Calls for the adoption of cryptocurrencies are rising in sub-Saharan Africa.

Cryptocurrency adoption is increasing in sub-Saharan Africa.Translation: Africa-Asia-Latin America Web3 Research Institute

Compiled by: vand

Typesetting: Xiaolu

- Galaxy Digital Bitcoin Ordinals Protocol Research Report Important Data, Impact on Bitcoin, and Latest Developments

- Andrew Kang Cryptocurrency and stock market correlation has dropped to a low level and will continue to stay that way.

- LianGuai Observation | Explaining why Hong Kong can become the engine of the East Asian Web3 market

SHARE

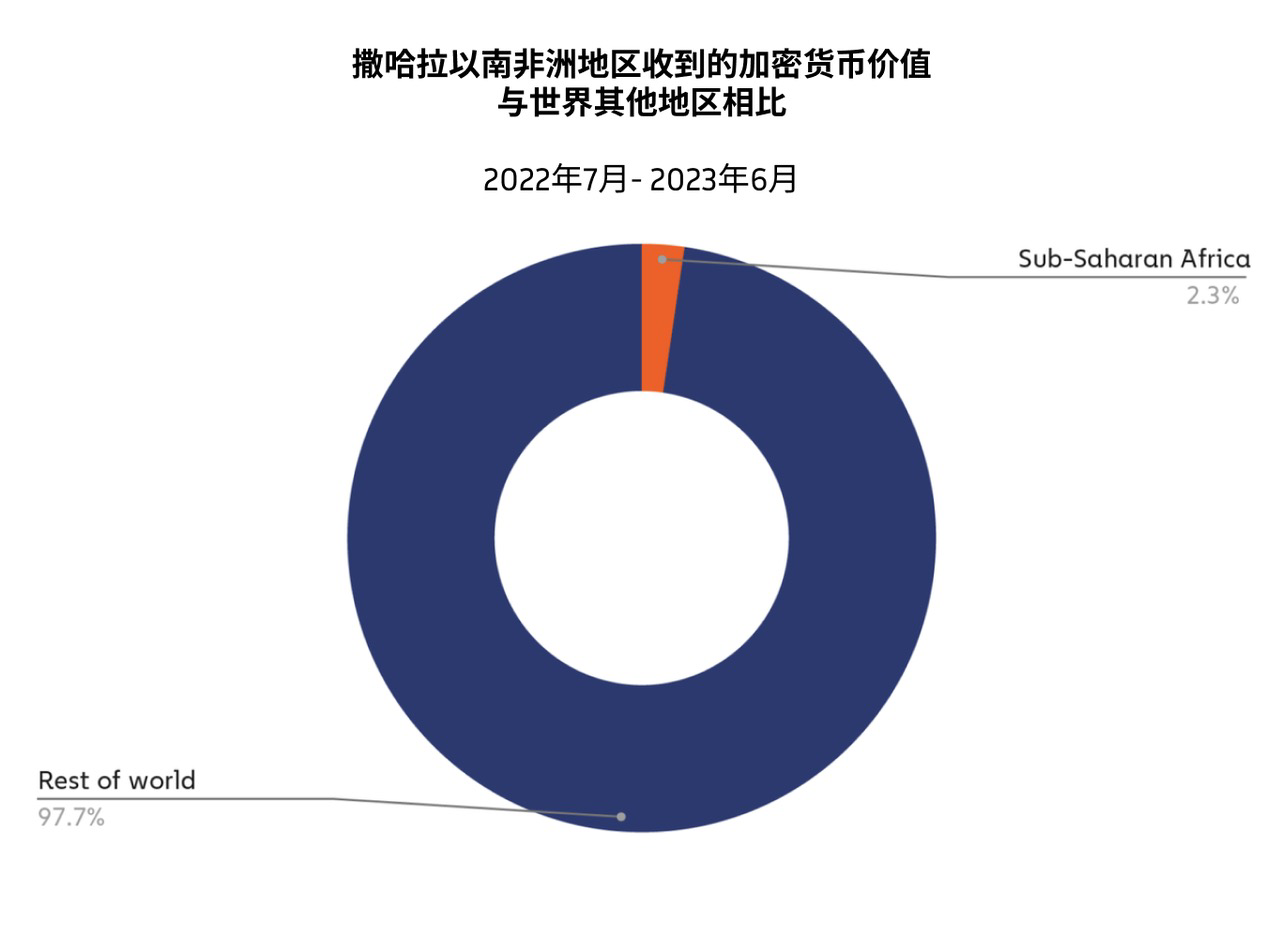

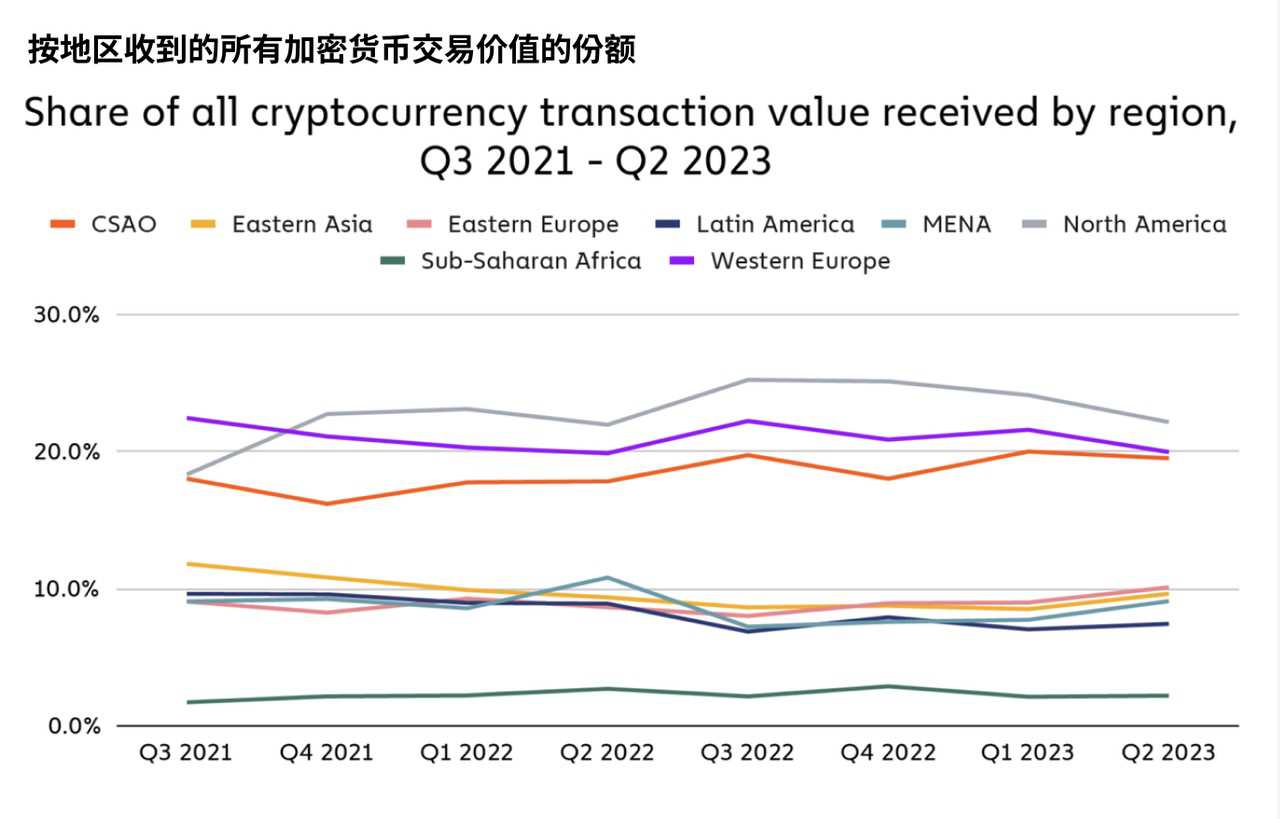

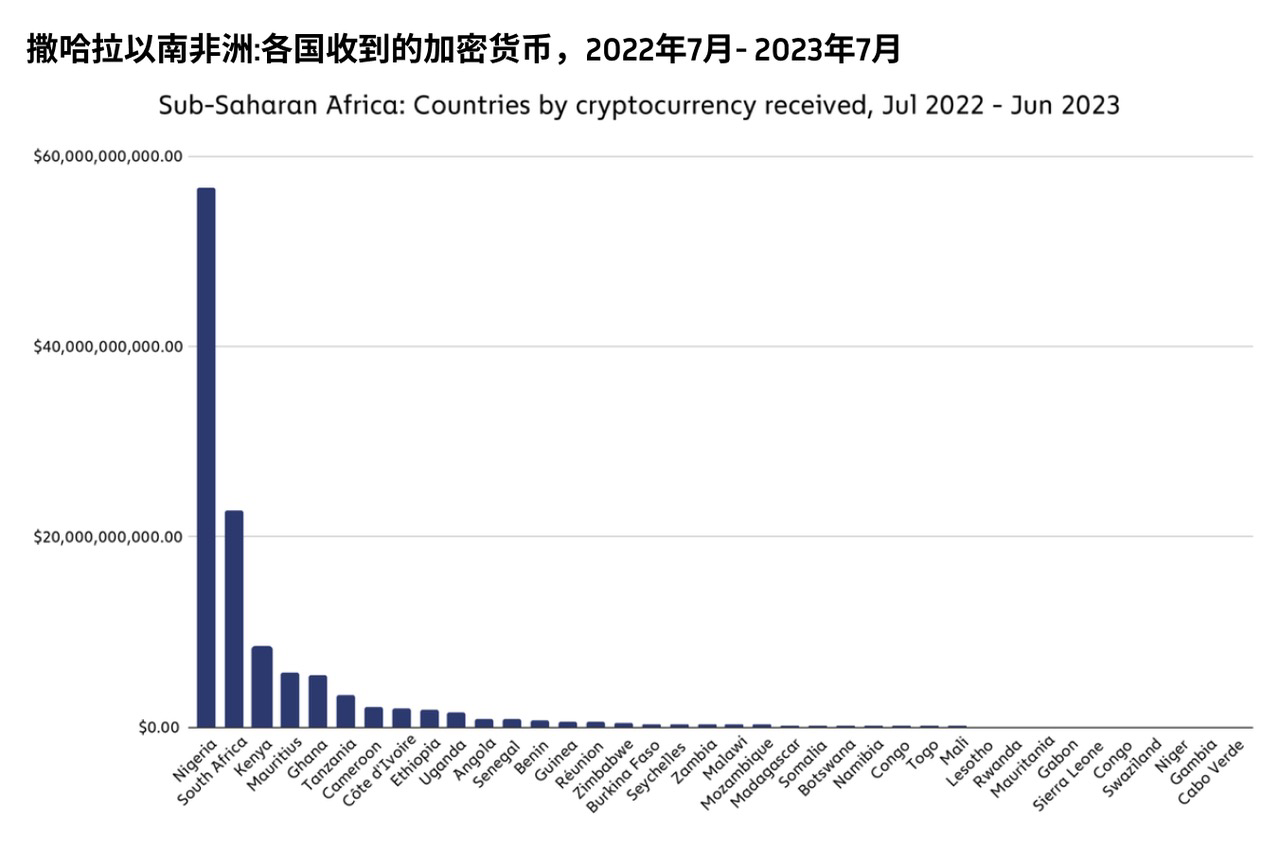

Similar to previous years, the sub-Saharan Africa region is the smallest cryptocurrency economy, accounting for 2.3% of global transaction volume from July 2022 to June 2023. During this period, the region is estimated to have accumulated $117.1 billion in on-chain value.

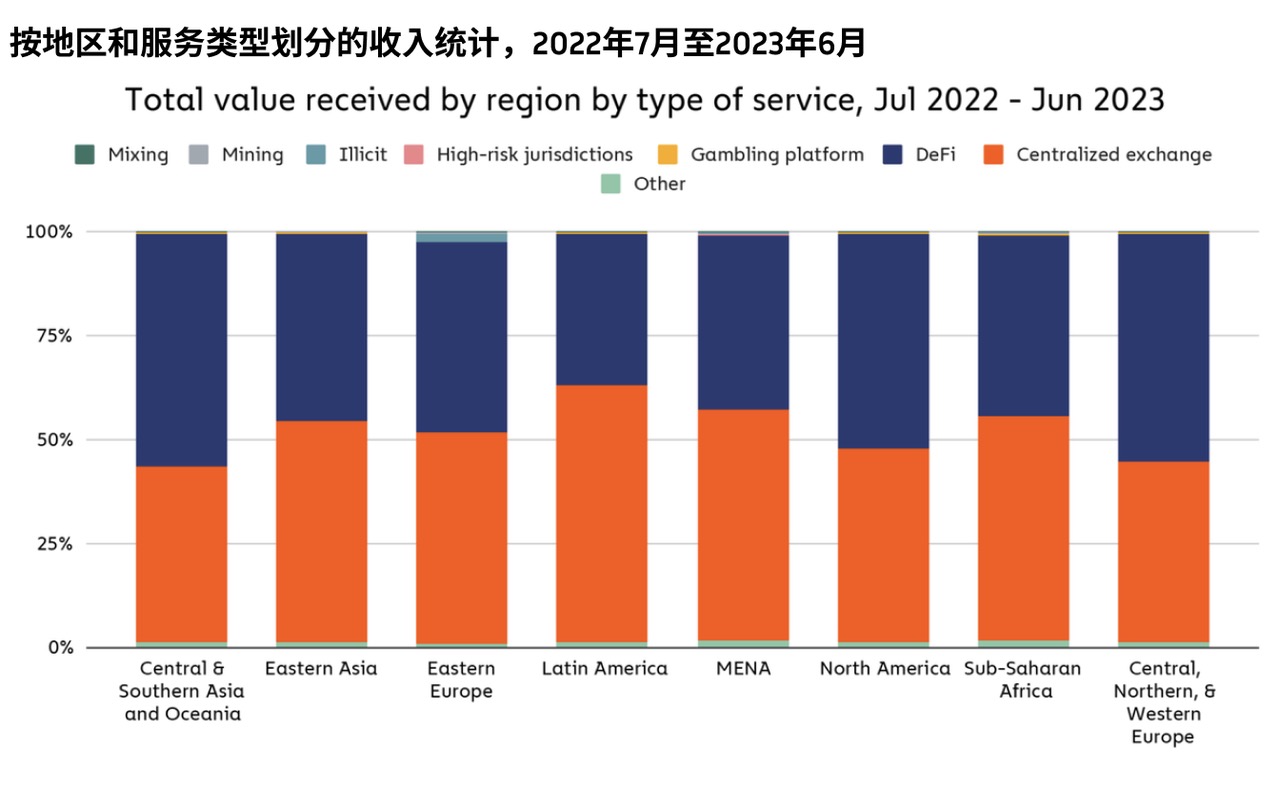

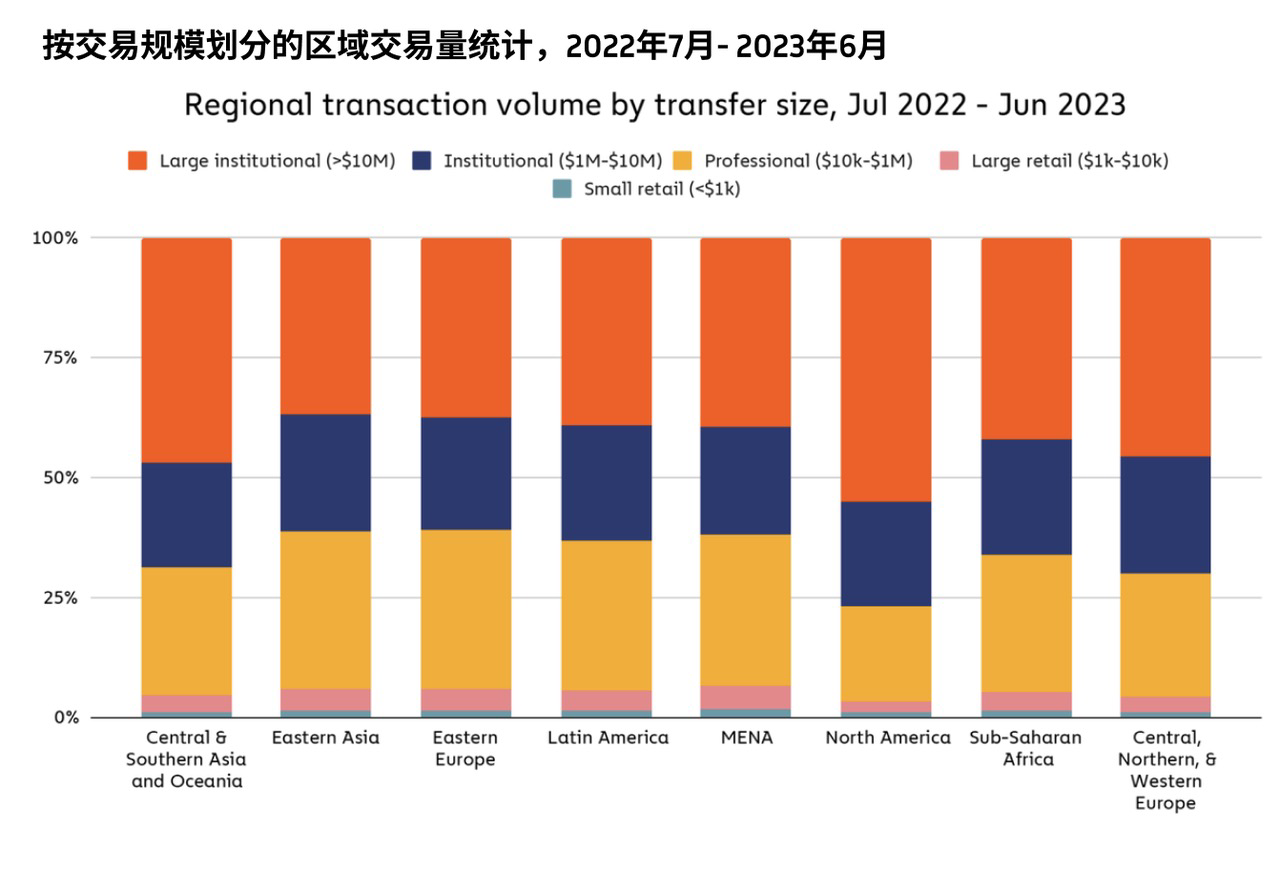

When examining the cumulative transaction value, centralized exchanges are the most commonly used platform type, contributing to over half of the transaction volume. The cryptocurrency market in the sub-Saharan Africa region also has more small-value orders compared to most regions. Exchanges with transaction values below $1 million have a larger share compared to other regions.

Although cryptocurrency trading volume is not high in the sub-Saharan Africa region, careful analysis indicates that the penetration rate of cryptocurrencies is quite high and has become an important part of many residents’ daily lives. No country exemplifies this better than Nigeria, which ranks second in the global cryptocurrency adoption index.

Citizens flock to Bitcoin and stablecoins to hedge against inflation and debt crises

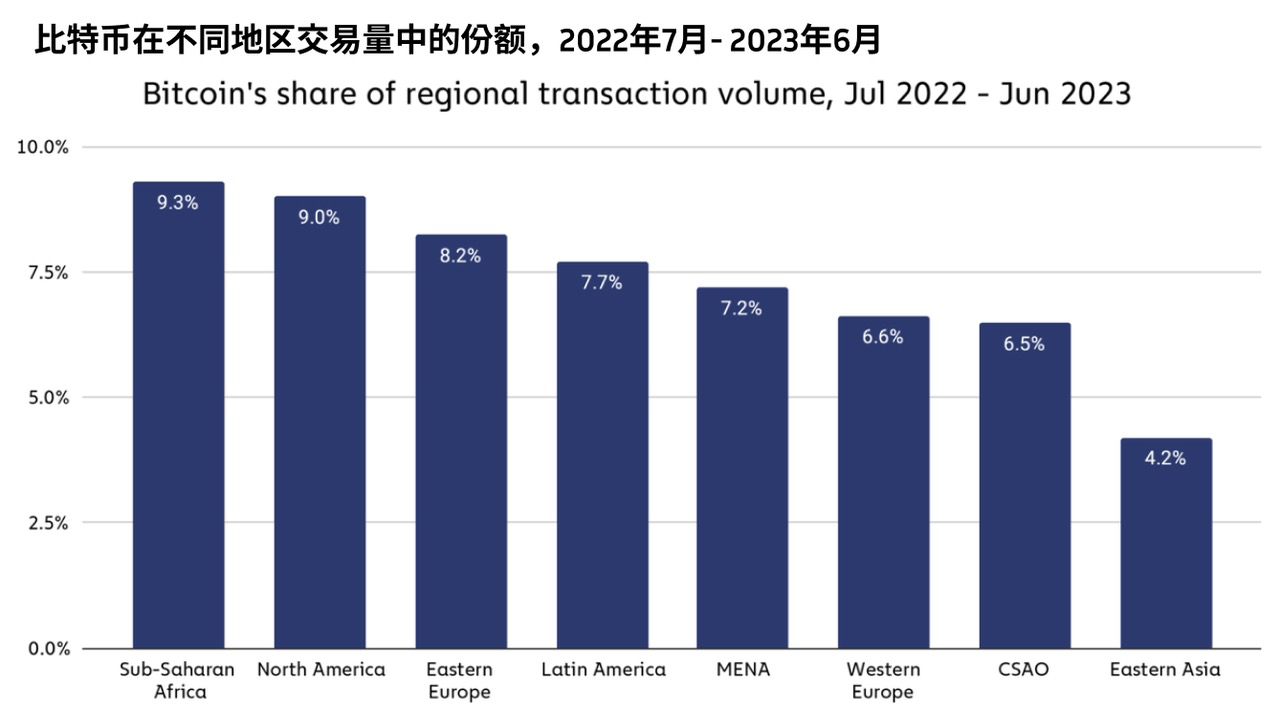

No region dominates BTC more than the sub-Saharan Africa region. The share of BTC transactions is higher than any other region.

Residents in the sub-Saharan Africa region may be turning to the so-called digital gold (BTC) as an alternative store of value.

Many countries in the region are facing rising inflation and debt crises, making cryptocurrencies an attractive store of value for purposes such as saving and achieving greater financial freedom.

For example, in Ghana, the inflation rate has been increasing for 13 consecutive months, reaching the highest level in 20 years in June 2022: 29.8%. Due to limited financial opportunities, many Ghanaians have adopted Bitcoin. Nigeria, Kenya, and South Africa have faced similar issues in recent years, and a large number of people have adopted cryptocurrencies, which is not a coincidence in market development.

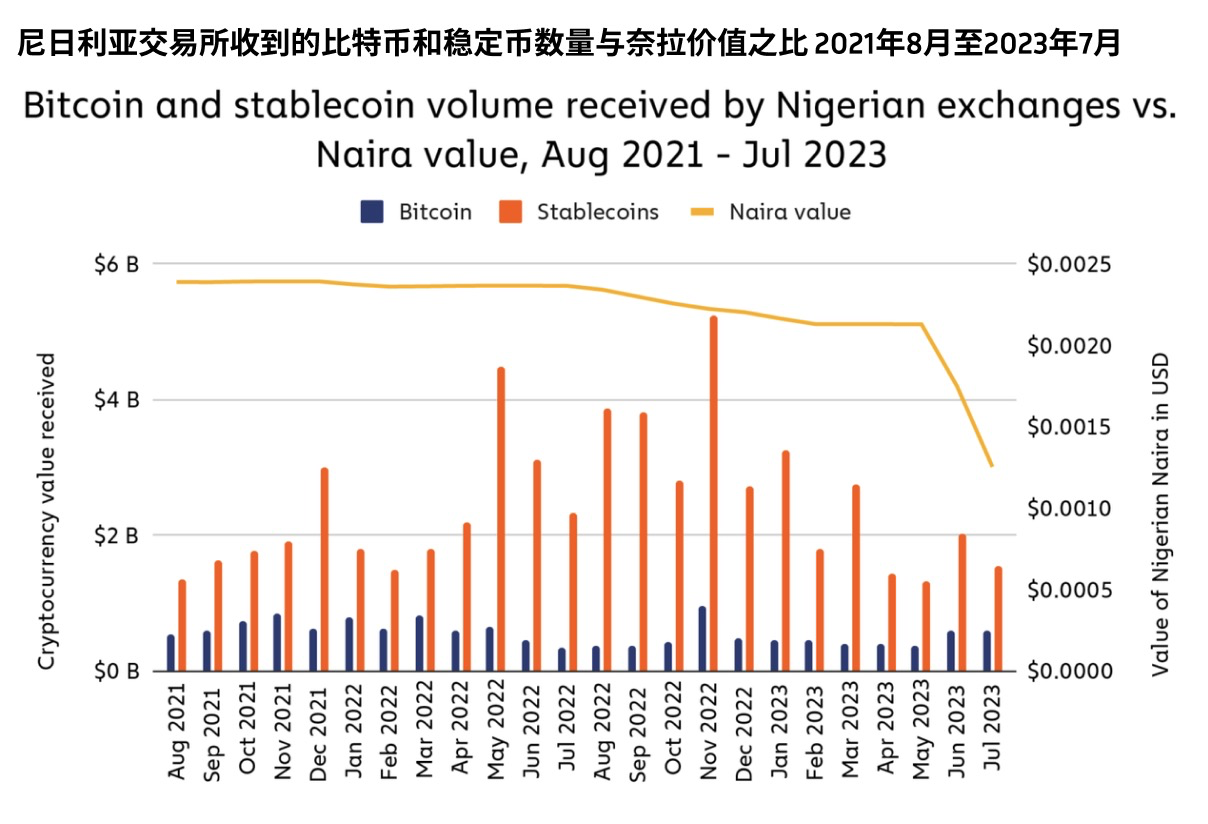

Local experts tell us that some market participants have shifted from Bitcoin to stablecoin usage. This is because stablecoins have much lower price volatility compared to BTC, and the price of Bitcoin is far below its historical high.

The co-founder and CPO of Busha, a cryptocurrency exchange based in Nigeria, Moyo Sodipo, said, “When Busha was rapidly growing in 2019, Bitcoin was highly sought after by many people. Many people initially did not accept stablecoins. But now, in the bear market, people want more options between Bitcoin and stablecoins. However, the market changes have not suppressed economic activities. People are constantly seeking opportunities to hedge against the devaluation of the Naira and the ongoing economic recession since COVID.”

Focus: Nigeria is the largest cryptocurrency economy in Africa

Nigeria has the largest population and economy south of the Sahara and is also the largest cryptocurrency economy in the region. Despite entering a bear market, Nigeria’s cryptocurrency economy continues to grow. Its cryptocurrency trading volume continues to grow year-on-year. The growth rate of 9.0% ranks third among these six countries.

Cryptocurrency is one of the solutions to Nigeria’s economic problems. Since 2016, Nigeria has experienced two major economic recessions, political instability, COVID-19, and a plunge in oil prices. As a result, Nigerians of all ages face high unemployment rates, with over 20 million people looking for jobs in 2021, and many people migrating to other countries.

The recent Naira crisis has exacerbated these problems. In 2022, the Central Bank of Nigeria announced plans to redesign the Naira currency and issue new banknotes to combat inflation and counterfeit currency, and control the quantity of circulating money.

The resulting cash shortage has caused trouble for people without bank accounts and has led to uncertainty in the value of old banknotes. The unstable economic environment encourages many citizens to seek financial alternatives, providing an opportunity for cryptocurrency to expand its market.

These changes are reflected in the data, as interest in crypto generally rises as the value of the Naira declines. The peak values around May and November 2022 might be users seeking to trade the volatility caused by the crashes of TerraLuna and FTX, rather than the local economic situation.

At the same time, interest in altcoins in the region has been increasing.

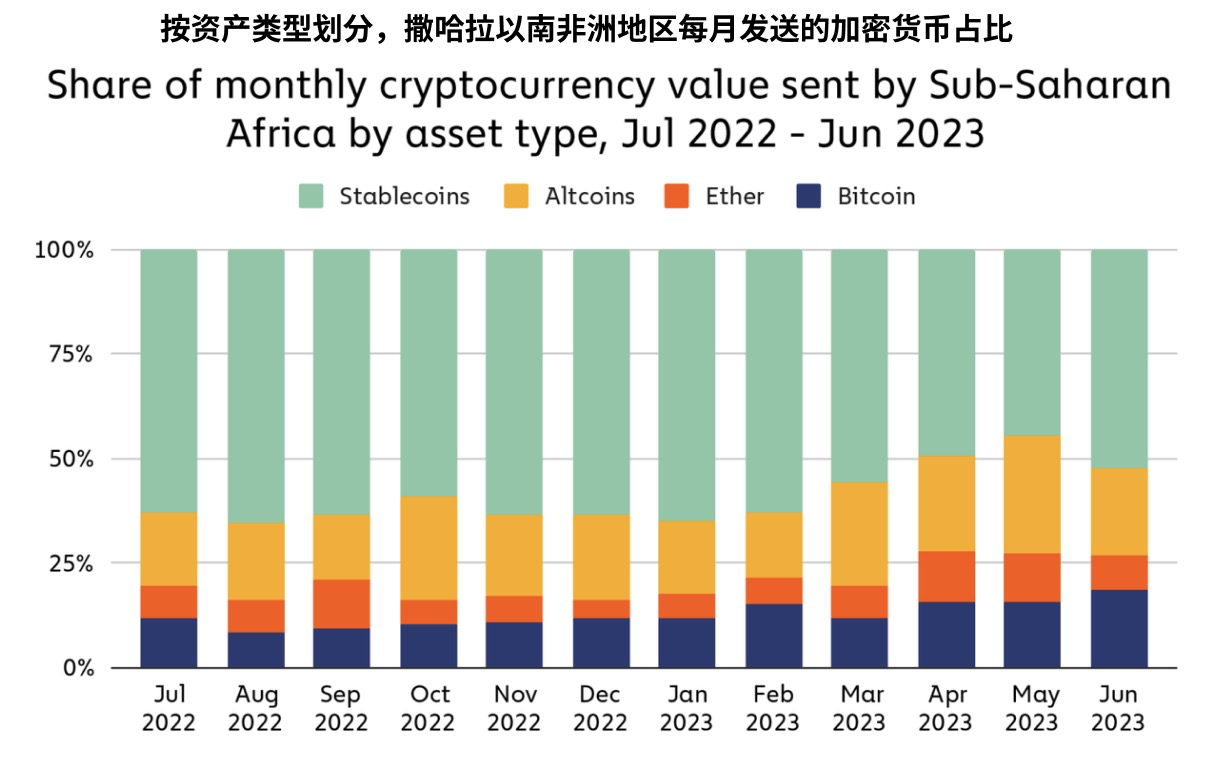

Moyo Sodipo explained, “During market black swan events, we see a frenzy of coin buying. When there’s a new memecoin, such as Dogecoin or Shiba, it triggers a buying frenzy. There are always people interested in a token that seems to make you earn thousands of dollars.” The graph below shows the increase in altcoin activity and the proportion of stablecoin value each month.

Regulatory policy improvement paves the way for large-scale adoption

The improvement of regulatory policies has brought new development to the exchanges in Sub-Saharan Africa. By the end of 2022, the Financial Sector Conduct Authority (FSCA) announced a licensing system for cryptocurrency businesses and declared that crypto assets are financial products, which provides them with stronger legal support and enables financial investigators to better combat illegal activities in this field.

The country’s positive attitude has reduced the uncertainty of unregulated activities and encouraged the trading of digital tokens. In fact, citizens of the country have traded digital currencies worth billions of dollars in recent years.

According to Marius, the General Manager of Luno Africa, “Currently, the main use case for cryptocurrency in South Africa revolves around investment. In the past three years, the number of Luno customers holding cryptocurrencies has increased by nearly 50%. He added, “In a well-regulated market, we tend to take responsibility for the development of the crypto industry because the market is developing in the open. The interaction between regulatory agencies and exchanges is more transparent. But with or without regulation, the crypto industry will continue to grow. The formulation of some regulations to protect consumers and create a safer operating environment for everyone is in everyone’s interest.”

The Central Bank of Kenya (CBK) has also been exploring cryptocurrencies and issued a statement on potential volatility risks as leaders consider implementing CBDC. In early 2023, the government proposed a bill advocating for a consistent securities definition for digital currencies and record keeping by licensed crypto traders. At the same time, the Nigerian government approved a national blockchain policy to help integrate blockchain into the legal framework and emphasized that the adoption of blockchain can benefit the country.

In Mauritius, where cryptocurrency trading volume lags behind Kenya, the Virtual Asset and Initial Coin Offering Services Act of 2021 provides comprehensive legislative support for token offerings. The country is committed to consumer protection, promoting the adoption of cryptocurrencies, and attracting traders, while other countries in the region have issued explicit bans on certain cryptocurrency-related activities.

The recent series of policy enactments has helped develop the local cryptocurrency industry in Africa. As mentioned above, the largest African countries have enacted many of the most important crypto regulations in early 2023. The chart below compares the use of local, domestic cryptocurrency exchanges in the Sub-Saharan Africa region.

This demonstrates the supportive policy attitude, instills confidence in consumers, and provides a secure environment brought by local cryptocurrency enterprises’ compliance with regulations, which is one of the reasons why local exchanges in the region have grown faster than their international competitors since early 2023.

What is the next step for the cryptocurrency economy in Sub-Saharan Africa?

The future of cryptocurrency is bright. Countries like Nigeria have already become global leaders in cryptocurrency adoption, with increased local transparency driving growth. Cryptocurrency operators will leverage this to enter the market. Years of experience studying emerging markets have taught us that while residents of wealthy countries may trade more cryptocurrency than those in emerging markets, the latter have a greater demand for cryptocurrencies in their daily lives, aligning with the original vision of Bitcoin and the entire industry.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Morning News | The supply of Bitcoin on exchanges has decreased from 5.99% since September 1st to 5.73%.

- LianGuai Daily | Bitcoin temporarily stabilizes above $28,000; FTX founder SBF’s trial will begin tomorrow, with jury selection on the first day.

- Analysis Why will the bull market start as early as next year from the perspective of the halving period?

- Wu’s Selection Zhu Su of Three Arrows suddenly arrested, Binance exits Russia, Mixin hacked for 200 million, MicroStrategy continues to buy BTC, and Top 10 news.

- Hong Kong Securities and Futures Commission discloses regulatory list, which crypto company has the highest risk?

- Ethereum transactions decrease, Layer 2 dominating the market in-depth analysis of on-chain activities and trends

- Q3 Eight major hotspots review Ripple, L2, PYUSD