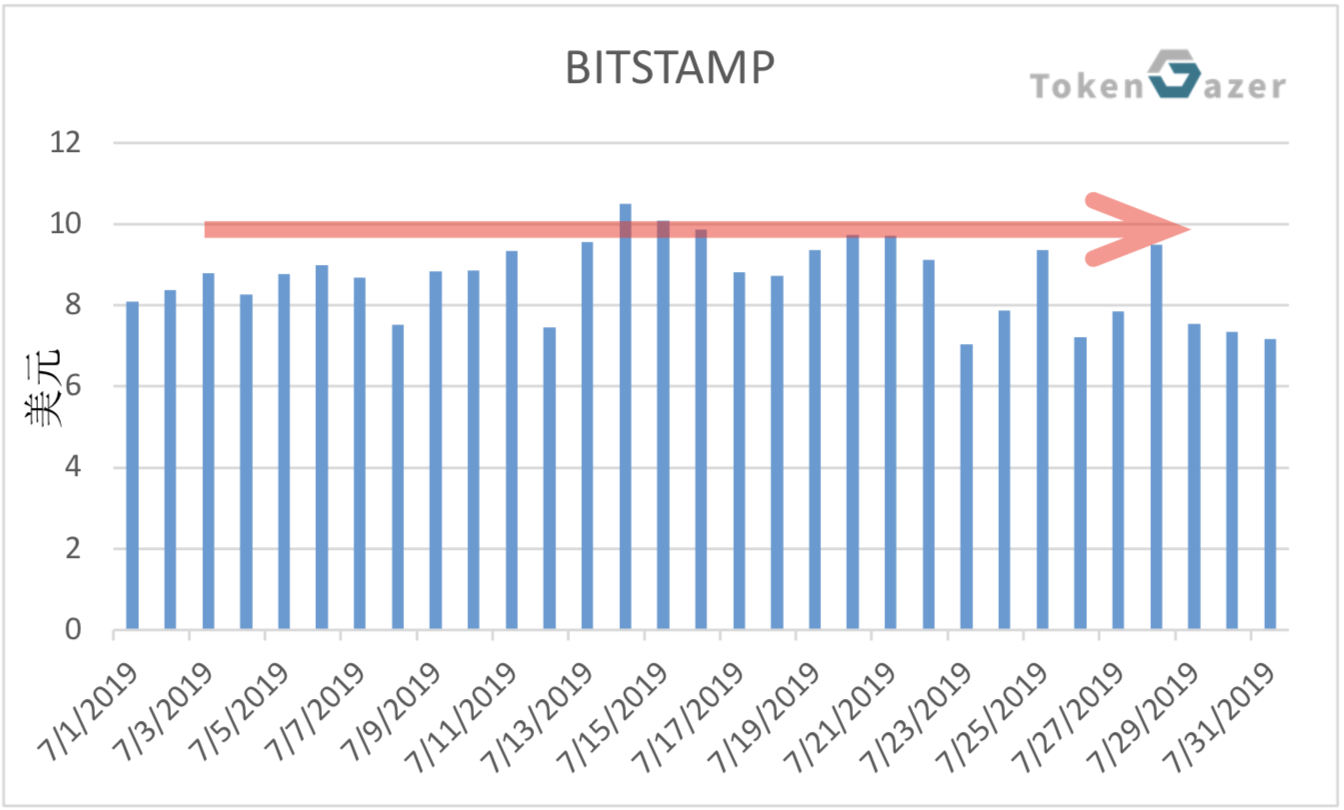

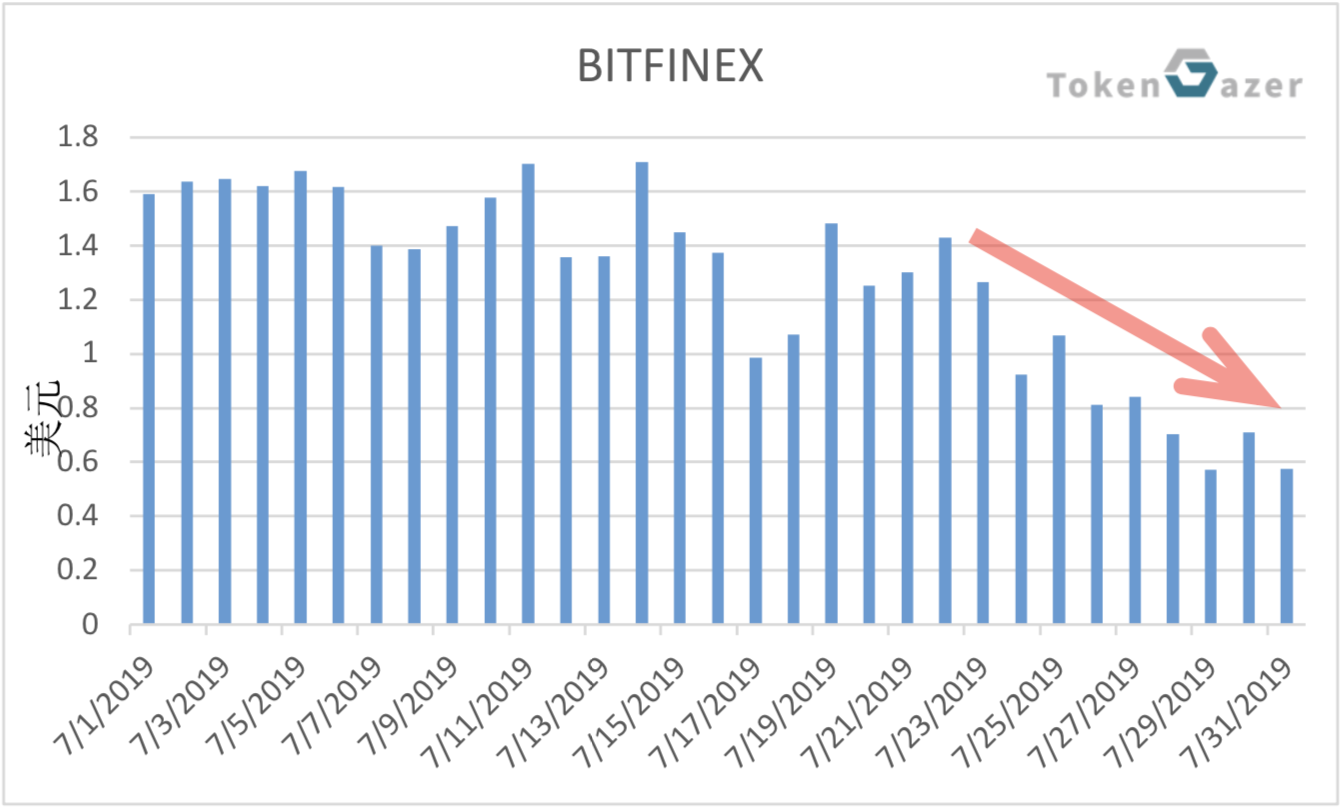

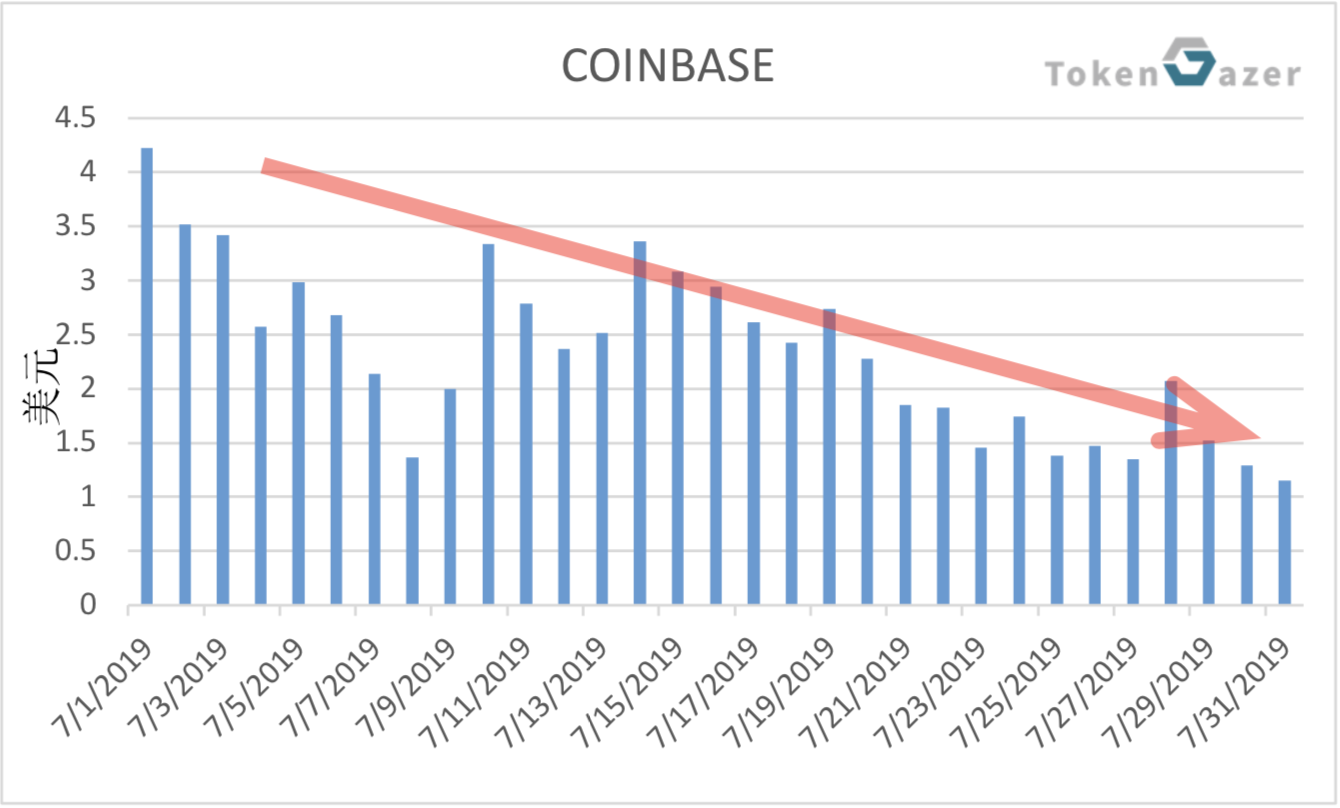

In July, Bitstamp's Bid/Ask spread fluctuated around $9. Bitfinex's Bid/Ask spread has remained below $2, and the spread has further narrowed due to lower bitcoin volatility at the end of July. Coinbase's Bid/Ask spreads have fallen sharply this month, thanks to an increase in order depth on Coinbase. The Bid/Ask spread is also related to the volume of trading and the price fluctuations. When the price fluctuates greatly, the spread is often large.

6. Trading trends in the chain

In July, especially at the end of July, there are several aspects of Bitcoin chain trading that may need to be brought to the attention of investors.

In July, large-scale transfers occurred frequently in the chain. On July 29, NVT reached 26 US dollars, which was the lowest point in the past two years. At the same time, it was the second highest in history on July 29th. Possible reasons for NVT reduction and currency destruction maximums include:

– XAPO wallet large transfer;

– coin wallet finishing;

– BitMEX was sent out by the CFTC investigation to trigger an increase in the currency;

However, the rapid expansion of trading volume on the chain and the history of currency destruction have been accompanied by a phased reversal of market trends. TokenGazer will continue to track the impact of including the exchange's cold wallet balance and analysis of possible subsequent impacts.

Source: blockchair.com

7. Conclusion

In the falling market in July, there are still some positive points worthy of attention. Throughout July, Bitstamp funds net inflows, and Bitstamp and Coinbase net outflows. In the case of falling prices, Bitstamp also maintains capital inflows for a long time, indicating that the market still has multiple strengths. If it continues to fall, it will give more purchase opportunities. Although Bitfinex funds flow out, due to the lack of US dollar deposits, the money should continue to flow into the cryptocurrency market in the long run, and continue to pay attention to the hearing of Bitfinex's 90-day ruling. Coinbase's capital inflows and outflows are generally related to price fluctuations, but may also be related to the IRS's urging cryptocurrency users to pay taxes. Even in this case, Coinbase's trading depth is still improving, liquidity is still improving, and the Bid/Ask spread continues to drop sharply, which is good for the cryptocurrency market. Later, we will continue to pay attention to the tight US policy, and the short-term market may still be dominated by shocks.

Copyright Information and Disclaimer

Unless otherwise stated herein, all content is original and researched and produced by TokenGazer. No part of this content may be reproduced in any form or in any other publication without the express consent of TokenGazer.

TokenGazer's logos, graphics, logos, trademarks, service marks and titles are TokenGazer Inc.'s service marks, trademarks (whether registered or not) and/or trade dress. All other trademarks, company names, logos, service marks and/or trade dress ("Third Party Trademarks") mentioned, displayed, quoted or otherwise indicated herein are the exclusive property of their respective owners. . You may not copy, download, display, use as a meta-tag, misuse or otherwise utilize a mark or third-party mark without the prior written permission of TokenGazer or the owner of such third party mark. .

This document is for informational purposes only and all information contained herein should not be used as a basis for investment decisions.

This document does not constitute investment advice or assist in determining specific investment objectives, financial conditions and other investor needs. If investors are interested in investing in digital assets, they should consult their own investment advisors. Investors should not rely on this article for legal, tax or investment advice.

The asset prices and intrinsic values mentioned in this study are not static. The past performance of an asset cannot be used as a basis for future performance of any of the assets described herein. The value, price or income of certain investments may be adversely affected by exchange rate fluctuations.

Certain statements contained herein may be TokenGazer's assumptions about future expectations and other forward-looking statements, and known and unknown risks and uncertainties that may cause actual results, performance or events and statements and Suppose there is a substantial difference.

In addition to forward-looking statements as a result of contextual derivation, there are words of “may, future, should, may, can, expect, plan, intend, anticipate, believe, estimate, predict, potential, predict or continue” Similar expressions identify forward-looking statements. TokenGazer is not obligated to update any forward-looking statements contained herein, and Buyer shall not place excessive reasons on such statements, which merely represent opinions prior to the deadline. While TokenGazer has taken reasonable care to ensure that the information contained herein is accurate, TokenGazer makes no representations or warranties, either expressed or implied, including the liability of third parties, for its accuracy, reliability or completeness. You should not make any investment decisions based on these inferences and assumptions.

Investment risk warning

Price fluctuations: In the past, digital currency assets have single-day and post-price fluctuations.

Market acceptance: Digital assets may never be widely adopted by the market, in which case single or multiple digital assets may lose most of their value.

Government regulations: The regulatory framework for digital assets remains unclear, and regulatory and regulatory restrictions on existing applications may have a significant impact on the value of digital assets.

Note: This "BTC US Dollar Trading Market Monthly Report" is a paid update to the TokenGazer official website at the beginning of the month (August 1st). Readers want to get the first time to grasp the market dynamics and view TokenGazer's previous project rating report, in-depth research report, cryptocurrency monthly report, strategy analysis, exchange data, etc., please visit the official website: tokengazer.com.

This article is the original content of TokenGazer, please indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | Bitcoin and gold fell together, "up also Xiao He, fall also Xiao He" (0814)

- Proof of Life: Why is Bitcoin a living being?

- Observation | What hinders the large-scale application of blockchain?

- Multinational currency is being swallowed up, surpassed, replaced by Bitcoin

- The relationship between Barclays Bank and Coinbase is over! The user may be a little troublesome

- The Bitcoin Mining Index has continued to grow in recent years. What is the trend of 2019?

- Seed CX tests physical settlement of bitcoin swap contracts, scheduled to launch within three months