After Bald quickly became the leader of running away, can Base ecosystem recreate the Meme craze?

Can Base ecosystem revive the Meme craze after Bald's sudden rise as the runaway leader?Author: Mia, ChainHunter

Recently, the leading Meme project on Base, Bald, has sparked heated discussions in the crypto community. Just as everyone was immersed in the speculation of whether Bald would create a new wave of overnight wealth, Bald’s rapid Rug Pull dealt a heavy blow to crypto users.

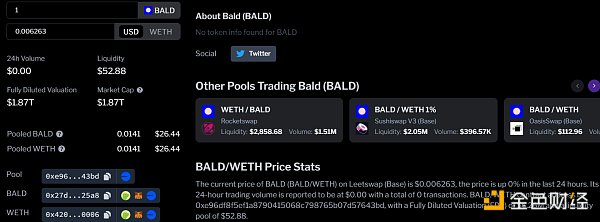

Within just 7 minutes, Bald withdrew a total of 8,660 ETH and 179 million BALD tokens from liquidity, causing a significant drop in the price of BALD, with a maximum decline of 80%. According to Geckoterminal data, there is currently only 0.0141 ETH left in Bald’s liquidity pool. In addition, Base’s Total Value Locked (TVL) has also plummeted. According to DefiLlama data, the peak TVL on Base reached $41.2 million yesterday, but it has now dropped to $8.97 million, a decrease of 78.22%.

- Breaking the dilemma of poor user experience How does intent computing change Web3 interaction?

- Bald Runaway How a Low-Level Scam Deceives Everyone

- Semafor US Department of Justice considering fraud charges against Binance

Source: Geckoterminal.com

Source: DefiLlama.com

After experiencing a roller-coaster ride of price surges and crashes, Bald only responded on Twitter, suggesting that “it seems that the Base chain can handle heavy loads well.” This implies that the release of the Bald project was only to test its actual load handling capacity on the Base chain mainnet, and denied the sale of tokens, stating that “since deployment, only operations such as adding and removing liquidity and buying tokens have been carried out.”

However, Bald’s mysterious actions have sparked a lot of speculation in the crypto community about its mastermind. What is even more important is that with the withdrawal of liquidity from Bitcoin Ordinals and BRC-20 projects, more and more funds on the chain are starting to make their moves. With the upcoming launch of Base mainnet in August and the breaking of the circle caused by Bald’s Rug Pull, can Base create a new Meme craze?

Meme project Bald turns into a “runaway leader,” raising suspicions about the mastermind behind it

As the name suggests, “Bald” refers to “baldness,” and the Bald project deployed on Coinbase’s native Layer2 network, Base, inevitably reminds people of Coinbase’s CEO, Brian Armstrong. On one hand, the bald image in the social media background of Bald seems to resemble Brian Armstrong’s bald silhouette; on the other hand, the holder of a large amount of cbETH has also sparked speculation that Bald was created by people related to Coinbase.

As the price of Bald skyrocketed 30,000 times within 24 hours of its launch, people began to speculate whether this was Brian Armstrong’s way of giving everyone benefits on the Base mainnet. For a while, rumors that “Coinbase is behind Bald” started to ferment in the crypto community, leading to intensified FOMO sentiment and a trading frenzy of Meme coins on Base.

According to DEX Screener data, LeetSwap, the largest decentralized exchange on the Base chain, saw its 24-hour trading volume soar to $230 million, with a total of 526,000 transactions. Besides the platform token Leet, the other top ten trading pairs were all Meme coins. In addition, investors’ enthusiasm for Bald remains high, with its 24-hour trading volume accounting for half of the platform’s total trading volume, reaching $110 million.

However, the rumors about “Bald and Brian Armstrong” were quickly debunked. The deployer of Bald removed most of the liquidity, causing an unexpected “Rug Pull”. If Bald is really related to Brian Armstrong or Coinbase, wouldn’t that be like shooting oneself in the foot? So, who is the mastermind behind Bald?

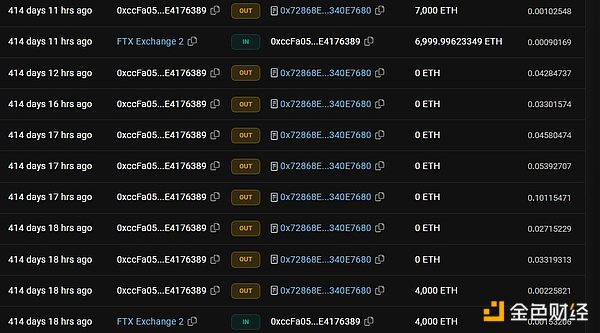

Cryptocurrency KOLs simultaneously threw out a “bombshell”, and SBF was the culprit behind it all, and the rumors were not groundless. According to on-chain data research, the deployer’s address received thousands of ETH from wallets associated with FTX and Alameda Research.

Furthermore, Andrew Thurman, a data analyst at Blockworks, further confirmed this speculation in his research. He found that the deployer’s related wallet address had made about 400 transfers to blacklisted USDT addresses and said that there is “definitely a serious connection with Alameda Research.”

In addition, observant members of the crypto community, “Hype”, discovered clues from Bald’s Twitter language, such as “Correct” and “quite well”, which appeared in a few of Bald’s tweets, and these are SBF’s commonly used phrases. Hype also stated that the deployer’s wallet address has existed for a long time and was one of the first voters in the Sushi Swap proposal on the DeFi platform, indicating that the Bald deployer can be regarded as an OG predecessor in the crypto circle.

And just yesterday, the FTX 2.0 restructuring plan was resubmitted. This coincidence has been linked by crypto users, speculating whether SBF really intends to use the funds from the “Bald Rug Pull” to make up for FTX users’ funding gap?

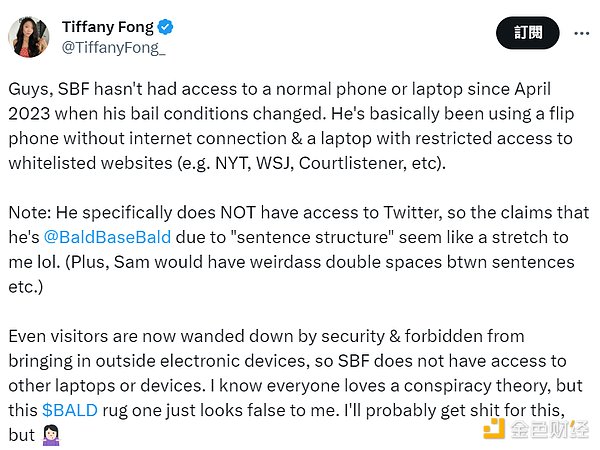

Of course, some people find these conspiracy theories a bit funny, considering that SBF is currently under strict internet surveillance and can only use a flip phone. These assumptions are completely baseless. Additionally, it is too one-sided to judge that SBF is the mastermind behind Bald based on Bald’s tweets.

The situation briefly got out of control, with some even attributing Bald’s collapse conspiracy to SEC Chairman Gary Gensler’s self-directed performance, believing that Bald’s collapse could provide more evidence to sue Coinbase, the mastermind behind Base.

Currently, there is no definitive conclusion as to who is behind Bald. However, it is undeniable that Bald’s short-lived myth of getting rich overnight has brought a breath of fresh air to the crypto community. Despite becoming a game of going back to zero, it has become a traffic magnet for the Base ecosystem.

Meme coins have become the new traffic magnet for ecosystems. Can Base recreate the Meme craze?

It is worth mentioning that Meme coins, with their characteristics of skyrocketing and plummeting, being full of hot topics and speculation, have gradually become a new tool for attracting new ecology in the bear market with liquidity exhaustion.

Earlier this year, Solana’s Meme coin Bonk also brought new hope to the gloomy Solana ecosystem. With the rise of Bonk’s price, the price of SOL tokens also experienced a sharp correction, and more liquidity began to flow back to the Solana ecosystem, and previous projects that had left the ecosystem also began to return.

Similarly, the first Meme coin in the Arbitrum ecosystem, AIDOGE, also brought new vitality to the Arbitrum ecosystem. On the one hand, the skyrocketing of AIDOGE undoubtedly activated the enthusiasm of the Arbitrum community users. On the other hand, it combined popular elements such as AI, Arb, and Doge, creating popularity and further fueling FOMO in the market, opening up new narrative gameplay.

Although Bald also experienced a sharp rise followed by an immediate drop, it to some extent successfully attracted the Base chain and even became an effective tool to test the actual load processing capacity of the BASE chain, benefiting some “smart” players.

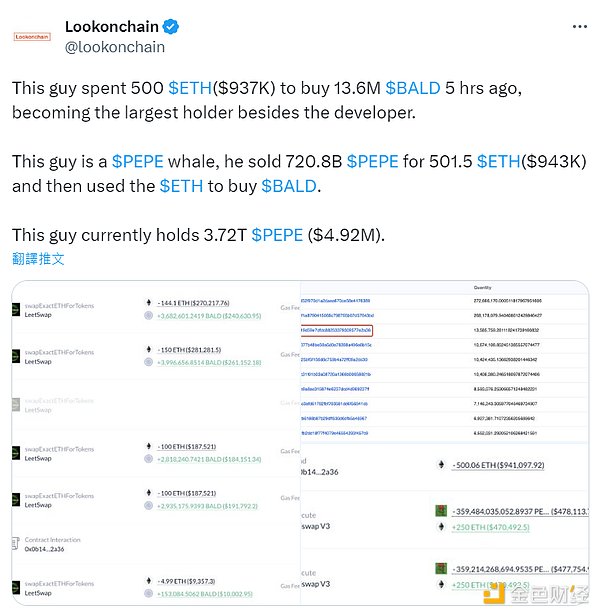

According to the blockchain detective Lookonchain, the rapid rise of Bald has allowed some savvy investors to earn huge returns. It lists four profitable addresses that purchased 50 million Bald with 0.534 ETH (about $1000). These transactions occurred within minutes after Bald was launched, accounting for 50% of the total supply. Subsequently, these addresses quickly sold 37 million Bald, earning a huge return of 554 ETH, which is more than $1.04 million.

With the continuous fermentation of the myth of getting rich on the Base chain, Base has gradually become the birthplace of the new trend in cryptocurrencies, and more and more Meme projects are starting to gather momentum on Base. Currently, by searching on Twitter, you can find various Meme projects of all sizes that are about to be launched on Base.

With the withdrawal of liquidity from Bitcoin Ordinals and BRC-20 windfall projects, more and more on-chain funds are starting to move. More attention and funds may be concentrated on this Base chain, which is likely to trigger the next wave of Meme frenzy. However, the outcome of Bald’s “Rug pull” may also serve as a cautionary tale for users who intend to join the wave. It is difficult to say whether Base can become the next “Wild West” of Meme.

Furthermore, it needs to be emphasized that although the Solana ecosystem Meme coin Bonk, the first Meme coin in the Arbitrum ecosystem AIDOGE, and other Meme coins mentioned above have been used as “attraction tools” and brought hope and passion to the rapid rise and recovery of the ecosystem, in hindsight, their outcomes were doomed to be negative and short-lived.

Under the crypto winter, where is the market stimulant other than Meme?

The short-term volatility, the FOMO sentiment in the community, and excessive speculation have made the crypto market of Meme coins full of bubble risks. Each wave of Meme market sentiment, whether long or short term, has caused the overall market to collapse. This time, Bald’s Rug pull has also become the shortest-lived Meme coin in the world. Before the collapse of Bald, no user discovered that Bald did not lock the pool, and even some major crypto V communities rushed in to cheer for Bald. Investors and even the entire crypto community are like “starving wolves” longing for the birth of a “get-rich-quick myth.”

Perhaps the crypto winter is too long, making every new thing a hot project for investors to “FOMO”. However, when we truly look back at the so-called “hot projects” this year, from the Shanghai upgrade of Ethereum at the beginning of the year to the revival of the Bitcoin ecosystem (the emergence of Ordinals and BRC-20), and even the once highly regarded projects like Arbitrum and Sui, they did not bring any surprises to investors. Even if they did, most of them were fleeting.

From FTX’s collapse last year, the bankruptcy of crypto banks at the beginning of the year, to multiple top-tier exchanges being sued by the SEC, black swan events have been happening frequently. The liquidity of the crypto industry is slowly drying up, and the entire crypto market is showing unprecedented weakness. Investors are gradually losing patience and becoming impatient. The entire crypto industry seems to be waiting for an opportunity to revive the market as a whole, and before that, every “hot project” has become a lifeline for the market.

The restless market atmosphere has also led to frequent security incidents. Just recently, Curve, the big brother of stablecoin protocols, was attacked by hackers due to a vulnerability in the underlying programming language Vyper, facing a loss of over $50 million. In addition, the founder will also face on-chain debt liquidation. Influenced by the collapse of Bald, the liquidity pool of the incomplete Base ecosystem DEX Leetswap was also attacked by hackers, resulting in a loss of about $620,000. Trading has been suspended and an investigation is underway to recover the funds.

In the current chaotic crypto market, compared to the narrative and underlying logic of “high-end” projects, the crude and simple Meme coins seem to be more capable of activating the market. However, as mentioned above, Meme coins have pros and cons and are not a long-term solution. The recovery of the crypto market and the entire blockchain field still require the birth of a truly disruptive long-term product or project, as well as the expansion of application scenarios. Only by breaking the shackles of the crypto circle, promoting the application of internal concepts and technologies, and introducing the broader liquidity from the outside world, can we bring more vitality and fresh fuel to the entire market.

Despite the bear market being calm and agonizing, the prolonged bear market also gives the market and industry an opportunity to pause and reflect: what is the future direction of blockchain?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Future of Worldcoin

- Has DeFi resumed business under the positive and negative news of regulation in 2023?

- A Quick Overview of the AA Smart Contract Wallet Launched by Europe Easy OKX

- Will the IT team be able to survive while Web3 heads south to ‘make a fortune’?

- Is the dream of RWA assets being put on the chain a reality or an illusion in the cryptocurrency community?

- Is Curve helpless in the face of a crisis? A perspective on response strategies from the perspective of DeFi mining.

- Uniswap Trading Volume Revealed Robots Account for 70% of Trading Activity